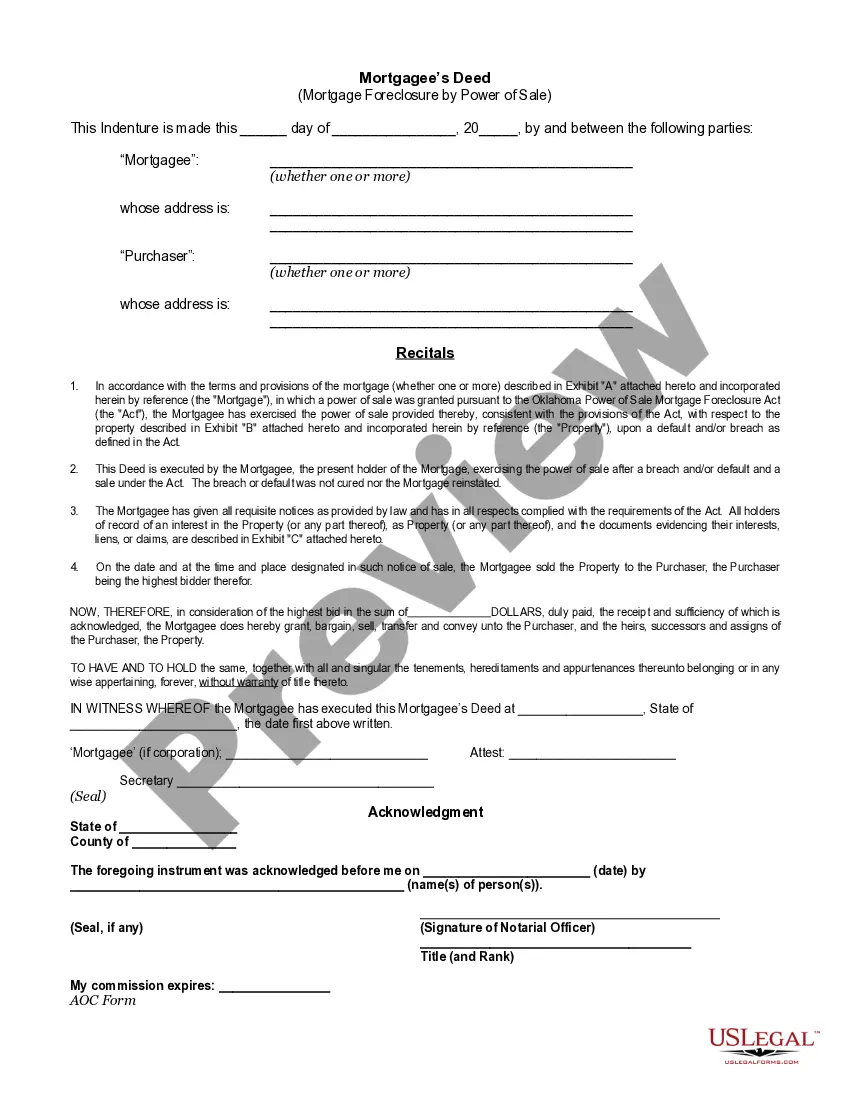

An Oklahoma Mortgagee's Deed is a legal document that is used to transfer the title of a property from a borrower to the lender in the event of a foreclosure. This document is usually executed when the borrower has failed to make payments on their mortgage and the lender has initiated foreclosure proceedings. The Oklahoma Mortgagee's Deed is a type of deed that is used in conjunction with a mortgage to secure the loan. It allows the lender to take possession of the property in the event of a foreclosure. There are two types of Oklahoma Mortgagee's Deed: the Statutory Mortgagee's Deed and the Special Mortgagee's Deed. The Statutory Mortgagee's Deed is used when the borrower has defaulted on the loan and the foreclosure process has been completed. The Special Mortgagee's Deed is used when the borrower has made payments on the loan but has taken action that has caused the lender to foreclose on the property.

Oklahoma Mortgagee's Deed

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Oklahoma Mortgagee's Deed?

Coping with official paperwork requires attention, accuracy, and using well-drafted templates. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your Oklahoma Mortgagee's Deed template from our service, you can be certain it meets federal and state regulations.

Dealing with our service is straightforward and quick. To get the required document, all you’ll need is an account with a valid subscription. Here’s a quick guideline for you to obtain your Oklahoma Mortgagee's Deed within minutes:

- Make sure to carefully check the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Search for another official blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Oklahoma Mortgagee's Deed in the format you prefer. If it’s your first experience with our service, click Buy now to proceed.

- Register for an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or add it to a professional PDF editor to prepare it paper-free.

All documents are drafted for multi-usage, like the Oklahoma Mortgagee's Deed you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

The Mortgage Deed will be sent to your address from the mortgage lender.

If your name is on the mortgage, but not the deed, this means that you are not an owner of the home. Rather, you are simply a co-signer on the mortgage. Because your name is on the mortgage, you are obligated to pay the payments on the loan just as the individual who owns the home.

Not all states recognize a Trust Deed. Use a Mortgage Deed if you live in: Connecticut, Delaware, Florida, Indiana, Iowa, Kansas, Louisiana, New Jersey, New York, North Dakota, Ohio, Oklahoma, Pennsylvania, South Carolina, Vermont, or Wisconsin.

Step 1 ? Go to the Registrar of Deeds site. Step 2 ? Read the disclosure and then click on ?OKCC. ONLINE.? Step 3 ? Select the ?ROD? button to proceed with the search.

A Mortgage Deed is a legal contract that specifies certain property as collateral in exchange for a loan. With a Mortgage Deed, you can outline the terms and conditions of the loan, and come up with a termination plan.

From a lender's perspective, a deed of trust is usually better because it can foreclose more quickly using a nonjudicial process if the borrower stops making payments.

Oklahoma law recognizes three general forms of deeds?warranty deeds, special warranty deeds, and quitclaim deeds?that a property owner can use to transfer real estate. The three deed forms differ in the warranty of title provided by the current owner (the grantor) to the new owner (the grantee).

To put simply, the deed is the legal document that proves who holds title to a property, while a mortgage is an agreement between a financial lender and borrower to repay the amount borrowed to purchase a home.