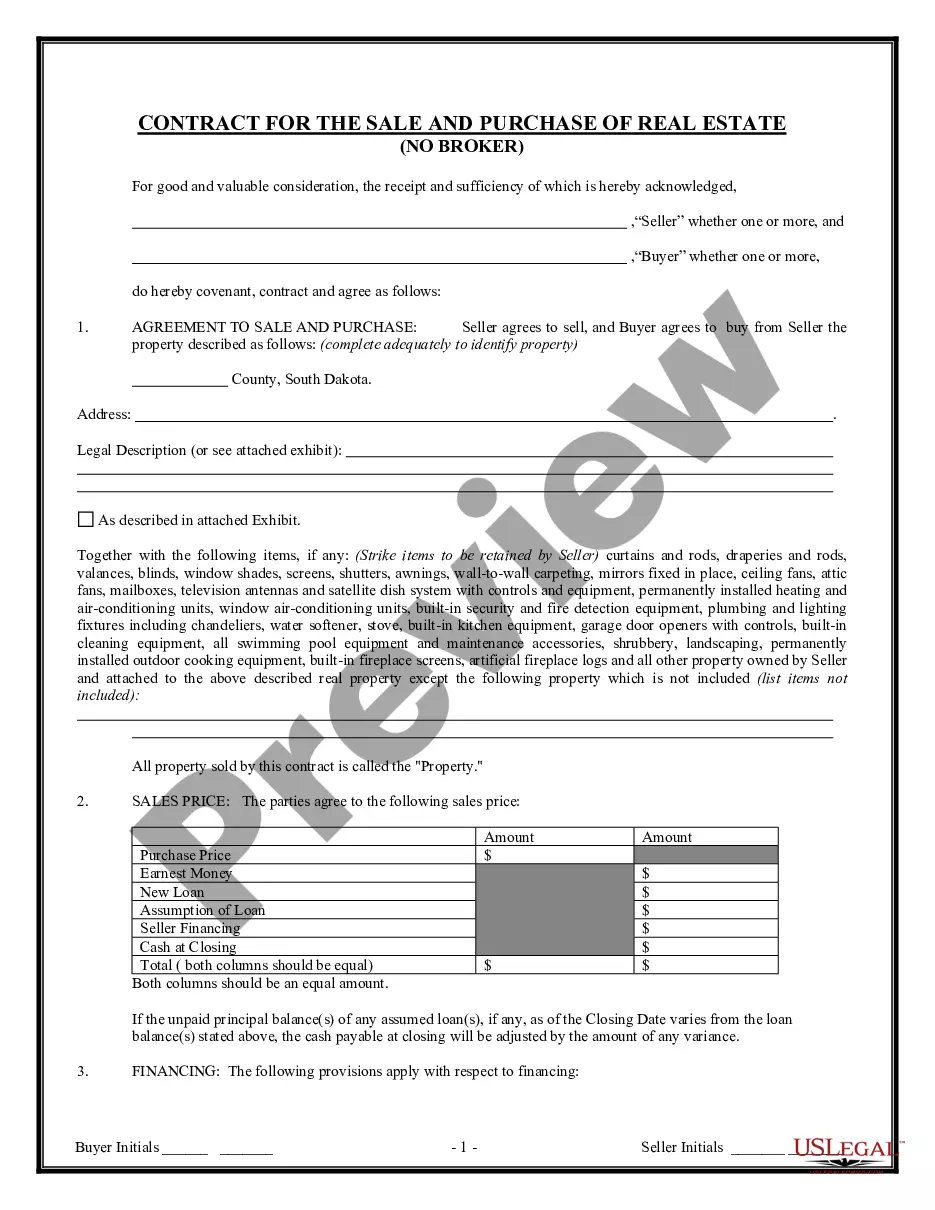

This is an official form from the Oklahoma Secretary of State, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Oklahoma statutes and law.

Oklahoma Procedures for Completing Professional Certificate of Limited Partnership

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Oklahoma Procedures For Completing Professional Certificate Of Limited Partnership?

In terms of submitting Oklahoma Procedures for Completing Professional Certificate of Limited Partnership, you almost certainly imagine a long procedure that involves choosing a perfect sample among hundreds of very similar ones after which having to pay out legal counsel to fill it out to suit your needs. Generally speaking, that’s a sluggish and expensive choice. Use US Legal Forms and pick out the state-specific document in a matter of clicks.

In case you have a subscription, just log in and click Download to find the Oklahoma Procedures for Completing Professional Certificate of Limited Partnership template.

In the event you don’t have an account yet but want one, follow the step-by-step guide below:

- Be sure the file you’re saving applies in your state (or the state it’s required in).

- Do this by reading the form’s description and by clicking on the Preview option (if offered) to find out the form’s information.

- Simply click Buy Now.

- Find the proper plan for your financial budget.

- Join an account and choose how you want to pay out: by PayPal or by card.

- Download the file in .pdf or .docx file format.

- Find the record on your device or in your My Forms folder.

Professional attorneys work on drawing up our samples so that after saving, you don't need to worry about editing and enhancing content material outside of your individual information or your business’s info. Join US Legal Forms and receive your Oklahoma Procedures for Completing Professional Certificate of Limited Partnership sample now.

Form popularity

FAQ

When you are a general partner in a limited partnership you by default are like an employee of the company, and therefore, all your income is considered earned income.Throughout the year, you may get paid by the business with guaranteed payments as a way of compensating you as the general partner.

To start an LLC in Oklahoma you will need to file the Articles of Organization with the Oklahoma Secretary of State, which costs $100. You can apply online, by mail, or in-person. The Articles of Organization is the legal document that officially creates your Oklahoma Limited Liability Company.

A limited partnership is similar to a general partnership, but offers limited liability protection to some partners. At least one partner must be a general partner with unlimited liability, and at least one partner must be a limited partner whose liability is typically limited to the amount of his or her investment.

You can obtain your Oklahoma certificate of good standing by requesting it from the Secretary of State. What is a certificate of good standing? A certificate of good standing is a state document that verifies your business was legally formed and has been properly maintained.

To form a limited partnership, you have to register in your state, pay a filing fee and create a limited partnership agreement, which defines how much ownership each limited partner has in your company, and other terms of the partnership.

Cost to Form an LP: The state of California charges a filing fee of $70 to form a limited partnership. Processing Time: The Secretary of State will generally process your LP formation in around 10 business days.

LPs are pass-through entities that offer little to no reporting requirements.Most U.S. states govern the formation of limited partnerships, requiring registration with the Secretary of State.

Oklahoma requires LLCs to file an annual certificate, which is due on the anniversary date of the LLC's incorporation. The filing fee is $25. Taxes. For complete details on state taxes for Oklahoma LLCs, visit Business Owner's Toolkit or the State of Oklahoma .

The fees to the State of Oklahoma to start an LLC are $100 plus the credit card processing fee if you don't pay by another means. There's no way to spend less than the fees charged by the Secretary of State.