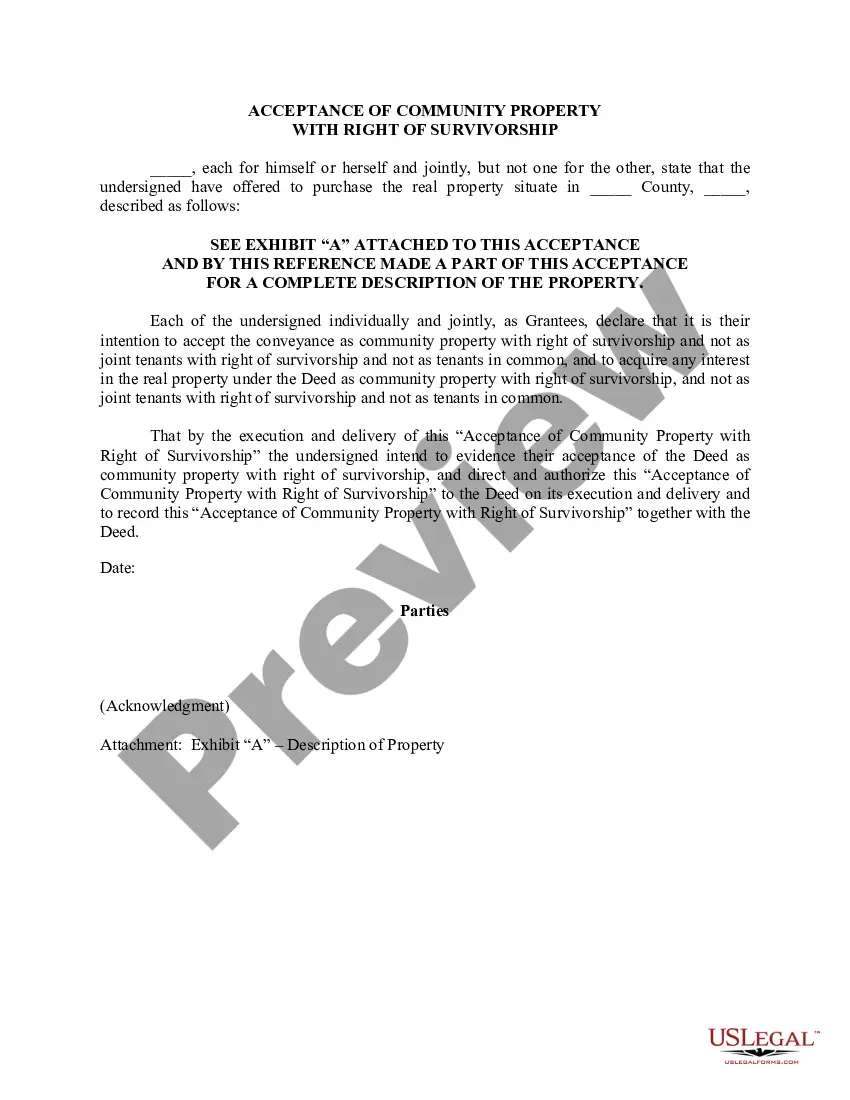

Kansas Deed (Including Acceptance of Community Property with Right of Survivorship)

Description

How to fill out Deed (Including Acceptance Of Community Property With Right Of Survivorship)?

US Legal Forms - among the most significant libraries of authorized kinds in the United States - provides a variety of authorized papers web templates you are able to download or printing. While using web site, you can find 1000s of kinds for organization and specific reasons, sorted by groups, suggests, or key phrases.You can find the latest types of kinds like the Kansas Deed (Including Acceptance of Community Property with Right of Survivorship) in seconds.

If you have a registration, log in and download Kansas Deed (Including Acceptance of Community Property with Right of Survivorship) in the US Legal Forms local library. The Download key will show up on each and every form you view. You gain access to all in the past acquired kinds in the My Forms tab of your own profile.

If you would like use US Legal Forms for the first time, listed below are simple instructions to help you started:

- Be sure you have chosen the correct form to your area/region. Click the Preview key to analyze the form`s content material. Browse the form explanation to actually have chosen the proper form.

- In the event the form does not fit your needs, take advantage of the Look for discipline towards the top of the monitor to obtain the one who does.

- If you are satisfied with the form, confirm your option by clicking on the Get now key. Then, opt for the prices program you want and offer your qualifications to sign up for an profile.

- Approach the deal. Make use of your bank card or PayPal profile to complete the deal.

- Select the format and download the form in your gadget.

- Make modifications. Fill up, revise and printing and signal the acquired Kansas Deed (Including Acceptance of Community Property with Right of Survivorship).

Every single format you included in your account lacks an expiration particular date and it is your own forever. So, if you want to download or printing an additional version, just check out the My Forms section and click about the form you will need.

Gain access to the Kansas Deed (Including Acceptance of Community Property with Right of Survivorship) with US Legal Forms, one of the most considerable local library of authorized papers web templates. Use 1000s of professional and condition-certain web templates that satisfy your company or specific requirements and needs.

Form popularity

FAQ

Kansas is one of a few states with no transfer tax or deed tax on real estate transfers.

The current property owner with the right to transfer the property must sign a Kansas deed. A deed that transfers a co-owned property should include the signatures of both owners. A lawful agent or attorney who can act on the owner's behalf may sign a deed for the owner.

Laws. Recording ? A quitclaim deed must be filed with the County Recorder's Office where the real estate is located. Go to your County Website to locate the office nearest you. Signing (§ 58-2205) ? A quitclaim deed is required to be authorized with a notary public present.

Ing to § 58-2205, -2209, -2211 of State Law, the deed must be signed by both parties to the transaction. In addition, the form must be notarized. Once drafted and certified, the document must be recorded as soon as possible. This is to protect both parties and to ensure that the state is aware of property rights.

Revoking the deed. If you later change your mind about who you want to inherit the property, you are not locked in. You have two options: (1) sign and record a revocation or (2) record another TOD deed, leaving the property to someone else. You cannot use your will to revoke or override a TOD deed.

Kansas Transfer-on-Death Deed A transfer-on-death (TOD) deed is like a regular deed you might use to transfer real estate located in Kansas, but with a crucial difference: It doesn't take effect until your death.

(a) An interest in real estate may be titled in transfer-on-death, TOD, form by recording a deed signed by the record owner of such interest, designating a grantee beneficiary or beneficiaries of the interest. Such deed shall transfer ownership of such interest upon the death of the owner.

The right of survivorship controls the disposition of property at the death of one co-owner. Property owned in joint tenancy immediately passes to the surviving joint tenant(s). Wills or state intestate laws do not control property held in joint tenancy.