Oklahoma Authority of Partnership to Open Deposit Account and to Procure Loans

Description

How to fill out Authority Of Partnership To Open Deposit Account And To Procure Loans?

Are you currently in a location where you often require documents for business or personal purposes almost every day.

There are numerous legal form templates available online, but finding ones you can rely on isn’t easy.

US Legal Forms offers a wide array of form templates, such as the Oklahoma Authority of Partnership to Open Deposit Account and to Procure Loans, which are crafted to meet state and federal regulations.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes.

The service offers professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- After that, you can download the Oklahoma Authority of Partnership to Open Deposit Account and to Procure Loans template.

- If you don't have an account and want to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/county.

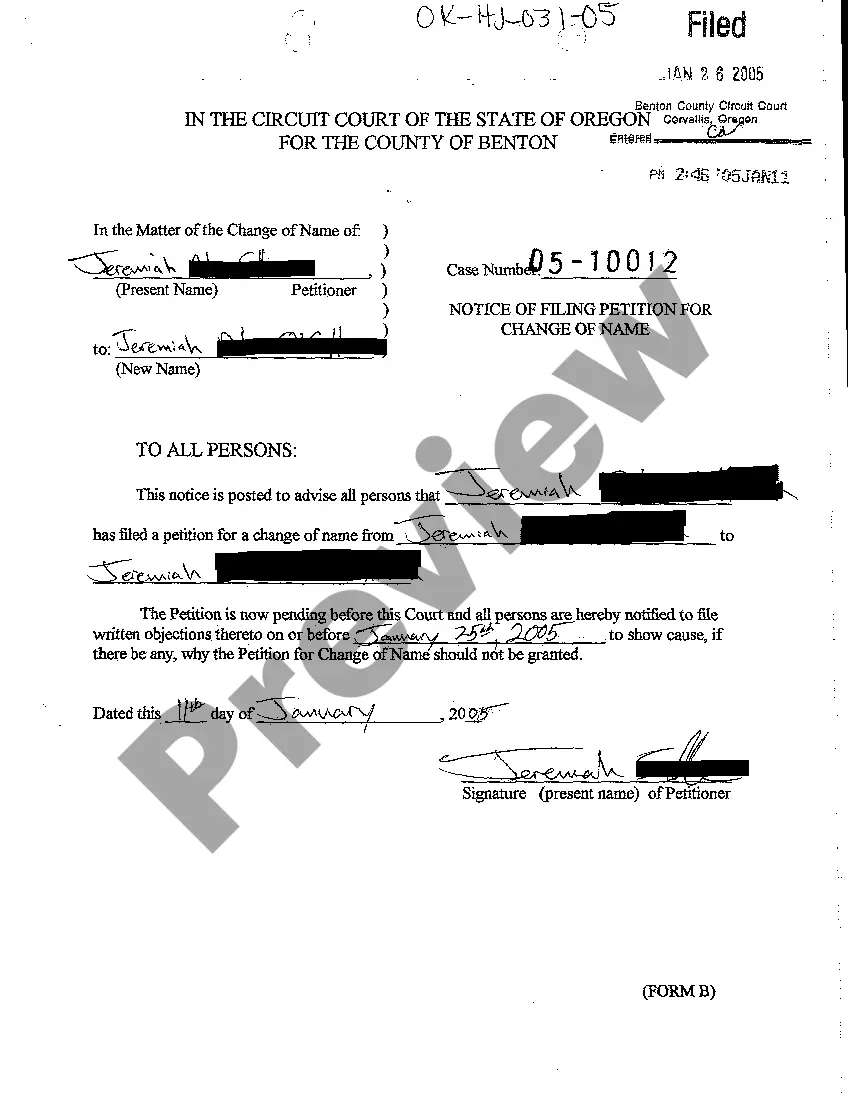

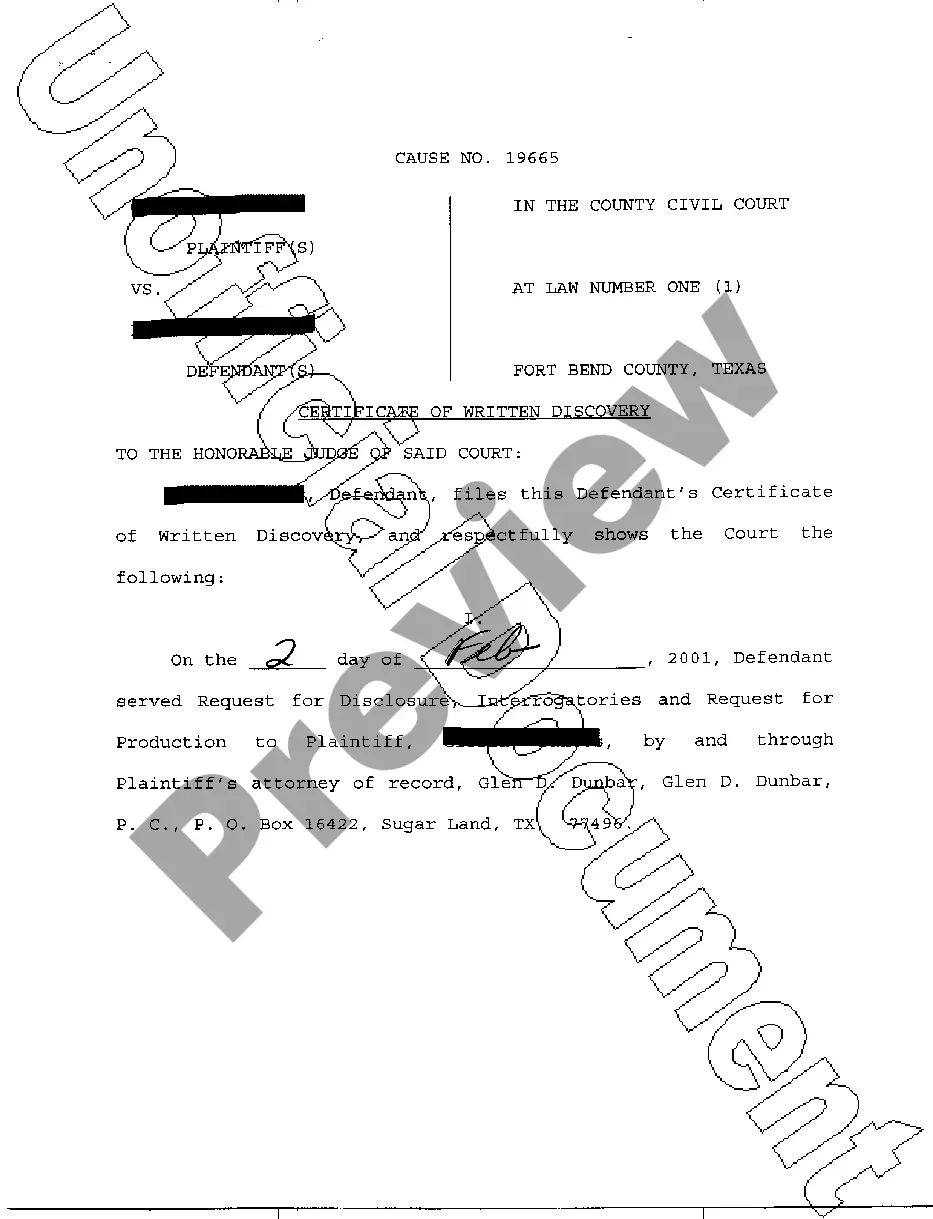

- Utilize the Preview button to review the form.

- Examine the description to confirm you have selected the correct form.

- If the form isn’t what you need, use the Search area to find the form that meets your needs and requirements.

- Once you find the correct form, simply click Get now.

- Choose the pricing plan you want, enter the required information to create your account, and purchase the order using your PayPal or credit card.

- Choose a convenient file format and download your copy.

- Retrieve all the form templates you have purchased in the My documents section. You can download an additional copy of the Oklahoma Authority of Partnership to Open Deposit Account and to Procure Loans anytime if needed. Click on the desired form to download or print the template.

Form popularity

FAQ

First Entity Proof (Any one of the following documents) Eg: Sales Tax, TIN/ TAN etc. Registration Certificate issued by Excise & Customs Department. Sales Tax Registration Certificate/ TIN Certificate/ GST certificate/ TAN certificate. Valid Shops & Establishment Certificate/ Trade License.

Documents required to open a Current account in the name of partnership FirmCopy of the Partnership Deed.PAN Card in the Name of the Partnership Firm.Aadhar Card Of all the Partners.Address Proof of the Partnership Firm.Identity Proof of all Partners.Partnership Registration Certificate (if Registered Partnership)More items...

Current Bank AccountAddress Proof of the partnership firm. Identity proofs of all the partners. Partnership registration certificate (if partnership has been registered) Any registration document issued by central or state government (normally GST certificate is submitted)

Current Bank AccountPartnership deed.Partnership firm PAN card.Address Proof of the partnership firm.Identity proofs of all the partners.Partnership registration certificate (if partnership has been registered)Any registration document issued by central or state government (normally GST certificate is submitted)More items...?

Documents required to open a Current account in the name of partnership FirmCopy of the Partnership Deed.PAN Card in the Name of the Partnership Firm.Aadhar Card Of all the Partners.Address Proof of the Partnership Firm.Identity Proof of all Partners.Partnership Registration Certificate (if Registered Partnership)More items...

Some requirements for opening a bank account may include: At least two forms of government-issued photo identification, such as a valid driver's license or passport. Social security number or individual taxpayer identification number. Utility bill with current address information.

Partnerships must file Form SS-4 with the Internal Revenue Service. Form SS-4 is used to get an employer identification number, also known as a federal tax ID number, from the IRS. The IRS allows a partnership to file Form SS-4 online using the IRS website, by telephone, by fax or by mail.

Get documents you need to open a business bank accountEmployer Identification Number (EIN) (or a Social Security number, if you're a sole proprietorship)Your business's formation documents.Ownership agreements.Business license.

You typically need to provide the following personal and bank details:Bank's mailing address. Find this on your bank statement or your financial institution's website.Bank's routing number.Your account number.Type of account.Other.

Here are the basic steps to forming a partnership:Choose a business name.Register a fictitious business name.Draft and sign a partnership agreement.Comply with tax and regulatory requirements.Obtain Insurance.