Oklahoma Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property

Description

How to fill out Renunciation And Disclaimer Of Right To Inheritance Or To Inherit Property From Deceased - Specific Property?

Finding the right authorized document format can be a have a problem. Needless to say, there are tons of layouts available online, but how do you obtain the authorized kind you will need? Utilize the US Legal Forms web site. The assistance offers a large number of layouts, including the Oklahoma Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property, that can be used for organization and private needs. All the types are checked out by specialists and meet state and federal needs.

Should you be presently authorized, log in in your bank account and click the Download switch to get the Oklahoma Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property. Make use of bank account to appear with the authorized types you might have purchased earlier. Go to the My Forms tab of your respective bank account and obtain another version of the document you will need.

Should you be a new user of US Legal Forms, listed below are straightforward guidelines that you should follow:

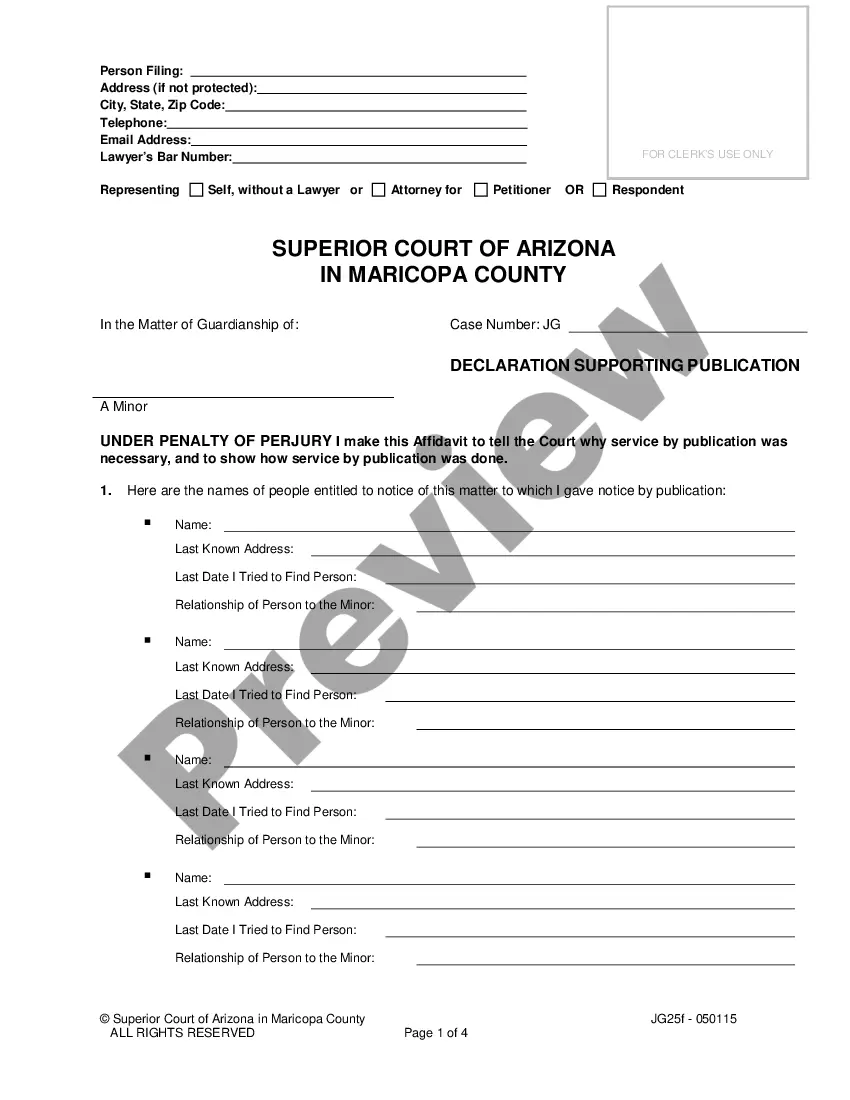

- First, make certain you have selected the proper kind for your city/county. It is possible to check out the shape making use of the Review switch and study the shape information to ensure this is the right one for you.

- If the kind will not meet your needs, use the Seach area to discover the proper kind.

- Once you are certain that the shape is acceptable, go through the Get now switch to get the kind.

- Choose the costs strategy you would like and enter in the needed information. Create your bank account and pay money for an order using your PayPal bank account or credit card.

- Opt for the submit format and down load the authorized document format in your gadget.

- Total, modify and produce and signal the received Oklahoma Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property.

US Legal Forms is definitely the most significant library of authorized types where you can find a variety of document layouts. Utilize the service to down load skillfully-manufactured paperwork that follow state needs.

Form popularity

FAQ

You make your disclaimer in writing. Your inheritance disclaimer specifically says that you refuse to accept the assets in question and that this refusal is irrevocable, meaning it can't be changed. You disclaim the assets within nine months of the death of the person you inherited them from.

In order to disclaim an inheritance, you will need to write a Disclaimer, which states that you are disclaiming your inheritance in writing. Within your Disclaimer, you will need to explain what is being disclaimed, whether it is only part of your inheritance or all of it, as well as sign the document to make it legal.

DISCLAIMER OF INHERITANCE RIGHTS I have been fully advised of my rights to certain property of the Estate of __________________ and waive and disclaim my right to same voluntarily and without duress or undue influence. This disclaimer applies to all real and personal property I would have received.

You make your disclaimer in writing. Your inheritance disclaimer specifically says that you refuse to accept the assets in question and that this refusal is irrevocable, meaning it can't be changed. You disclaim the assets within nine months of the death of the person you inherited them from.

Disclaiming an inheritance is when a potential heir renounces their right to inherit any assets or property left to them. This decision must be made before the heir takes any possession or control of the inheritance. There are no reversals.

A qualified disclaimer is an irrevocable refusal by a beneficiary, including a beneficiary of retirement assets, to accept an interest in property pursuant to IRC Sec. 2518(b). A beneficiary can refuse to accept her entire interest in property or a partial share under certain circumstances.

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor, ...

An inheritance disclaimer form is a legal document that allows a beneficiary of an inheritance to waive their right to receive the inheritance.