Oklahoma Release of Production Payment Created by An Assignment

Description

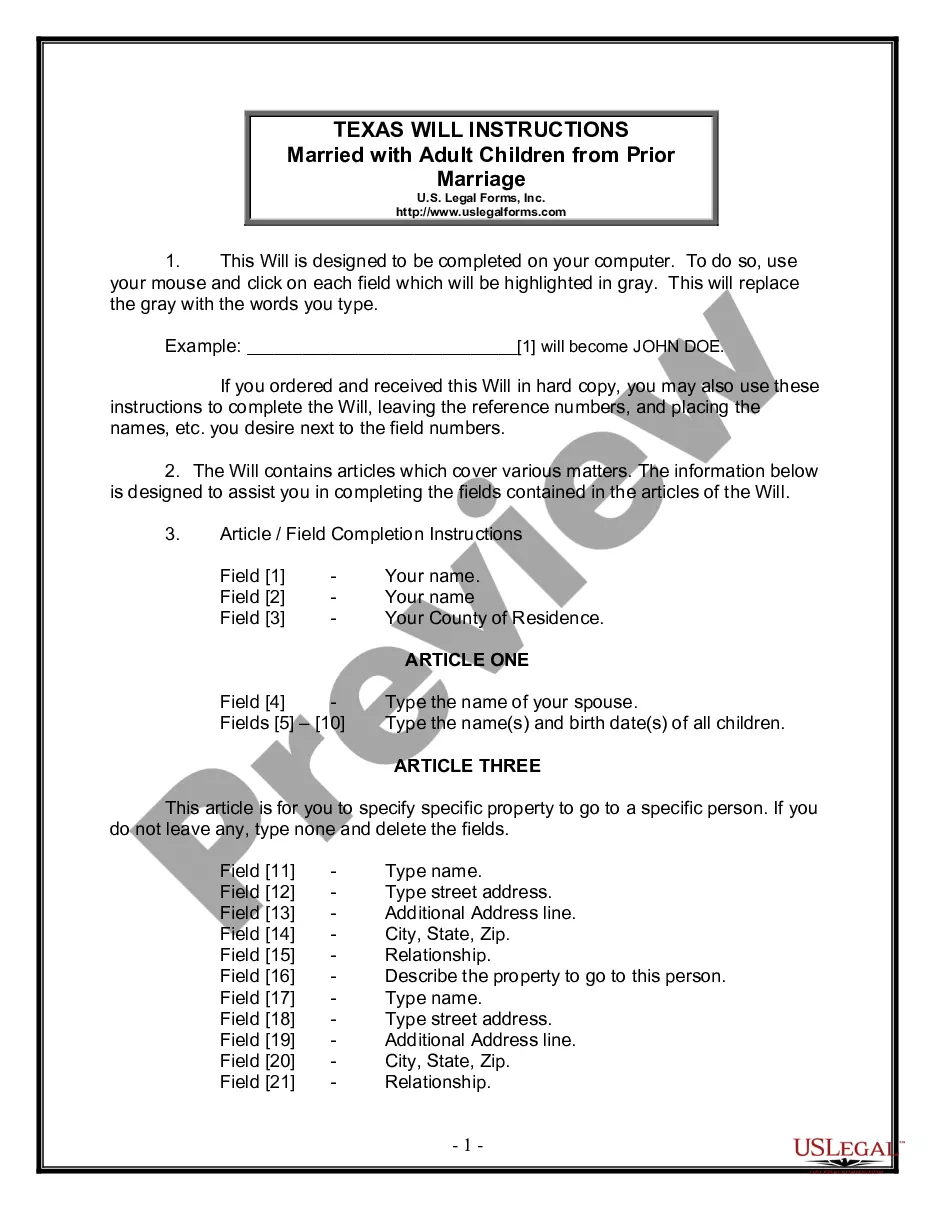

How to fill out Release Of Production Payment Created By An Assignment?

If you want to full, obtain, or print out lawful record layouts, use US Legal Forms, the largest assortment of lawful kinds, that can be found online. Utilize the site`s easy and handy lookup to obtain the paperwork you need. Various layouts for company and specific functions are categorized by classes and says, or keywords. Use US Legal Forms to obtain the Oklahoma Release of Production Payment Created by An Assignment with a handful of mouse clicks.

When you are already a US Legal Forms customer, log in in your accounts and click on the Obtain option to obtain the Oklahoma Release of Production Payment Created by An Assignment. Also you can access kinds you in the past acquired within the My Forms tab of your respective accounts.

Should you use US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Make sure you have chosen the shape for the appropriate city/land.

- Step 2. Utilize the Preview option to check out the form`s articles. Never overlook to learn the information.

- Step 3. When you are not happy using the kind, make use of the Look for discipline towards the top of the monitor to discover other models of your lawful kind format.

- Step 4. When you have located the shape you need, click the Purchase now option. Opt for the prices strategy you prefer and add your qualifications to sign up for an accounts.

- Step 5. Process the financial transaction. You can use your Мisa or Ьastercard or PayPal accounts to finish the financial transaction.

- Step 6. Find the format of your lawful kind and obtain it in your product.

- Step 7. Total, edit and print out or indication the Oklahoma Release of Production Payment Created by An Assignment.

Each and every lawful record format you acquire is the one you have forever. You have acces to every single kind you acquired inside your acccount. Click on the My Forms portion and choose a kind to print out or obtain again.

Contend and obtain, and print out the Oklahoma Release of Production Payment Created by An Assignment with US Legal Forms. There are thousands of expert and status-distinct kinds you can use for the company or specific demands.

Form popularity

FAQ

A volumetric production payment (VPP) is a means of financing used predominantly in the oil and gas industry wherein the owner of an oil or gas property sells a percentage of the total production for an upfront cash payment. It allows the issuer to monetize his/her assets without diluting his control on them.

A quick definition of production payment: A production payment is a type of agreement in the oil and gas industry where a person or company receives a share of the oil and gas produced from a property. This share is given without having to pay for the costs of production.

(1) The term production payment means, in general, a right to a specified share of the production from mineral in place (if, as, and when produced), or the proceeds from such production. Such right must be an economic interest in such mineral in place.

26 U.S. Code § 636 - Income tax treatment of mineral production payments. A production payment carved out of mineral property shall be treated, for purposes of this subtitle, as if it were a mortgage loan on the property, and shall not qualify as an economic interest in the mineral property.