Oklahoma Provisions Which May Be Added to a Division Or Transfer Order

Description

How to fill out Provisions Which May Be Added To A Division Or Transfer Order?

Choosing the best legal document format can be quite a struggle. Obviously, there are a variety of themes available on the net, but how would you find the legal develop you will need? Use the US Legal Forms internet site. The support delivers a huge number of themes, including the Oklahoma Provisions Which May Be Added to a Division Or Transfer Order, that you can use for enterprise and personal needs. All the types are checked by specialists and meet up with state and federal needs.

If you are currently registered, log in for your profile and then click the Obtain option to find the Oklahoma Provisions Which May Be Added to a Division Or Transfer Order. Use your profile to look with the legal types you might have acquired in the past. Go to the My Forms tab of the profile and have an additional duplicate from the document you will need.

If you are a new end user of US Legal Forms, allow me to share straightforward directions that you should comply with:

- Initial, make certain you have chosen the proper develop for your metropolis/area. It is possible to examine the form making use of the Preview option and study the form outline to make sure this is basically the best for you.

- In case the develop fails to meet up with your expectations, utilize the Seach discipline to obtain the right develop.

- Once you are sure that the form is suitable, go through the Acquire now option to find the develop.

- Opt for the prices program you would like and type in the essential information and facts. Create your profile and purchase an order utilizing your PayPal profile or credit card.

- Select the data file file format and down load the legal document format for your system.

- Full, edit and printing and indicator the obtained Oklahoma Provisions Which May Be Added to a Division Or Transfer Order.

US Legal Forms is the biggest collection of legal types for which you can find a variety of document themes. Use the company to down load appropriately-produced paperwork that comply with condition needs.

Form popularity

FAQ

Unsolicited purchase offers are happening in greater numbers and for greater ? sometimes much greater ? amounts than in the past. The upshot? Sometimes selling makes good sense. Indeed, depending on your situation, the sale of your mineral rights can represent a prudent ? and even compelling ? opportunity.

Taxes: The #1 reason for selling mineral rights is taxes. If you inherited mineral rights and then sold them for $100,000, you could pay only $5,250 in taxes and keep $94,750. If you collect royalty income of $100,000, you could pay $30,000+ in taxes and only keep $70,000 and it would takes years to collect.

Cons of Selling Your Mineral Rights Loss of Potential Future Income: When you sell your mineral rights, you also give up any potential future income from those rights. This can be a significant loss if the mineral rights end up producing more than expected or if there are new discoveries in the future.

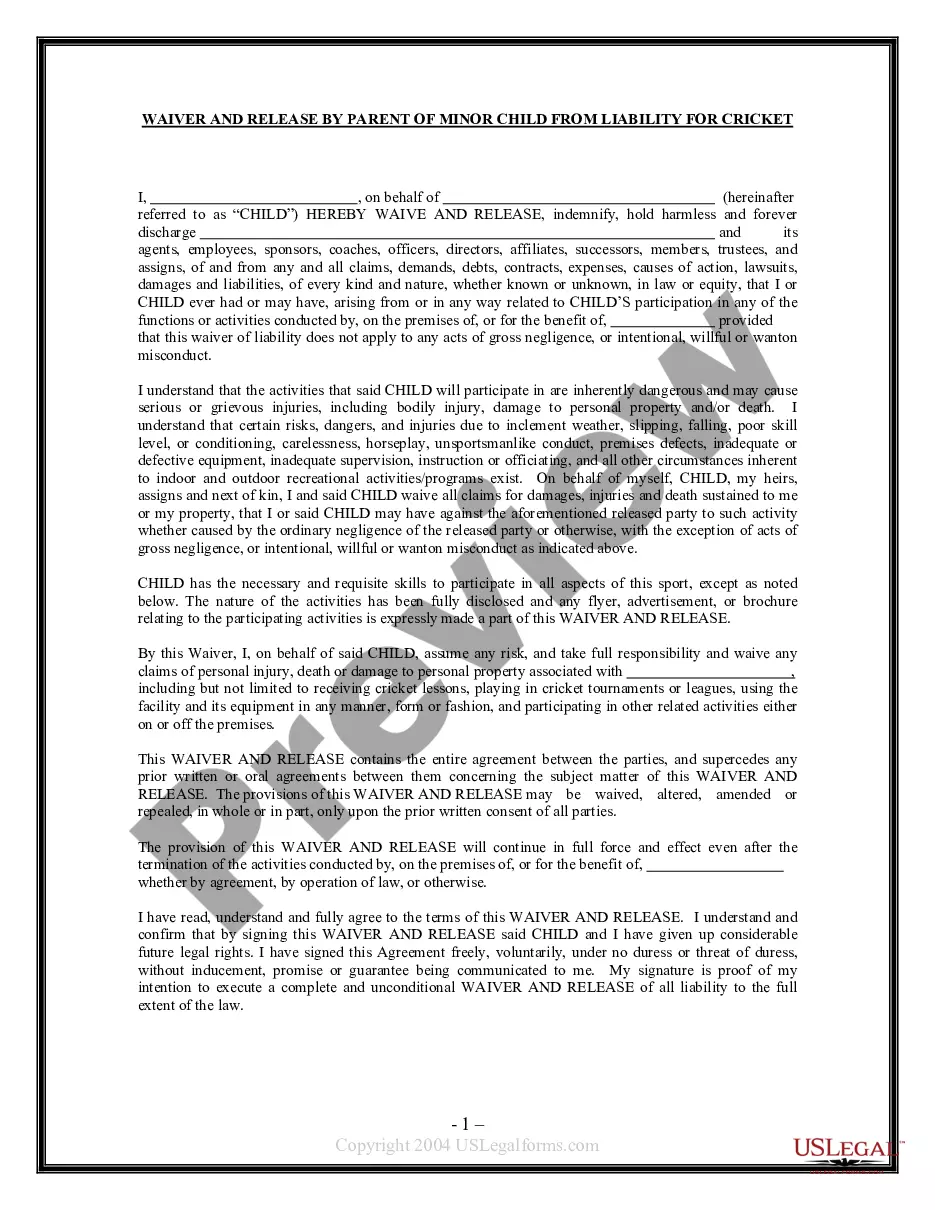

A Division Order is an instrument which sets forth the proportional ownership in produced hydrocarbons, including crude oil, natural gas, and NGL's. Sometimes the Division Order is referred to as a division of interest. More often than not, a single well or lease will have multiple owners.

Yes, it can be beneficial to sell your mineral rights for a fair price, even producing rights. First, sellers must be aware of the different stages of the production process. They must also know the value their minerals and royalties command in every development stage.

The division order describes the minerals, it asks for information about yourself, and often asks you to agree to certain things related to the payment of royalties. But beware, in Oklahoma you are not required to sign and return a division order. In fact, you may be unnecessarily impairing or giving away your rights.

The value of mineral rights per acre differs from state to state. Typically, the price ranges from $100 to $5,000 per acre in several states. In Texas, the average price per acre for non-producing mineral rights is usually between $0 and $250 per acre, as a general guideline.

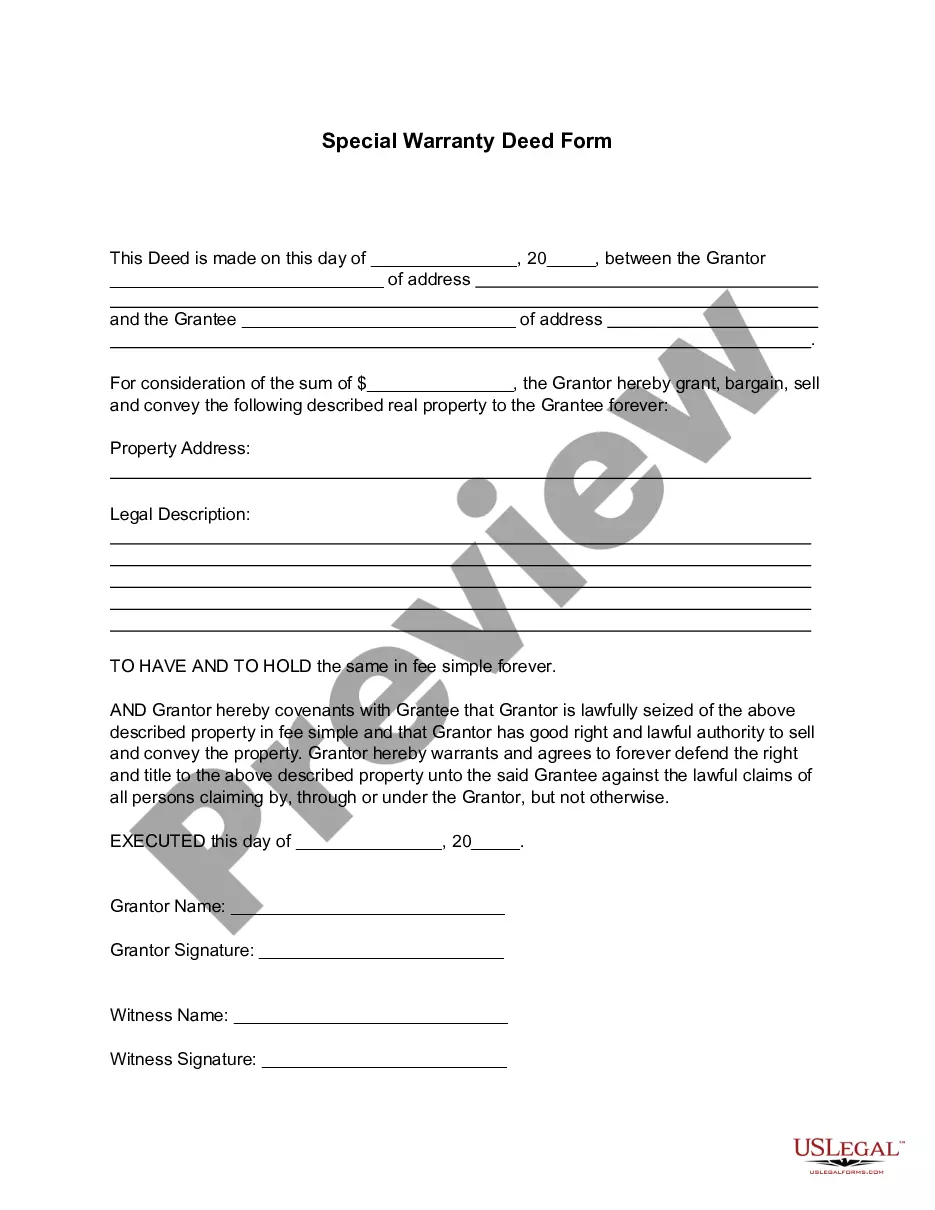

Whether mineral rights transfer with the property depends on the estate type. If it's a severed estate, surface rights and mineral rights are separate and do not transfer together. However, if it's a unified estate, the land and the mineral rights can be conveyed with the property.