This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Oklahoma Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually

Description

How to fill out Promissory Note With No Payment Due Until Maturity And Interest To Compound Annually?

Are you presently in a situation where you need paperwork for either business or personal reasons almost every working day.

There are numerous legitimate document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms provides thousands of template forms, such as the Oklahoma Promissory Note with no Payment Due Until Maturity and Interest Compounding Annually, which can be tailored to meet state and federal requirements.

Once you find the correct form, click Get now.

Select the pricing plan you desire, enter the necessary information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- After that, you can download the Oklahoma Promissory Note with no Payment Due Until Maturity and Interest Compounding Annually template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your correct area/county.

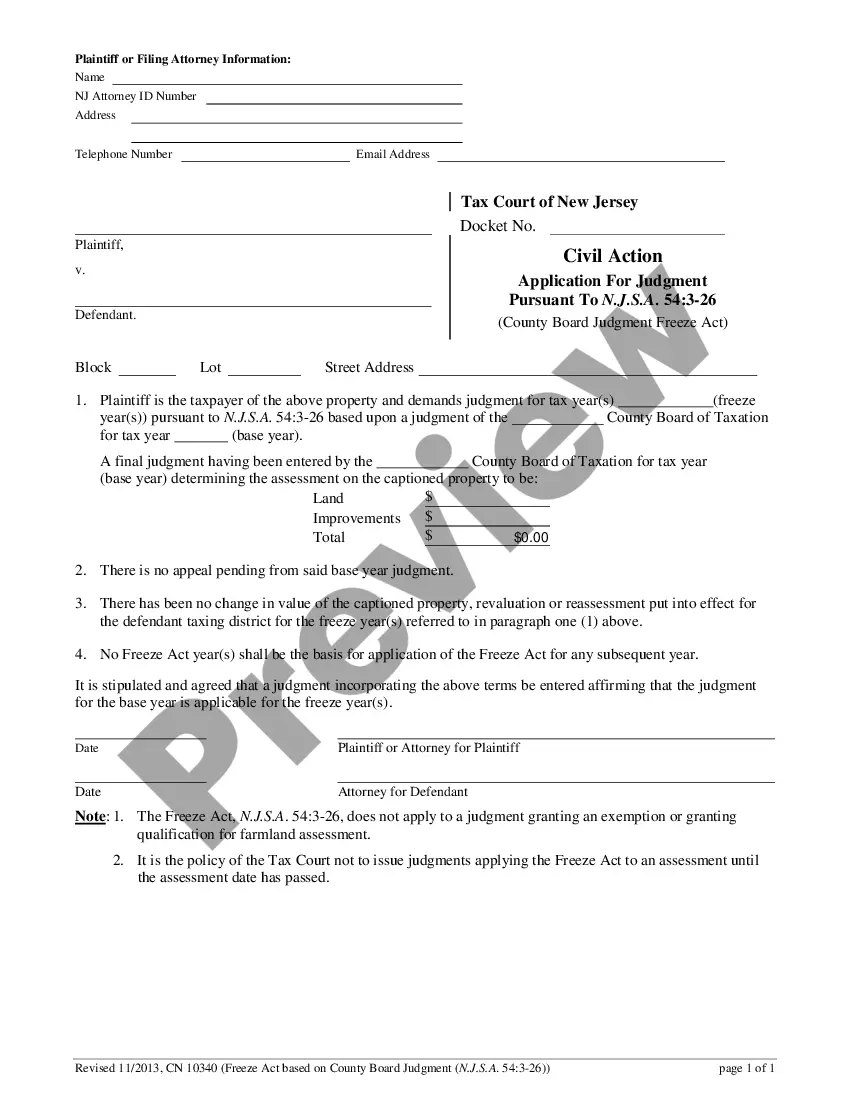

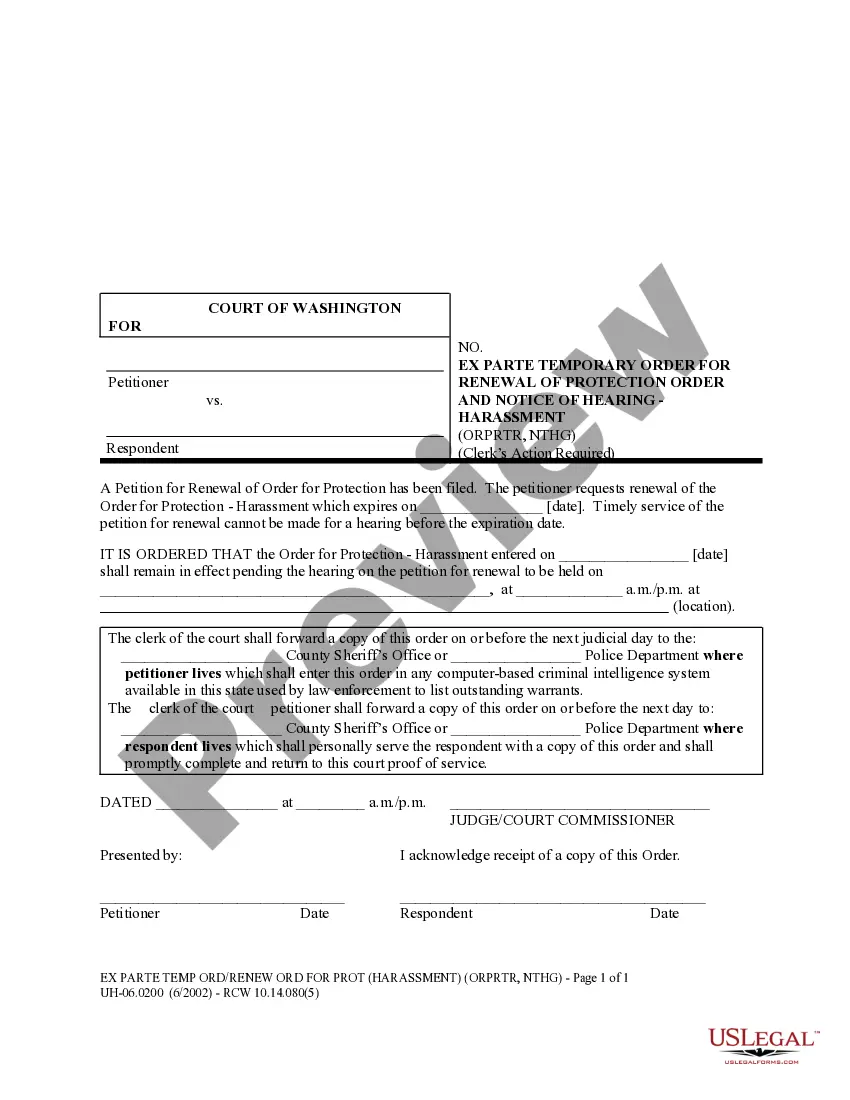

- Use the Preview button to review the form.

- Check the summary to ensure that you have selected the correct form.

- If the form is not what you're looking for, use the Search field to find the form that meets your requirements.

Form popularity

FAQ

Yes, you can create a promissory note without interest. However, when considering an Oklahoma Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, it's important to understand that typically, interest is a key component of these agreements. A note without interest may not fulfill certain financial needs or expectations from lenders. If you seek a tailored solution, consider using US Legal Forms to draft a compliant and customized promissory note that meets your specific requirements.

Yes, income from a promissory note is taxable, and this includes any earnings from an Oklahoma Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually. As a note holder, you must report this income on your tax return as it is considered ordinary income. Proper documentation of your interest income will be necessary for tax compliance. Engaging a tax advisor can assist you in navigating this requirement.

Yes, interest can compound on a promissory note, including an Oklahoma Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually. Compounding means that interest earned will be added to the principal balance, leading to greater returns over time. Understanding how compounding works in your note can help you better assess your overall investment strategy. Always review the terms of your note to confirm how interest will be calculated.

Income from a promissory note is generally taxed as ordinary income, including for an Oklahoma Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually. This means the interest you earn is subject to your regular income tax rate. It's essential to track the interest payments you receive for accurate tax reporting. Consulting with a tax professional will ensure you meet all tax obligations associated with your investment.

Yes, a promissory note typically requires a maturity date, even if it's an Oklahoma Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually. This date marks when the principal balance is due, allowing both parties to understand their obligations clearly. Without a maturity date, the agreement may face legal challenges or misunderstandings. Always ensure your promissory note specifies this important detail.

The maturity value of a promissory note signifies the total amount due upon its expiration, usually combining the principal and any accrued interest. If you utilize an Oklahoma Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, you can expect the interest to be added to the principal balance by the maturity date. Understanding this value is vital, as it influences future financial decisions. Make sure to check resources on platforms like US Legal Forms for detailed guidance.

Calculating compound interest on a promissory note involves understanding the principal amount, the interest rate, and the frequency of compounding. For an Oklahoma Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, you would apply the formula: A = P (1 + r/n)^(nt), where A is the amount, P is the principal, r is the annual interest rate, n is the number of times interest compounds per year, and t is the number of years. This method provides clarity on how much you will owe at maturity, helping you manage your finances.

The maturity value of a promissory note represents the total amount owed on the repayment date, which includes the principal and any accrued interest. For an Oklahoma Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, this amount will accumulate until the note matures. Accurately determining the maturity value is essential for both borrowers and lenders. Tools and templates available on the US Legal Forms platform can help you calculate this effectively.

To determine the maturity value of a 90-day note at 12% interest for $10,000, you would calculate the interest accrued over the 90 days and add it to the principal. The formula is simple: Interest equals Principal multiplied by Rate multiplied by Time. Thus, you would add the interest to the original amount of $10,000 to find the total due at maturity. Utilizing an Oklahoma Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually facilitates smooth calculations.

To ensure a promissory note is valid, it must include certain essential elements. These include the amount owed, the terms of repayment, and the signatures of both parties involved. Additionally, for an Oklahoma Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, clarity in terms allows for effective tracking of interest accumulation. Having these elements in place helps protect the rights of both the lender and the borrower.