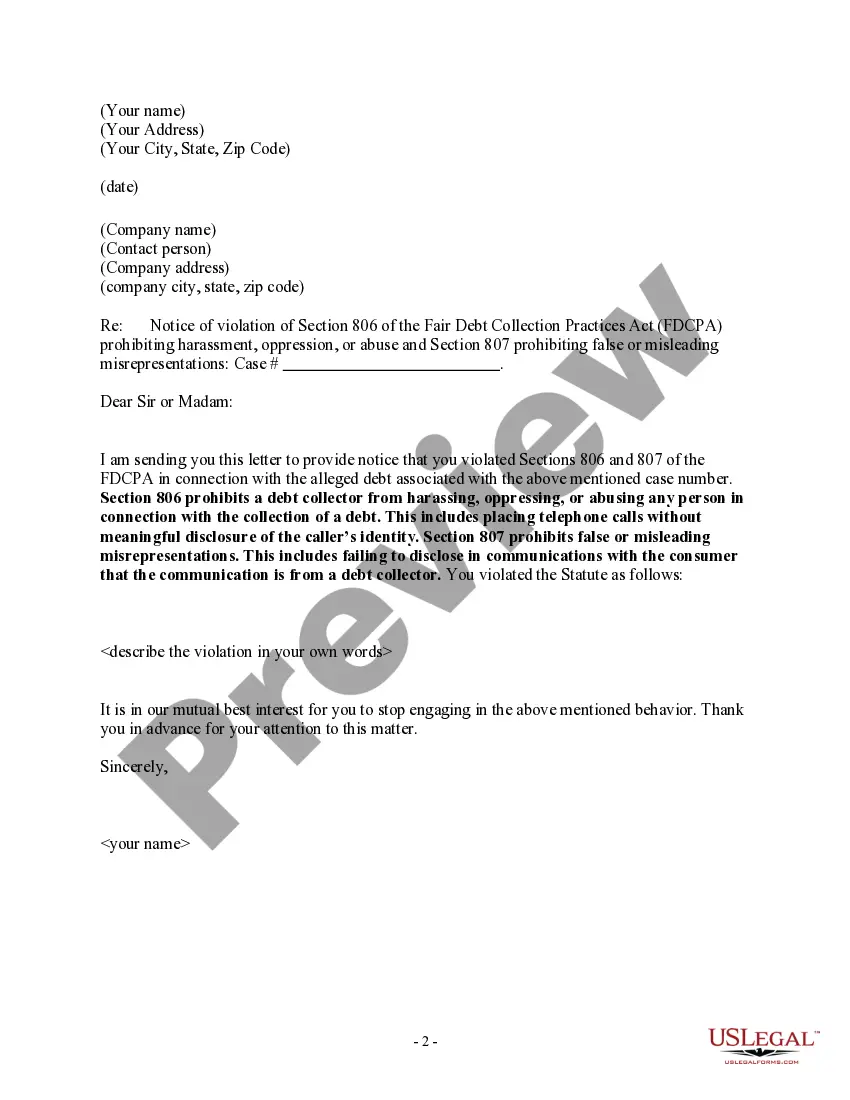

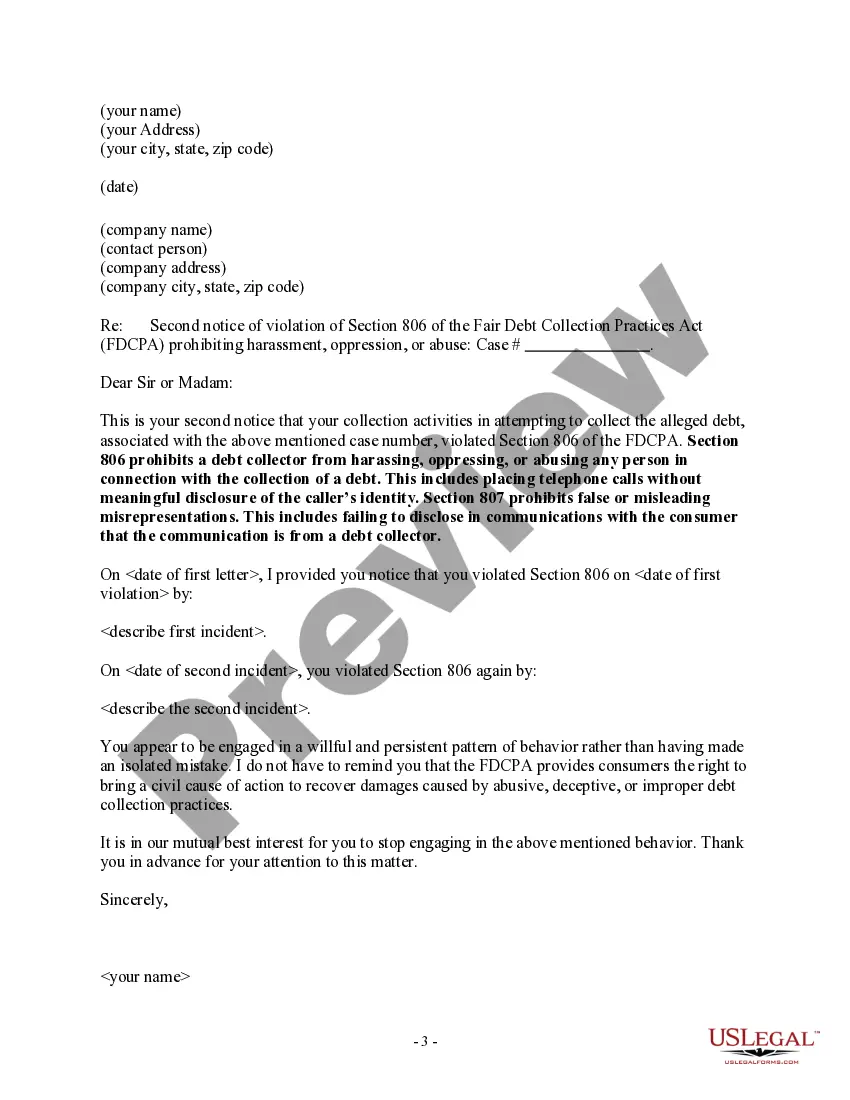

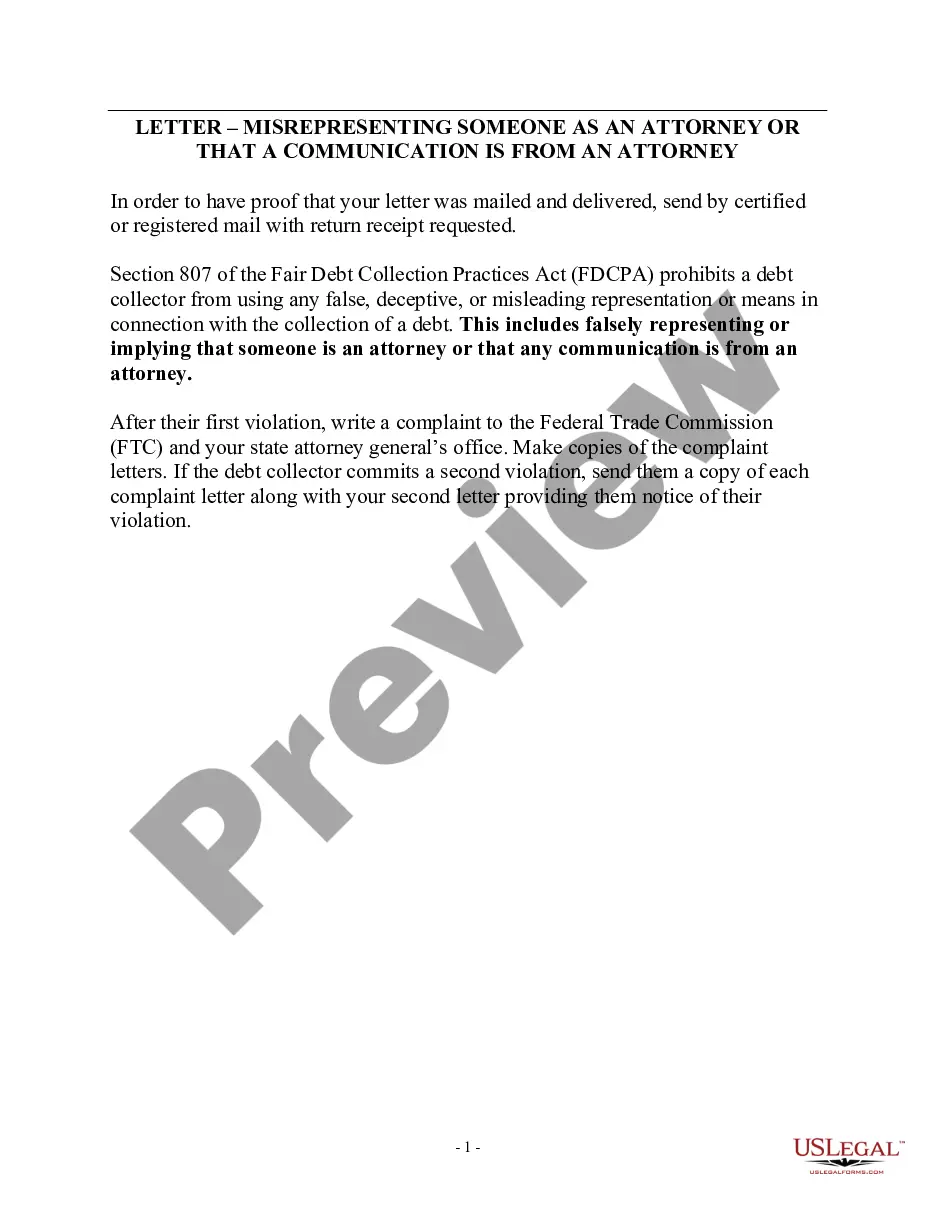

Section 806 of the Fair Debt Collection Practices Act says a debt collector may not harass, oppress, or abuse any person in connection with the collection of a debt. This includes placing telephone calls without meaningful disclosure of the caller's identity.

New York Notice to Debt Collector - Not Disclosing the Caller's Identity

Description

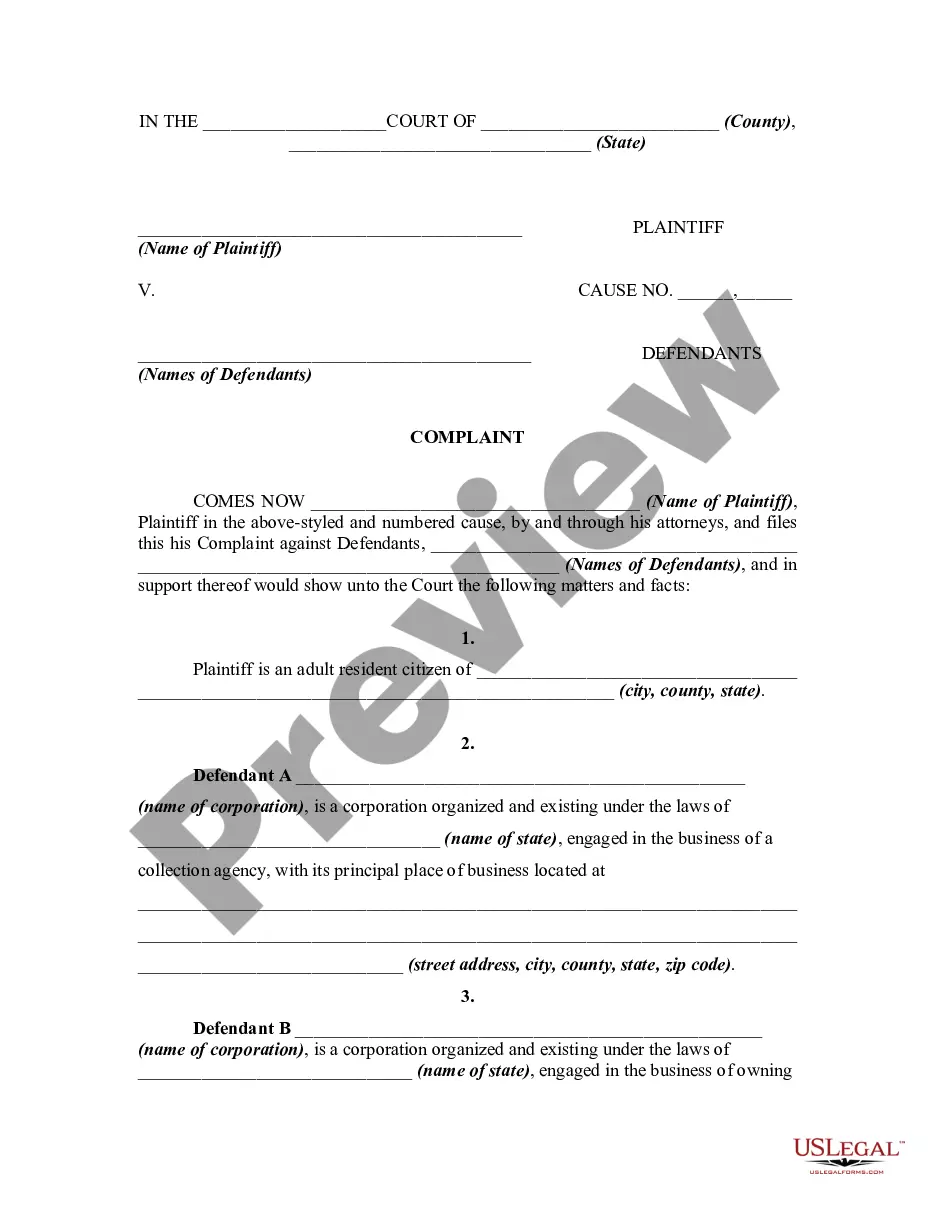

How to fill out Notice To Debt Collector - Not Disclosing The Caller's Identity?

Are you presently in a position where you need documents for potentially professional or personal purposes almost daily.

There are numerous legal document templates accessible online, but finding reliable ones isn't simple.

US Legal Forms offers a plethora of form templates, such as the New York Notice to Debt Collector - Not Disclosing the Caller's Identity, which can be generated to meet federal and state regulations.

Once you locate the appropriate document, click Acquire now.

Select the pricing plan you prefer, complete the required details to create your account, and pay for your order using PayPal or credit card.

- If you are familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the New York Notice to Debt Collector - Not Disclosing the Caller's Identity template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the document you need and ensure it is for the correct city/county.

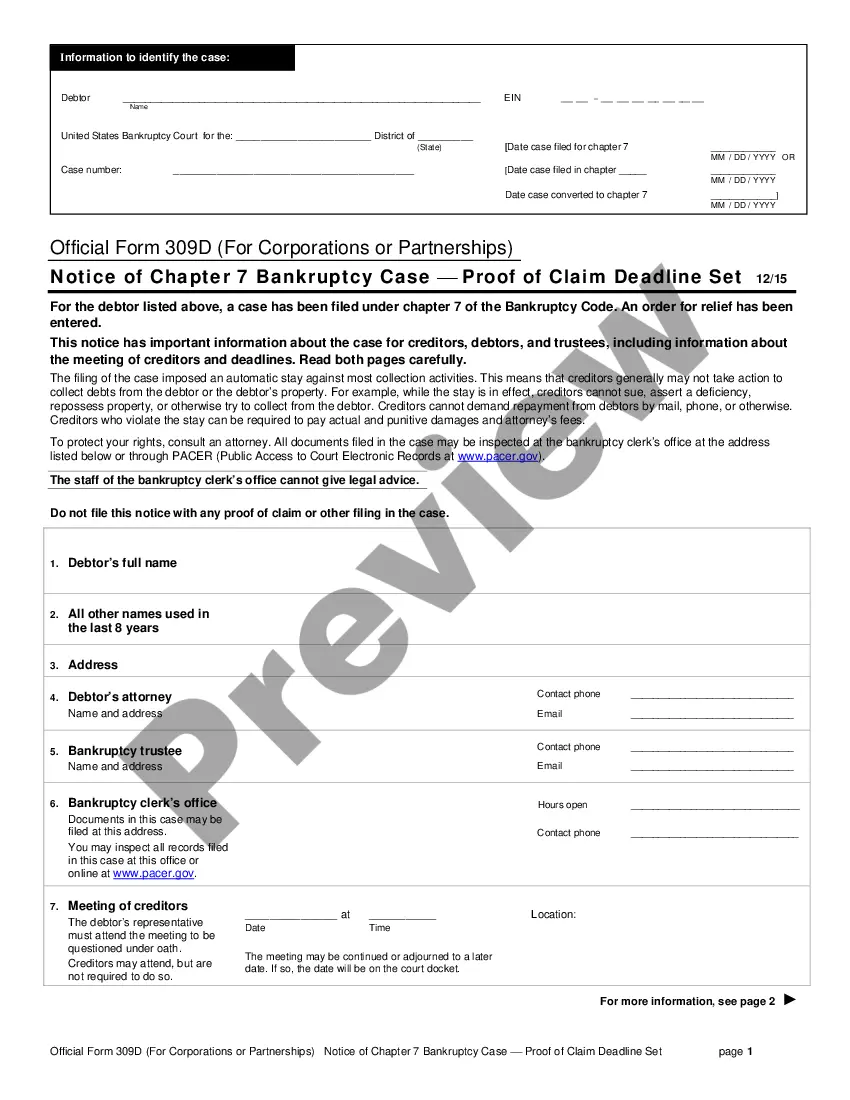

- Use the Preview feature to review the document.

- Read the description to confirm that you have selected the right form.

- If the document isn’t what you are looking for, use the Search box to find the form that fits your needs.

Form popularity

FAQ

The Fair Debt Collection Practices Act (FDCPA) It is always your choice whether to provide any information to a debt collector, even a legitimate one, including whether to verify your identity.

Be aware that collection agencies are forbidden from trying to collect a without first notifying you in writing or making a reasonable attempt to do so. Do not share financial and personal information if you are not certain you are dealing with a real collection agency.

Debt collectors often ask for Social Security numbers, birth dates or other personal information to ensure they have reached the correct debtor.

For a debt collector to have the legal right to pull your credit report without your consent, you must owe the company a legitimate debt and it must stem from a voluntary credit transaction.

Do not give the caller personal financial or other sensitive information. Never give out or confirm personal financial or other sensitive information like your bank account, credit card, or Social Security number unless you know the company or person you are talking with is a real debt collector.

Your personal information can never be disclosed to a third party as stated by the FDCPA. The only person to who your debt may be disclosed is your spouse. This means that debt collectors may not leave a voicemail message if it is shared with your employer, roommates, or even your children.

While these procedures may vary by company and whether the call is inbound or outbound, there is a common thread: generally debt collectors ask the consumer to verify some piece of personal information, such as the last four digits of the consumer's social security number or the consumer's birth date, to ensure they

Can Debt Collectors Call Friends and Family? Debt collectors are legally allowed to call your friends or family to try to locate you. But they cannot call these people to try to collect the payment for the debt, and they are only allowed to call once unless they believe there may be new information to be found.

Asking family members about your whereabouts and basic contact information is perfectly legal. But debt collectors cannot ask your friends or family members about other subjects. In fact, bill collectors can't even mention your debt or how much you owe.

Generally, a debt collector can't discuss your debt with anyone other than: You. Your spouse. Your parents (if you are a minor)