Oklahoma Specific Consent Form for Qualified Joint and Survivor Annuities - QJSA

Description

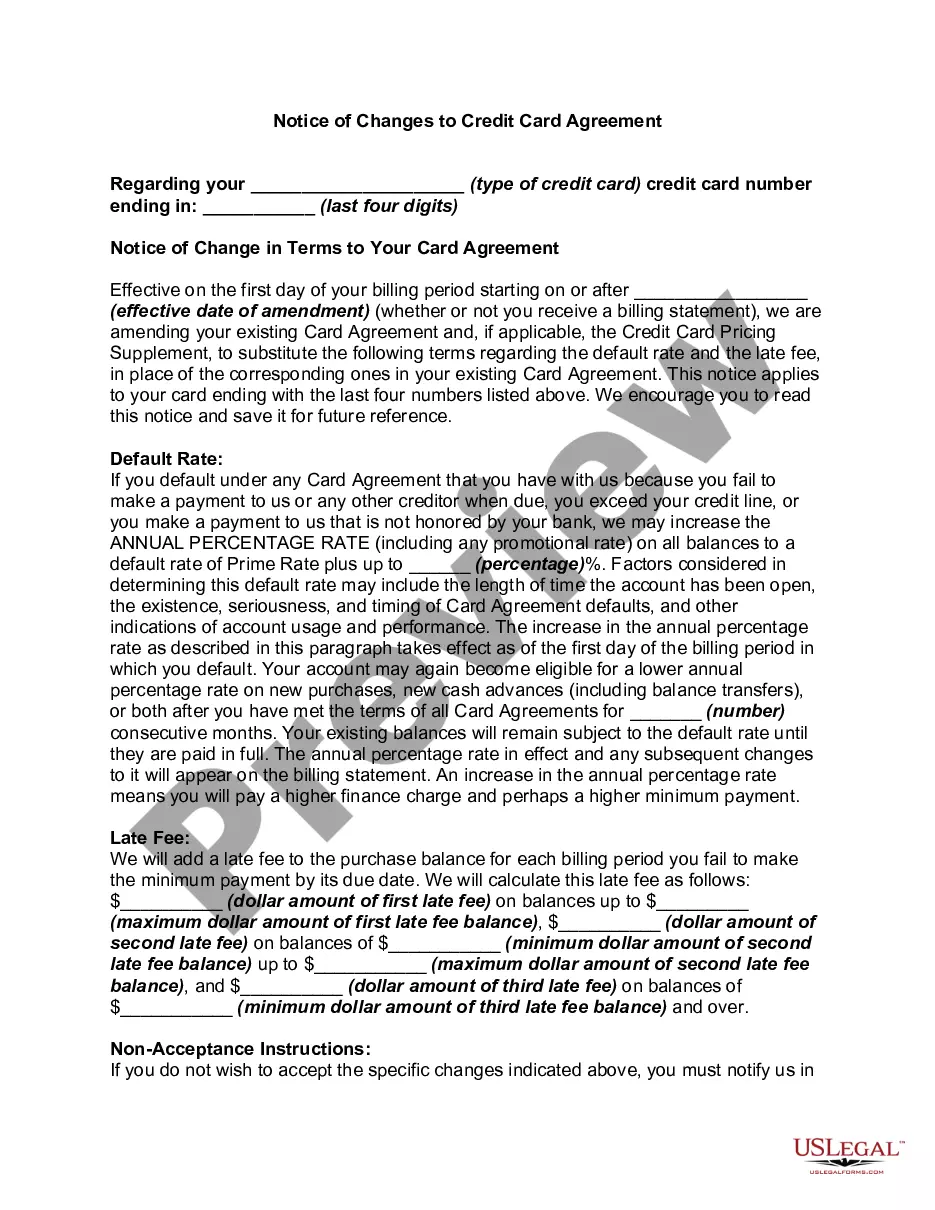

How to fill out Specific Consent Form For Qualified Joint And Survivor Annuities - QJSA?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal template files that you can download or print.

By utilizing the website, you will have access to thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can quickly find the most recent versions of forms such as the Oklahoma Specific Consent Form for Qualified Joint and Survivor Annuities - QJSA.

If you already possess a subscription, Log In to download the Oklahoma Specific Consent Form for Qualified Joint and Survivor Annuities - QJSA from your US Legal Forms library. The Download button will appear on every form you view. You can find all previously downloaded forms in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Complete, edit, print, and sign the downloaded Oklahoma Specific Consent Form for Qualified Joint and Survivor Annuities - QJSA. Every template you add to your account does not expire and is yours forever. So, to download or print another copy, simply go to the My documents section and click on the form you wish to access. Gain access to the Oklahoma Specific Consent Form for Qualified Joint and Survivor Annuities - QJSA with US Legal Forms, one of the most comprehensive libraries of legal document templates. Utilize numerous professional and state-specific templates that meet your business or personal needs and requirements.

- If you wish to use US Legal Forms for the first time, here are simple instructions to get you started.

- Ensure you have selected the correct form for your city/state.

- Click on the Review button to examine the content of the form.

- Consult the form overview to confirm that you have chosen the appropriate document.

- If the form does not fulfill your requirements, use the Search box at the top of the screen to find the one that does.

- Once you are satisfied with the form, finalize your choice by clicking the Acquire now button.

- Then, select the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

A joint and survivor annuity is an annuity that pays out for the remainder of two people's lives. Depending on the contract, the annuity may pay 100 percent of the payments upon the death of the first annuitant or a lower percentage typically 50 or 75 percent.

QJSA rules apply to money-purchase pension plans, defined benefit plans, and target benefits. They can also apply to profit-sharing and 401(k) and 403(b) plans, but only if so elected under the plan.

A qualified pre-retirement survivor annuity (QPSA) provides monetary distribution to a surviving spouse of a deceased employee. The employee must be under a qualified plan in order for compensation to occur. The Employee Retirement Income Security Act (ERISA) dictates how payments are to be calculated.

A QJSA is when retirement benefits are paid as a life annuity (a series of payments, usually monthly, for life) to the participant and a survivor annuity over the life of the participant's surviving spouse (or a former spouse, child or dependent who must be treated as a surviving spouse under a QDRO) following the

A qualified pre-retirement survivor annuity (QPSA) is a death benefit that is paid to the surviving spouse of a deceased employee.

This special payment form is often called a qualified joint and survivor annuity or QJSA payment form. This benefit is paid to the participant each year and, on the participant's death, a survivor annuity is paid to the surviving spouse.

The QJSA payment form gives your spouse, the annuitant, a retirement payment for the rest of his or her life. Under the QJSA payment form, after your spouse dies, the contract will pay you, the surviving spouse, at least 50% percent of the retirement benefit that was paid to your spouse, the annuitant.

Qualified Joint and Survivor Annuity (QJSA) includes a level monthly payment for your lifetime and a survivor benefit for your spouse after your death equal to the percentage designated of that monthly payment.

If you do not waive the QPSA, after your death the Plan will pay your spouse the QPSA unless your spouse elects another benefit form. The QPSA will not pay benefits to other beneficiaries after your spouse dies. If you waive the QPSA, the Plan will pay your account to your designated beneficiary.