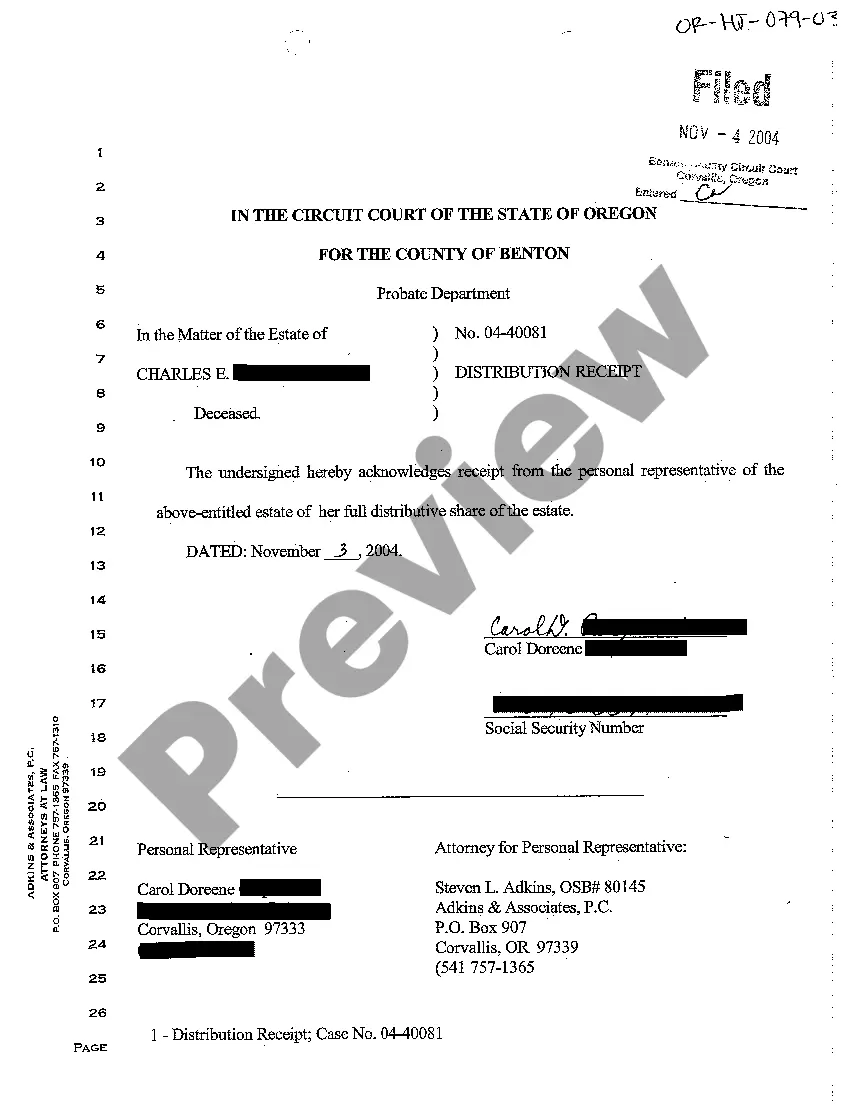

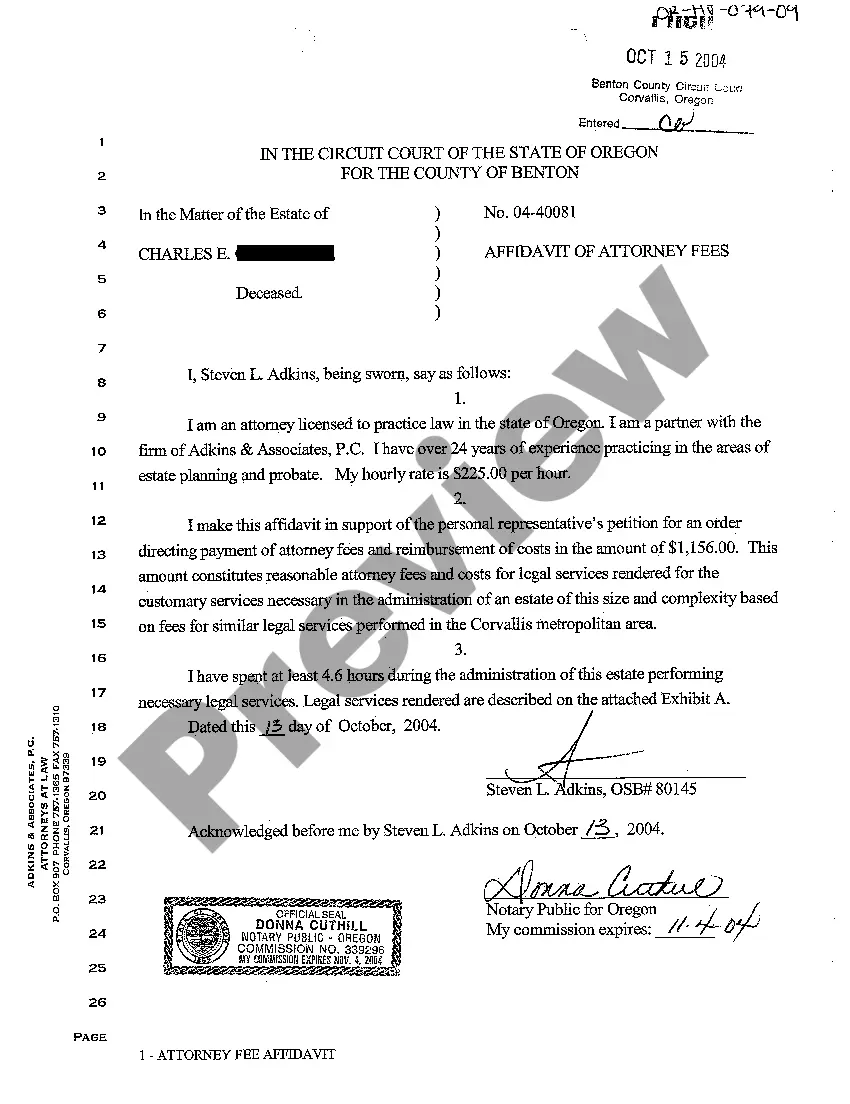

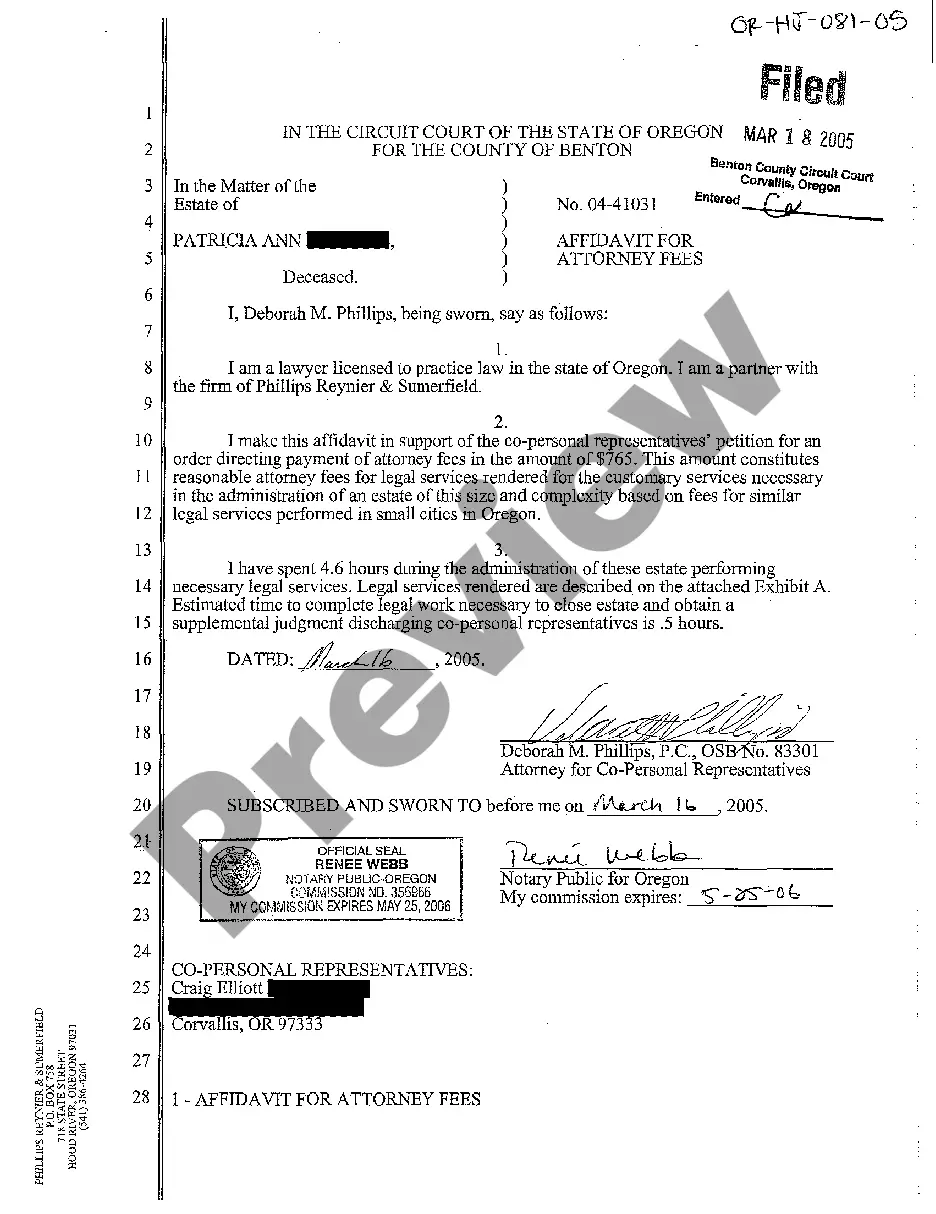

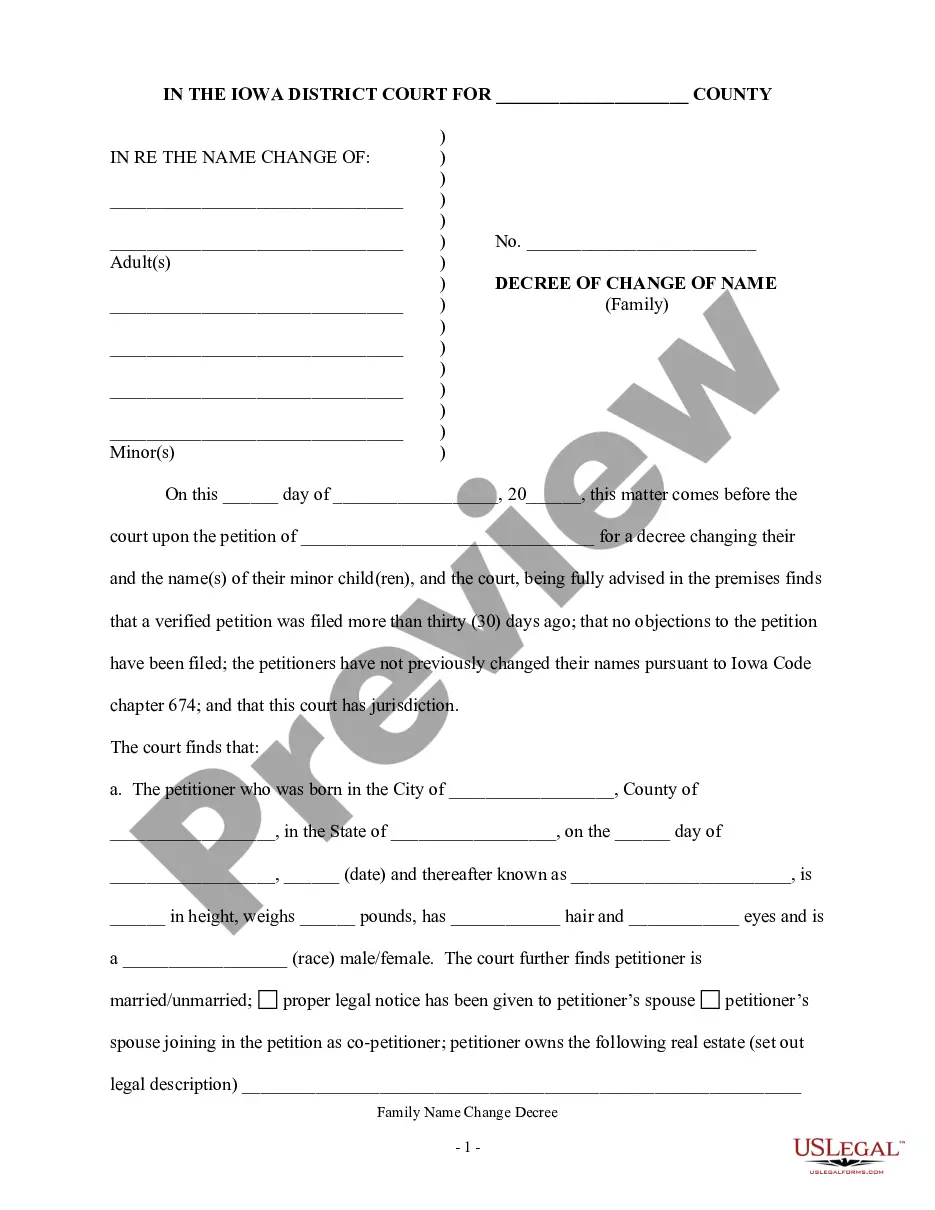

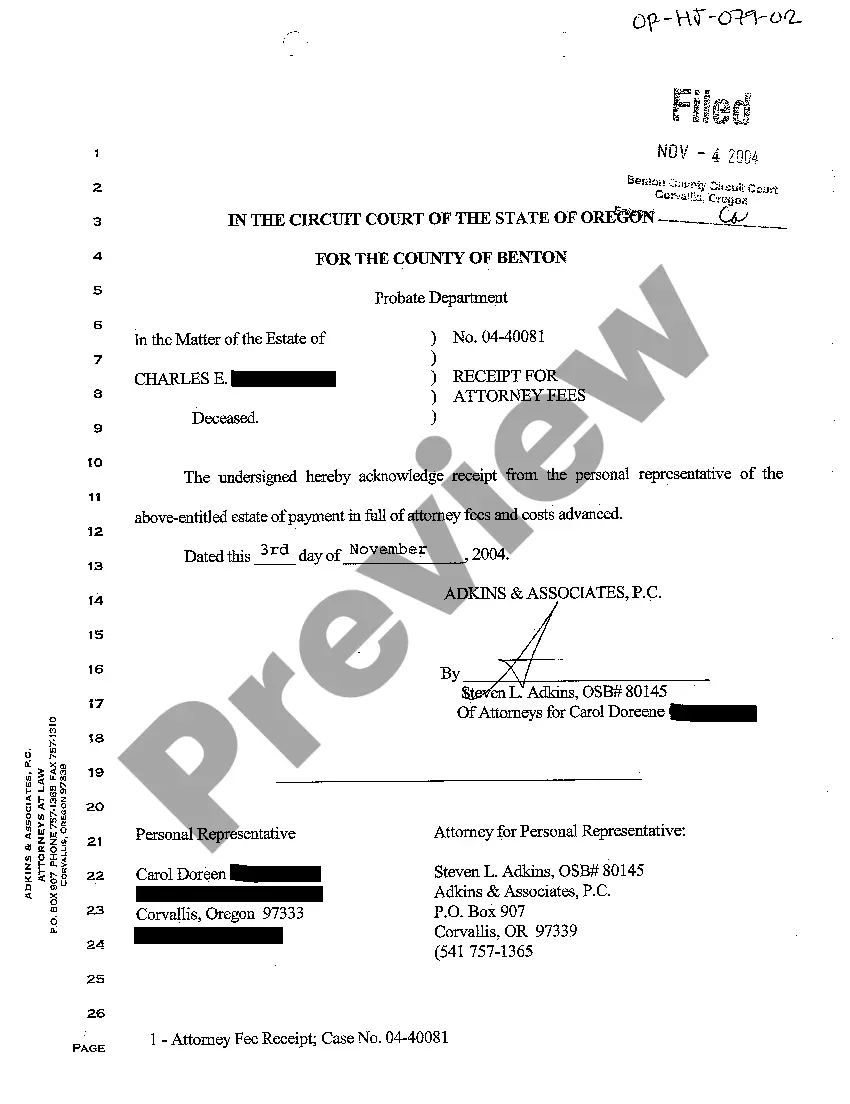

Oregon Receipt for Attorney Fees

Description

How to fill out Oregon Receipt For Attorney Fees?

In terms of filling out Oregon Receipt for Attorney Fees, you almost certainly think about a long process that requires finding a suitable form among hundreds of very similar ones and then having to pay out legal counsel to fill it out for you. On the whole, that’s a slow and expensive choice. Use US Legal Forms and select the state-specific form in a matter of clicks.

In case you have a subscription, just log in and click on Download button to have the Oregon Receipt for Attorney Fees sample.

In the event you don’t have an account yet but want one, follow the point-by-point guide below:

- Be sure the file you’re getting applies in your state (or the state it’s required in).

- Do this by looking at the form’s description and through clicking the Preview function (if offered) to see the form’s content.

- Click on Buy Now button.

- Choose the appropriate plan for your budget.

- Sign up to an account and choose how you want to pay: by PayPal or by card.

- Save the document in .pdf or .docx format.

- Find the document on your device or in your My Forms folder.

Professional attorneys draw up our templates to ensure that after downloading, you don't have to bother about editing and enhancing content outside of your individual information or your business’s info. Join US Legal Forms and receive your Oregon Receipt for Attorney Fees document now.

Form popularity

FAQ

The law in California generally provides that unless attorneys' fees are provided for by statute or by contract they are not recoverable. In other words, unless a law or contract says otherwise the winning and losing party to lawsuit must pay their own attorneys fees.

Reasonable attorneys' fees, including: time and labor required, novelty and difficultly of the issues, skill required, customary fees charged in the locality, amounts involved and results obtained, nature and length of representation, and experience and reputations of the lawyer).

A client pays a contingent fees to a lawyer only if the lawyer handles a case successfully.If you win the case, the lawyer's fee comes out of the money awarded to you. If you lose, neither you nor the lawyer will get any money, but you will not be required to pay your attorney for the work done on the case.

To recap: fees are the amount paid for the attorneys' time and effort working on your case, costs are the amount paid for out-of-pocket expenses on your case. Every case will have both fees and costs. Be sure you understand the difference.

Attorney's fee awards refer to the order of the payment of the attorney fees of one party by another party. In the U.S., each party in a legal case typically pays for his/her own attorney fees, under a principle known as the American rule.

To recap: fees are the amount paid for the attorneys' time and effort working on your case, costs are the amount paid for out-of-pocket expenses on your case. Every case will have both fees and costs. Be sure you understand the difference.

The prevalent form appears to be attorney's fees (whether there is one attorney, two attorneys, or an entire firm involved). But attorneys' fees is also acceptable and preferred by some if it's clear that more than one attorney is charging for services.

The American Rule states that each party pays its own attorneys' fees, regardless of who is the prevailing party.There are thus conditions to recover your attorneys' fees in a legal matter, and attorneys' fees are never recovered in California unless a lawsuit has been filed.