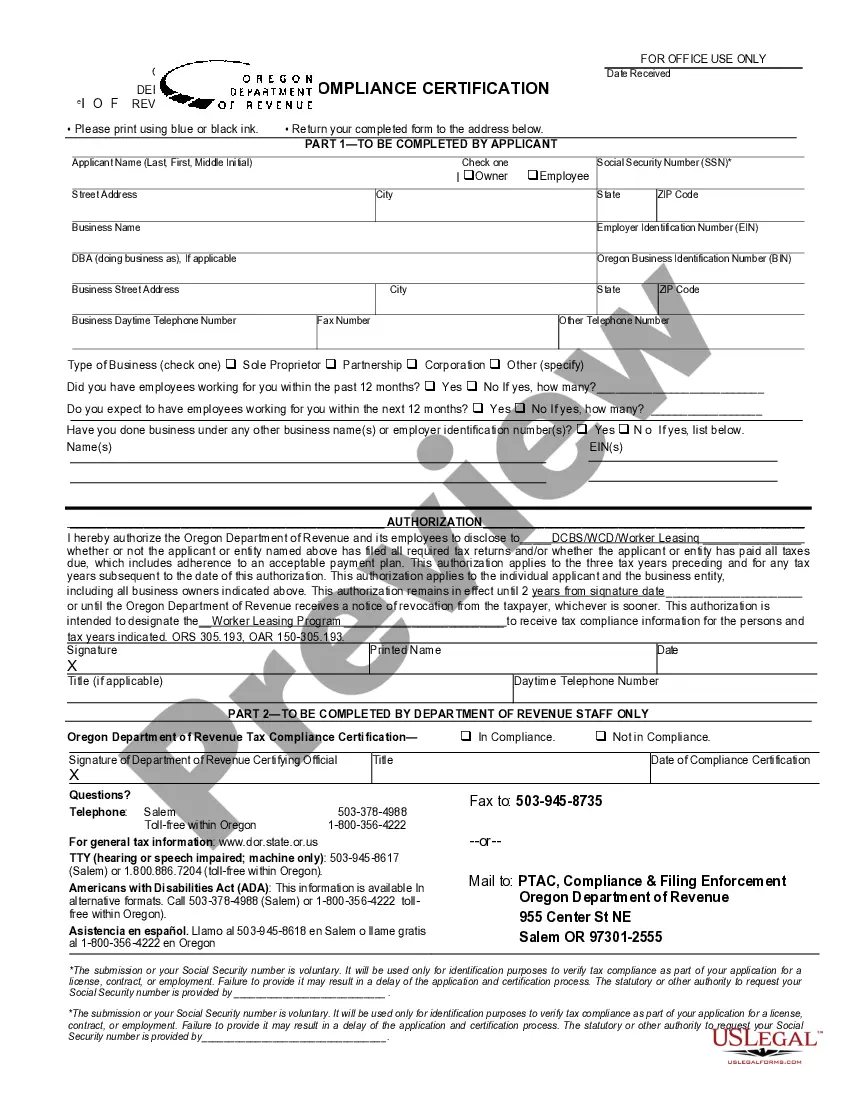

Oregon Employment Department Tax Compliance Certification

Description

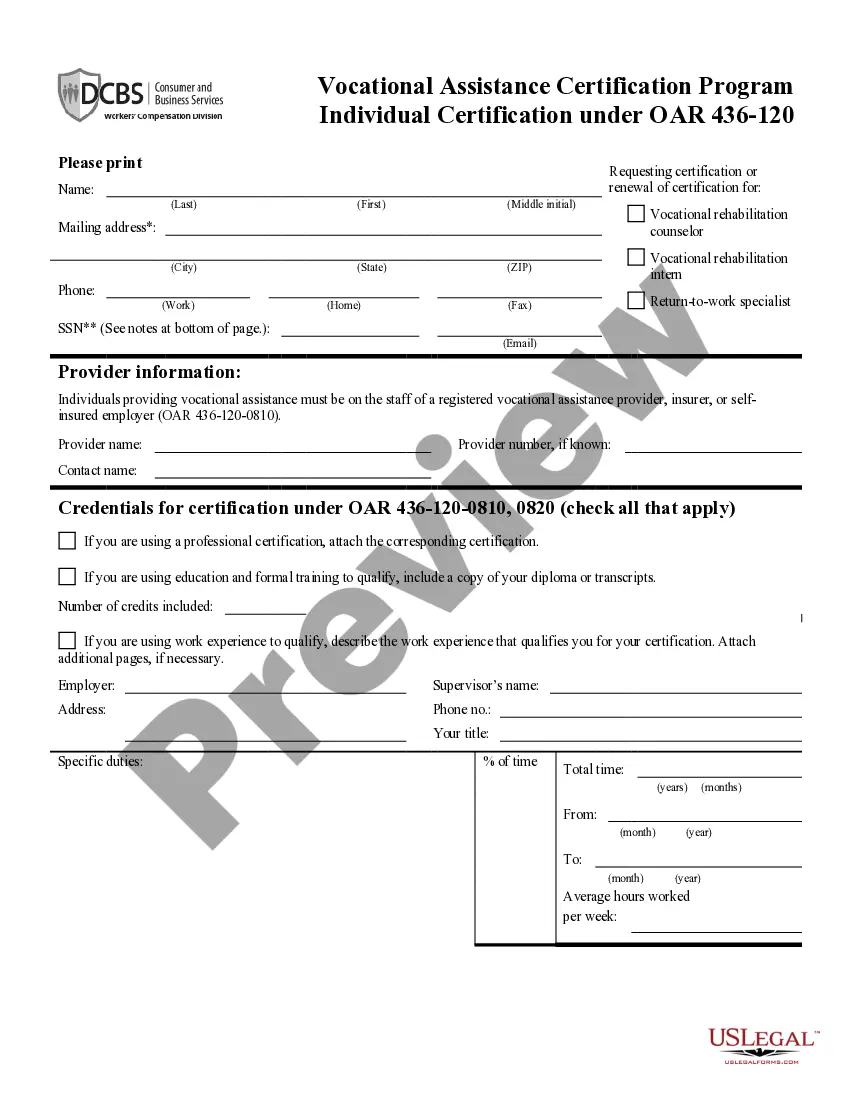

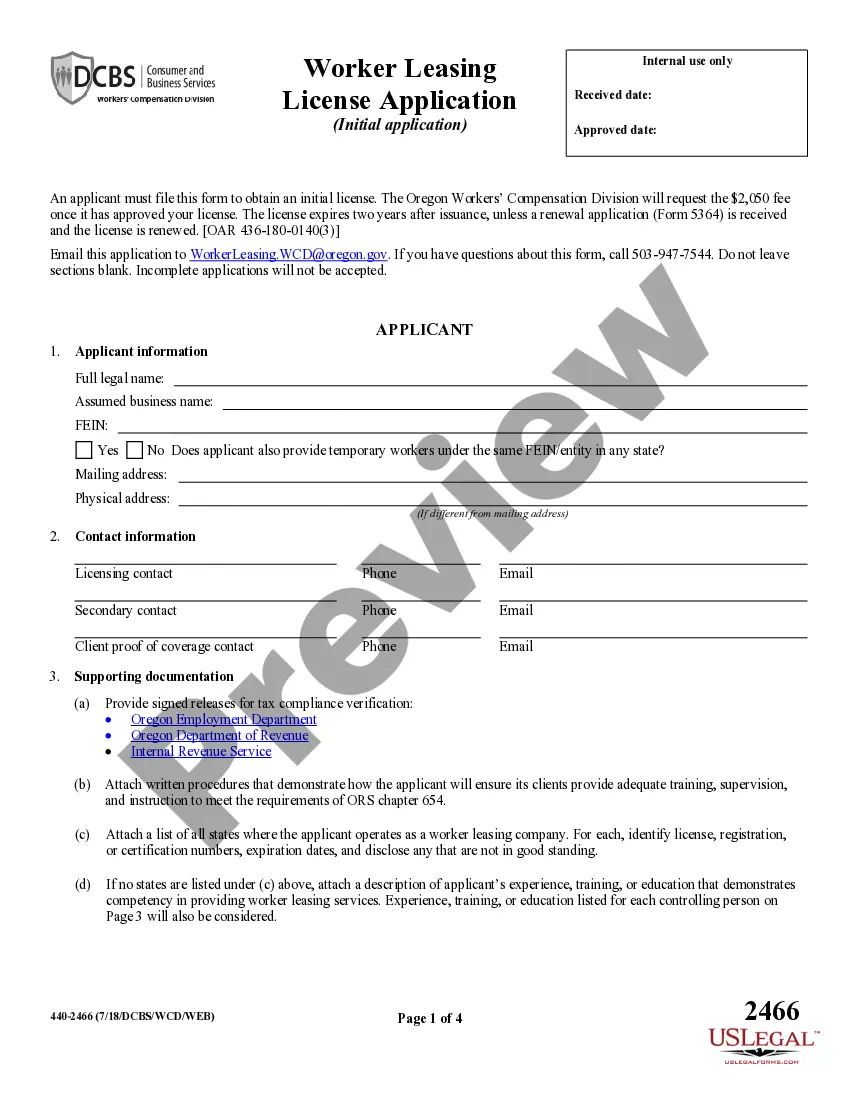

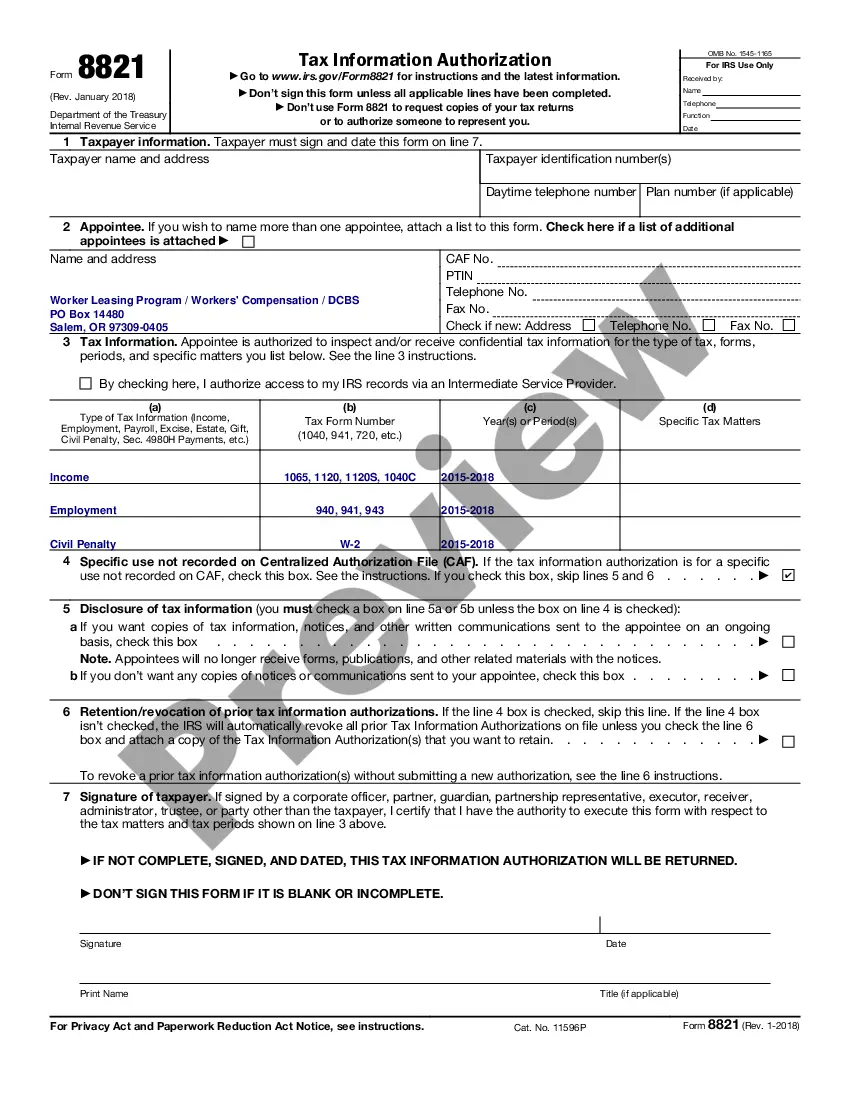

How to fill out Oregon Employment Department Tax Compliance Certification?

In terms of submitting Oregon Employment Department Tax Compliance Certification, you probably imagine an extensive procedure that requires finding a suitable sample among countless similar ones then needing to pay a lawyer to fill it out for you. Generally speaking, that’s a slow-moving and expensive choice. Use US Legal Forms and pick out the state-specific template in a matter of clicks.

If you have a subscription, just log in and click on Download button to find the Oregon Employment Department Tax Compliance Certification template.

If you don’t have an account yet but need one, follow the step-by-step guideline listed below:

- Be sure the file you’re getting is valid in your state (or the state it’s needed in).

- Do so by reading the form’s description and by clicking on the Preview option (if available) to view the form’s content.

- Simply click Buy Now.

- Choose the proper plan for your financial budget.

- Sign up for an account and select how you would like to pay out: by PayPal or by credit card.

- Download the document in .pdf or .docx format.

- Find the file on your device or in your My Forms folder.

Skilled attorneys work on drawing up our samples to ensure that after saving, you don't have to worry about editing and enhancing content outside of your individual information or your business’s info. Join US Legal Forms and receive your Oregon Employment Department Tax Compliance Certification sample now.

Form popularity

FAQ

Local governments and schools are largely funded by property taxes. Oregon is one of only five states in the nation that levies no sales or use tax. State government receipts of personal income and corporate excise taxes are contributed to the State's General Fund budget, the growth of which is controlled by State law.

You can get a SARS-issued Tax Clearance Pin Certificate within 24 hours by using our Tax Clearance Pin Certificate service.

Usually, Tax Compliance is issued within a period of 5 days according to KRA service charter; however, it may be issued before. It's always important to follow up on your application at your Tax Station for faster processing of your application.

Application for a TCC is done through iTax platform and the certificate is sent to applicants' email address. You can now check if your Tax Compliance Certificate is valid using the new KRA M-Service App.

Originally Answered: Why does Oregon have no sales tax? Because we have a state wage tax. Because we have property taxes. The State government tries with some frequency to pass a sales tax and its always been voted down by a large margin.

It would take about thirty days for someone to receive the tax clearance certificate KRA which you can obtain today in five working days.

Following IRS's lead, Oregon extends tax filing deadline to May 17 due to COVID-19. The Internal Revenue Service is pushing back the tax filing deadline by a month. Income taxes and payments will now be due May 17 instead of April 15, the agency and Treasury Department announced Wednesday.

Step 1: Visit KRA iTax Portal using https://itax.kra.go.ke/KRA-Portal/ Step 2: Enter Your KRA PIN Number. Step 3: Enter KRA iTax Password and Solve Arithmetic Question (Security Stamp) Step 4: iTax Account Dashboard. Step 5: Apply for Tax Compliance Certificate (TCC) Step 6: Download Tax Compliance Certificate.

Overall, tax compliance involves being aware of and observing the state, federal, and international tax laws and requirements set forth by government officials and other taxing authorities.Individuals who don't complete their tax return filing by this date are considered noncompliant.