This due diligence form provides a list of meeting compliances and requirements for company directors regarding business transactions.

Oklahoma Directors Meeting Compliance with Requirements

Description

How to fill out Directors Meeting Compliance With Requirements?

Have you found yourself in a scenario where you require documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but discovering ones that are reliable is challenging.

US Legal Forms provides a vast array of document templates, including the Oklahoma Directors Meeting Compliance with Requirements, designed to comply with federal and state regulations.

Once you find the correct document, click Purchase now.

Select the pricing plan you want, provide the necessary information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Oklahoma Directors Meeting Compliance with Requirements template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the document you need and ensure it is for the correct city/state.

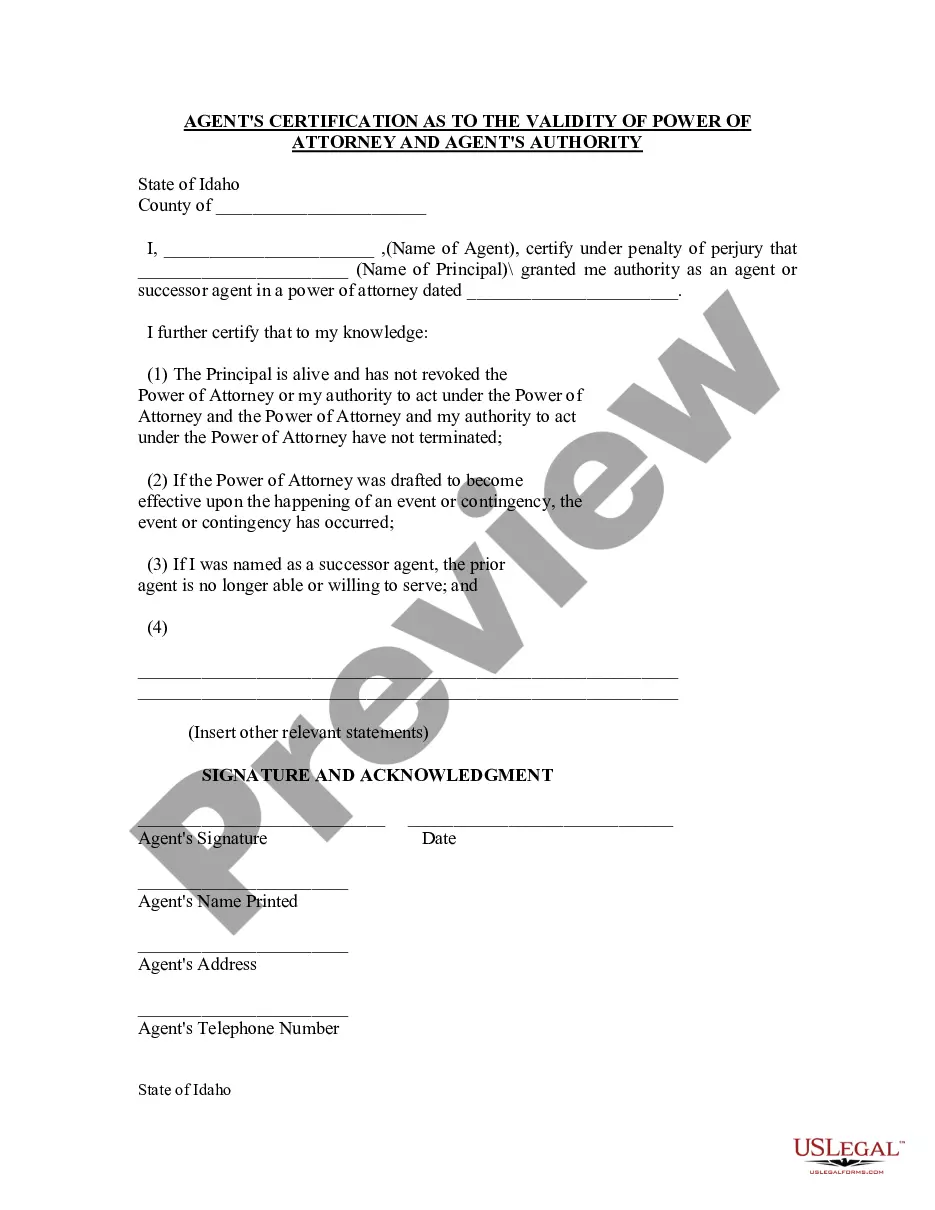

- Utilize the Review button to examine the form.

- Check the description to confirm you have selected the right document.

- If the document is not what you are looking for, use the Lookup field to find the template that meets your needs.

Form popularity

FAQ

To file a DBA (Doing Business As) in Oklahoma, you need to complete the required forms and file them with the appropriate county clerk’s office. This process typically includes providing your business name, ownership details, and the nature of your business. Filing a DBA properly supports compliance with Oklahoma Directors Meeting Compliance with Requirements. US Legal Forms offers tools and templates that can make this filing easier for you.

The 183 day rule in Oklahoma is a guideline that determines tax residency based on the number of days spent in the state. If you are in Oklahoma for more than 183 days during the year, you may be classified as a resident for tax purposes. Understanding this rule ensures that you meet Oklahoma Directors Meeting Compliance with Requirements effectively. Always consult local authorities or legal advisors for personalized guidance.

In general, living in Oklahoma for more than six months, or 183 days, qualifies you as a resident for tax purposes. This status is important as it can affect your tax filings and obligations. Additionally, being a resident may influence your compliance with Oklahoma Directors Meeting Compliance with Requirements. For clarity on your residency status, always seek advice tailored to your personal situation.

To file an Oklahoma annual report, you must first access the state’s online filing system or complete a paper form. The report typically requires information about your business, including address, officers, and registered agent. Timely filing ensures you maintain compliance with Oklahoma Directors Meeting Compliance with Requirements. If needed, US Legal Forms provides resources to help simplify this process.

The 183 day rule in Oklahoma applies to residency for tax purposes. If you spend more than 183 days in Oklahoma within a calendar year, you are likely considered a resident. This classification impacts your obligations regarding income tax and compliance with other state requirements. Understanding this rule is essential for meeting Oklahoma Directors Meeting Compliance with Requirements.

Mandatory reporting requirements in Oklahoma involve certain professionals who must report any signs of abuse or neglect to authorities. This obligation ensures that vulnerable individuals receive necessary protection, aligning with the principles of Oklahoma Directors Meeting Compliance with Requirements. Understanding and adhering to these requirements can safeguard both individuals and organizations from legal repercussions.

Kayden's Law in Oklahoma focuses on protecting children involved in custody disputes, highlighting the necessity of safe environments. This law dovetails with Oklahoma Directors Meeting Compliance with Requirements, particularly regarding discussions and decisions about child welfare. Understanding Kayden's Law allows organizations to bridge legal requirements with ethical obligations during their meetings.

Mandated reporting in Oklahoma requires individuals in specific professions to report suspected abuse or neglect. Compliance with these requirements is essential for the safety and well-being of vulnerable populations. Organizations should ensure their directors are well-informed about these mandates, promoting a culture of accountability and adherence to Oklahoma Directors Meeting Compliance with Requirements.

Rule 13 in Oklahoma pertains to the guidelines for public meeting procedures. Understanding this rule is vital for ensuring Oklahoma Directors Meeting Compliance with Requirements, as it dictates how meetings should be conducted, including notice requirements and public access. By following these rules, organizations can enhance their credibility and foster public trust.

Rule 4.2 of the Oklahoma Professional Conduct refers to communication with a represented person. This rule is crucial in the context of directors' meetings as it outlines ethical boundaries during discussions. Proper adherence to this rule supports Oklahoma Directors Meeting Compliance with Requirements by ensuring that all communication is fair and within legal boundaries.