Oklahoma Invoice Template for Consulting Services

Description

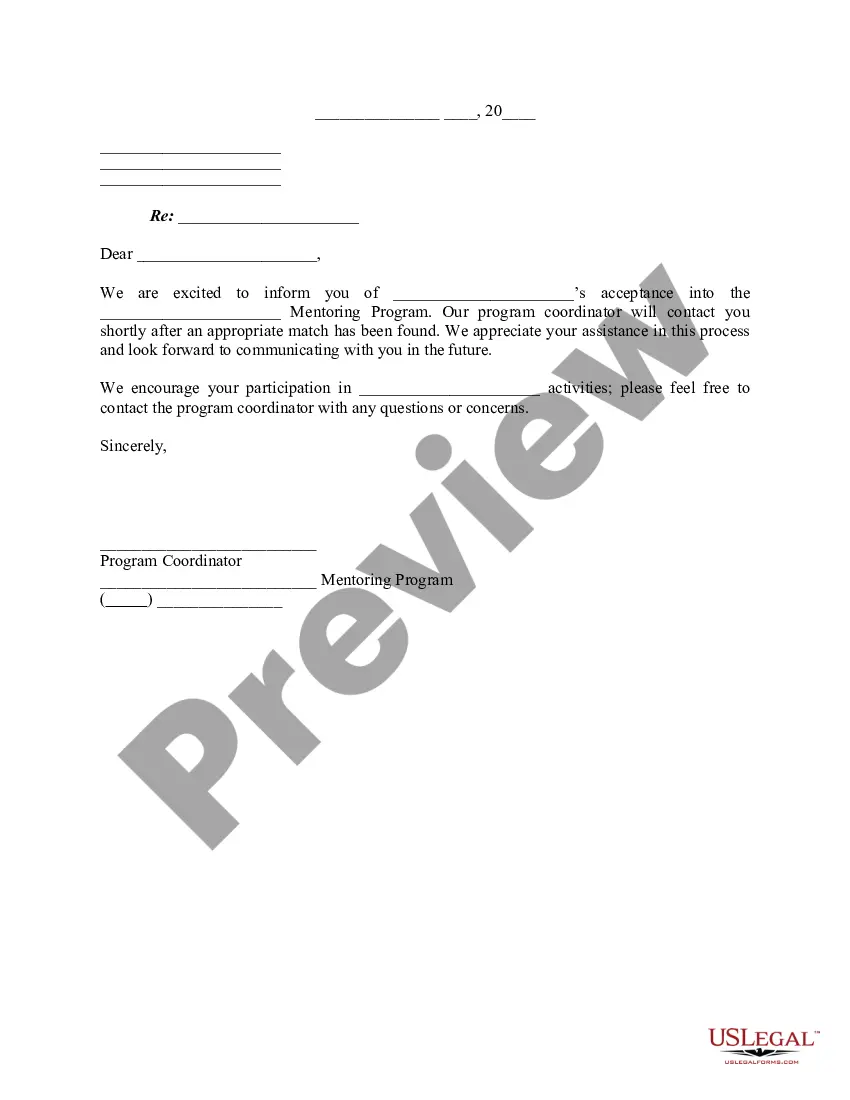

How to fill out Invoice Template For Consulting Services?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal form templates you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords.

You can find the latest versions of forms like the Oklahoma Invoice Template for Consulting Services within moments.

If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

If you are satisfied with the form, confirm your selection by clicking the Purchase now button. Then, select the pricing plan you prefer and enter your details to register for an account.

- If you already possess a subscription, Log In and obtain the Oklahoma Invoice Template for Consulting Services from the US Legal Forms library.

- The Download button appears on every form you view.

- You have access to all previously downloaded forms in the My documents section of your account.

- To use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your city/state.

- Preview the form to review its contents.

Form popularity

FAQ

Creating a consulting invoice involves listing your services, rates, and the total amount due. Using an Oklahoma Invoice Template for Consulting Services simplifies this task by providing a structured format that you'll find easy to fill out. Just include your contact information, the client's details, and add a description of each service provided. This approach not only looks professional but also ensures that all necessary information is communicated clearly.

Billing someone as a consultant starts with detailing your services and the agreed-upon fees. You can utilize an Oklahoma Invoice Template for Consulting Services to make this process efficient and professional. This template allows you to itemize your services, adding clarity for your client. Additionally, always ensure to include payment terms and deadlines to avoid any confusion.

Raising a consultancy invoice involves several key steps. First, prepare a detailed list of your consultancy services and their respective costs, using an Oklahoma Invoice Template for Consulting Services for clarity. Ensure that you include payment terms and due dates to avoid any confusion. After finalizing the details, deliver the invoice to your client through email or a preferred method, making it easier for them to process your payment.

To generate an invoice as a consultant, start by collecting all relevant client information and details about the services rendered. Use an Oklahoma Invoice Template for Consulting Services to streamline the process and ensure compliance with local laws. Include your consulting business name, address, and contact information, along with a clear description of the services provided. Finally, calculate the total amount due and send the invoice to your client promptly.

To create an invoice for your services, begin with a clear format that includes your business name, client details, services rendered, and total amount due. An Oklahoma Invoice Template for Consulting Services can make this process easier by providing a structured layout. This allows you to focus on delivering valuable services while presenting your billing clearly.

Creating an invoice for services provided involves detailing the specific services, dates, and charges. You can utilize an Oklahoma Invoice Template for Consulting Services to organize this information clearly and effectively. This template not only saves time but also ensures your invoices are professional and easy to understand.

To create your own invoice, begin by selecting a template that suits your consulting style, such as the Oklahoma Invoice Template for Consulting Services. Fill in your details, add your services rendered, and specify your payment terms. This personalized approach ensures that your invoice matches your branding and communicates professionalism.

Consultants typically bill their clients based on hourly rates, project milestones, or fixed fees. With an Oklahoma Invoice Template for Consulting Services, you can detail your billing structure, letting clients know exactly what to expect. This clarity fosters better communication and helps maintain professional relationships.

Creating an e-invoice for a service involves using digital tools to generate and send the invoice via email. An Oklahoma Invoice Template for Consulting Services can streamline this process, letting you easily convert your invoice into a PDF format to share electronically. Ensure you provide clear payment instructions to facilitate a smooth transaction.

To make an invoice for consulting services, start by outlining your services, including the date and amount owed. Using an Oklahoma Invoice Template for Consulting Services simplifies this process, allowing you to fill in your information quickly. Just include your contact details, payment terms, and any applicable taxes to complete your invoice.