Kansas Revocable Trust for Minors

Description

How to fill out Revocable Trust For Minors?

If you desire to be thorough, acquire, or print valid document templates, utilize US Legal Forms, the largest collection of lawful forms available online.

Make use of the site's simple and user-friendly search function to find the documents you need.

A selection of templates for commercial and personal uses are organized by categories and states, or search terms.

Step 4. Once you have located the form you require, click the Purchase now button. Choose the payment plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase. Step 6. Choose the format of the legal document and download it to your device. Step 7. Complete, modify, and print or sign the Kansas Revocable Trust for Minors.

Every legal document template you obtain is yours indefinitely. You will have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again.

Stay competitive and download, and print the Kansas Revocable Trust for Minors using US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to obtain the Kansas Revocable Trust for Minors with just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and select the Acquire option for the Kansas Revocable Trust for Minors.

- You can also revisit templates you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Confirm you have chosen the form for the correct city/county.

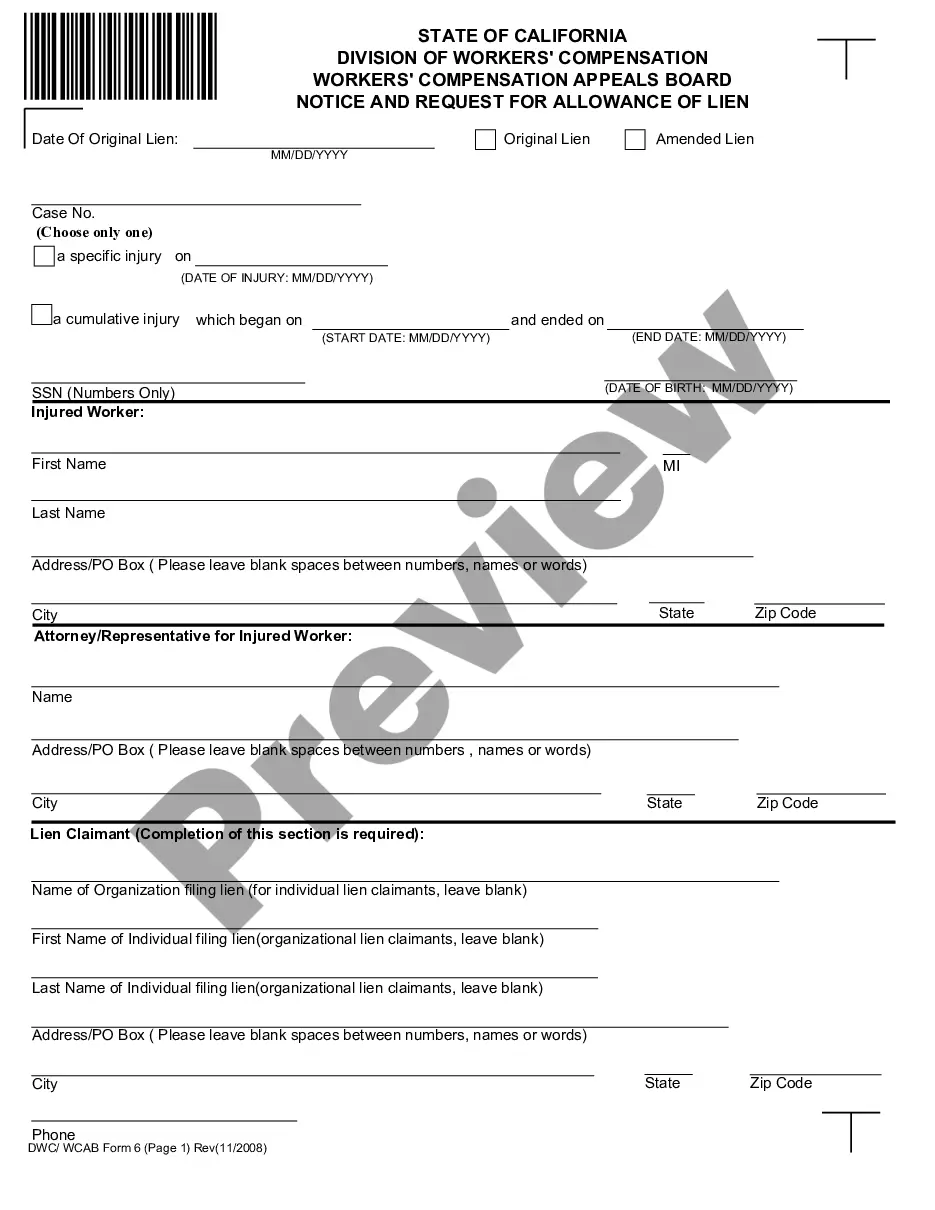

- Step 2. Use the Review feature to examine the form's contents. Be sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Lookup field at the top of the screen to find other variations in the legal document format.

Form popularity

FAQ

Setting up a Kansas Revocable Trust for Minors is often worth the effort. It helps ensure that assets are managed according to your wishes. This arrangement can prevent legal challenges and provide a secure financial future for your child. Overall, it can be a proactive step in safeguarding your child's inheritance.

Yes, a minor can have a Kansas Revocable Trust for Minors. This trust allows you to manage the assets until the child reaches a certain age. It ensures that the assets are used for the child's benefit. Setting this up can grant peace of mind regarding the future management of your child's inheritance.

One downside to a Kansas Revocable Trust for Minors is that it does not provide protection from creditors. If your child faces a legal issue, assets held in the trust may be at risk. Additionally, revocable trusts do not offer tax advantages like some irrevocable trusts. However, they provide flexibility and easier management of assets.

To establish a Kansas Revocable Trust for Minors, start by creating a comprehensive trust document that states your wishes clearly. Utilize platforms like USLegalForms to customize a document that fits your needs, ensuring all necessary elements are included. Next, fund the trust by transferring assets into the trust's name. After these steps, regularly review the trust as your family circumstances change to ensure it continues to serve its purpose.

The Kansas Revocable Trust for Minors is often considered one of the best options for holding and managing assets for children. This trust provides the necessary flexibility and control over when and how funds are distributed. Using this type of trust, parents can set specific conditions or milestones for distributions, helping to ensure that their children use the funds wisely. It’s essential to evaluate your family's unique situation when selecting the right trust.

When choosing between a will and a Kansas Revocable Trust for Minors, consider your specific needs and goals. A will is straightforward and provides directives for asset distribution after your passing. However, a revocable trust can help you avoid probate, offering more privacy and quicker access to funds for your minor beneficiaries. Ultimately, aligning your approach with your family dynamics can lead to better outcomes.

A minor trust, often referred to as a Kansas Revocable Trust for Minors, is designed to hold and manage assets for a child until they reach a certain age. This type of trust allows for the controlled distribution of funds and protects minor beneficiaries from mismanaging their inheritance. By using this trust structure, you retain flexibility in adjusting its terms as your child's needs evolve. Remember, the appointed trustee plays a significant role in managing these assets responsibly.

One common mistake parents make when setting up a Kansas Revocable Trust for Minors is failing to fund the trust properly. If you neglect to transfer assets into the trust, your intentions may not come to fruition, leaving your child without access to those resources. It's crucial to remember that merely creating the trust isn't enough; regular checks on the trust's funding status help ensure your minor's needs are met. Consulting a professional can clarify the process and safeguard your child's future.

To form a Kansas Revocable Trust for Minors, you need to start by drafting a trust document that outlines the terms of the trust. You can use online resources or legal services like USLegalForms to assist you in creating a tailored trust agreement. Once your document is ready, you will need to fund the trust with assets such as bank accounts, property, or investments. Finally, ensure you appoint a reliable trustee who will manage the trust for your minor beneficiaries.

To set up a Kansas Revocable Trust for Minors, begin by gathering the necessary documentation, including asset details and guardian information. Next, you can use a reliable platform like US Legal Forms to create your trust documents, guiding you through each step of the process. Once your trust documents are prepared, sign them in front of a notary public to ensure their validity. Finally, fund the trust by transferring assets into it, which protects those assets for your minor beneficiaries.