Oklahoma Wage and Income Loss Statement

Description

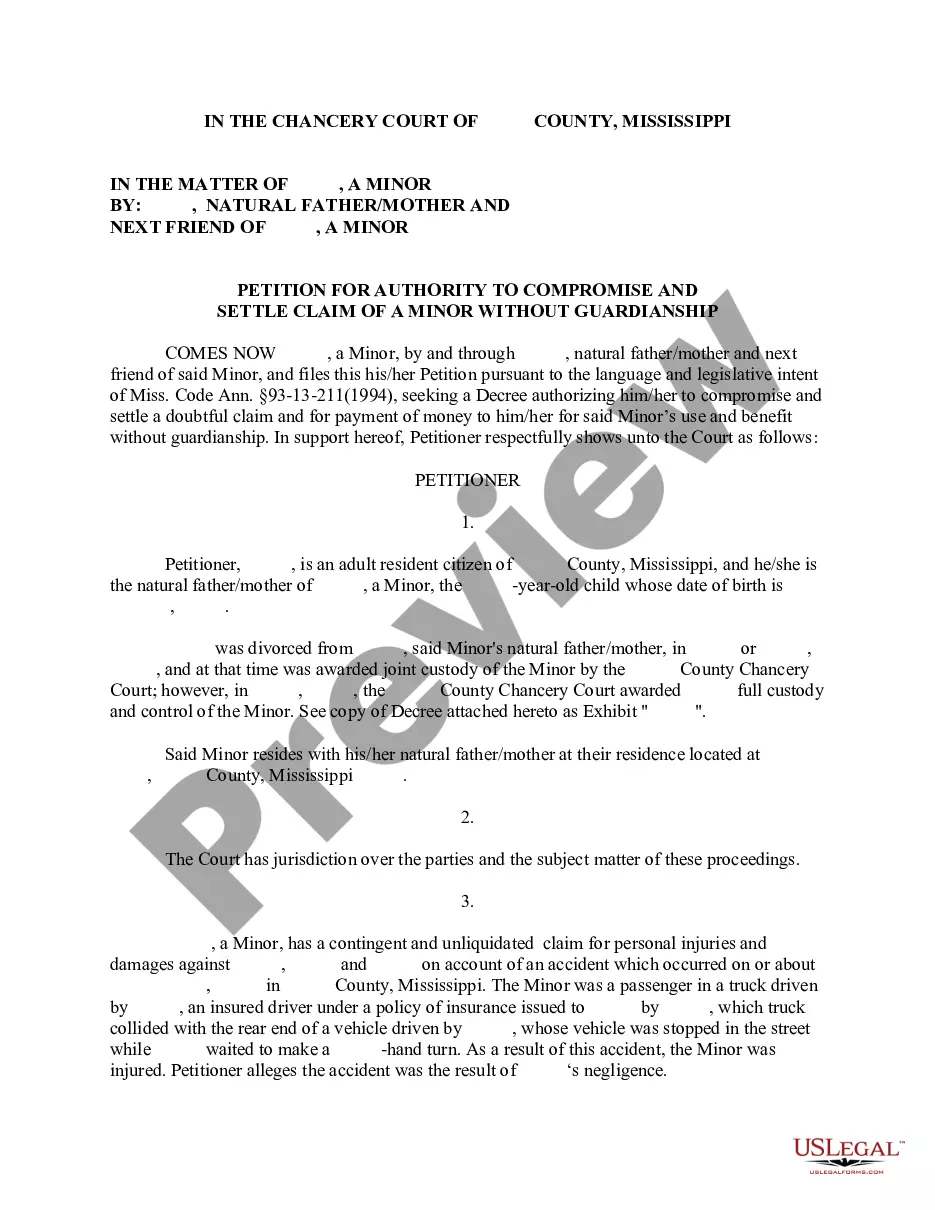

How to fill out Wage And Income Loss Statement?

Are you presently in a position in which you need to have files for possibly organization or individual purposes just about every time? There are a lot of authorized document themes available on the Internet, but finding types you can trust isn`t straightforward. US Legal Forms provides a huge number of type themes, much like the Oklahoma Wage and Income Loss Statement, which are written to meet federal and state specifications.

If you are currently informed about US Legal Forms internet site and possess a free account, basically log in. Following that, you are able to down load the Oklahoma Wage and Income Loss Statement format.

Unless you provide an profile and would like to begin to use US Legal Forms, abide by these steps:

- Find the type you need and ensure it is for the right metropolis/area.

- Take advantage of the Review switch to examine the form.

- Look at the description to ensure that you have selected the right type.

- When the type isn`t what you`re searching for, utilize the Search field to obtain the type that meets your requirements and specifications.

- Whenever you get the right type, click on Get now.

- Pick the costs strategy you need, fill out the required information to create your bank account, and purchase an order using your PayPal or charge card.

- Choose a practical file format and down load your duplicate.

Locate all the document themes you might have bought in the My Forms food selection. You can obtain a more duplicate of Oklahoma Wage and Income Loss Statement anytime, if needed. Just click the needed type to down load or printing the document format.

Use US Legal Forms, one of the most substantial variety of authorized varieties, in order to save efforts and avoid blunders. The services provides professionally manufactured authorized document themes that you can use for a variety of purposes. Create a free account on US Legal Forms and commence generating your lifestyle easier.

Form popularity

FAQ

What Can You Do to Fight Wage Theft? Learn about your rights. If you are a victim of wage theft, take action: File a wage claim against your employer. The Labor Commissioner's Office can order your employer to pay you the wages and penalties you are owed. Report widespread cases of wage theft to our investigators.

Your suspended losses will show on federal form 8582, Passive Activity Loss Limitations. That form will carry over automatically in TurboTax to future years. The loss will be applied to future Oklahoma tax income as is allowed by law.

How do I file a complaint against an employer in Oklahoma? Contact the Oklahoma Merit Protection Commission by: E-mail MPC. Telephone: (405) 525-9144. Regular mail: Oklahoma Merit Protection Commission.

Statute of Limitations Oklahoma wage payment law does not contain a limitations period, however, the general limitations period for civil suits under state law is 5 years. There are several exceptions to this with shorter timeframes.

If you have earned wages that have not been paid on the regularly scheduled date and the additional three (3) days has passed, you can download and submit a Wage Claim form. You can also contact a labor compliance officer at the Oklahoma Department of Labor's Wage and Hour Unit at (405) 521-6100 or (888) 269-5353.

With regard to each member of an electing PTE, the electing PTE shall multiply such member's Oklahoma distributive share of the electing PTE's Oklahoma net entity income by the applicable 4.75% or 4% tax rate.

A Form 500-B must be completed for each nonresident member to whom the pass-through entity has made an Oklahoma taxable distribution and paid withholding to Oklahoma. Form 500-B should not report withhold- ing paid by sources other than the pass-through entity.

Oklahoma sets its minimum wage to be the same as the federal minimum wage, which is $7.25. Employers who have less than 10 employees or earn less than $100,000 of business annually are exempt from complying with the minimum wage rate, ing to wage and hour laws.