Oregon Full Reconveyance of Deed of Trust - Individual Lender or Holder

About this form

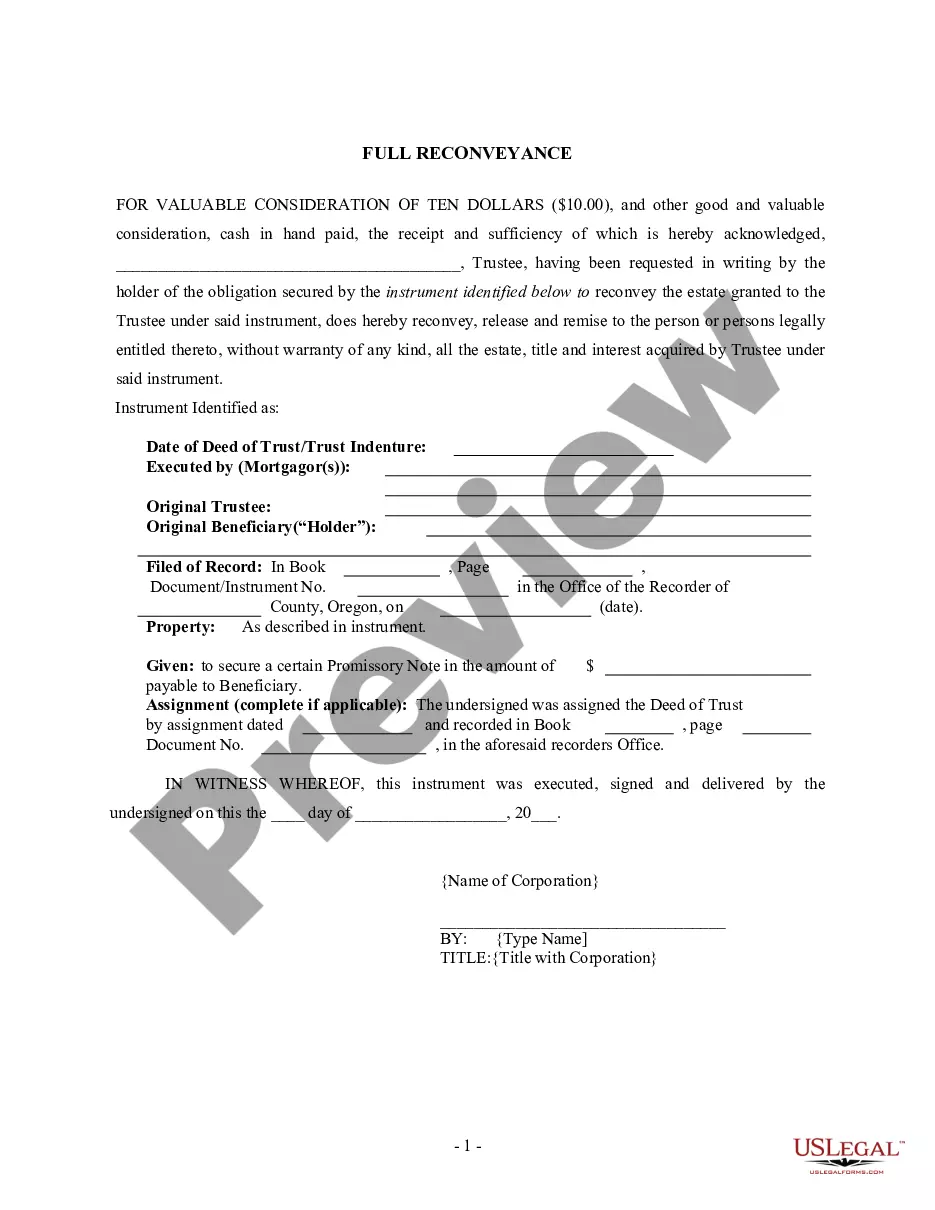

The Full Reconveyance of Deed of Trust is a legal document used to release a property tied to a mortgage or deed of trust back to the borrower. This form is specifically designed for use in Oregon and is completed by an individual lender or holder. Unlike other satisfaction or reconveyance forms, this document confirms the release of the mortgage on the specified real estate, ensuring that the borrower is no longer bound by the mortgage obligations.

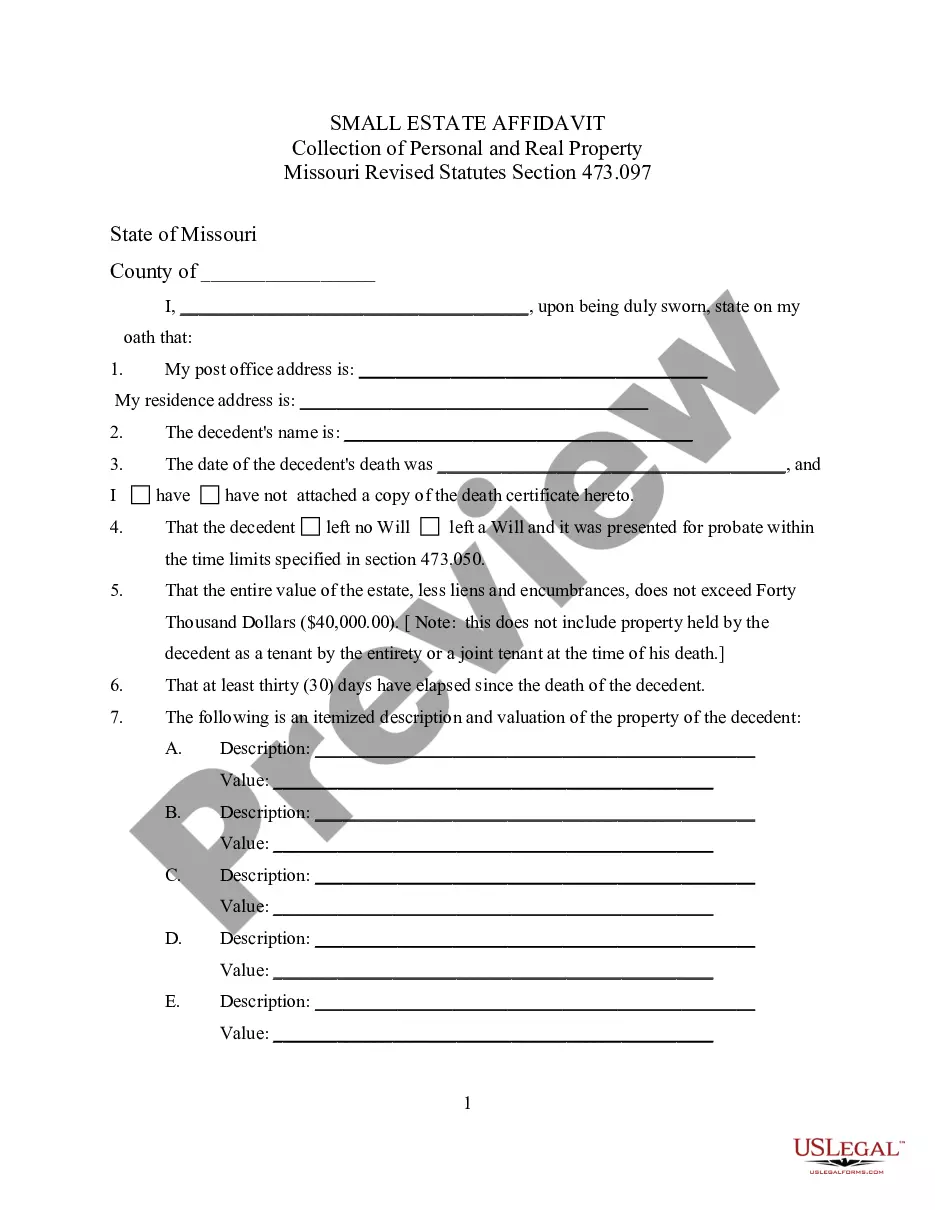

Main sections of this form

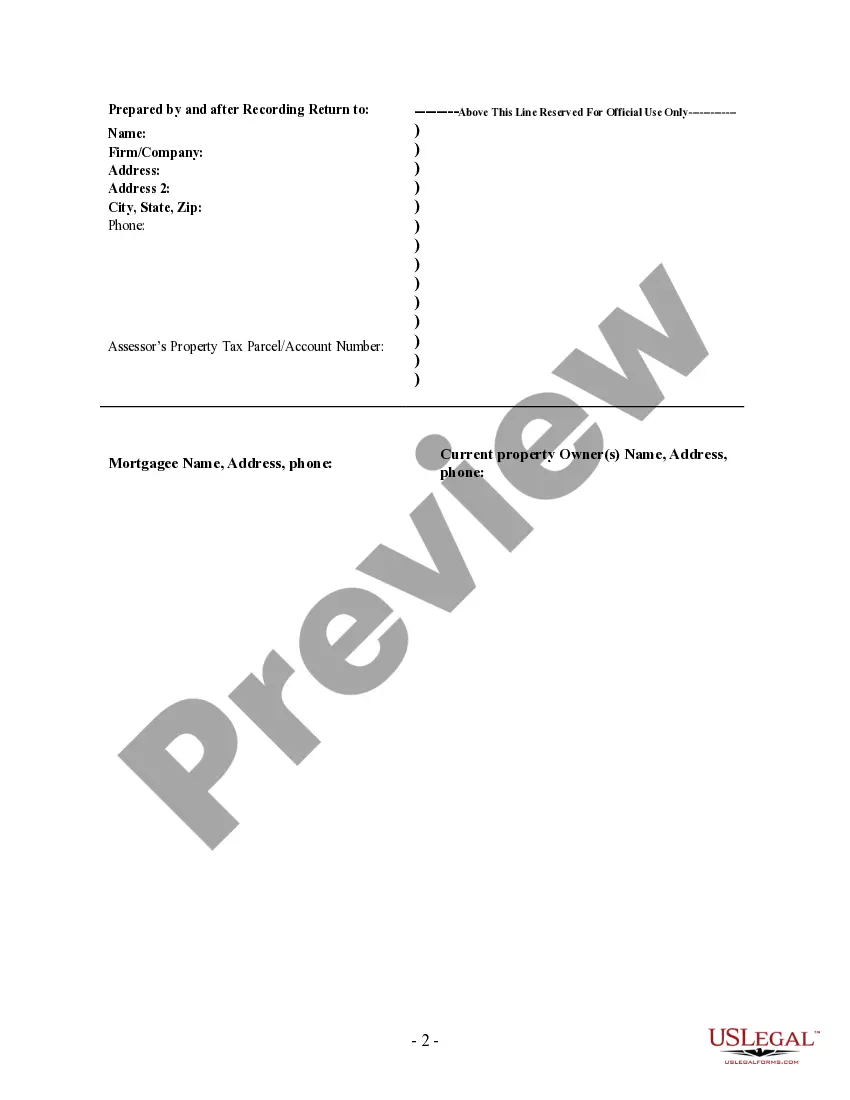

- Identification of the trustee and the parties involved.

- Details of the deed of trust, including dates and instrument numbers.

- The legal description of the property being reconveyed.

- Acknowledgment section for notarization.

- Signature lines for the trustee and notary public.

When this form is needed

This form should be used when the trustee has fulfilled all obligations related to a mortgage, and the borrower is seeking to have the deed of trust formally reconveyed. Scenarios include paying off a loan or refinancing property, where the old deed of trust needs to be released to clear the title to the property.

Who this form is for

- Individual lenders or holders who have acted as trustees.

- Borrowers seeking to release the deed of trust on their property.

- Real estate professionals facilitating the reconveyance process.

Completing this form step by step

- Identify the parties involved: the trustee, borrower, and lender.

- Specify the property: provide the legal description as stated in the original deed of trust.

- Enter the required details, including dates and document numbers associated with the original deed of trust.

- Sign the form in front of a notary public to ensure legal validation.

Is notarization required?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to include all required information about the original deed of trust.

- Not having the form notarized, which is necessary for it to be legally valid.

- Incorrectly identifying parties or property, leading to potential legal issues.

Why use this form online

- Convenient access to a legally compliant template drafted by licensed attorneys.

- Editable format allows users to input their specific information easily.

- Immediate download ensures that users can complete the form quickly without delays.

Summary of main points

- The Full Reconveyance of Deed of Trust is essential for releasing property from mortgage obligations in Oregon.

- Ensure the form is completed accurately and notarized for legal validity.

- This document protects both parties and clarifies property ownership status post-repayment.

Looking for another form?

Form popularity

FAQ

Only until the debt is paid off by the borrower can a deed of reconveyance then be used to clear the deed of trust from the title to the property. The document is signed by the trustee, whose signature must be notarized.

A deed of trust is a method of securing a real estate transaction that includes three parties: a lender, borrower and a third-party trustee.

In order to clear the Deed of Trust from the title to the property, a Deed of Reconveyance must be recorded with the Country Recorder or Recorder of Deeds. If the Trustee/Beneficiary fails to record a satisfaction within the set time limits, the Trustee/Beneficiary may be responsible for damages as set out by statute.

In real estate in the United States, a deed of trust or trust deed is a legal instrument which is used to create a security interest in real property wherein legal title in real property is transferred to a trustee, which holds it as security for a loan (debt) between a borrower and lender.

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.

The deed must be signed by the party or parties making the conveyance or grant; and 7.

A mortgage holder issues a deed of reconveyance to indicate that the borrower has been released from the mortgage debt. The deed transfers the property title from the lender, also called the beneficiary, to the borrower. This document is most commonly used when a mortgage has been paid in full.

A deed of trust is a written instrument with three parties: The trustor, who is the borrower and homeowner. The beneficiary, who is the lender. The trustee, who is a third party such as an insurance company or escrow management agency that holds actual title to the property in trust for the beneficiary.

Giving the wrong legal address for the property or the wrong amount of the debt can render the deed unenforceable. In some cases, the error is easy to fix, and the court will rule the deed is enforceable.