Oregon Full Reconveyance of Deed of Trust - Individual Lender or Holder

Description

Key Concepts & Definitions

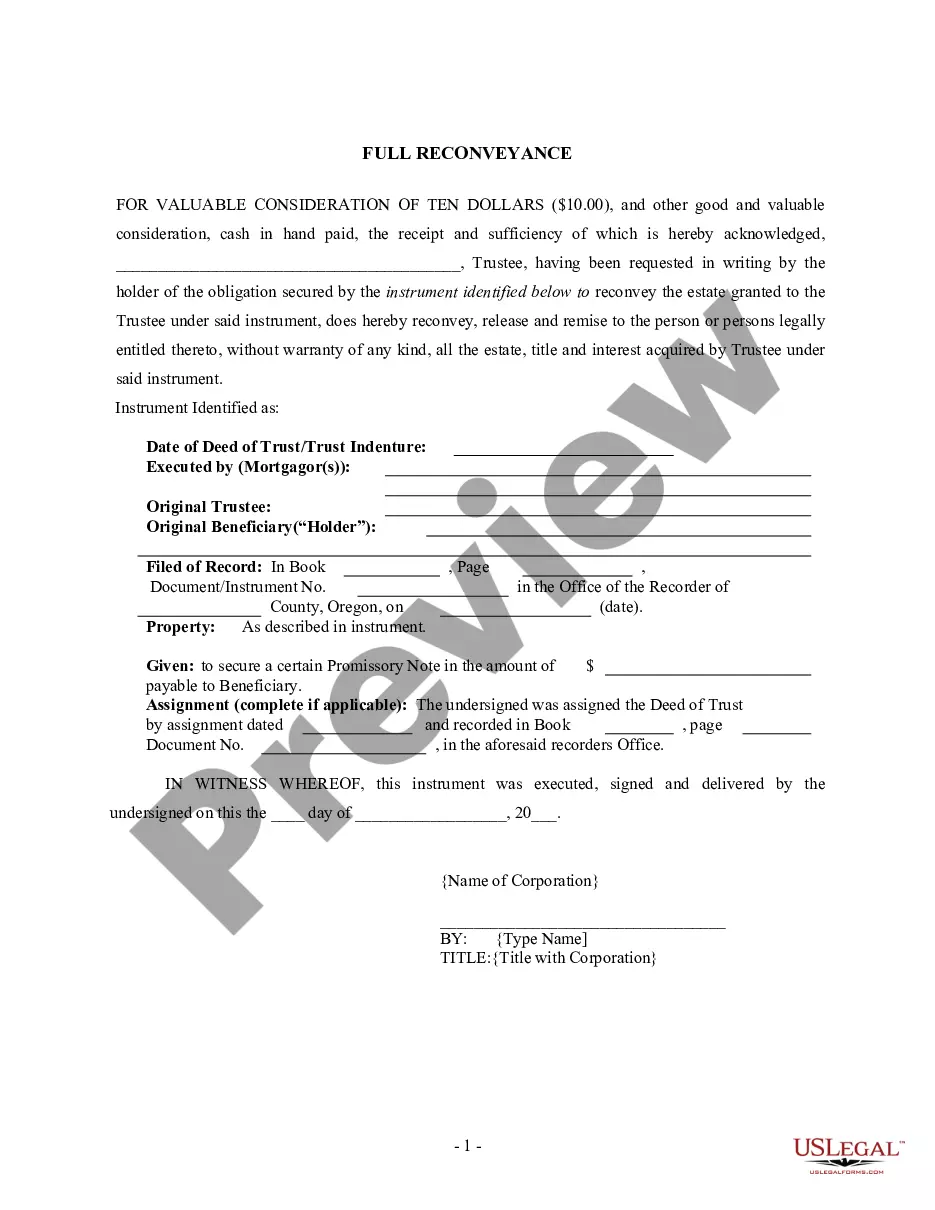

Deed of Trust: A legal document in which the borrower conveys the title of their property to a trustee as security for a loan. Reconveyance: The act of transferring the property title back to the property owner once the loan is fully paid. Full Reconveyance: Occurs when the trustee returns full title to the borrower after the complete repayment of the debt under the deed of trust.

Step-by-Step Guide to Full Reconveyance of Deed of Trust

- Verification of Payment: The property owner verifies full repayment of the debt associated with the deed of trust.

- Request for Reconveyance: The property owner requests a full reconveyance from the trustee or subtitution trustee.

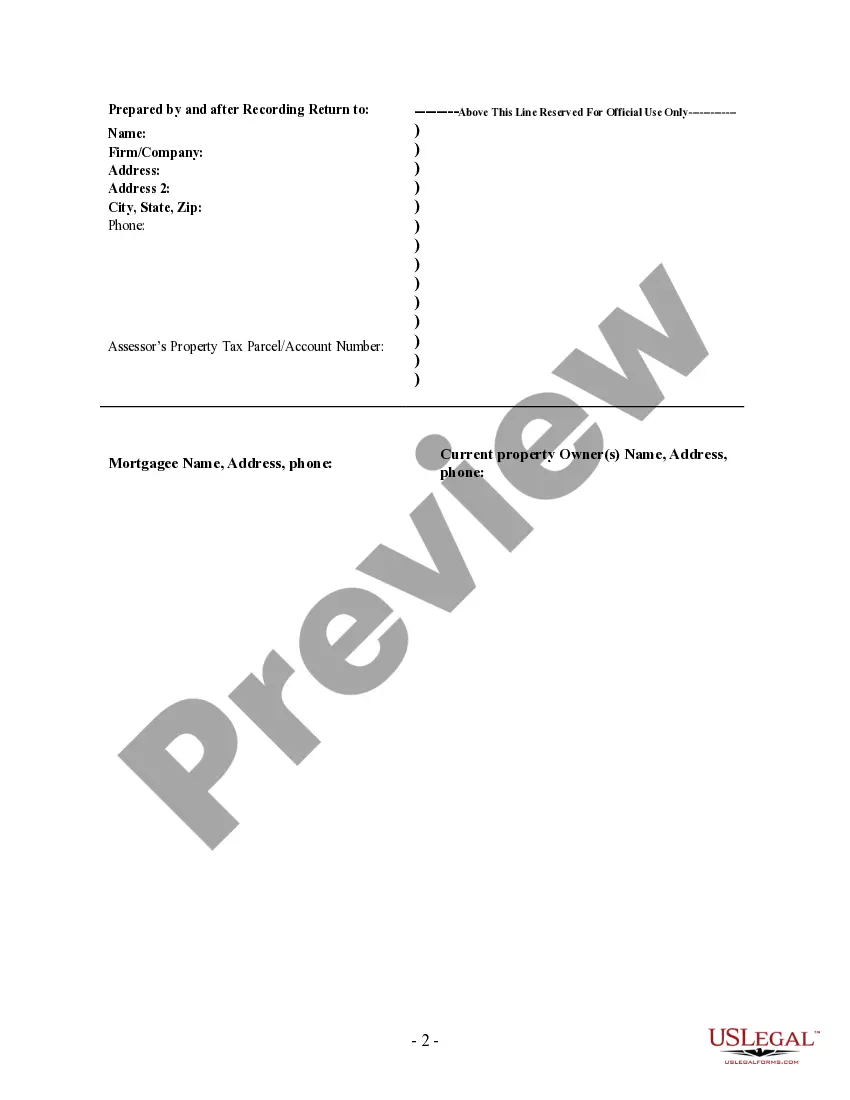

- Preparation of Reconveyance Document: The trustee prepares the necessary reconveyance document, often with the assistance of legal counsel to ensure accuracy.

- Submission to County Recorder: The document is then submitted to the county recorders office to be officially recorded.

- Confirmation of Recording: The property owner receives confirmation from the county recorder that the reconveyance has been recorded, which completes the process.

Risk Analysis in Reconveyance

Reconveyance processes involve certain risks, including improper recording of the reconveyance which can result in legal complications or clear title issues. There is also the risk of fraud, particularly if the process involves incorrect parties or if the paperwork is handled improperly.

Key Takeaways

- Ensuring all debts are fully paid before initiating a reconveyance is crucial.

- Working with experienced professionals, like a knowledgeable substitution trustee or legal advisor, can mitigate risks associated with deed reconveyance.

- The confirmation of recording by the county recorder solidifies the full reconveyance process.

Pros & Cons of Full Reconveyance

Pros: Full reconveyance clears any liens against the property related to the deed of trust, thereby providing the property owner with clear title. Cons: The process can be time-consuming and requires precise paperwork and adherence to local laws, which can be a barrier for some property owners.

Common Mistakes & How to Avoid Them

Common mistakes include failing to verify the completeness of the document and submitting incomplete or incorrect paperwork to the county recorder. These can be avoided by double-checking all documents for accuracy and completeness before submission.

How to fill out Oregon Full Reconveyance Of Deed Of Trust - Individual Lender Or Holder?

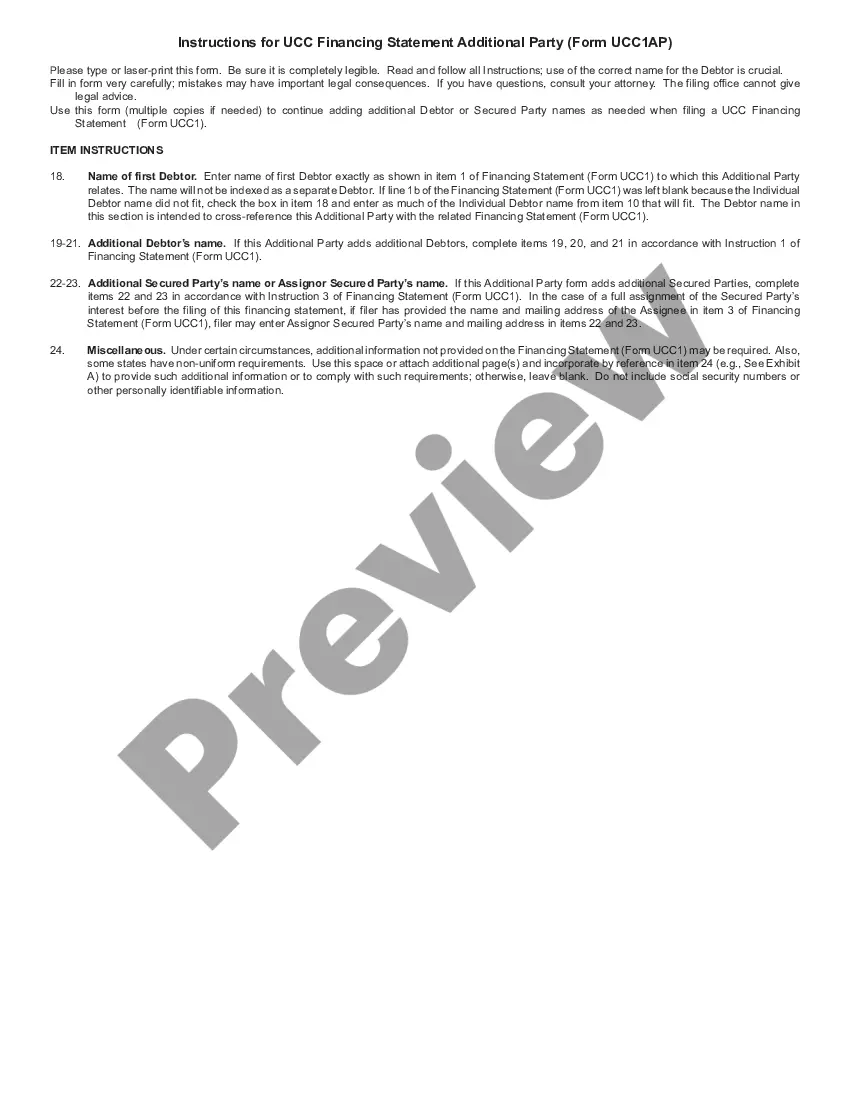

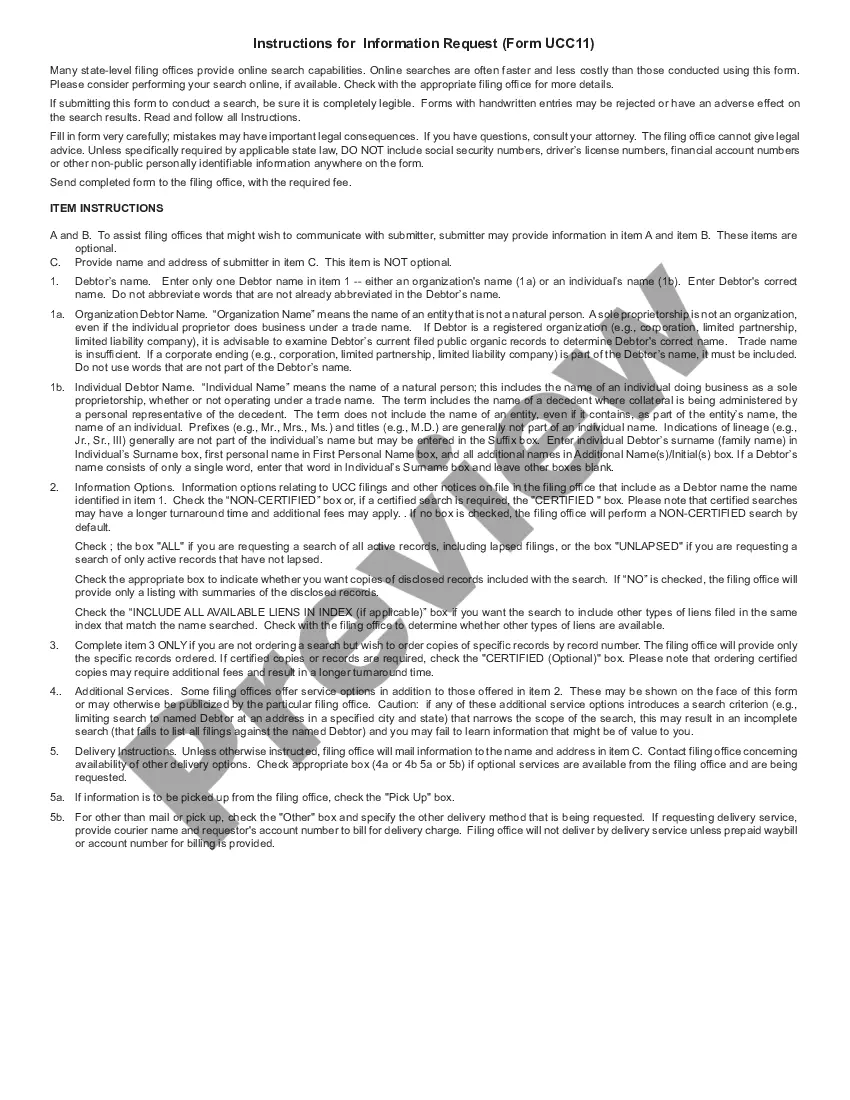

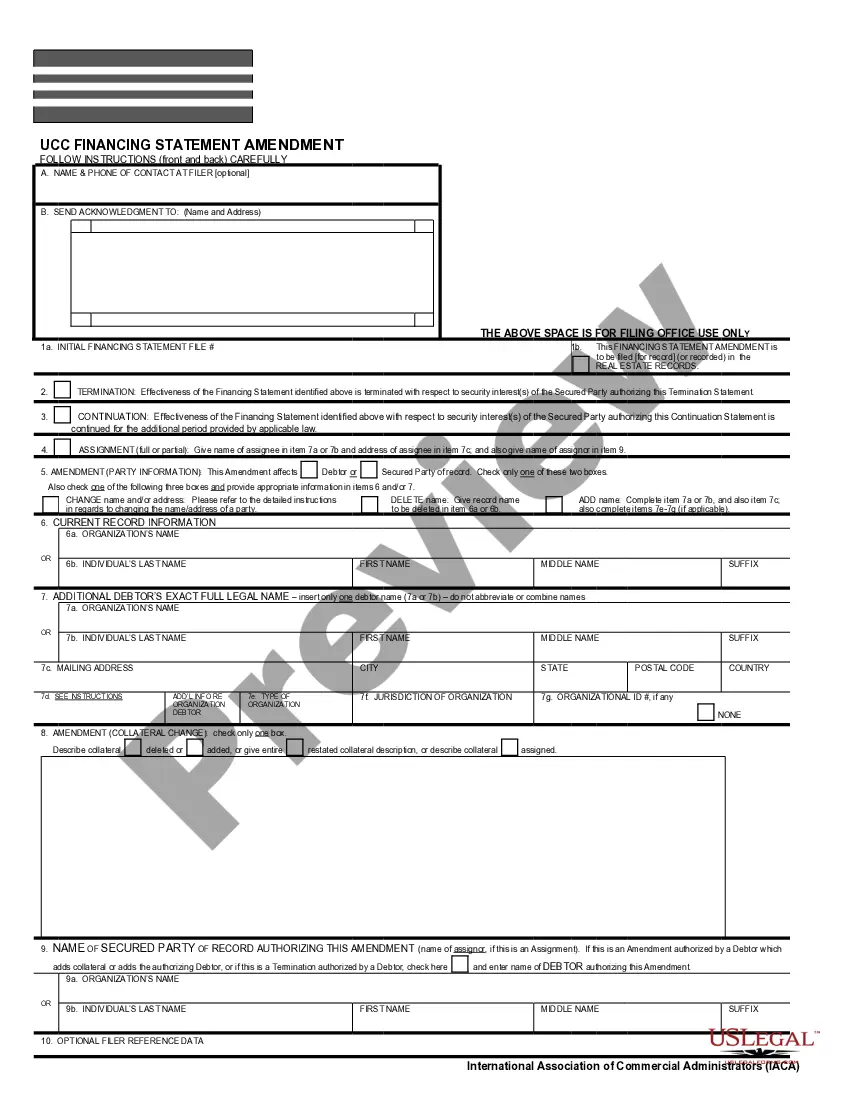

Creating documents isn't the most easy process, especially for those who rarely work with legal paperwork. That's why we advise using accurate Oregon Full Reconveyance of Deed of Trust - Individual Lender or Holder samples created by professional lawyers. It gives you the ability to avoid troubles when in court or dealing with official organizations. Find the documents you need on our website for top-quality forms and exact explanations.

If you’re a user having a US Legal Forms subscription, just log in your account. As soon as you are in, the Download button will immediately appear on the file webpage. Right after accessing the sample, it will be stored in the My Forms menu.

Users without a subscription can quickly get an account. Make use of this brief step-by-step guide to get your Oregon Full Reconveyance of Deed of Trust - Individual Lender or Holder:

- Ensure that the sample you found is eligible for use in the state it is necessary in.

- Confirm the file. Use the Preview feature or read its description (if offered).

- Buy Now if this form is what you need or return to the Search field to get a different one.

- Choose a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

Right after doing these straightforward steps, it is possible to complete the sample in an appropriate editor. Recheck filled in info and consider requesting a lawyer to examine your Oregon Full Reconveyance of Deed of Trust - Individual Lender or Holder for correctness. With US Legal Forms, everything gets easier. Try it now!

Form popularity

FAQ

Only until the debt is paid off by the borrower can a deed of reconveyance then be used to clear the deed of trust from the title to the property. The document is signed by the trustee, whose signature must be notarized.

A deed of trust is a method of securing a real estate transaction that includes three parties: a lender, borrower and a third-party trustee.

In order to clear the Deed of Trust from the title to the property, a Deed of Reconveyance must be recorded with the Country Recorder or Recorder of Deeds. If the Trustee/Beneficiary fails to record a satisfaction within the set time limits, the Trustee/Beneficiary may be responsible for damages as set out by statute.

In real estate in the United States, a deed of trust or trust deed is a legal instrument which is used to create a security interest in real property wherein legal title in real property is transferred to a trustee, which holds it as security for a loan (debt) between a borrower and lender.

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.

The deed must be signed by the party or parties making the conveyance or grant; and 7.

A mortgage holder issues a deed of reconveyance to indicate that the borrower has been released from the mortgage debt. The deed transfers the property title from the lender, also called the beneficiary, to the borrower. This document is most commonly used when a mortgage has been paid in full.

A deed of trust is a written instrument with three parties: The trustor, who is the borrower and homeowner. The beneficiary, who is the lender. The trustee, who is a third party such as an insurance company or escrow management agency that holds actual title to the property in trust for the beneficiary.

Giving the wrong legal address for the property or the wrong amount of the debt can render the deed unenforceable. In some cases, the error is easy to fix, and the court will rule the deed is enforceable.