Oklahoma Corporate Guaranty - General

Description

How to fill out Corporate Guaranty - General?

Have you ever found yourself in a situation where you need documents for a company or individual on a nearly daily basis.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of document templates, including the Oklahoma Corporate Guaranty - General, which is designed to meet state and federal requirements.

Once you find the correct template, click Buy now.

Choose the pricing plan you prefer, fill in the necessary information to create your account, and complete the transaction using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Oklahoma Corporate Guaranty - General template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the template you need and ensure it corresponds to the correct city/county.

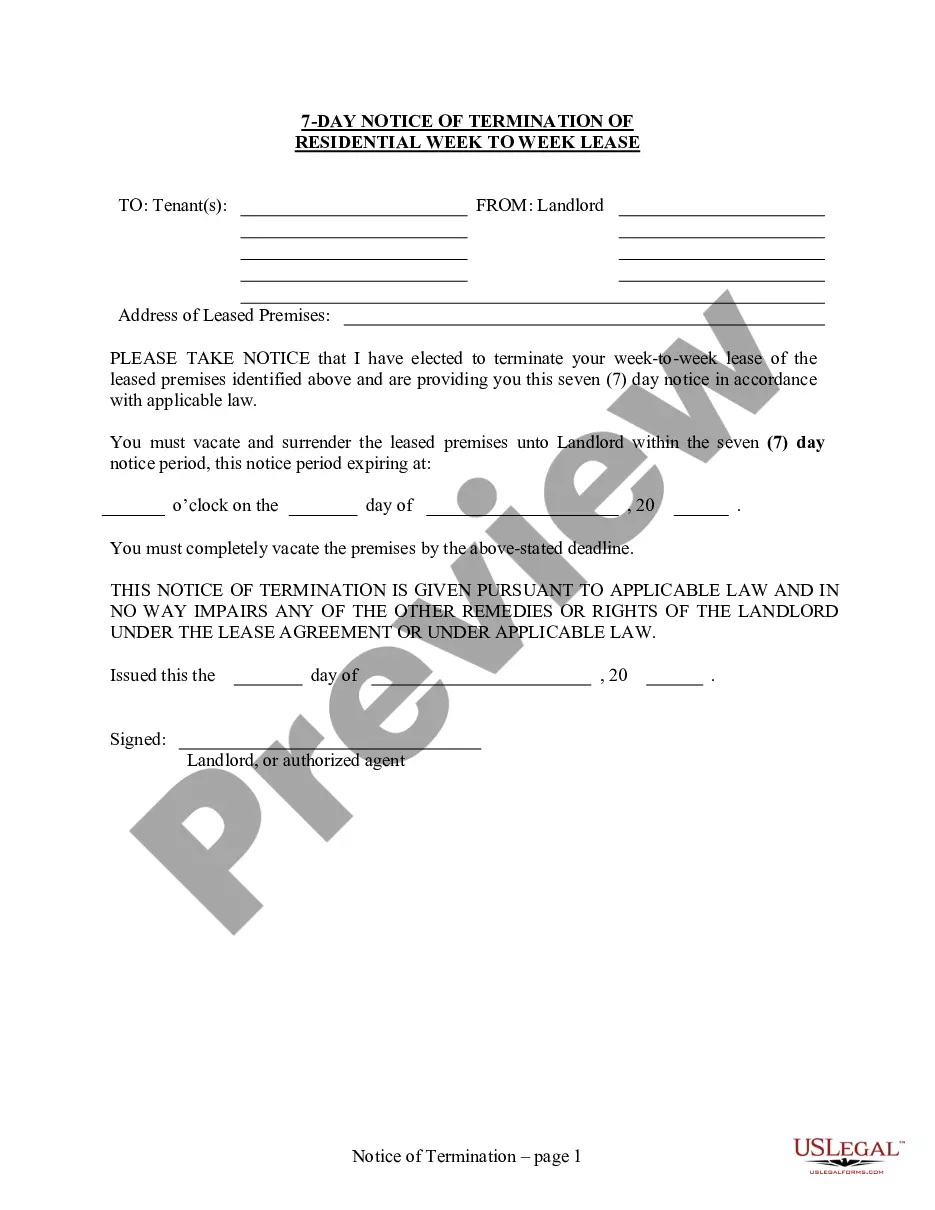

- Use the Review button to evaluate the document.

- Examine the details to confirm that you have selected the appropriate template.

- If the template is not what you require, use the Lookup field to find the document that suits your needs.

Form popularity

FAQ

The MBT tax, or Modified Barge Tax, is a tax based on gross receipts instead of net income in Oklahoma. This approach simplifies tax compliance for many businesses. If you are managing any related concerns as part of an Oklahoma Corporate Guaranty - General, understanding how the MBT tax works will aid in financial planning and filing.

Yes, in Oklahoma, businesses typically must file 1099 forms for reporting payments made to independent contractors and freelancers. This requirement ensures proper documentation of earnings, which is essential for tax reporting purposes. If your business involves independent contractors, understanding this process is pivotal when operating under an Oklahoma Corporate Guaranty - General.

The 514 PT form is a specific tax form used in Oklahoma to provide the state with information regarding partnership tax returns. This form enables partnerships to report income, deductions, and credits, ensuring transparency in financial reporting. It’s important for those operating under an Oklahoma Corporate Guaranty - General to be familiar with this form to comply with tax obligations.

Recently, Oklahoma implemented changes regarding the sales tax on groceries, reducing the rate to help families manage living expenses. This new tax structure aims to alleviate the financial burden on residents while ensuring that funds still contribute to state revenue. If you are looking into financial implications under an Oklahoma Corporate Guaranty - General, it's vital to consider how these tax changes might affect business operations.

In Oklahoma, most businesses that operate as corporations must file a franchise tax return, including those under an Oklahoma Corporate Guaranty - General. This requirement applies whether the corporation is active or inactive during the tax year. By filing the appropriate returns, businesses fulfill legal obligations while ensuring compliance with state regulations.

The base tax in Oklahoma refers to the foundational tax amount upon which additional taxes may be calculated. It includes various components, such as property tax or income tax, depending on the individual or business's specific circumstances. Understanding the base tax is essential if you are considering an Oklahoma Corporate Guaranty - General, as it helps in evaluating your overall tax responsibilities.

The MBT tax, or the Modified Barge Tax, is a unique tax structure in Oklahoma applicable to certain business entities. This tax is calculated based on gross receipts instead of net income, which can simplify some aspects of tax compliance for businesses. If you are exploring options under an Oklahoma Corporate Guaranty - General, understanding the MBT tax is crucial for maintaining compliance and optimizing your tax responsibilities.

Yes, an LLC operating in Oklahoma is required to file a franchise tax return if it meets the state's thresholds for business activities. This obligation is part of maintaining compliance under the Oklahoma Corporate Guaranty - General framework. Ensuring timely filing helps prevent penalties and keeps your LLC in good standing with Oklahoma business regulations.

To file your Oklahoma franchise tax, you need to complete and submit the appropriate forms to the Oklahoma Tax Commission. Ensure that you provide accurate details about your business's assets to determine the correct tax amount. Staying compliant with the Oklahoma Corporate Guaranty - General ensures your business operates smoothly and legally.

You can file your Oklahoma franchise tax online through the Oklahoma Tax Commission's website. The online portal provides a user-friendly interface for entering your business information and calculates your tax due based on your inputs. Utilizing this resource simplifies the compliance process related to Oklahoma Corporate Guaranty - General, ensuring timely submissions.