Alaska Term Sheet - Six Month Promissory Note

Description

How to fill out Term Sheet - Six Month Promissory Note?

If you have to full, down load, or produce lawful record web templates, use US Legal Forms, the biggest selection of lawful kinds, that can be found on the Internet. Use the site`s simple and easy hassle-free look for to obtain the files you will need. Numerous web templates for business and person reasons are categorized by categories and states, or keywords. Use US Legal Forms to obtain the Alaska Term Sheet - Six Month Promissory Note with a handful of mouse clicks.

Should you be presently a US Legal Forms customer, log in to your bank account and click the Download switch to have the Alaska Term Sheet - Six Month Promissory Note. You can even accessibility kinds you previously downloaded inside the My Forms tab of your respective bank account.

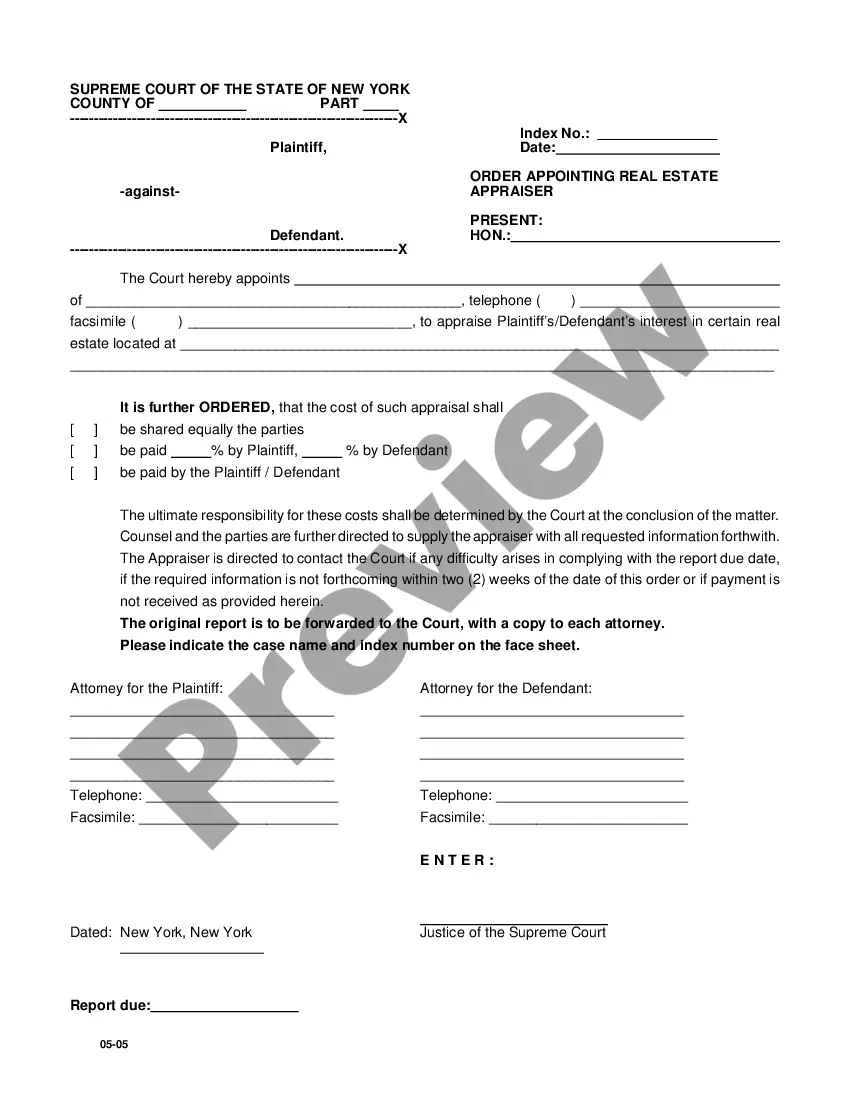

Should you use US Legal Forms for the first time, follow the instructions under:

- Step 1. Be sure you have chosen the shape to the correct metropolis/nation.

- Step 2. Take advantage of the Review option to check out the form`s content material. Don`t forget about to see the description.

- Step 3. Should you be unhappy using the form, make use of the Search field near the top of the display to discover other versions from the lawful form format.

- Step 4. After you have found the shape you will need, click on the Buy now switch. Choose the pricing plan you prefer and add your qualifications to sign up for an bank account.

- Step 5. Method the deal. You can utilize your Мisa or Ьastercard or PayPal bank account to perform the deal.

- Step 6. Select the format from the lawful form and down load it in your system.

- Step 7. Total, edit and produce or indicator the Alaska Term Sheet - Six Month Promissory Note.

Each lawful record format you purchase is yours forever. You may have acces to every form you downloaded inside your acccount. Go through the My Forms portion and choose a form to produce or down load again.

Remain competitive and down load, and produce the Alaska Term Sheet - Six Month Promissory Note with US Legal Forms. There are millions of expert and state-certain kinds you may use for your business or person demands.

Form popularity

FAQ

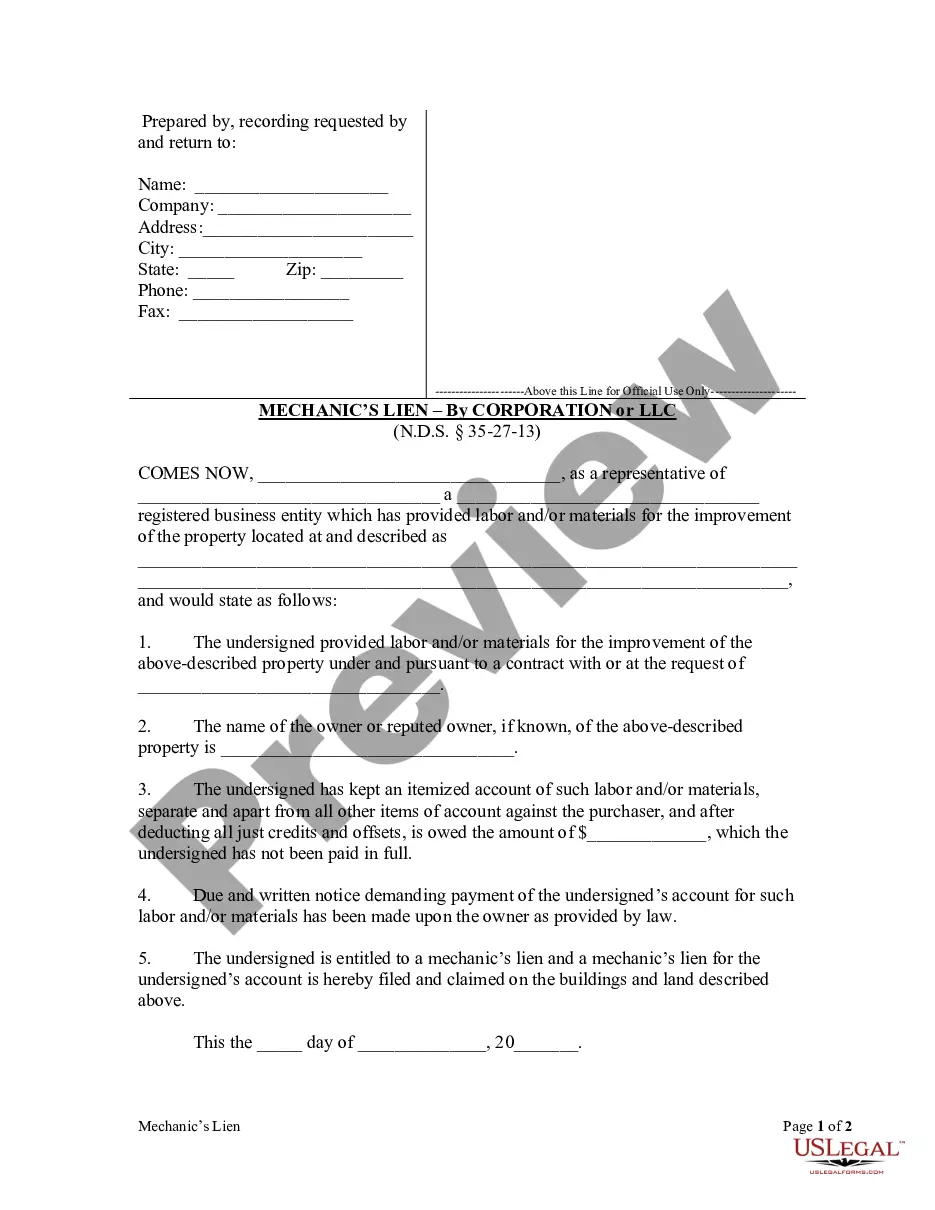

For a personal loan agreement to be enforceable, it must be documented in writing, as well as signed and dated by all parties involved. It's also a good idea to have the document notarized or signed by a witness.

This is to express in writing my inability to pay on time the amount due for my tuition fees amounting to P_____________________. I promise to pay said amount on or before ______________________. Furthermore, I am fully aware that subsequent Promissory Notes shall not be accepted without settling my current due amount.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

A promissory note is a written agreement between one party (you, the borrower) to pay back the loan issued by another party (often a bank or other financial institution). Anyone lending money (like home sellers, credit unions, mortgage lenders and banks, for instance) can issue a promissory note.

Although it is legally enforceable, a promissory note is less formal than a loan agreement and is suitable where smaller sums of money are involved. However, its terms - which can include a specific date of repayment, interest rate and repayment schedule - are more certain than those of an IOU.

A loan agreement serves a similar purpose as a promissory note. Like a promissory note it is a contractual agreement between a lender who agrees to loan money to a borrower. However, a loan agreement is much more detailed than a promissory note. There are two types of loan agreements.

A loan note can offer greater flexibility than a simple loan agreement, while still being legally actionable should it need to be upheld in court. They are also much easier to enforce than an informal IOU because the legal terms of the agreement are much more clearly defined.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.