This is an official form from the Oklahoma Secretary of State, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Oklahoma statutes and law.

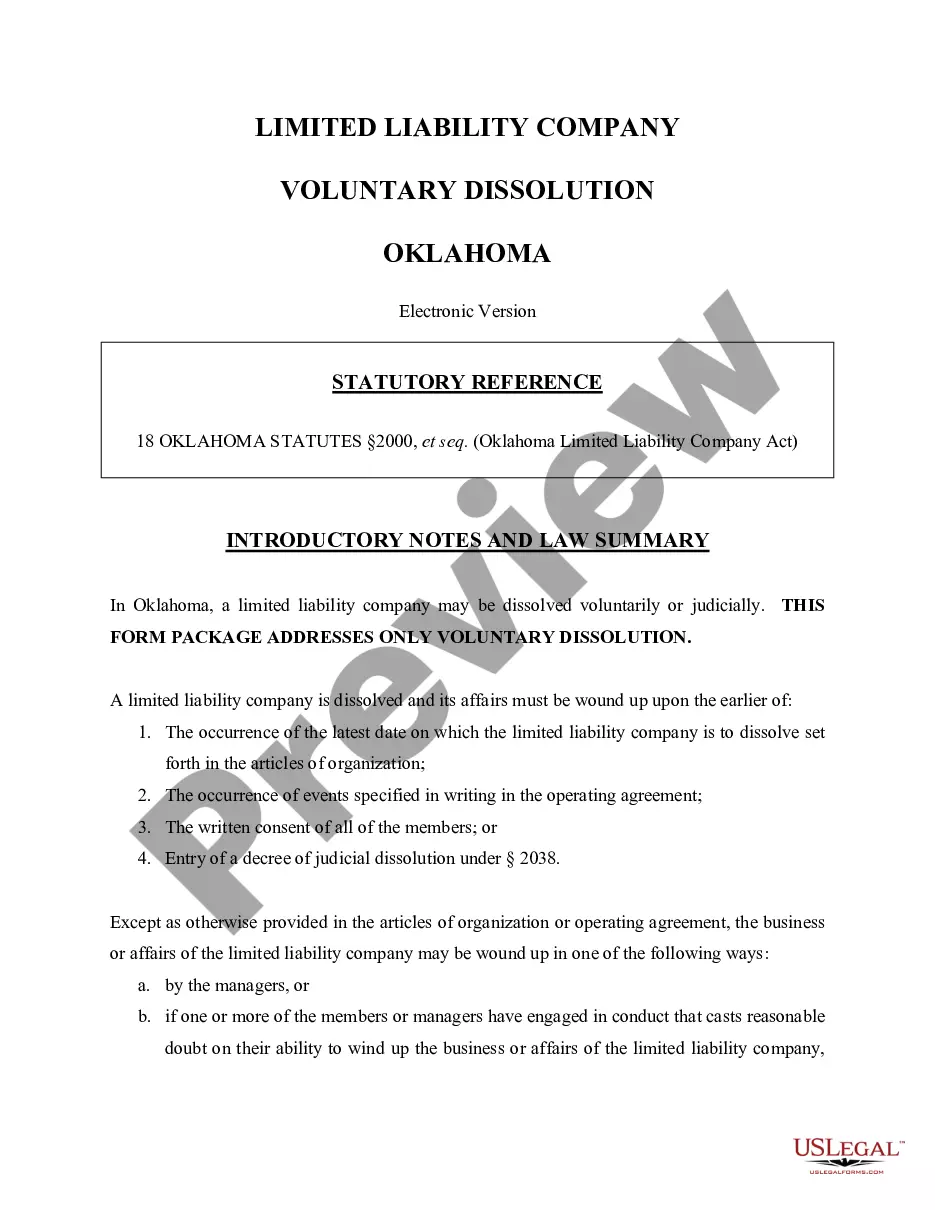

Articles of Dissolution of an Oklahoma Limited Liability Company

Description

How to fill out Articles Of Dissolution Of An Oklahoma Limited Liability Company?

- If you’re a returning user, log in to your US Legal Forms account and quickly download the necessary form template by selecting the Download button. Ensure your subscription is active to avoid any interruptions.

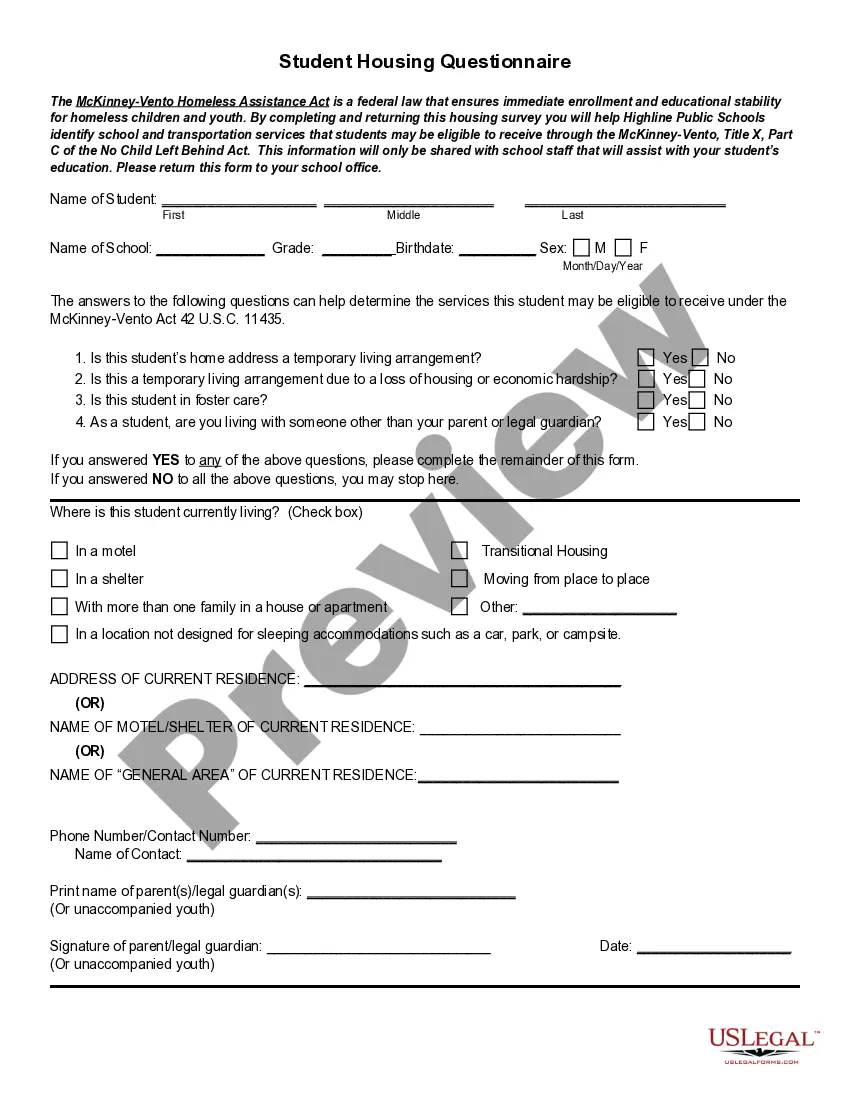

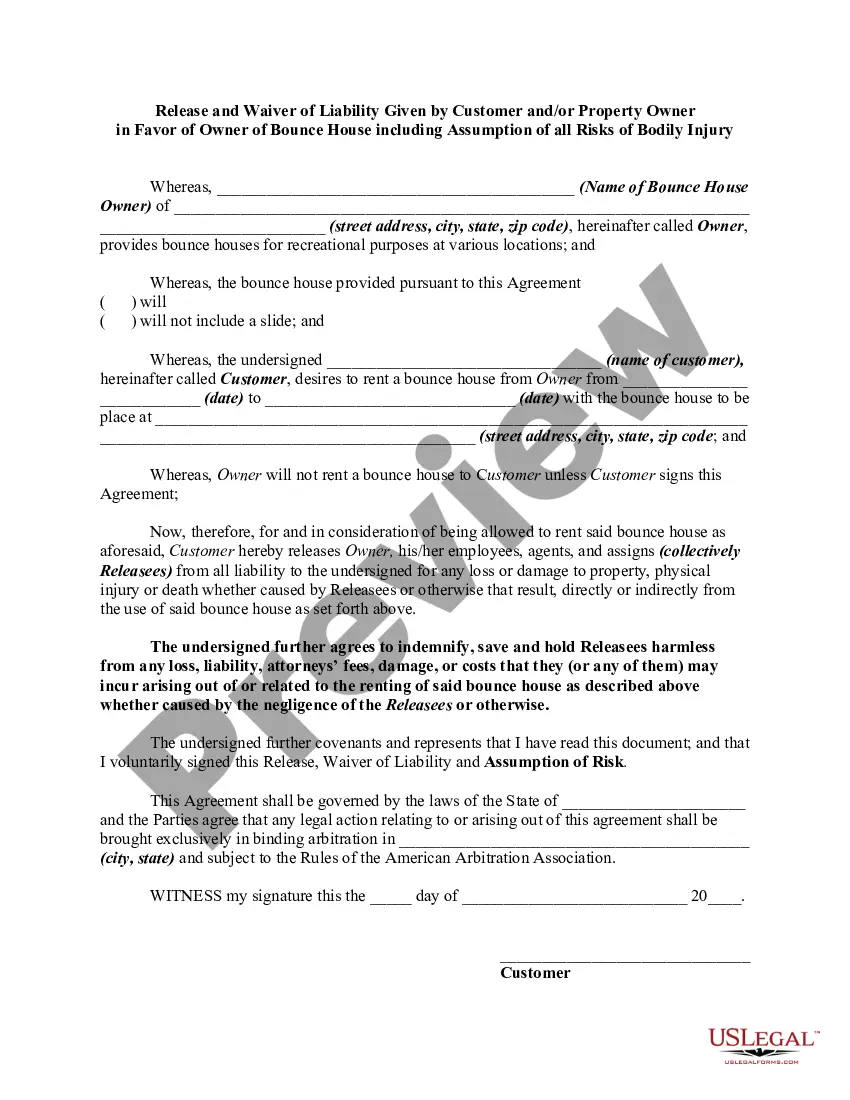

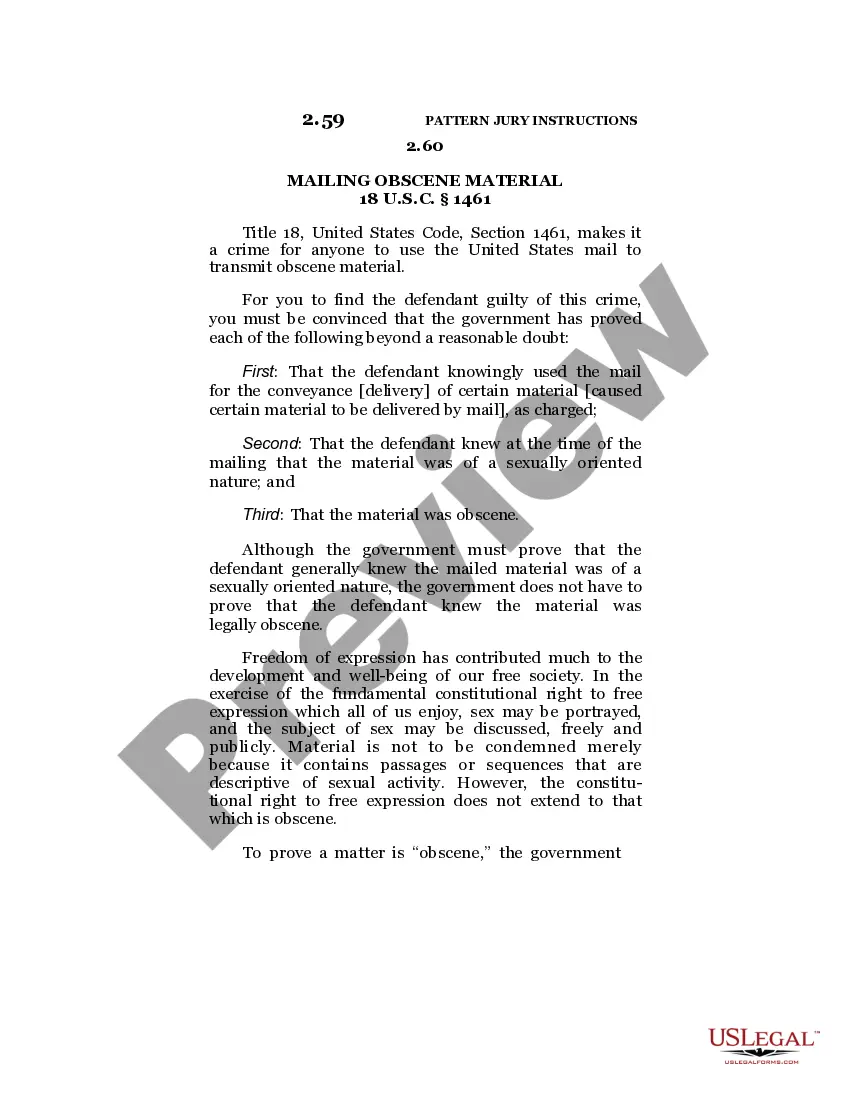

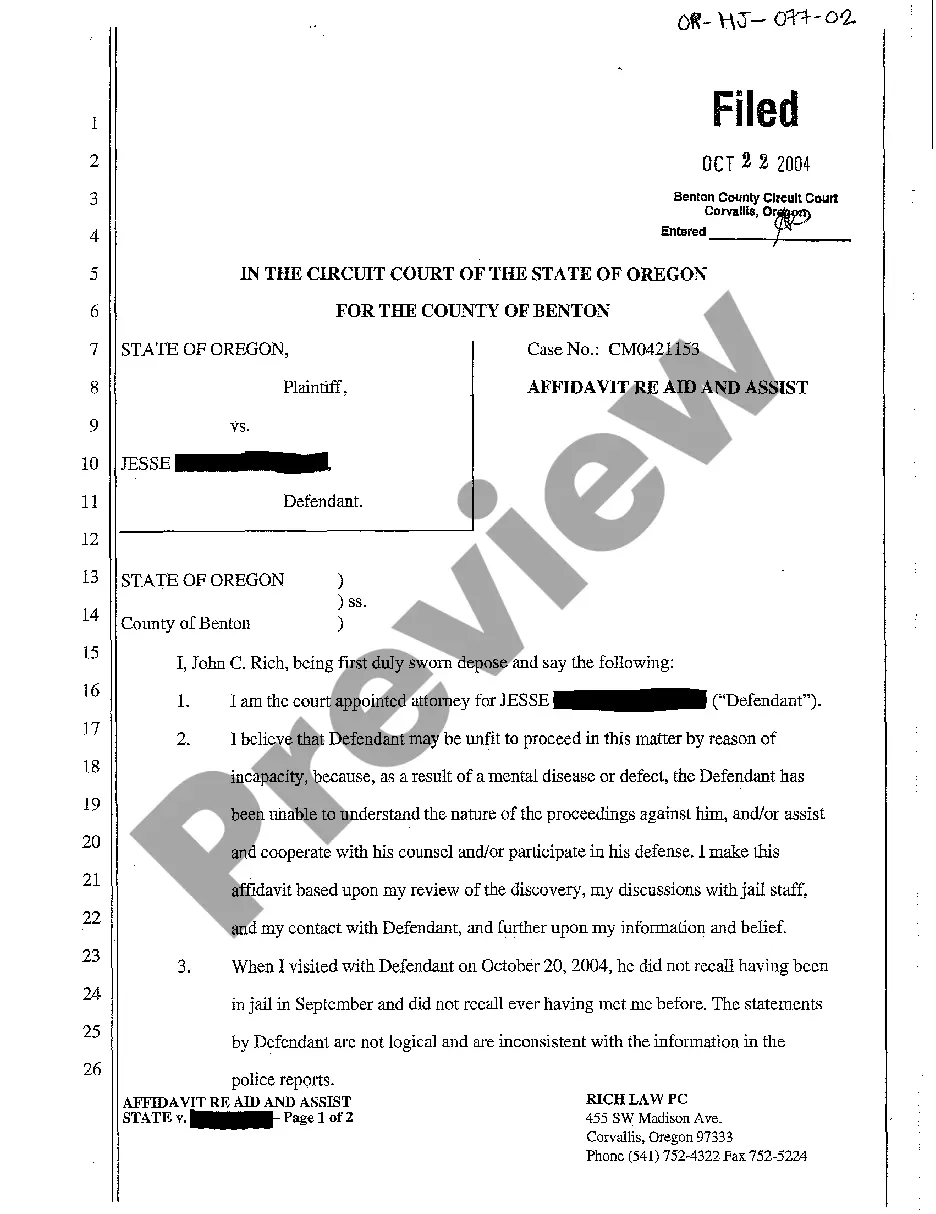

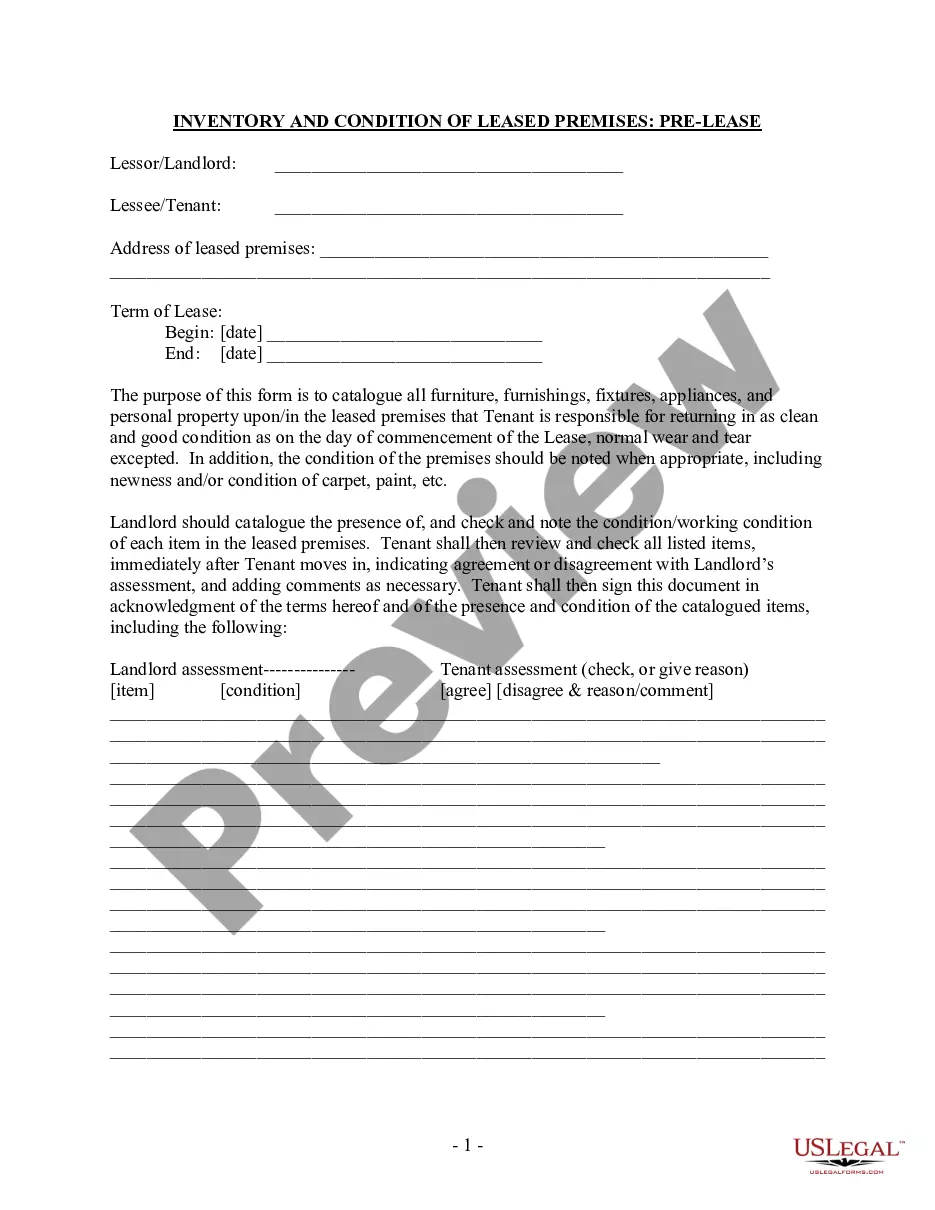

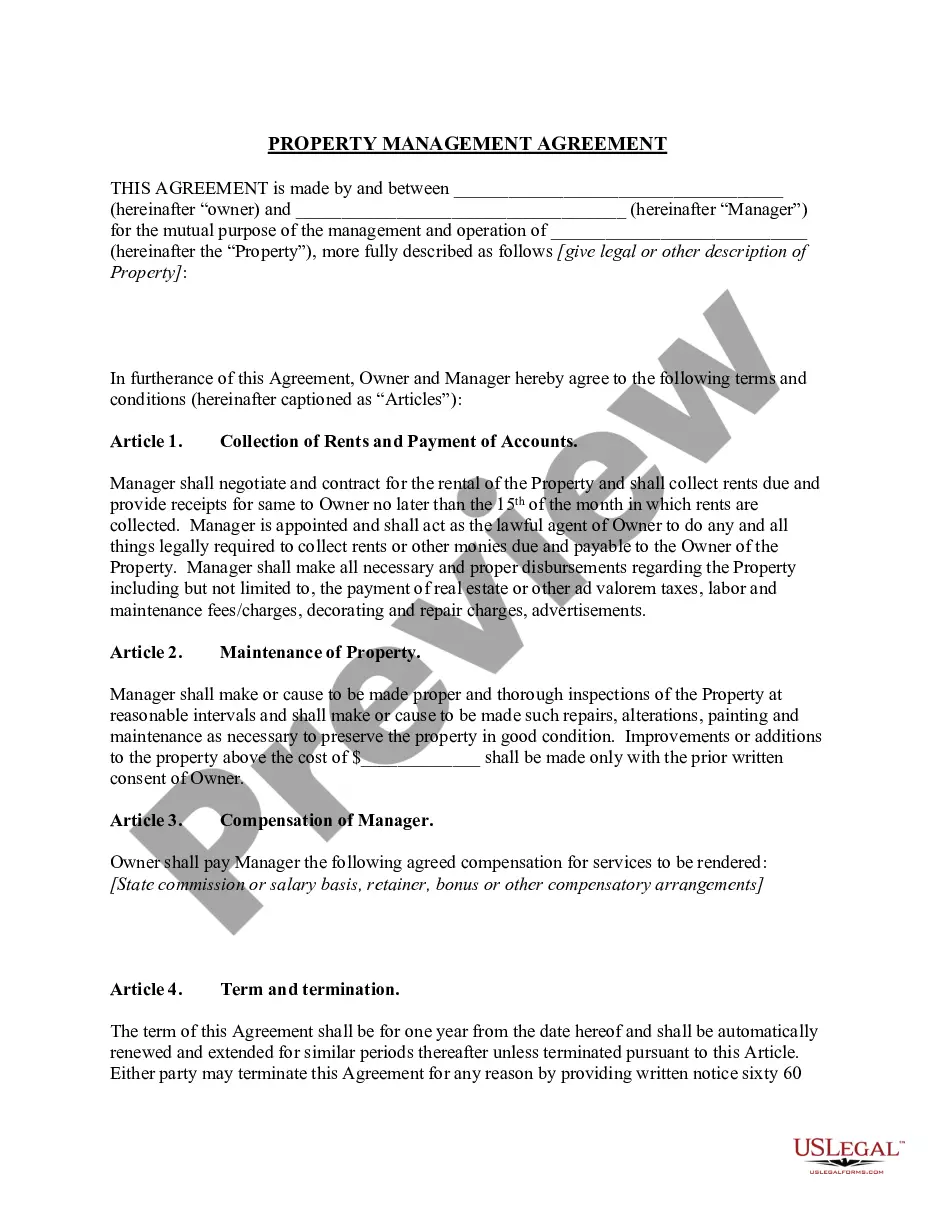

- For first-time users, start by examining the form's Preview mode and description. Confirm that it aligns with your requirements and meets local jurisdiction regulations.

- If you need an alternative template, utilize the Search tab at the top to locate a suitable document. Verify that it meets your needs before proceeding.

- Purchase the desired document by clicking the Buy Now button and selecting your preferred subscription plan. An account registration will be necessary for access.

- Complete your purchase by entering your credit card information or choosing to pay through your PayPal account.

- Download the form to your device, allowing you to fill it out and access it again later via the My documents section of your profile.

In conclusion, using US Legal Forms allows you to efficiently manage the dissolution of your LLC with access to an extensive library of documents. Their robust resources and expert assistance make document preparation hassle-free.

Start your process today and ensure all your legal documents are expertly handled by exploring US Legal Forms now!

Form popularity

FAQ

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office. It can take the SOS many weeks to process a certificate. However, expedited service is available for an additional fee.

Step 1: Corporation or LLC action. Step 2: Filing the Certificate of Dissolution with the state. Step 3: Filing federal, state, and local tax forms. Step 4: Notifying creditors your business is ending. Step 5: Settling creditors' claims.

The Effect of Dissolution After you close your LLC in California, that LLC shall be canceled, and its powers, rights, and privileges shall end upon the filing of the Certificate of Cancellation. This means you can no longer conduct business using that LLC.

The power of the Secretary of State, however, is broad, and in many states, an LLC can be dissolved for nearly any reason the Secretary deems fit. Voluntary dissolution is the result of members willingly choosing to close their business.

Settling. In some states, once you've exhausted your LLC assets, you're free to walk away. In others, LLCs can't dissolve until your debts are paid off. In any state, you have the option to negotiate and get an agreement from your creditors to settle for less.

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

Written Resolution. Pay creditors. Distribute to Members. Complete Articles of Dissolution. File with Secretary of State. File with Oklahoma Tax Commission. File with IRS. Unemployment Authority.

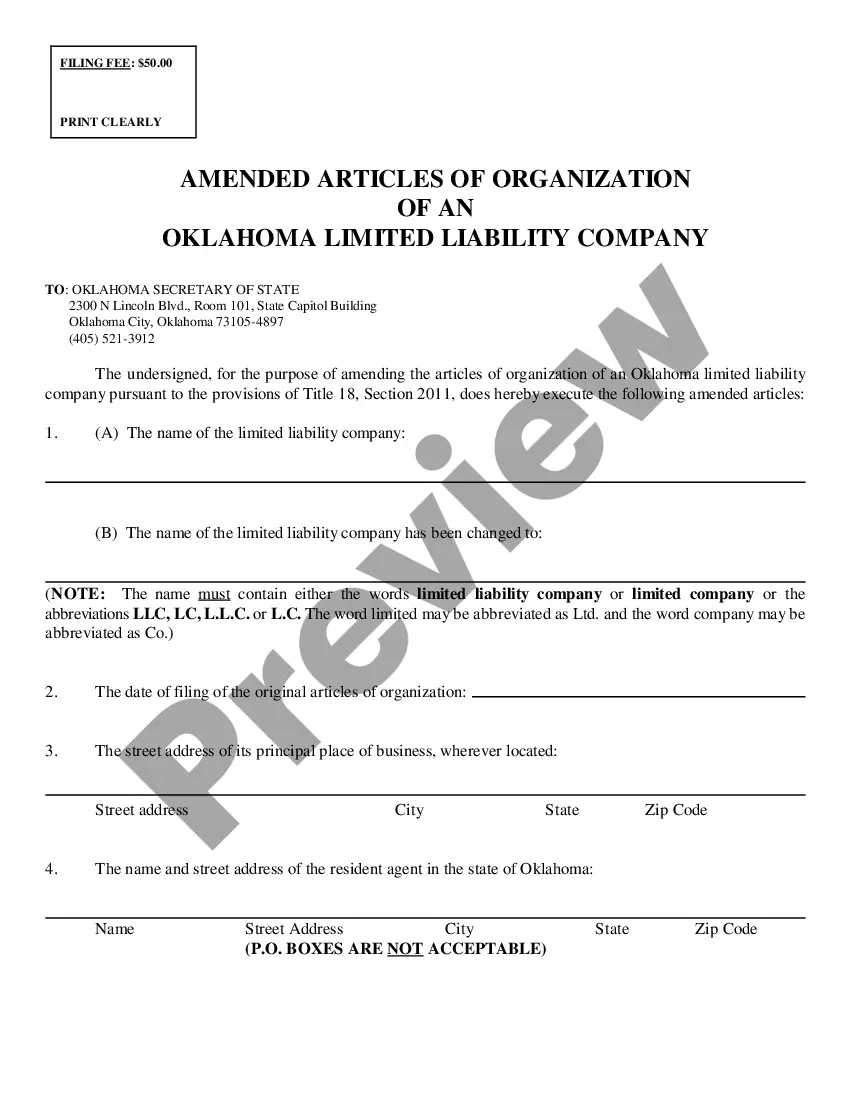

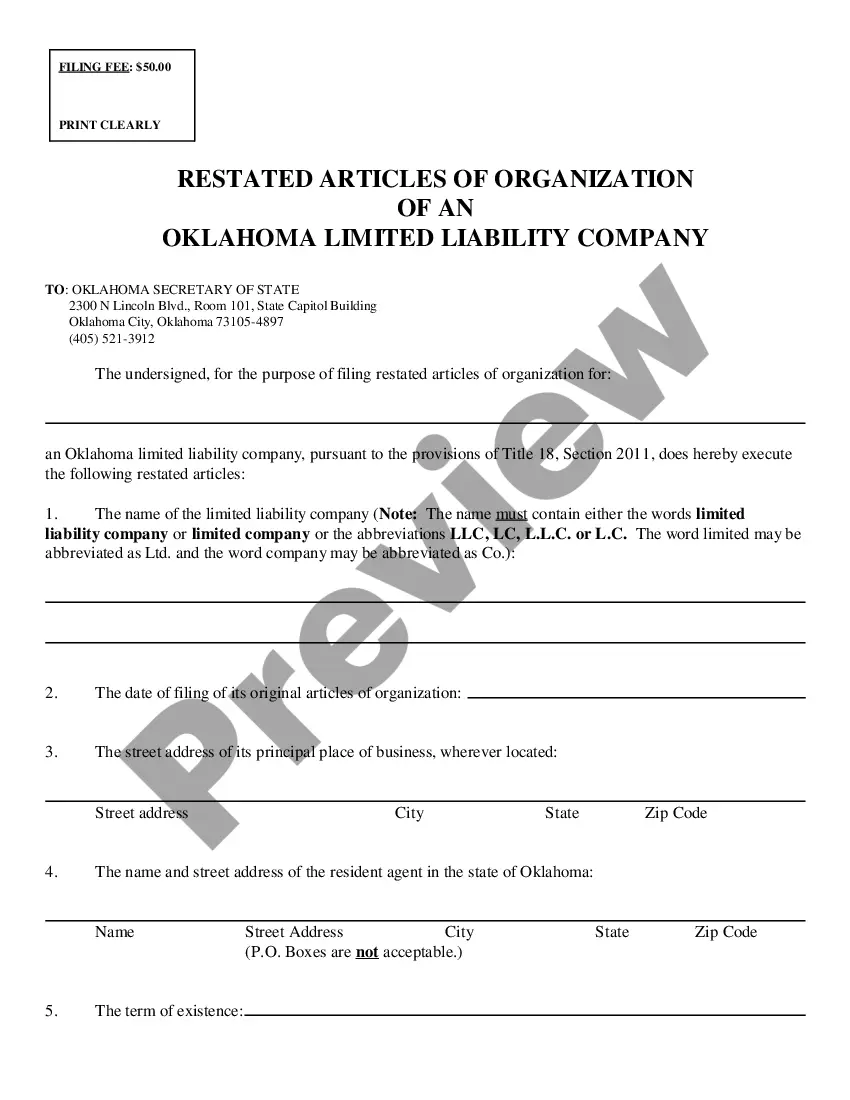

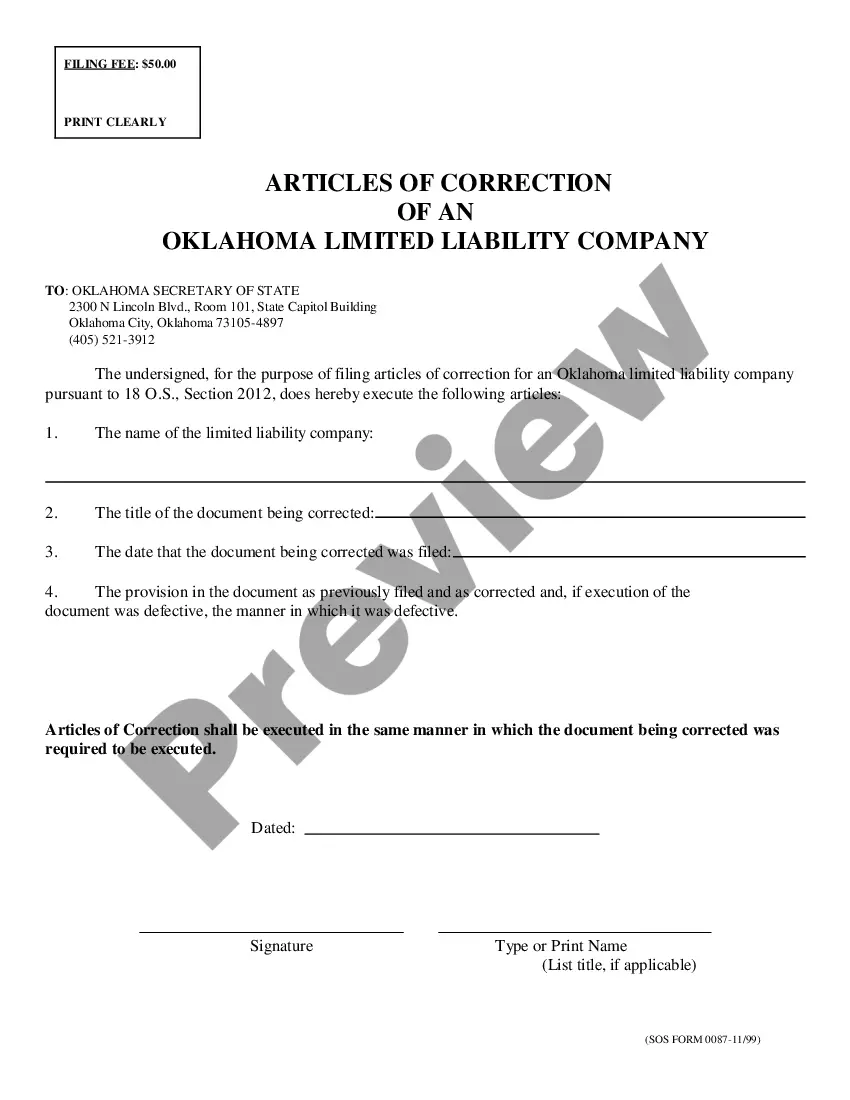

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.

Hold a board of directors meeting and formally move to dissolve your corporation. Fill out and file the Certificate of Dissolution with the Oklahoma Secretary of State. Fulfill all tax obligations with the state of Oklahoma, as well as with the IRS.