Oklahoma Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard

Description

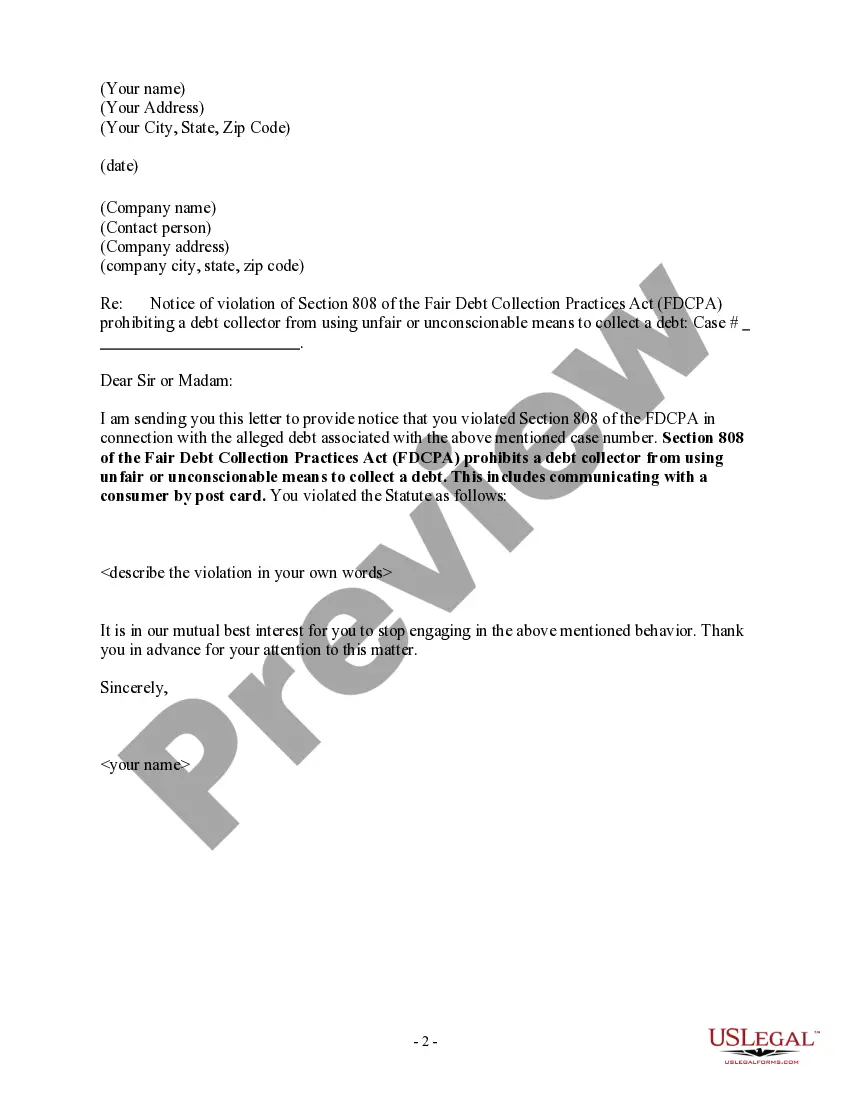

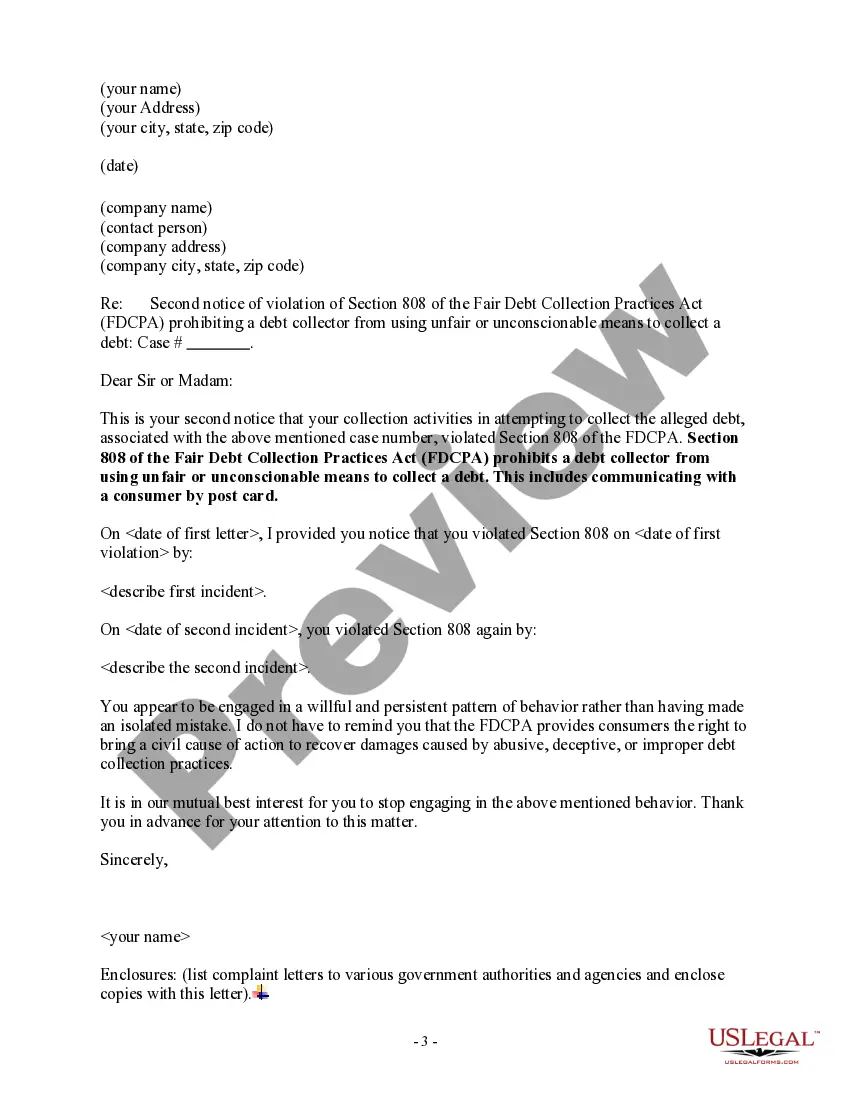

How to fill out Notice Of Violation Of Fair Debt Act - Unlawful Contact By Postcard?

Finding the appropriate authorized document template can be challenging.

Certainly, there are numerous formats available online, but how do you locate the legal form you require.

Utilize the US Legal Forms website.

Select the file format and download the legal document template to your device.

- Complete, edit, print, and sign the downloaded Oklahoma Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard.

- US Legal Forms is the largest repository of legal documents where you can find various document templates.

- Make use of the service to obtain professionally crafted papers that adhere to state regulations.

Form popularity

FAQ

You may ask a debt collector to contact you only by mail, or through your attorney, or set other limitations. Make sure you send your request in writing, send it by certified mail with a return receipt, and keep a copy of the letter and receipt.

Write a dispute letter and send it to each credit bureau. Include information about each of the disputed itemsaccount numbers, listed amounts and creditor names. Write a similar letter to each collection agency, asking them to remove the error from your credit reports.

Although debt collectors can leave a message on your machine, they cannot necessarily do it legally. The FDCPA exists in order to protect your privacy and prohibits debt collectors from disclosing your information to third parties. Third parties include your family, friends, boss, or anyone other than your spouse.

Normally, collections are disputed because the debtor believes they are incorrect for some reason. For example, if you review a copy of your credit report and you see a collection account that you believe belongs to another person, has an incorrect balance or is greater than seven years old, you can file a dispute.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

If you continue to ignore communicating with the debt collector, they will likely file a collections lawsuit against you in court. If you are served with a lawsuit and ignore this court filing, the debt collection company will then be able to get a default judgment against you.

Deceptive And Unfair Practices Calling you collect so that you have to pay to accept the call is an example of an unfair practice. Engaging in any practice that forces you to pay additional money other than the debt you owe is considered an FDCPA violation.

3 Things You Should NEVER Say To A Debt CollectorAdditional Phone Numbers (other than what they already have)Email Addresses.Mailing Address (unless you intend on coming to a payment agreement)Employer or Past Employers.Family Information (ex.Bank Account Information.Credit Card Number.Social Security Number.

Your dispute should be made in writing to ensure that the debt collector has to send you verification of the debt. If you're having trouble with debt collection, you can submit a complaint with the CFPB online or by calling (855) 411-CFPB (2372).

Don't be surprised if debt collectors slide into your DMs. A new rule allows debt collectors to contact you on social media, text or email not just by phone. The rule, which was approved last year by the Consumer Financial Protection Bureau's former president Kathleen L.