Oklahoma Deferred Compensation Agreement - Long Form

Description

How to fill out Deferred Compensation Agreement - Long Form?

Selecting the appropriate authorized document template can be a challenge.

Certainly, there are plenty of designs accessible online, but how do you find the legal form you need.

Utilize the US Legal Forms website. This platform offers thousands of templates, including the Oklahoma Deferred Compensation Agreement - Long Form, for business and personal use.

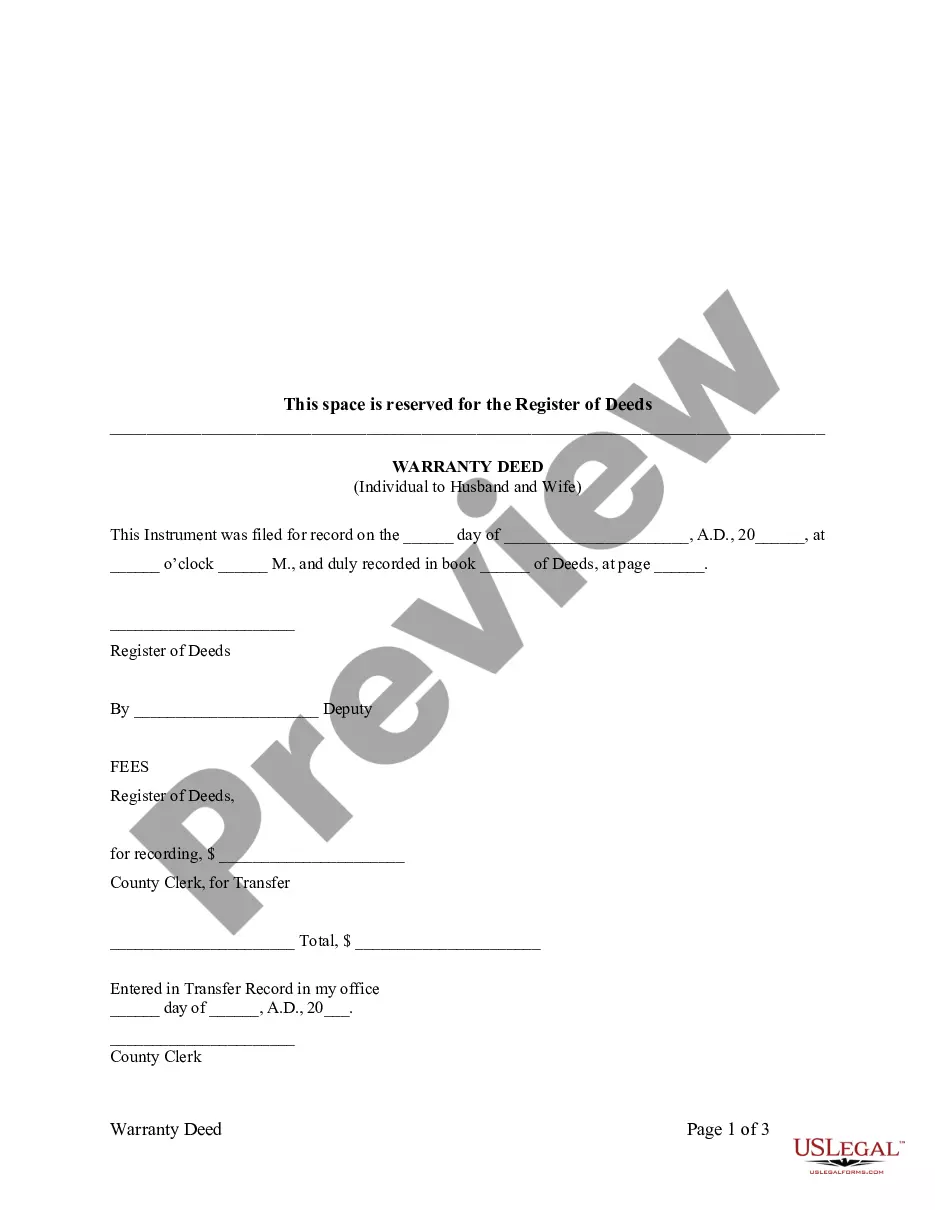

First, ensure you have selected the correct form for your region. You can preview the form using the Preview button and review the form details to confirm it is suitable for you. If the form does not meet your needs, use the Search area to find the appropriate form. Once you are confident that the form is correct, click the Get now button to obtain the form. Choose the payment plan you prefer and enter the required information. Create your account and pay for your order using your PayPal account or credit card. Select the document format and download the legal document template to your device. Fill out, edit, print, and sign the downloaded Oklahoma Deferred Compensation Agreement - Long Form. US Legal Forms is the premier repository of legal forms where you can discover numerous document templates. Use this service to obtain accurately crafted paperwork that adhere to state regulations.

- All documents are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Oklahoma Deferred Compensation Agreement - Long Form.

- Use your account to review the legal forms you have previously acquired.

- Navigate to the My documents tab in your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you can follow.

Form popularity

FAQ

Deferred compensation is a portion of an employee's compensation that is set aside to be paid at a later date. In most cases, taxes on this income are deferred until it is paid out. Forms of deferred compensation include retirement plans, pension plans, and stock-option plans.

Pathfinder is composed of a 401(a) Plan for mandatory and matching contributions and a 457(b) Plan for additional voluntary contributions. With each paycheck you make a mandatory contribution of 4.5% of your pretax salary to the 401(a) Plan. Your employer also contributes 6% of your pretax salary into the plan.

A 457 plan is a tax-deferred retirement savings plan. Funds are withdrawn from an employee's income without being taxed and are only taxed upon withdrawal, which is typically at retirement, after the funds have had several years to grow.

SoonerSave is one retirement savings program with two components: the Deferred Compensation (457) Plan and the Savings Incentive 401(a) Plan. Your contributions are deferred into the 457 Plan and the $25 employer contribution from the State of Oklahoma is contributed to the 401(a) Plan.

A 457(b) plan is an employer-sponsored, tax-favored retirement savings account. With this type of plan, you contribute pre-tax dollars from your paycheck, and that money won't be taxed until you withdraw the money, usually for retirement.

OPERS provides retirement benefits for Oklahoma state employees. The system provides a defined benefit (DB) pension, a retirement plan that typically offers a modest but stable monthly retirement income that lasts the remainder of a retiree's life.

A deferred compensation plan is another name for a 457(b) retirement plan, or 457 plan for short. Deferred compensation plans are designed for state and municipal workers, as well as employees of some tax-exempt organizations. The content on this page focuses only on governmental 457(b) retirement plans.

A deferred compensation plan allows a portion of an employee's compensation to be paid at a later date, usually to reduce income taxes. Because taxes on this income are deferred until it is paid out, these plans can be attractive to high earners.

To initiate a withdrawal, call the SoonerSave record keeper Empower Retirement at (877) 538-3457. A plan representative will walk you through the process and send you any necessary forms. How will I receive my distribution?