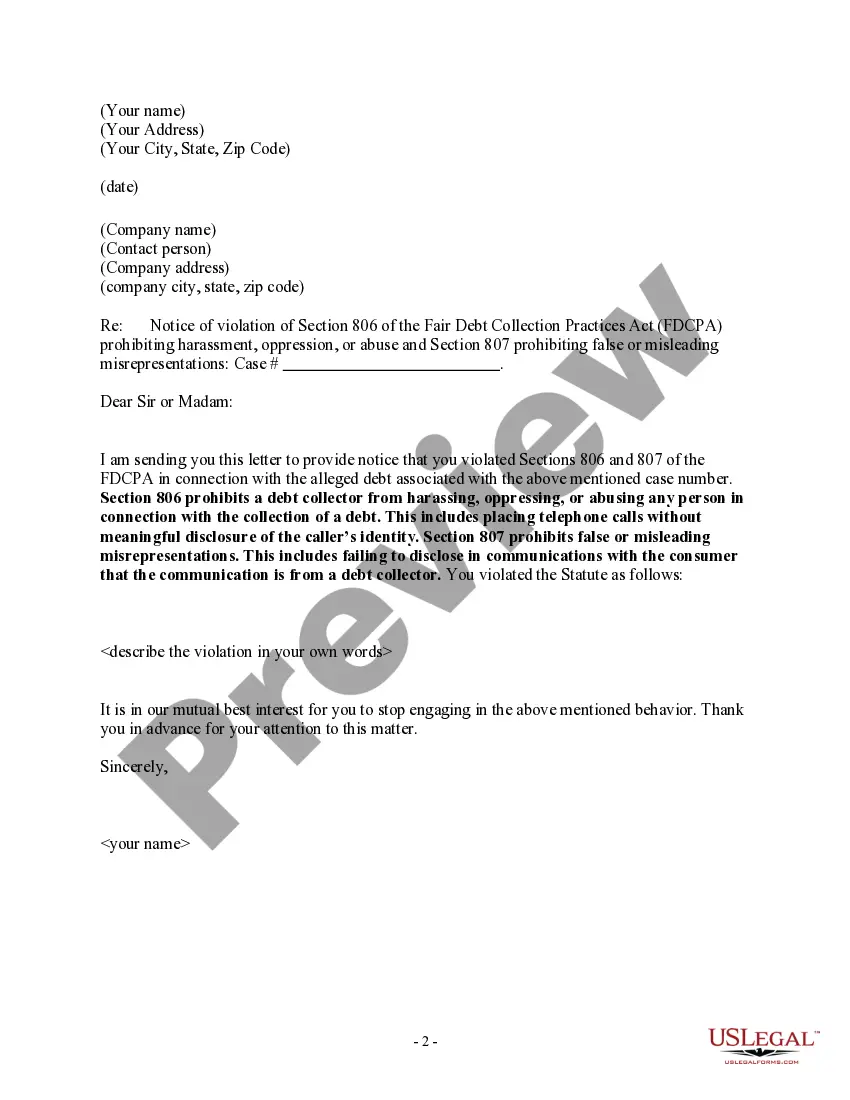

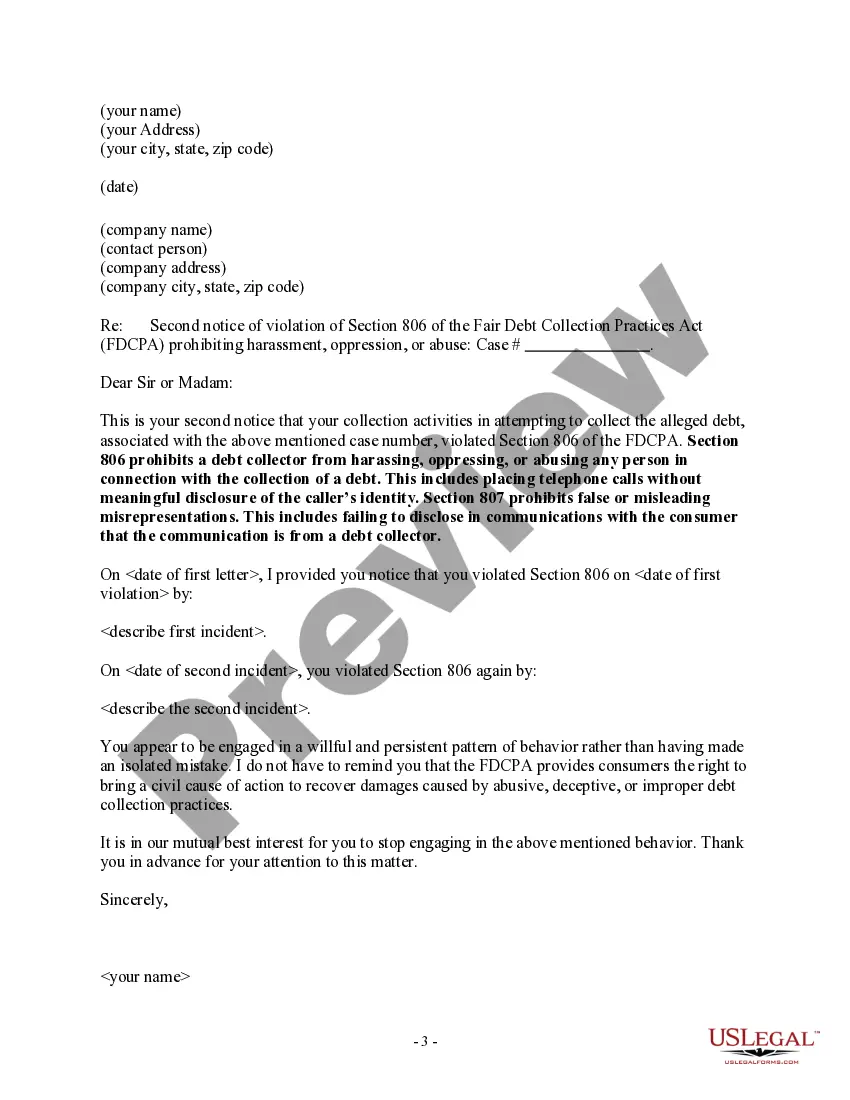

Section 806 of the Fair Debt Collection Practices Act says a debt collector may not harass, oppress, or abuse any person in connection with the collection of a debt. This includes placing telephone calls without meaningful disclosure of the caller's identity.

Ohio Notice to Debt Collector - Not Disclosing the Caller's Identity

Description

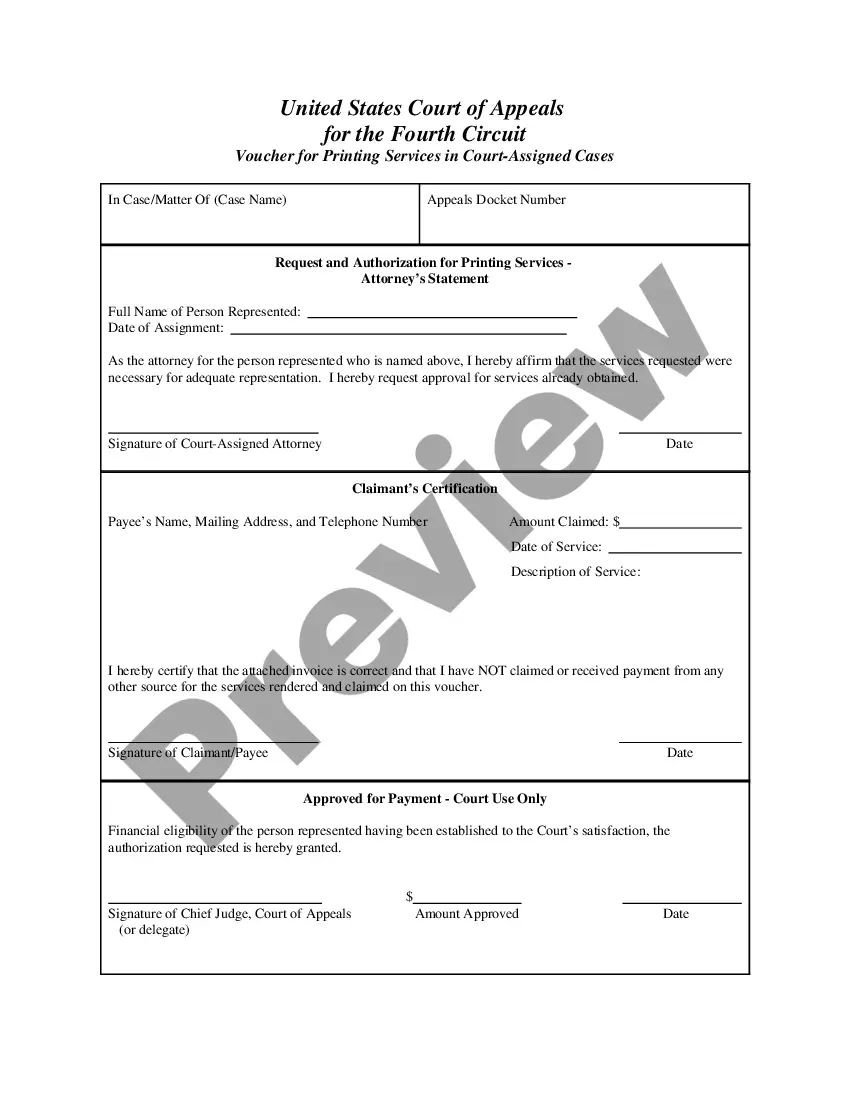

How to fill out Notice To Debt Collector - Not Disclosing The Caller's Identity?

Are you currently in a situation where you need documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

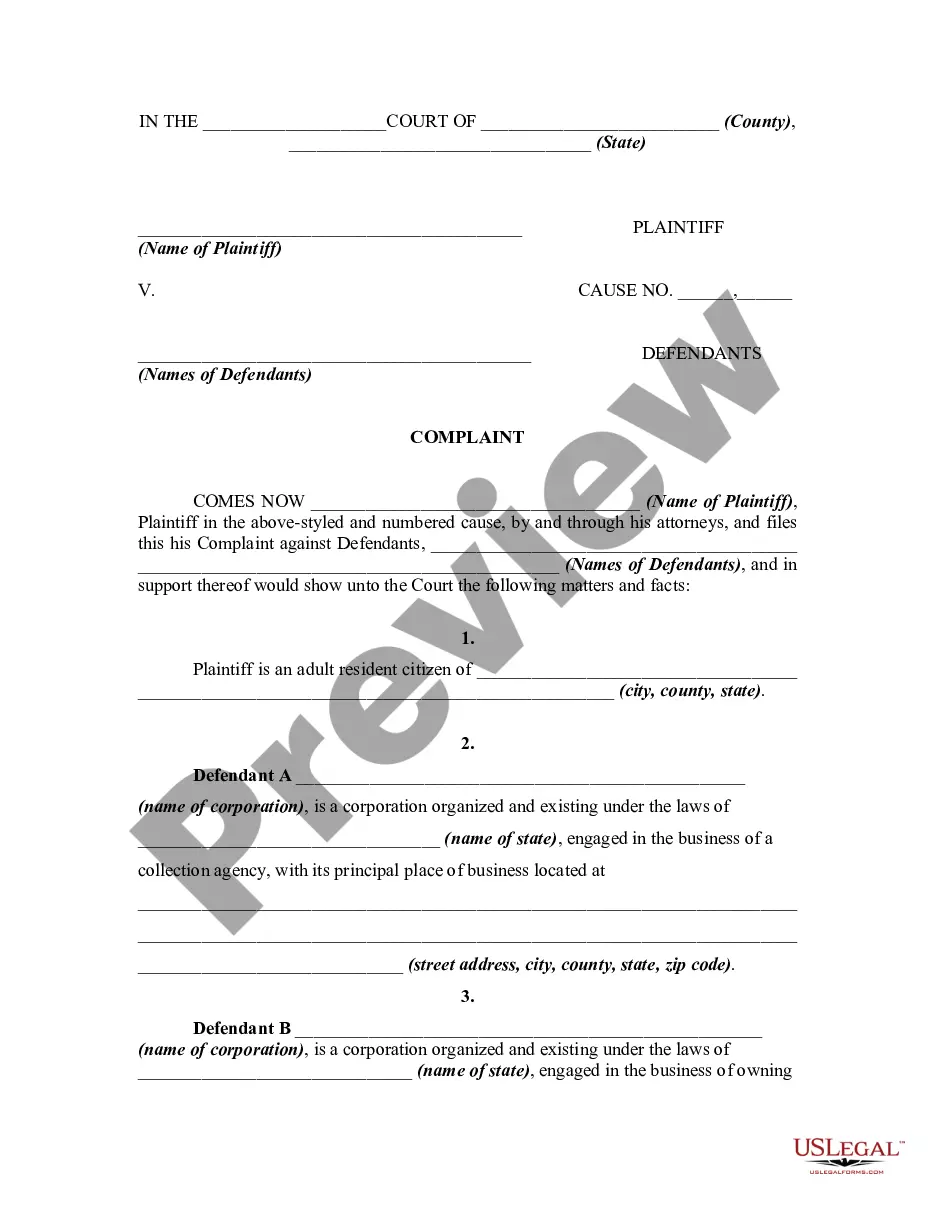

US Legal Forms offers a vast collection of form templates, such as the Ohio Notice to Debt Collector - Not Disclosing the Caller's Identity, designed to comply with state and federal regulations.

Once you find the appropriate form, click Get now.

Select the pricing plan you prefer, fill in the required information to create your account, and pay for your order using PayPal or a Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Ohio Notice to Debt Collector - Not Disclosing the Caller's Identity template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it's for the correct state/county.

- Use the Review option to examine the form.

- Read the description to confirm you have chosen the right form.

- If the form isn’t what you need, use the Lookup field to find the form that meets your needs.

Form popularity

FAQ

Under the FDCPA, any communication from a debt collector is required to disclose their identity. This means they must state their name, the name of the collection company and their phone number. Additionally, they must state that the communication is being done to collect a debt.

Debt collectors often ask for Social Security numbers, birth dates or other personal information to ensure they have reached the correct debtor.

The Fair Debt Collection Practices Act (FDCPA) It is always your choice whether to provide any information to a debt collector, even a legitimate one, including whether to verify your identity.

Can Debt Collectors Call Friends and Family? Debt collectors are legally allowed to call your friends or family to try to locate you. But they cannot call these people to try to collect the payment for the debt, and they are only allowed to call once unless they believe there may be new information to be found.

Generally, a debt collector can't discuss your debt with anyone other than: You. Your spouse. Your parents (if you are a minor)

Asking family members about your whereabouts and basic contact information is perfectly legal. But debt collectors cannot ask your friends or family members about other subjects. In fact, bill collectors can't even mention your debt or how much you owe.

At a minimum, proper debt validation should include an account balance along with an explanation of how the amount was derived. But most debt collectors respond with an account statement from the original creditor as debt validation and that's generally considered sufficient.

While these procedures may vary by company and whether the call is inbound or outbound, there is a common thread: generally debt collectors ask the consumer to verify some piece of personal information, such as the last four digits of the consumer's social security number or the consumer's birth date, to ensure they

Do not give the caller personal financial or other sensitive information. Never give out or confirm personal financial or other sensitive information like your bank account, credit card, or Social Security number unless you know the company or person you are talking with is a real debt collector.

Be aware that collection agencies are forbidden from trying to collect a without first notifying you in writing or making a reasonable attempt to do so. Do not share financial and personal information if you are not certain you are dealing with a real collection agency.