Oregon Living Trust for Husband and Wife with No Children

Description

How to fill out Oregon Living Trust For Husband And Wife With No Children?

When it comes to submitting Oregon Living Trust for Husband and Wife with No Children, you probably imagine an extensive process that involves choosing a perfect form among countless very similar ones after which needing to pay legal counsel to fill it out to suit your needs. In general, that’s a slow-moving and expensive option. Use US Legal Forms and pick out the state-specific document within clicks.

In case you have a subscription, just log in and then click Download to have the Oregon Living Trust for Husband and Wife with No Children form.

In the event you don’t have an account yet but want one, keep to the point-by-point guideline below:

- Make sure the document you’re saving is valid in your state (or the state it’s required in).

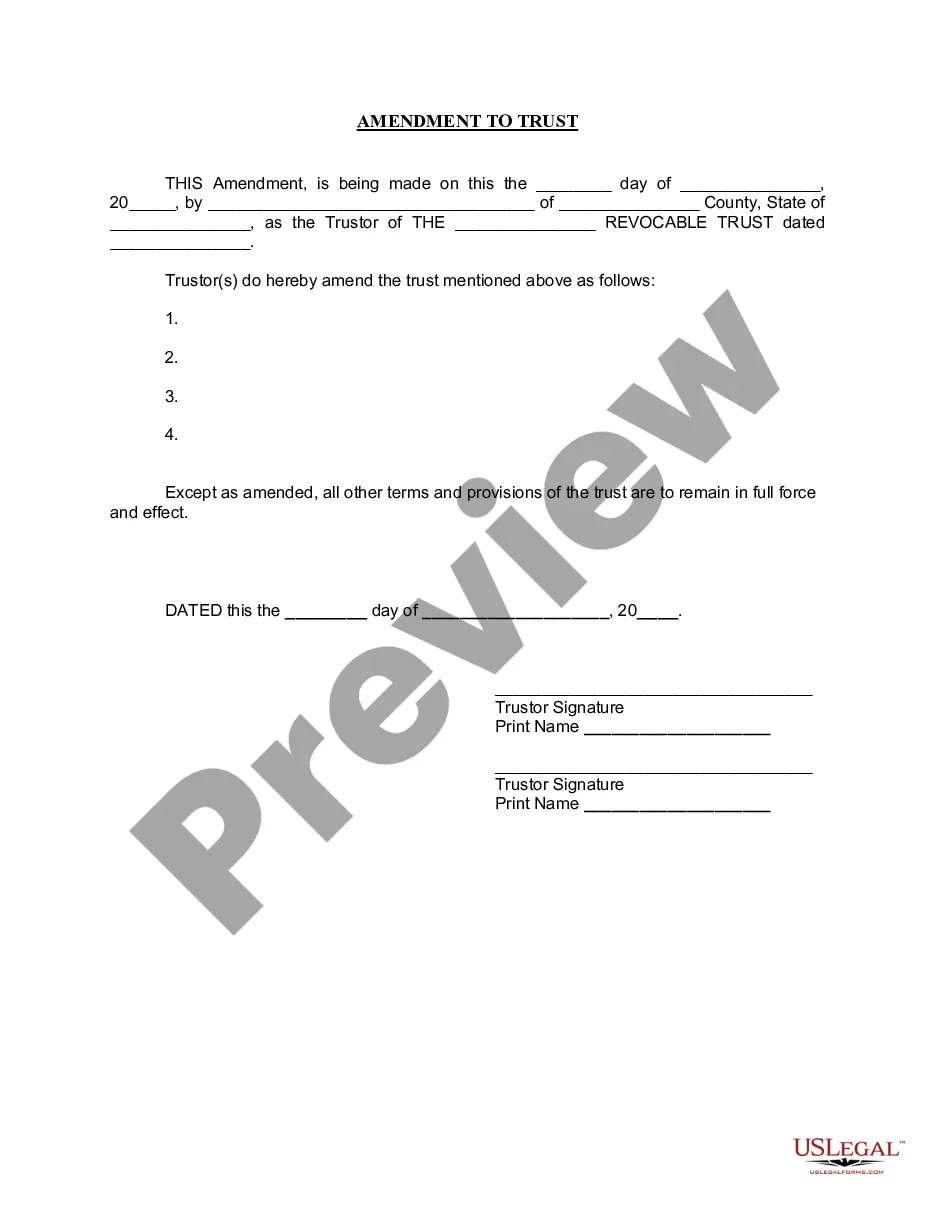

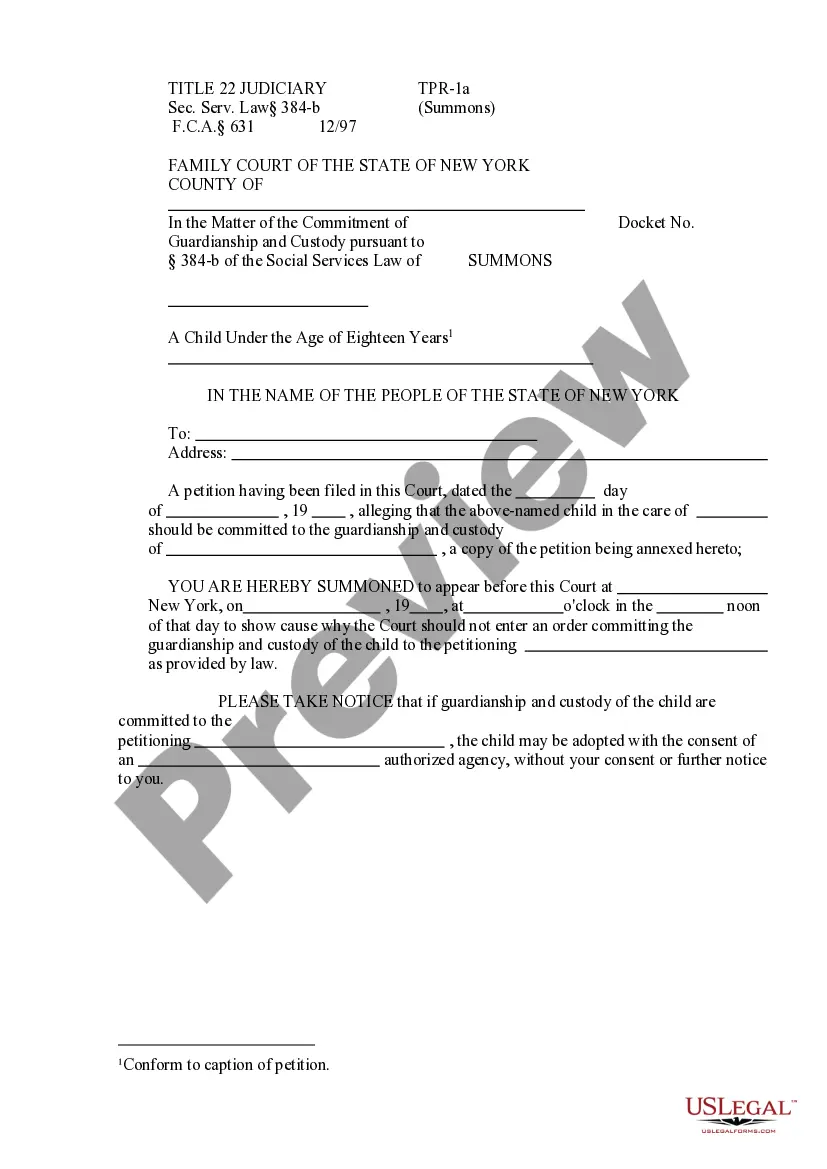

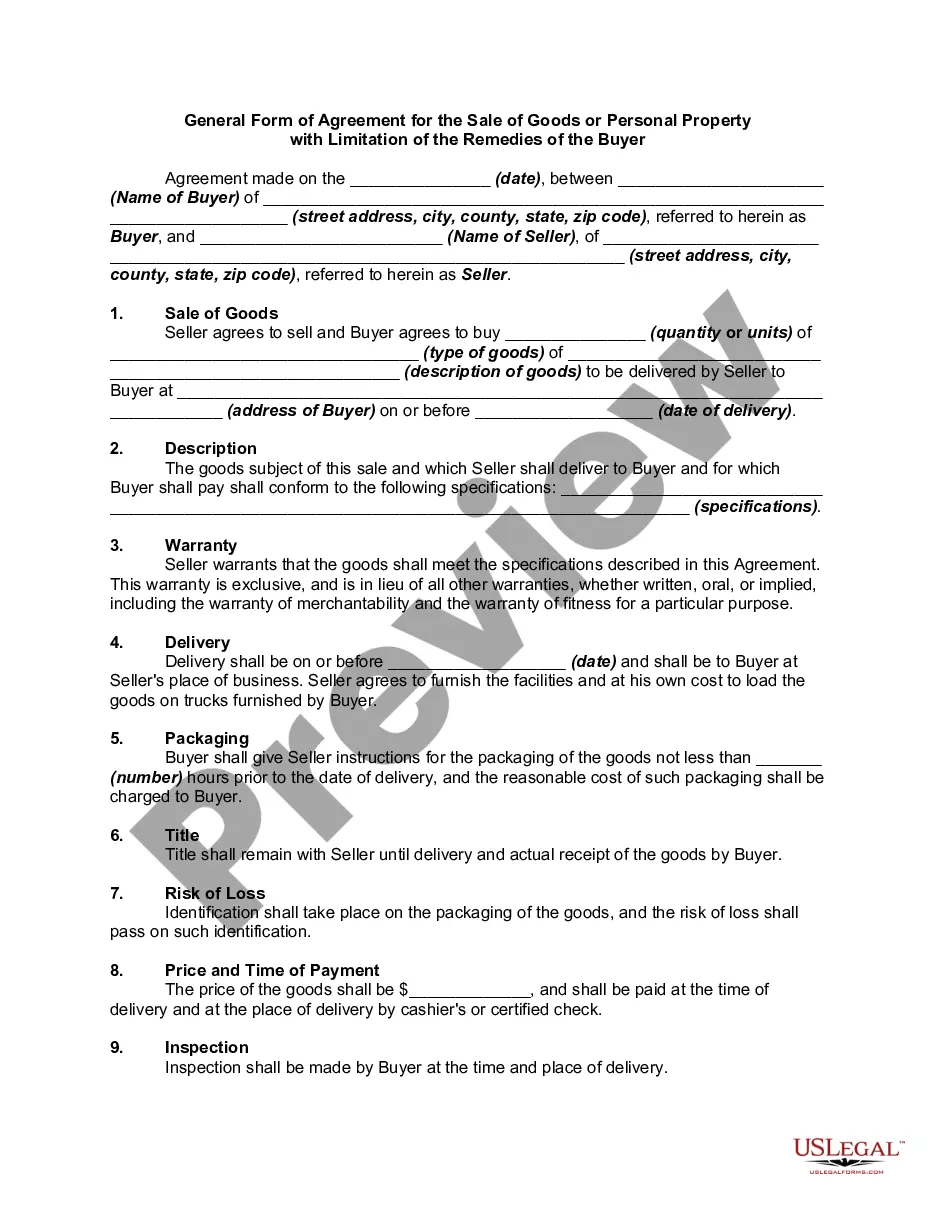

- Do this by reading the form’s description and also by clicking on the Preview function (if accessible) to find out the form’s information.

- Simply click Buy Now.

- Select the suitable plan for your financial budget.

- Sign up to an account and choose how you would like to pay: by PayPal or by card.

- Save the file in .pdf or .docx file format.

- Get the record on the device or in your My Forms folder.

Professional legal professionals work on creating our templates to ensure after downloading, you don't need to bother about editing and enhancing content material outside of your individual info or your business’s details. Sign up for US Legal Forms and get your Oregon Living Trust for Husband and Wife with No Children example now.

Form popularity

FAQ

You should still have a durable power of attorney for finances.You may even want to empower your attorney-in-fact to transfer into your living trust any property that becomes yours after you become incapacitated. Only a durable power of attorney for finances can grant that authority.

A basic trust plan may run anywhere from $2,000 to $3,000 or more, depending on complexity. There are additional costs for making changes and administration costs after your death. Different types of trusts and trustees can require different fees for administration and wealth management.

Typically, when a married couple utilizes a Revocable Living Trust based estate plan, each spouse creates and funds his or her own separate Revocable Living Trust. This results in two trusts. However, in the right circumstances, a married couple may be better served by creating a single Joint Trust.

Joint trusts are easier to fund and maintain.In a joint trust, after the death of the first spouse, the surviving spouse has complete control of the assets. When separate trusts are used, the deceased spouses' trust becomes irrevocable and the surviving spouse has limited control over assets.

In California, surviving spouses already receive all of the community property upon the death of their spouse.However, creating a joint will is still an option in California, and while it might help a couple save some time and money on their estate plan, it can also lead to some complex problems.

Separate trusts provide more flexibility in the event of a death in the marriage. Since the trust property is already divided, separate trusts preserve the surviving spouse's ability to amend or revoke assets held within their own trust, while ensuring that the deceased spouse's trust cannot be amended after death.

Separate trusts may offer better protection from creditors, if this is a concern. For example, at the death of the first spouse, the deceased spouse's trust becomes irrevocable, which makes it harder to access by creditors. And yet the surviving spouse can still access it for income and other needs.

Q: Can a person have more than one trust? A: Yes, it is not that uncommon for a person to be the beneficiary of multiple trusts. However, caution should be used. Trusts come in many shapes and sizes and can serve multiple purposes and can be established by you or by someone else for your benefit.