Oklahoma Design Agreement - Self-Employed Independent Contractor

Description

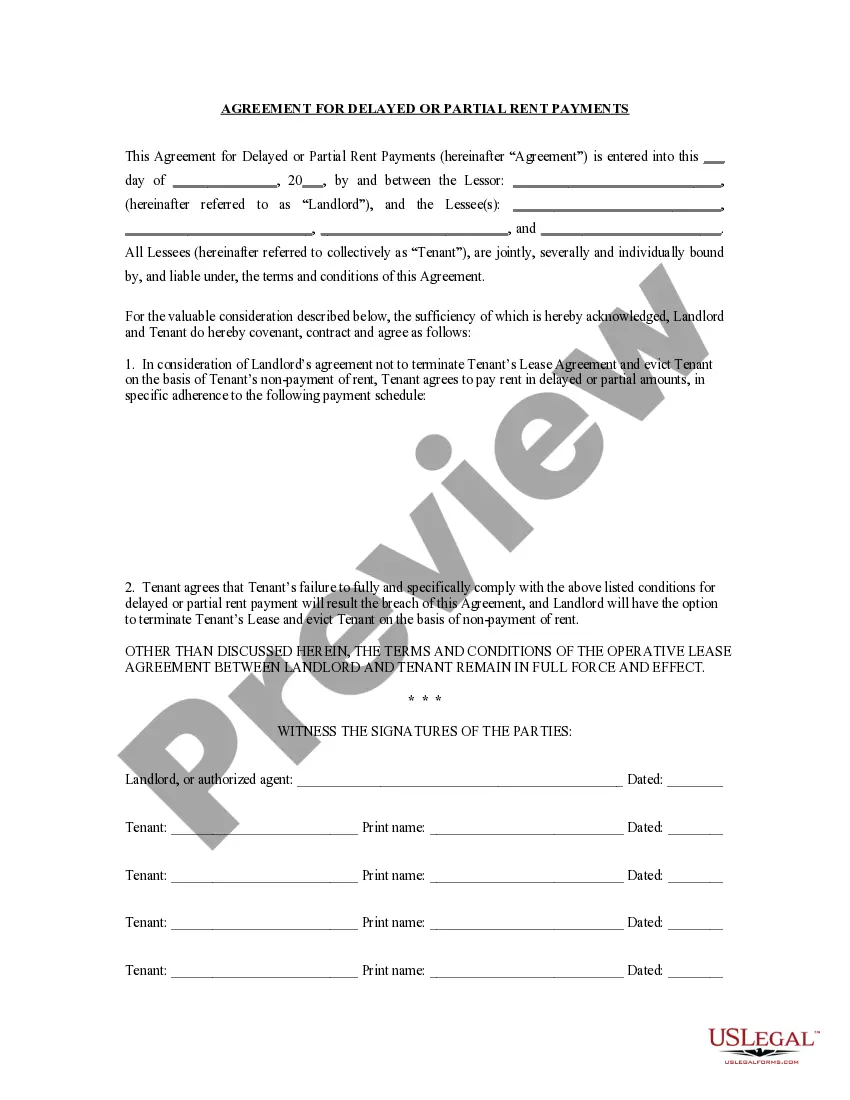

How to fill out Design Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of authentic templates in the United States - offers a diverse selection of legal document templates that you can download or print.

By utilizing the website, you can discover thousands of forms for both business and personal usage, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the Oklahoma Design Agreement - Self-Employed Independent Contractor in just minutes.

If you already have a membership, Log In and download the Oklahoma Design Agreement - Self-Employed Independent Contractor from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms from the My documents tab in your account.

Process the transaction. Use your Visa or Mastercard or PayPal account to complete the transaction. Choose the file format and download the form to your device.

Make edits. Fill out, modify, print, and sign the downloaded Oklahoma Design Agreement - Self-Employed Independent Contractor. Each template you added to your account has no expiration date and is yours indefinitely. Therefore, to download or print another copy, simply go to the My documents section and click on the form you need. Gain access to the Oklahoma Design Agreement - Self-Employed Independent Contractor with US Legal Forms, one of the most extensive libraries of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you want to use US Legal Forms for the first time, here are simple steps to get you started.

- Ensure you have selected the correct form for your city/region. Click the Preview button to review the form's content.

- Check the form description to confirm you have selected the correct form.

- If the form does not meet your requirements, use the Search section at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select the pricing plan you prefer and provide your details to register for the account.

Form popularity

FAQ

Writing an independent contractor agreement involves a few key components. Start with a title that describes the agreement, followed by the details of both parties. Include the project scope, payment structure, and termination clauses. You can utilize platforms like US Legal Forms to find templates that simplify the process of creating a professional Oklahoma Design Agreement - Self-Employed Independent Contractor.

When filling out an independent contractor agreement, clearly state the names of both parties involved and provide their contact details. Next, describe the services to be performed, payment terms, and deadlines. This comprehensive approach ensures both parties understand their commitments under the Oklahoma Design Agreement - Self-Employed Independent Contractor.

To fill out a declaration of independent contractor status form, start by providing your name and contact information. You will need to outline the nature of your work and confirm that you operate independently. This form is essential as it underlines your roles and responsibilities within the framework of the Oklahoma Design Agreement - Self-Employed Independent Contractor.

As a self-employed independent contractor, you typically need to complete several essential documents. These include a W-9 form for tax purposes and your independent contractor agreement, which outlines the scope of work and payment details. Make sure to keep copies of all forms, as they are crucial for managing your business effectively under the Oklahoma Design Agreement - Self-Employed Independent Contractor.

Filling out an independent contractor form is straightforward. Begin by entering your personal information, including your name, address, and contact information. Next, describe the services you offer in detail, along with the agreed payment terms. This ensures clarity for both parties involved in the Oklahoma Design Agreement - Self-Employed Independent Contractor.

Yes, independent contractors file taxes as self-employed individuals. This means they must report their income through a Schedule C form, reflecting earnings from their work, including those covered under an Oklahoma Design Agreement - Self-Employed Independent Contractor. It's crucial for contractors to keep thorough records of their income and expenses to ensure accurate filings. Using a proper agreement helps clarify earnings and responsibilities, making tax filing smoother.

Creating an Oklahoma Design Agreement - Self-Employed Independent Contractor is a straightforward process. Start by outlining key details such as the services provided, payment structure, and duration of the contract. You can leverage user-friendly platforms like UsLegalForms which offer templates and resources, making it easier to craft a comprehensive agreement. This ensures you cover essential elements that protect both you and the contractor.

In most cases, an Oklahoma Design Agreement - Self-Employed Independent Contractor does not need to be notarized to be legally binding. However, depending on the specific requirements of your state or the nature of the contract, notarization may serve as an added layer of verification. Always consider consulting a legal professional if you have concerns about the validity of your agreement. Using reliable resources from UsLegalForms can guide you in making the right choices.

Typically, the business hiring the independent contractor drafts the Oklahoma Design Agreement - Self-Employed Independent Contractor. It's important to clearly outline the scope of work, payment terms, and other responsibilities in this document. You can also use templates from platforms like UsLegalForms to ensure that you include all necessary elements. This approach helps protect both parties in the agreement.