Oklahoma Notice of Violation of Fair Debt Act - Notice to Stop Contact

Description

How to fill out Notice Of Violation Of Fair Debt Act - Notice To Stop Contact?

You have the capability to dedicate multiple hours online trying to locate the authentic document template that meets the local and national requirements you need.

US Legal Forms offers thousands of authentic forms that have been reviewed by professionals.

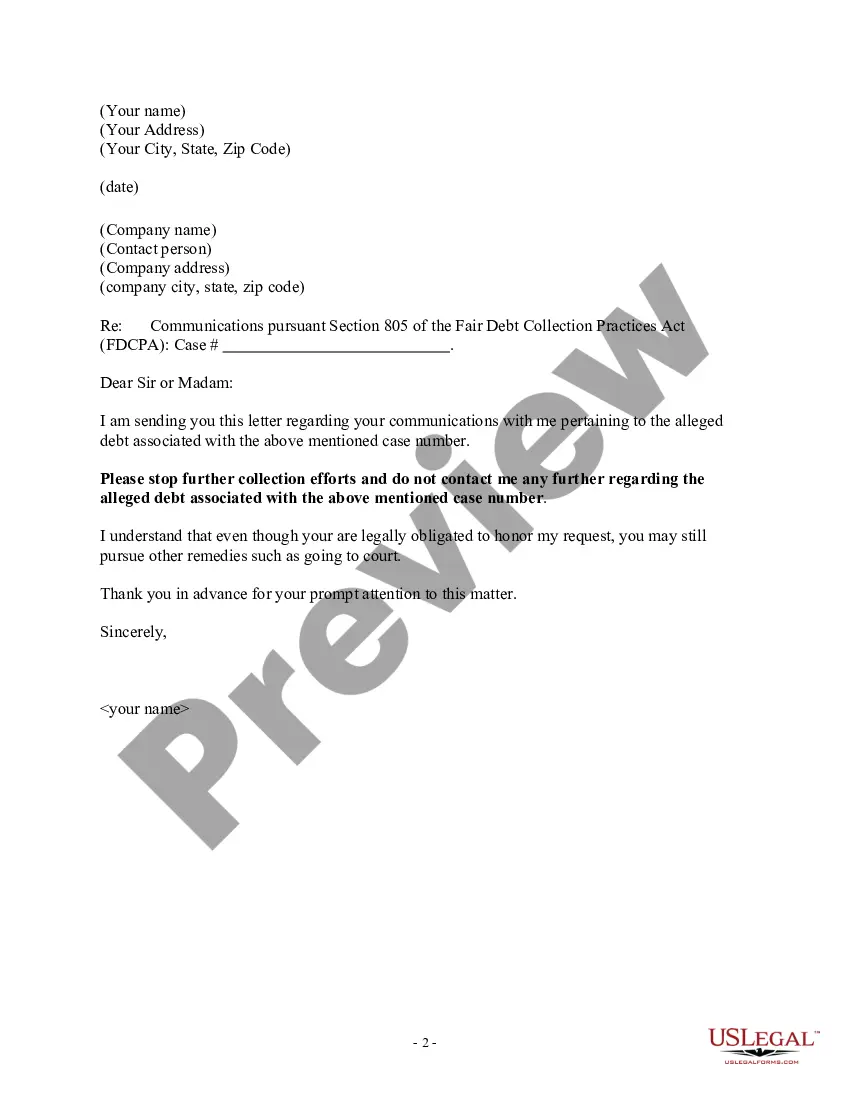

You can easily obtain or print the Oklahoma Notice of Violation of Fair Debt Act - Notice to Stop Contact from the services.

If available, use the Review button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Download button.

- After that, you can complete, edit, print, or sign the Oklahoma Notice of Violation of Fair Debt Act - Notice to Stop Contact.

- Every authentic document template you purchase is yours permanently.

- To obtain an additional copy of any purchased form, go to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/city of your choice.

- Check the form details to guarantee you have selected the correct form.

Form popularity

FAQ

In Oklahoma, for most debts, a creditor is afforded five years to take legal action on a debt. After the statute of limitations has expired, a creditor or debt collector can no longer sue you for the debt.

As is true in many states across the country, collections laws in Oklahoma have become increasingly debtor-friendly. As a result, it is more important now than ever for creditors and lenders to remain cognizant of the laws that will govern their future collections efforts even before accounts go into default.

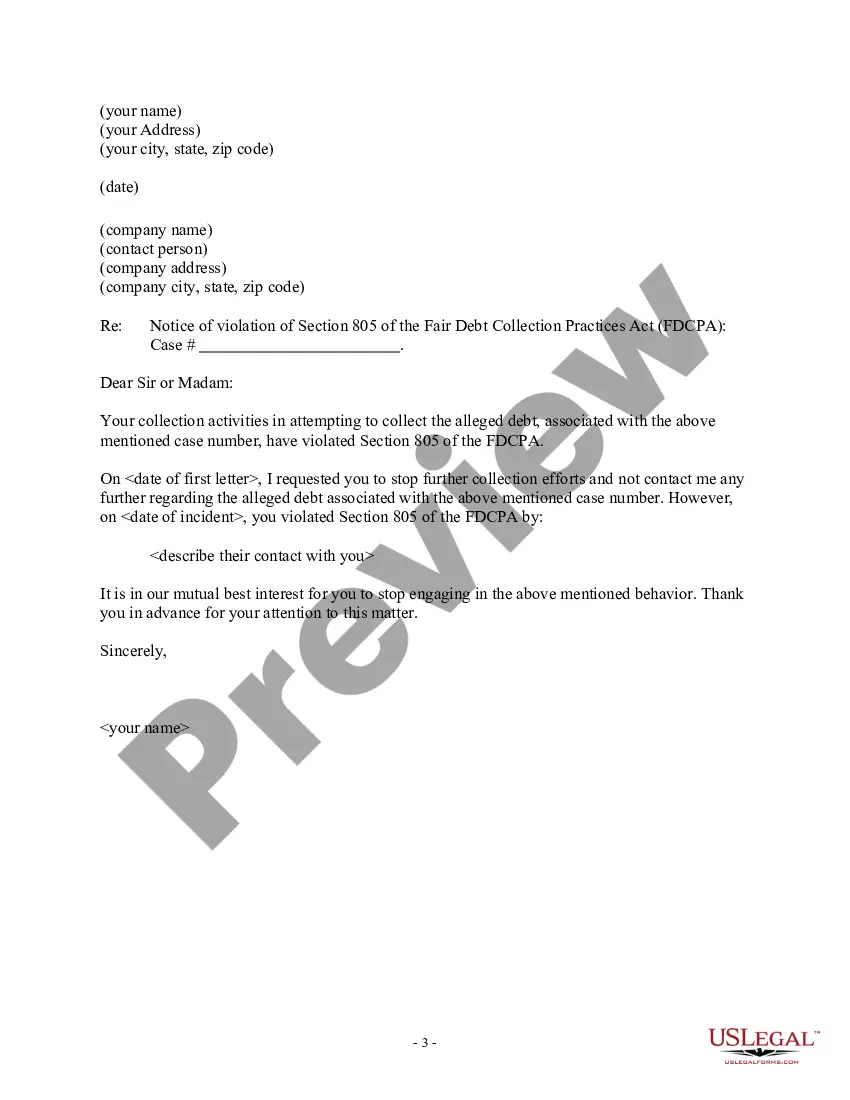

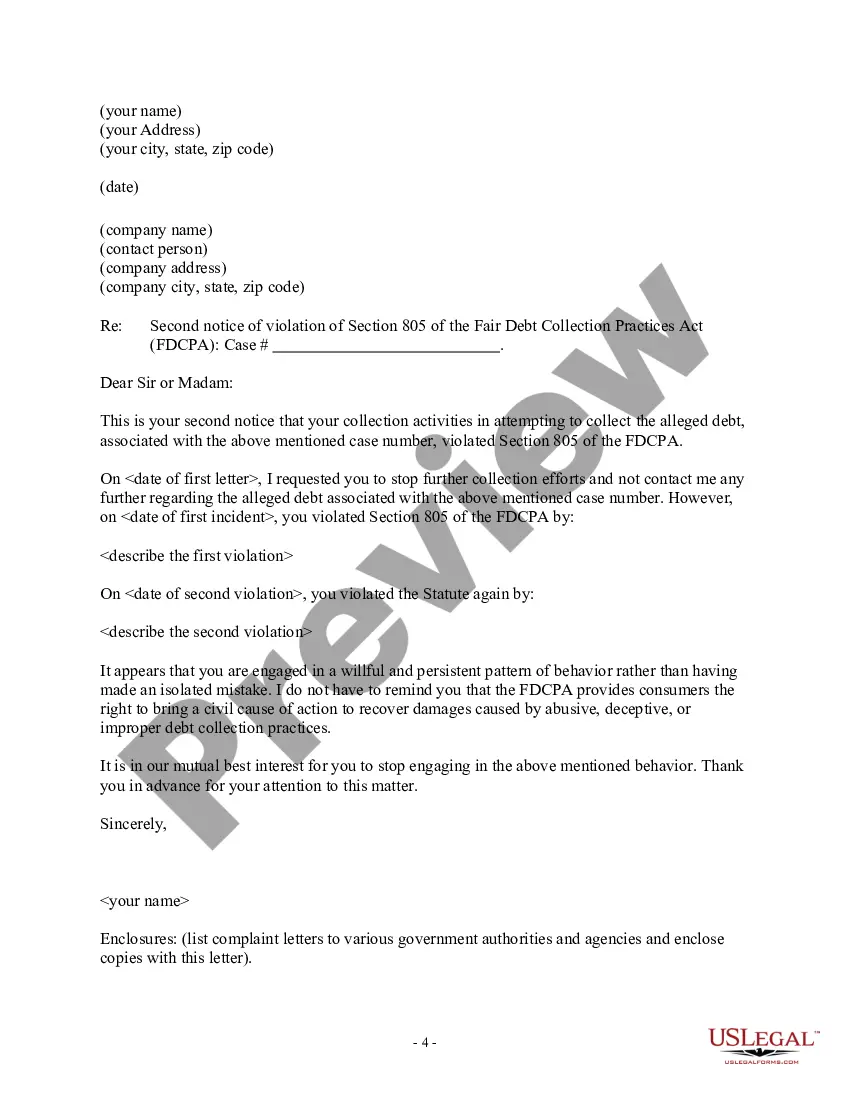

You have the right to tell a debt collector to stop communicating with you. To stop communication, send a letter to the debt collector and keep a copy of the letter. The CFPB's Debt Collection Rule clarifying certain provisions of the Fair Debt Collection Practices Act (FDCPA) became effective on November 30, 2021.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

According to the FDCPA, a debt collector can only contact you, your attorney, or a consumer reporting agency. According to the FDCPA, a debt collector can not: Contact you before am or after pm in your time zone or at an inconvenient time. Contact you at your place of employment.

The Fair Debt Collection Practices Act (FDCPA) is a federal law that provides a mechanism for you to stop debt collectors from contacting you. You can do this by sending a Cease and Desist Letter. Federal law allows you to communicate with debt collectors to tell them that you want them to stop contacting you.

The statute of limitations on open-account debt, like credit cards, for Oklahoma is five (5) years.

Know your rights. You cannot go to jail for not paying a consumer debt, even if a judgment is entered. Your house, social security, and most pensions cannot be foreclosed upon or garnished to pay consumer debts.

If you've been sued for debt in Oklahoma, the first step to responding is to file a written Answer with the court....4. File the answer with the court and serve the plaintiff.Print at least two copies of your Answer.Mail one copy to the court.Mail the other copy to the plaintiff's attorney.

Dear debt collector, I am responding to your contact about collecting a debt. You contacted me by phone/mail, on date and identified the debt as any information they gave you about the debt. I do not have any responsibility for the debt you're trying to collect.