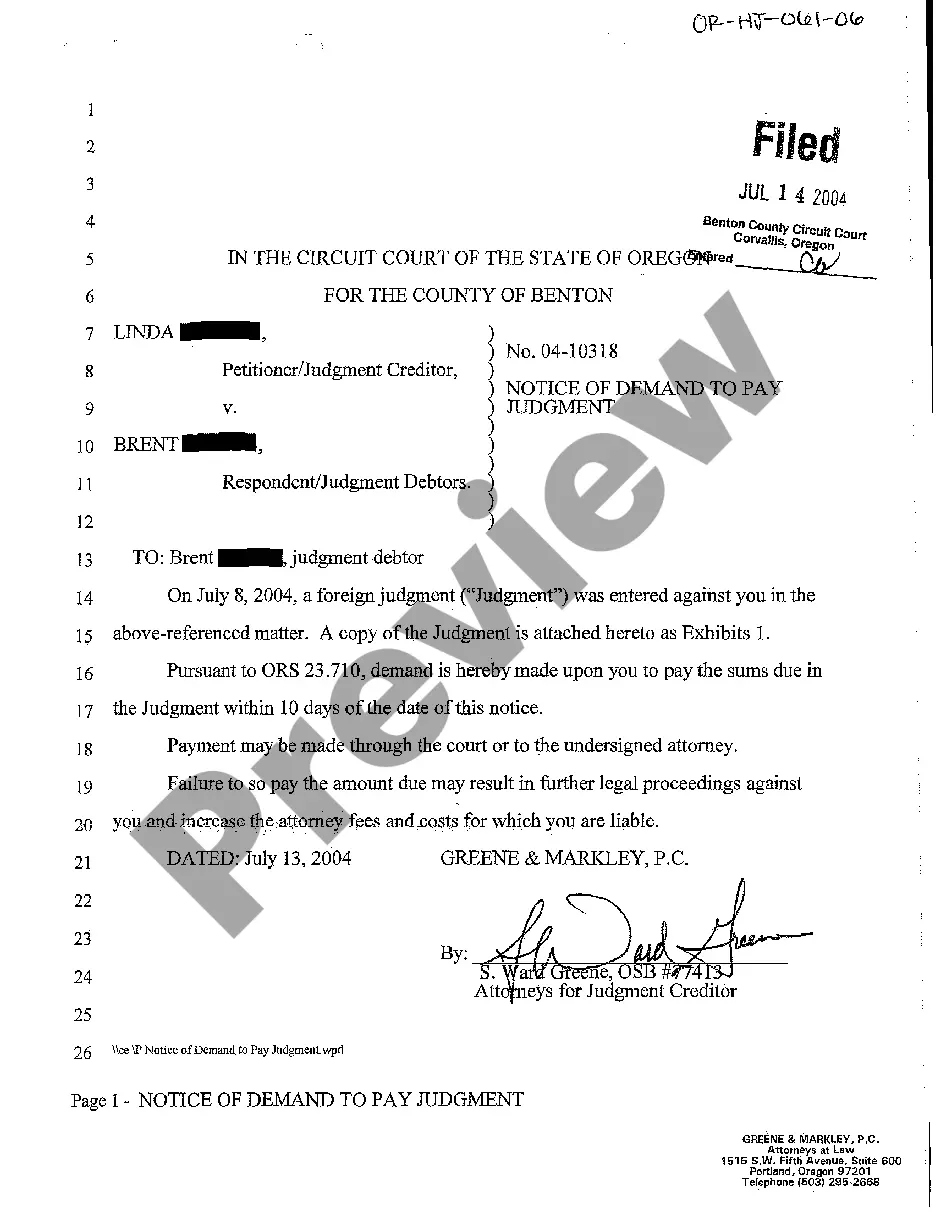

Oregon Notice of Demand to Pay Judgment

Description

How to fill out Oregon Notice Of Demand To Pay Judgment?

When it comes to submitting Oregon Notice of Demand to Pay Judgment, you probably visualize a long procedure that requires finding a appropriate sample among countless similar ones after which having to pay an attorney to fill it out for you. Generally, that’s a sluggish and expensive option. Use US Legal Forms and pick out the state-specific template within just clicks.

In case you have a subscription, just log in and click Download to get the Oregon Notice of Demand to Pay Judgment template.

In the event you don’t have an account yet but want one, follow the step-by-step guide listed below:

- Make sure the document you’re getting is valid in your state (or the state it’s needed in).

- Do so by reading the form’s description and through clicking the Preview option (if readily available) to see the form’s content.

- Simply click Buy Now.

- Pick the appropriate plan for your budget.

- Sign up for an account and choose how you would like to pay out: by PayPal or by card.

- Save the document in .pdf or .docx format.

- Get the file on the device or in your My Forms folder.

Skilled attorneys work on creating our templates to ensure after saving, you don't need to bother about enhancing content outside of your individual information or your business’s information. Be a part of US Legal Forms and receive your Oregon Notice of Demand to Pay Judgment document now.

Form popularity

FAQ

Paying off Judgments Will not Improve your Credit Score While the Fair Credit Reporting Act states that a judgment may stay on your credit report for as long as the statute of limitations in your state is in effect, all three bureaus remove judgments at the 7-year mark whether or not they are paid.

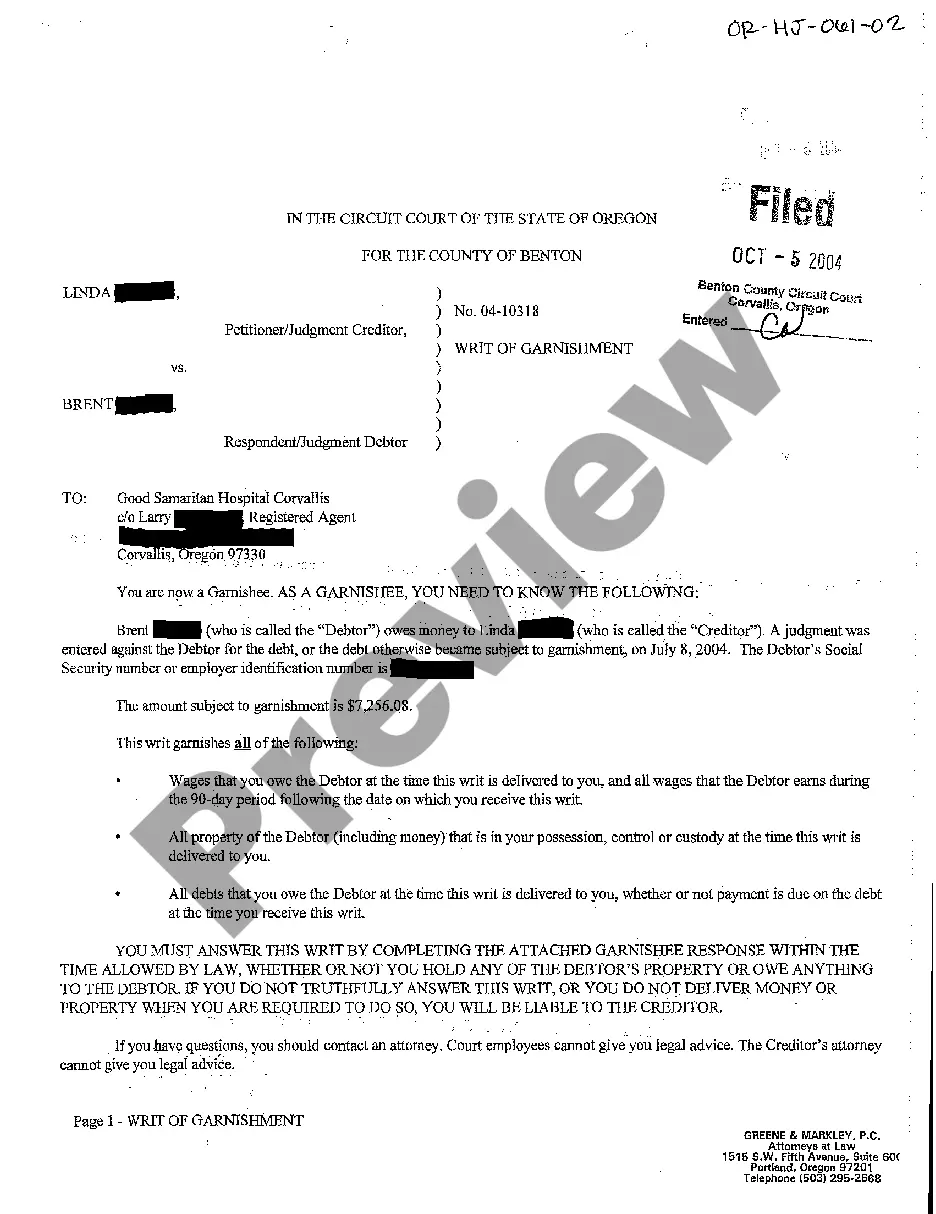

In many situations, one of the best ways to collect a judgment after winning a case is to put a lien on the debtor's property. This gives you a claim to the property and, in some cases, the property will be sold at public auction in order to satisfy the debt that is owed.

You have 30 days after entry of the original judgment before you have to pay the creditor. During this time, you can: Pay the judgment voluntarily;Fill out and send the creditor a Judgment Debtor's Statement of Assets (Form SC-133).

Enforcing a judgment in NSW is made by application to the NSW Civil and Administrative Tribunal (NCAT). If your judgment was entered in another State, you must first register it as a judgment of the Local Court. The rules governing enforcing a judgment are in the Civil Procedure Act.

Even after you win a lawsuit, you still have to collect the money awarded in the judgmentthe court won't do it for you. Financially sound individuals or businesses will routinely pay a judgment entered against them. However, not everyone will be as willing. If necessary, legal ways to force payment exist.

Do not use illegal ways to collect your money. The debtor may be protected from abusive or unfair ways to collect the debt. Encourage the debtor to pay you voluntarily. Be organized. Ask a lawyer or collection agency for help. Make sure you renew your judgment. Ask the court for help.

In order to vacate a judgment in California, You must file a motion with the court asking the judge to vacate or set aside the judgment. Among other things, you must tell the judge why you did not respond to the lawsuit (this can be done by written declaration).

If you fail to attend Court in accordance with the Examination Order you will be in contempt of Court and a warrant for your arrest can be issued. A judgment creditor can issue a Garnishee Order on the basis of the information the judgment creditor has obtained about your financial situation.

In order to get a judgment, the creditor must go to court. Either the original creditor or a collection agency may sue you to collect a debt. If this happens, you will be served with a summons and complaint. If you want to dispute the existence or the amount of the debt, you must file a timely response with the court.