Oklahoma Dancer Agreement - Self-Employed Independent Contractor

Description

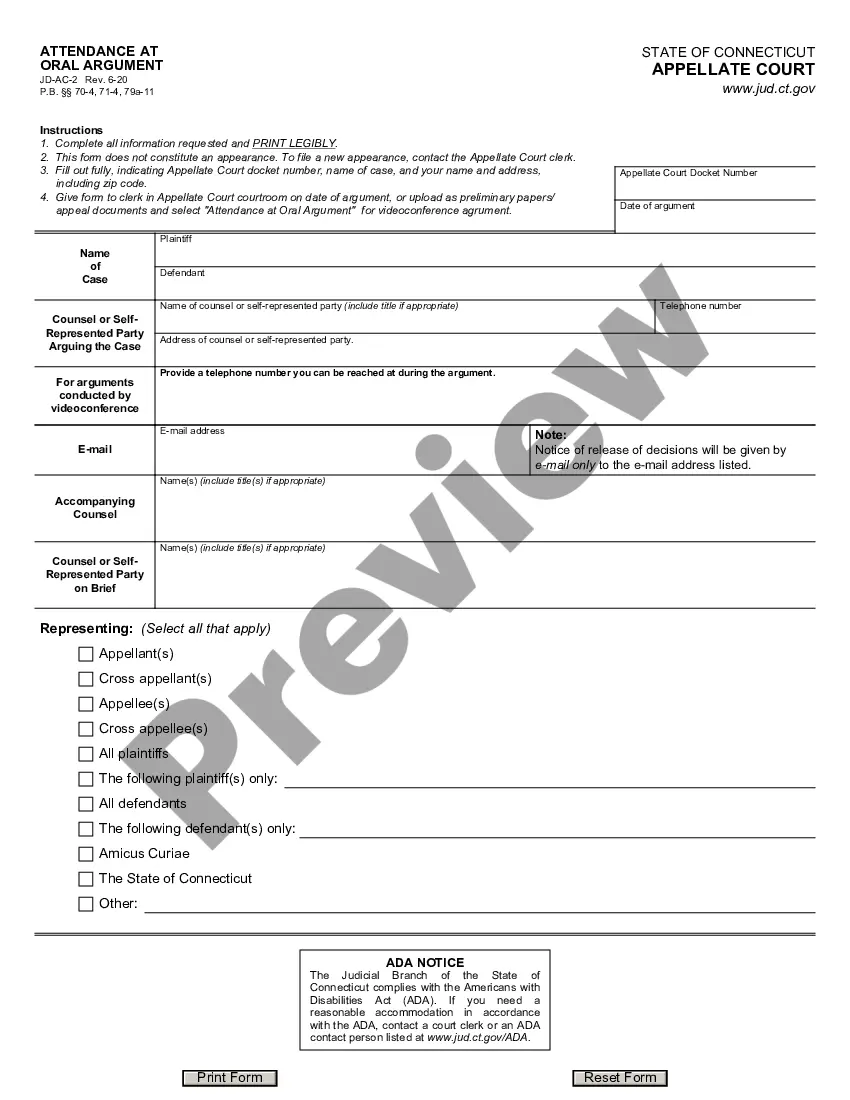

How to fill out Dancer Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the most prominent collections of legal documents in the United States - provides a range of legal document templates that you can download or create. By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can retrieve the latest versions of documents like the Oklahoma Dancer Agreement - Self-Employed Independent Contractor within minutes.

If you already have a subscription, Log In and download the Oklahoma Dancer Agreement - Self-Employed Independent Contractor from the US Legal Forms catalog. The Download option will appear on every form you view. You have access to all previously saved forms from the My documents section of your account.

If you are using US Legal Forms for the first time, here are some basic tips to get you started: Ensure you have selected the correct form for the city/state. Click the Review option to examine the form’s content. Check the form description to confirm you have selected the right form. If the form does not meet your requirements, use the Search field at the top of the screen to find one that does. If you are satisfied with the form, confirm your choice by clicking the Get now option. Then, choose the pricing plan you prefer and provide your details to create an account. Complete the transaction. Use your credit card or PayPal account to finalize the transaction. Select the file format and download the form to your device. Make changes. Fill out, edit, and print and sign the saved Oklahoma Dancer Agreement - Self-Employed Independent Contractor. Every template you added to your account has no expiration date and is yours forever. So, if you want to download or create another version, just go to the My documents section and click on the form you need.

US Legal Forms offers a broad selection of legal documents, making it a valuable resource for anyone in need of reliable templates.

Take advantage of their extensive library to fulfill your legal documentation needs efficiently.

- Access the Oklahoma Dancer Agreement - Self-Employed Independent Contractor with US Legal Forms, the most comprehensive collection of legal document templates.

- Utilize a vast array of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure to have the correct form selected.

- Review the form content thoroughly.

- Use the search feature if the initial form doesn't fit your criteria.

- Finalize your purchase using a credit card or PayPal.

Form popularity

FAQ

To become an independent contractor in Oklahoma, first, identify the services you wish to offer and build a portfolio showcasing your skills. Register your business if necessary, and familiarize yourself with local regulations regarding the Oklahoma Dancer Agreement - Self-Employed Independent Contractor. Networking with potential clients and utilizing resources from platforms like uslegalforms can help you find clients and create necessary agreements, facilitating your journey into independent contracting.

In general, an independent contractor must earn at least $600 in a calendar year to receive a 1099 form. This requirement applies to the total income received for services provided, including amounts related to the Oklahoma Dancer Agreement - Self-Employed Independent Contractor. If you meet this threshold, the client is obligated to report your earnings to the IRS. Keeping accurate records of your income will help ensure compliance and reporting accuracy.

To create an effective independent contractor agreement, start by clearly outlining the terms of the engagement. Include specific details such as the scope of work, payment terms, and duration of the agreement. It's essential to ensure that this agreement aligns with the Oklahoma Dancer Agreement - Self-Employed Independent Contractor guidelines. Consider using a platform like uslegalforms, which provides templates and resources to help you draft a solid agreement.

Filling out an independent contractor form involves entering your information, the client's details, and the specific tasks or services to be done. Additionally, clarify payment details and deadlines for task completion. To streamline the process, you may use the Oklahoma Dancer Agreement - Self-Employed Independent Contractor form available on uslegalforms, which ensures that all vital information is captured correctly and effectively.

Writing an independent contractor agreement involves outlining the services to be performed, detailing the payment structure, and establishing the contract's length. It’s also essential to include confidentiality or non-compete agreements if necessary. This process can be simplified by using the Oklahoma Dancer Agreement - Self-Employed Independent Contractor template from uslegalforms, which provides a ready-made structure to guide you.

An independent contractor typically needs to fill out the IRS Form W-9, which collects necessary information such as name, address, and Taxpayer Identification Number. Moreover, depending on the state, a specific independent contractor agreement form may be required to outline the terms of the engagement. The Oklahoma Dancer Agreement - Self-Employed Independent Contractor form provides a comprehensive, user-friendly option for those looking to formalize their work arrangements.

To fill out an independent contractor agreement, begin by entering your personal details and the contractor's details. Next, specify the services to be provided, the payment terms, and any additional clauses relevant to your arrangement. Including these elements ensures clarity and helps avoid misunderstandings. For an effective solution, consider using the Oklahoma Dancer Agreement - Self-Employed Independent Contractor template available on uslegalforms.

Yes, an independent contractor can indeed have a non-compete agreement. However, the enforceability of such agreements depends on state laws and the specific terms outlined in the Oklahoma Dancer Agreement - Self-Employed Independent Contractor. It's important to ensure that the agreement is reasonable in terms of time and geographical scope to be enforceable. For tailored agreements or guidance, consider using the resources available on UsLegalForms, where you can find templates and legal assistance to create the right contract for your needs.