Oklahoma Application for Extension of Time Period for Reservation of Corporate Name

Description

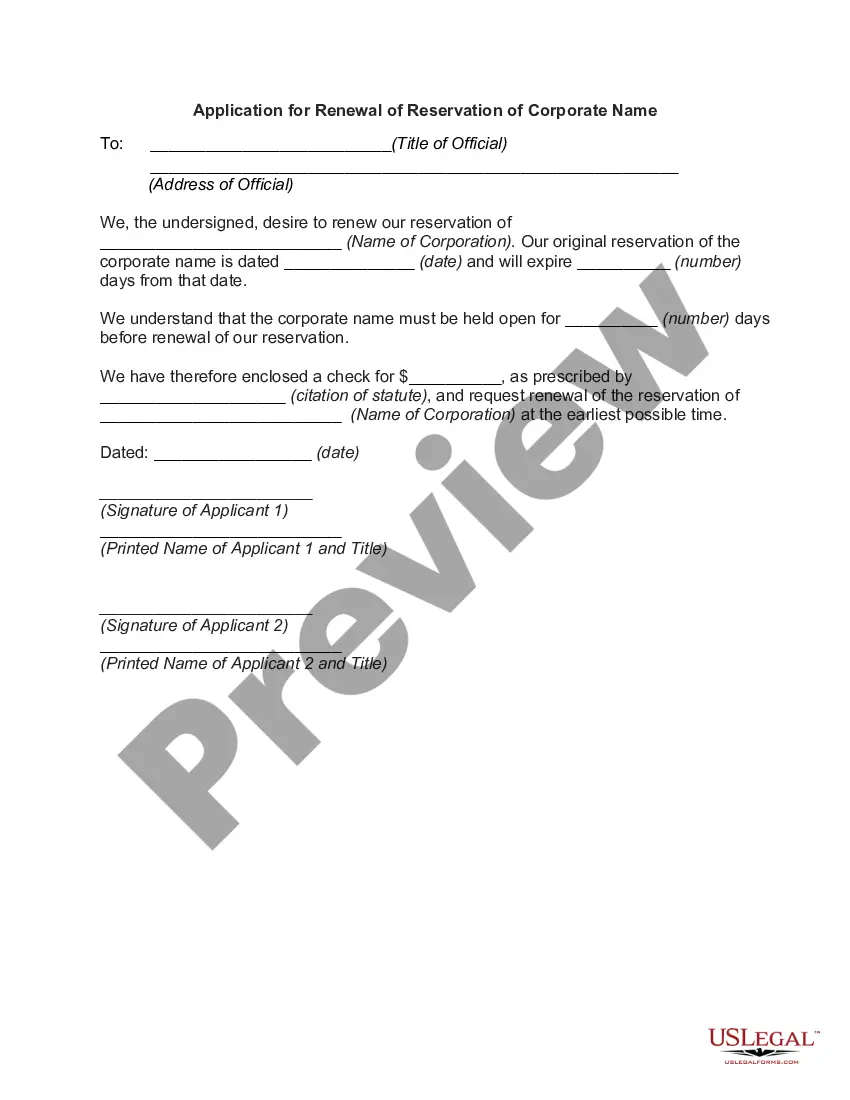

How to fill out Application For Extension Of Time Period For Reservation Of Corporate Name?

Choosing the best authorized record design can be a have difficulties. Naturally, there are a variety of themes available on the Internet, but how can you obtain the authorized type you will need? Take advantage of the US Legal Forms site. The support gives a large number of themes, for example the Oklahoma Application for Extension of Time Period for Reservation of Corporate Name, that you can use for company and personal requirements. Every one of the kinds are checked out by specialists and meet up with state and federal requirements.

When you are presently signed up, log in for your account and click on the Download button to have the Oklahoma Application for Extension of Time Period for Reservation of Corporate Name. Make use of account to check through the authorized kinds you might have purchased earlier. Visit the My Forms tab of your account and obtain another version of the record you will need.

When you are a whole new customer of US Legal Forms, listed below are straightforward guidelines that you can comply with:

- Very first, make certain you have chosen the proper type for the area/region. You are able to look over the form utilizing the Review button and read the form outline to make certain it will be the best for you.

- In case the type will not meet up with your requirements, use the Seach discipline to find the proper type.

- When you are sure that the form is acceptable, go through the Acquire now button to have the type.

- Pick the rates prepare you want and enter the needed information. Build your account and buy your order utilizing your PayPal account or credit card.

- Pick the document structure and down load the authorized record design for your device.

- Full, modify and produce and indication the acquired Oklahoma Application for Extension of Time Period for Reservation of Corporate Name.

US Legal Forms will be the greatest library of authorized kinds for which you will find various record themes. Take advantage of the service to down load appropriately-produced paperwork that comply with status requirements.

Form popularity

FAQ

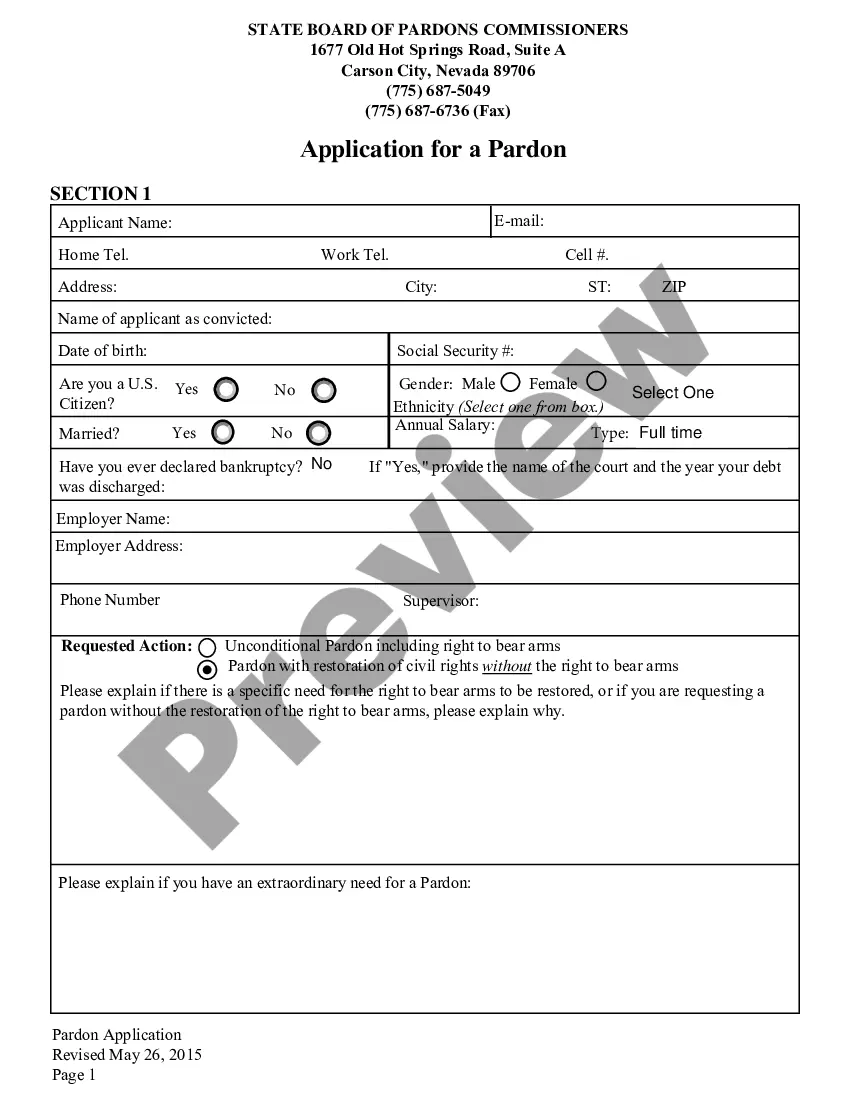

OK 512S Information All corporations having an election in effect under Subchapter S of the Internal Revenue Code (IRC) engaged in business or deriving income from property located in Oklahoma and that are required to file a federal income tax return using Form 1120-S, must file a return on Form 512-S.

A Form 500-B must be completed for each nonresident member to whom the pass-through entity has made an Oklahoma taxable distribution and paid withholding to Oklahoma. Form 500-B should not report withhold- ing paid by sources other than the pass-through entity.

If a federal consolidated return is filed, an Oklahoma consolidated return may be required or permitted under certain circumstances. ( Instructions, Form 512, Oklahoma Corporation Income Tax Return) The election to file a separate return or a consolidated return is made with the timely filing of the return.

Every corporation organized under the laws of this state or qualified to do or doing business in Oklahoma in a corporate or organized capacity by virtue or creation of organization under the laws of this state or any other state, territory, district, or a foreign country, including associations, joint stock companies ...

Extended Deadline with Oklahoma Tax Extension: For an extension of time to file the Oklahoma corporation return, the extension period may not exceed 7 months. Businesses that have a valid Federal tax extension (IRS Form 7004) will automatically be granted an Oklahoma tax extension for the same amount of time.

Each partner having Oklahoma source income sufficient to make a return, shall make such return as required by law. Partnerships filing Federal Form 1065-B will file Form 514.

To request a filing extension, use the California Department of Tax and Fee Administration's (CDTFA) online services. You must have a CDTFA Online Services Username or User ID and Password. You must submit a request for extension no later than one month after the due date of your return or prepayment form and payment.

Oklahoma Tax Extension Form: To request an Oklahoma extension, file Form 504 by the original due date of your return. NOTE: If you have an approved Federal tax extension (IRS Form 4868), you will automatically be granted an Oklahoma tax extension.