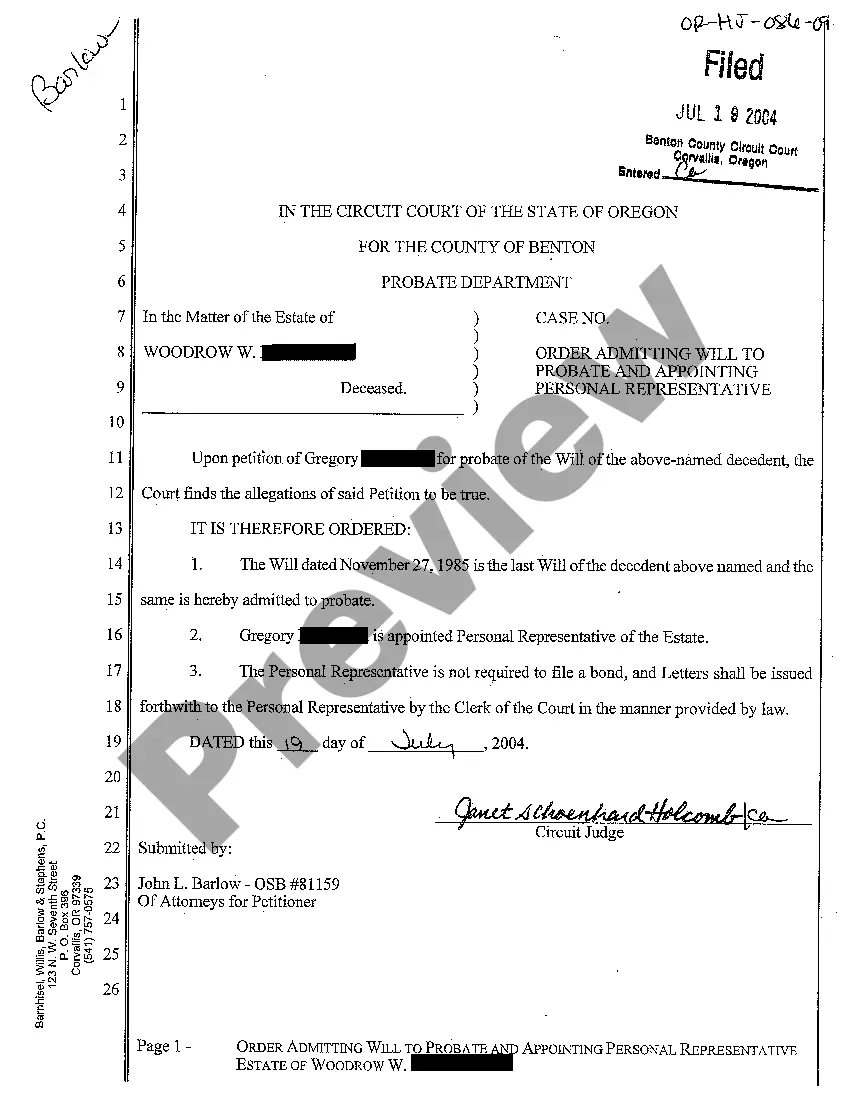

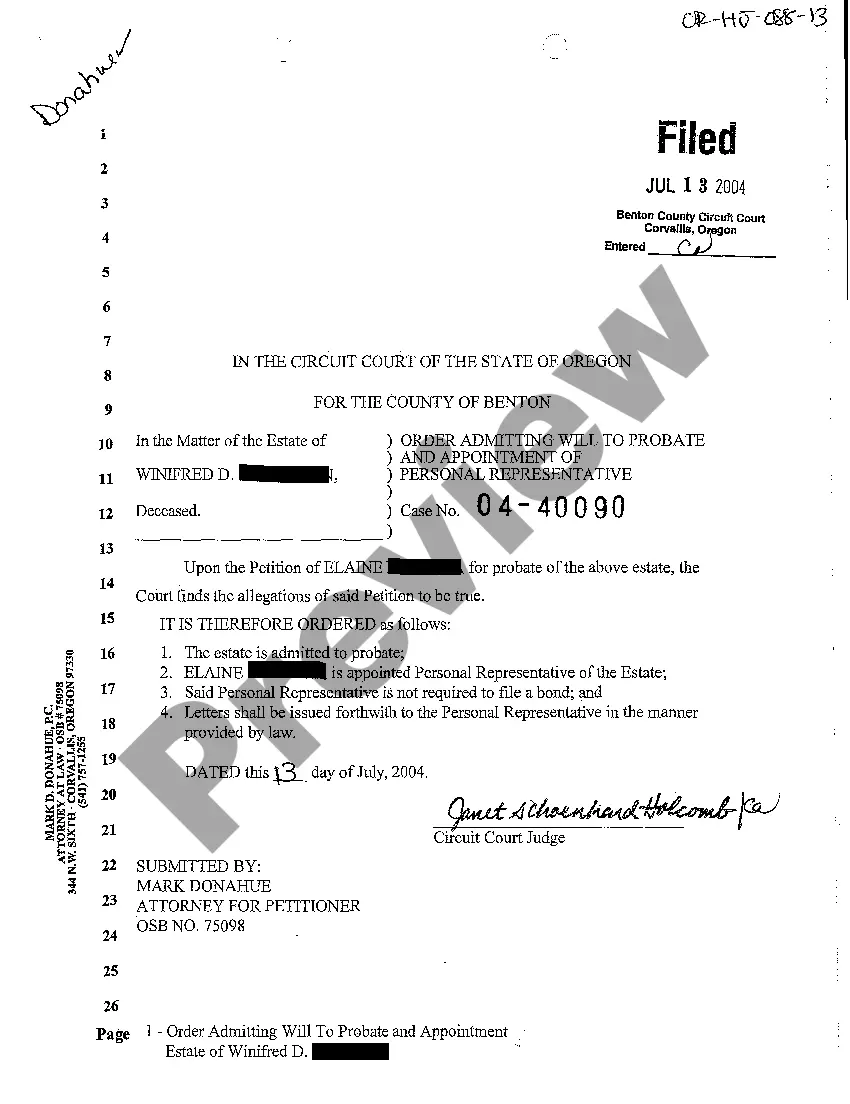

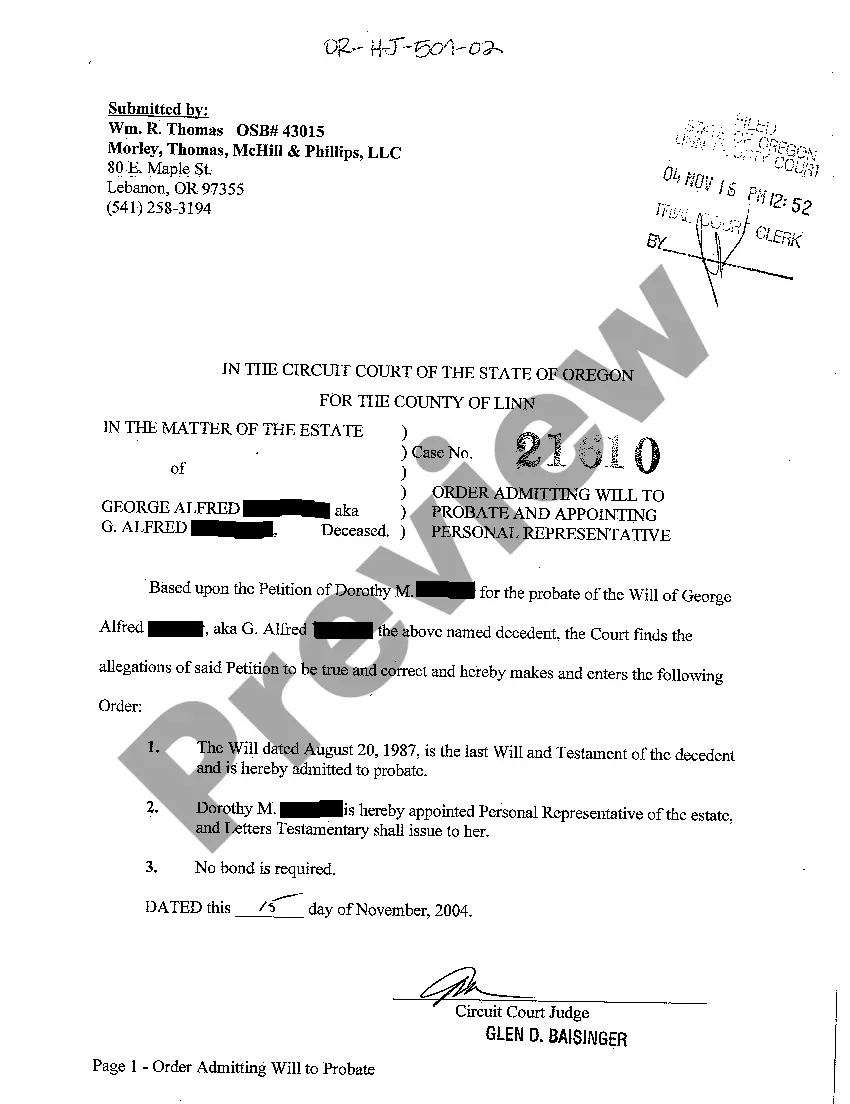

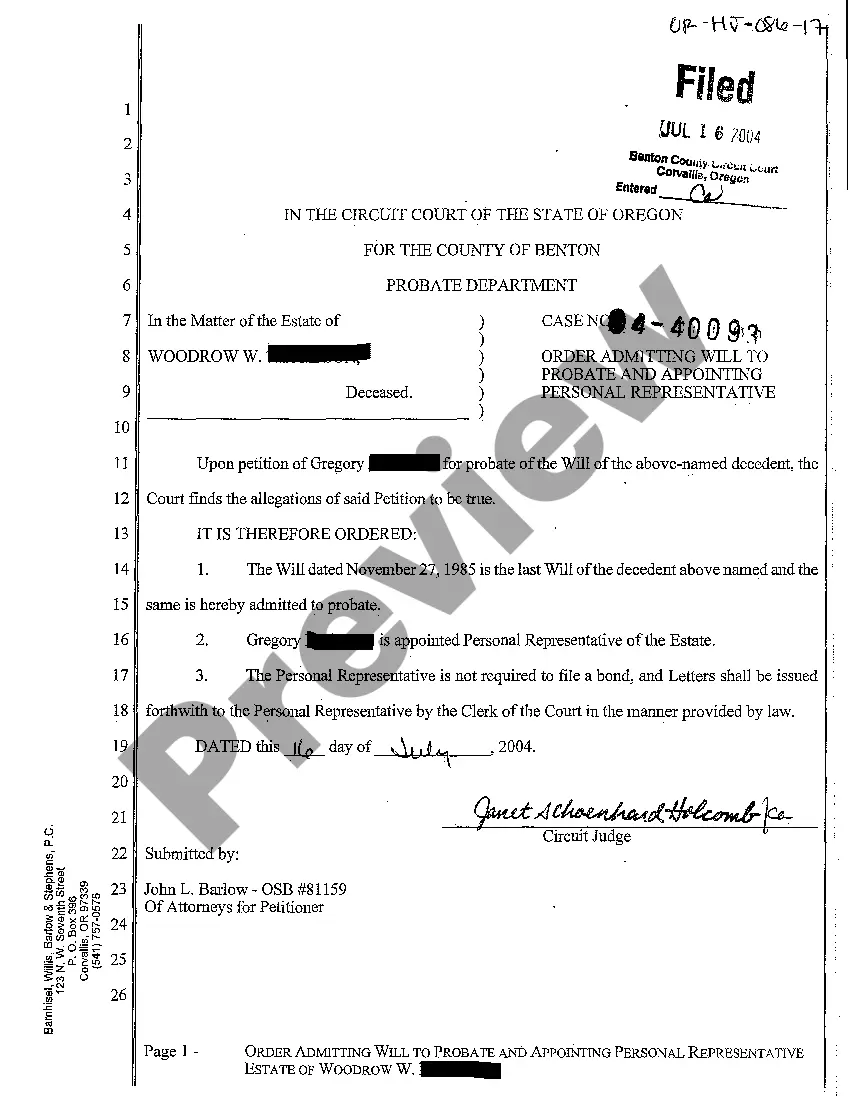

Oregon Order Admitting will to Probate and Appointing Personal Representative

Description

How to fill out Oregon Order Admitting Will To Probate And Appointing Personal Representative?

When it comes to completing Oregon Order Admitting will to Probate and Appointing Personal Representative, you most likely think about a long procedure that requires getting a appropriate form among a huge selection of similar ones after which needing to pay legal counsel to fill it out for you. Generally speaking, that’s a slow-moving and expensive choice. Use US Legal Forms and choose the state-specific template within just clicks.

In case you have a subscription, just log in and then click Download to have the Oregon Order Admitting will to Probate and Appointing Personal Representative template.

In the event you don’t have an account yet but need one, follow the point-by-point manual below:

- Make sure the file you’re saving is valid in your state (or the state it’s required in).

- Do it by reading the form’s description and through clicking on the Preview function (if offered) to find out the form’s content.

- Simply click Buy Now.

- Select the proper plan for your budget.

- Sign up to an account and choose how you want to pay: by PayPal or by card.

- Save the document in .pdf or .docx file format.

- Get the document on the device or in your My Forms folder.

Skilled attorneys draw up our templates so that after downloading, you don't have to bother about enhancing content material outside of your individual information or your business’s info. Join US Legal Forms and get your Oregon Order Admitting will to Probate and Appointing Personal Representative sample now.

Form popularity

FAQ

A personal representative is appointed by a judge to oversee the administration of a probate estate.When a personal representative is nominated to the position in a will, he's commonly called the executor of the estate.

Can I appoint a beneficiary as my executor? Yes, your executor may also be a beneficiary to your estate. In fact, if you are leaving everything to your spouse or adult children who are capable of managing their finances, it is a natural choice to appoint your spouse or one or more of your children as your executor(s).

As the Personal Representative, you are responsible for doing the following: 2022 Collecting and inventorying the assets of the estate; 2022 Managing the assets of the estate during the probate process; 2022 Paying the bills of the estate. Making distribution to the heirs or beneficiaries of the estate.

To be appointed executor or personal representative, file a petition at the probate court in the county where your loved one was living before they died. In the absence of a will, heirs must petition the court to be appointed administrator of the estate.

That person (it could be one or more individuals, a bank or trust company, or both) who acts for, or stands in the shoes of, the deceased is generally called the personal representative. If the decedent dies testate that is, with a Will an Executor is appointed as the personal representative.

You can administer an estate even if the deceased died without a will or failed to specify an executor. If your relationship to the deceased doesn't make you the probate court's default choice for administrator, you'll need to get permission from the relatives ahead of you in the priority order.

Determine Your Priority for Appointment. Receive Written Waivers From Other Candidates. Contact Court in the County Where Deceased Resided. File the Petition for Administration. Attend the Probate Hearing. Secure a Probate Bond.

No. The person must be appointed by the probate court as the personal representative and letters issued for the appointment as personal representative to be effective. California Probate Code §8400(a).To learn about the duties of a personal representative in California probate, click here.

An executor is someone named in your will, or appointed by the court, who is given the legal responsibility to take care of any remaining financial obligations. Typical duties include: Distributing assets according to the will. Maintaining property until the estate is settled (e.g., upkeep of a house)