This Policy Statement implements procedures to deter the misuse of material, nonpublic information in securities transactions. The Policy Statement applies to securities trading and information handling by directors, officers and employees of the company (including spouses, minor children and adult members of their households).

Ohio Policies and Procedures Designed to Detect and Prevent Insider Trading

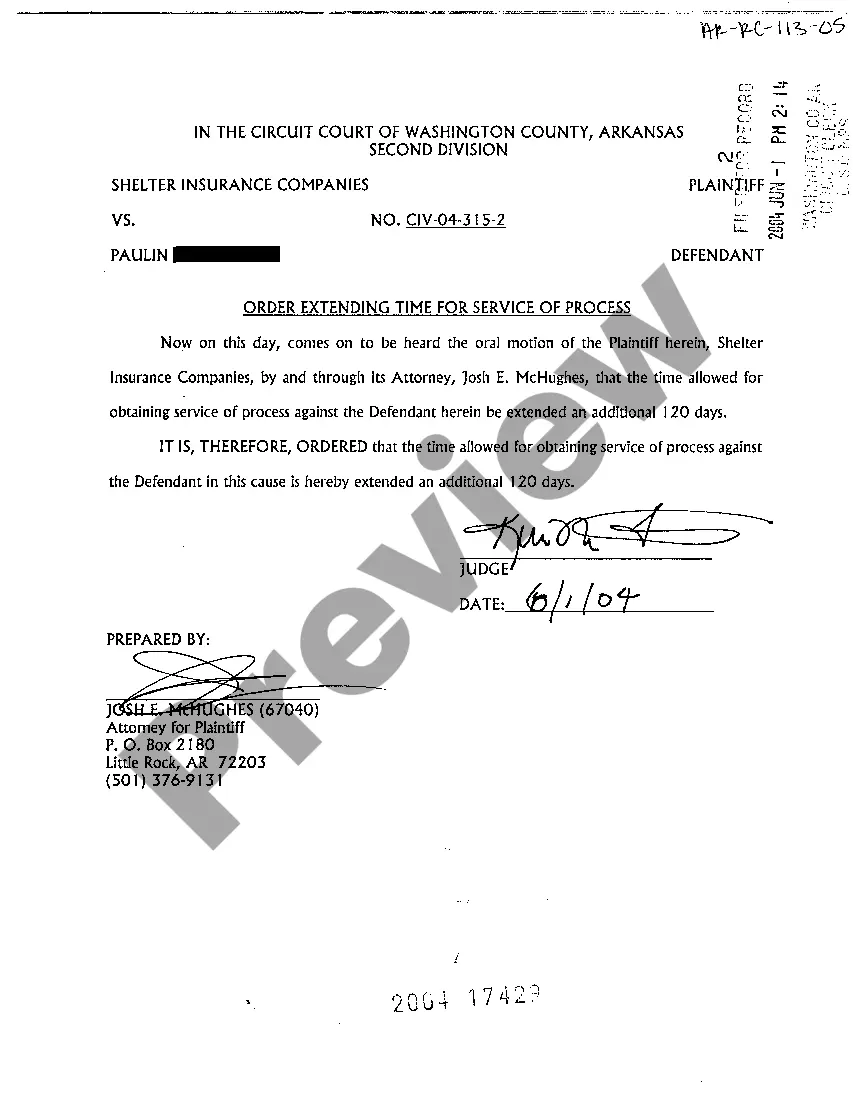

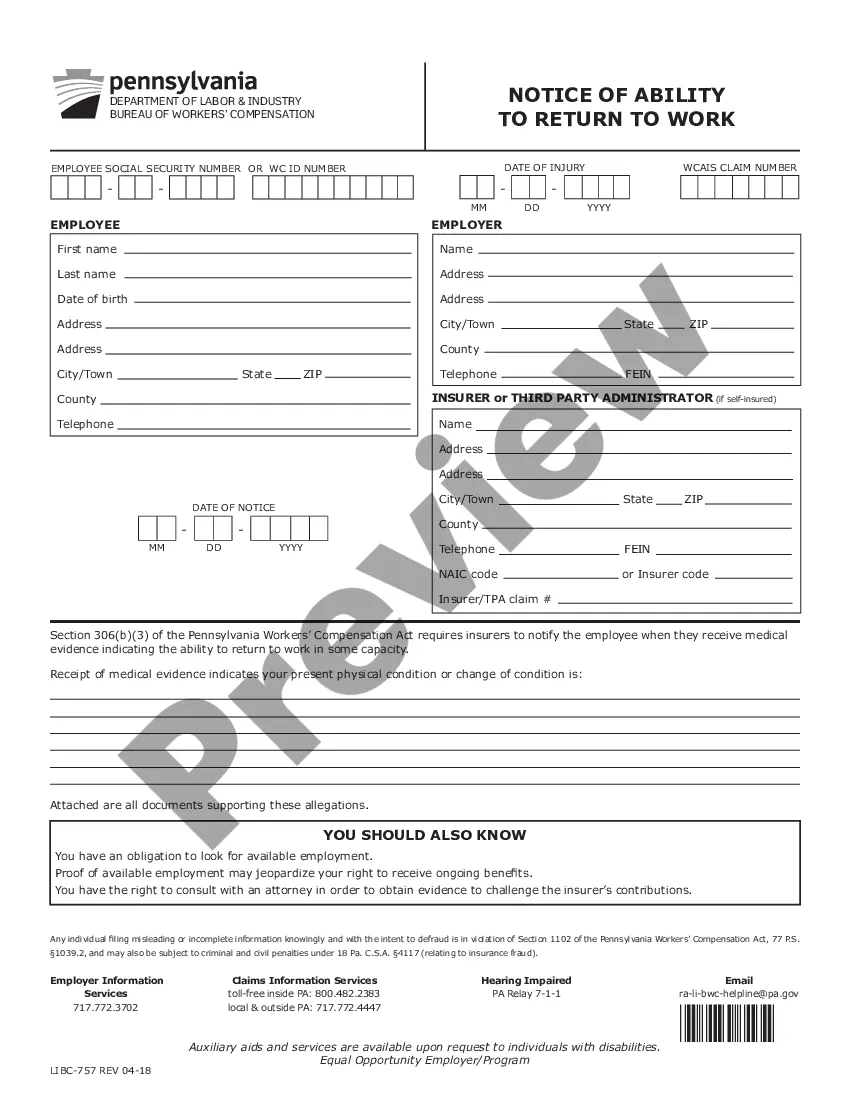

Description

How to fill out Policies And Procedures Designed To Detect And Prevent Insider Trading?

Are you inside a place that you need to have files for either business or specific reasons nearly every time? There are a lot of lawful record themes available on the net, but getting kinds you can trust isn`t effortless. US Legal Forms delivers a large number of type themes, such as the Ohio Policies and Procedures Designed to Detect and Prevent Insider Trading, which can be published in order to meet state and federal specifications.

In case you are already familiar with US Legal Forms web site and possess your account, merely log in. After that, you are able to download the Ohio Policies and Procedures Designed to Detect and Prevent Insider Trading web template.

If you do not come with an profile and need to begin using US Legal Forms, follow these steps:

- Get the type you need and make sure it is for the correct metropolis/county.

- Make use of the Review option to examine the form.

- See the outline to ensure that you have chosen the right type.

- In the event the type isn`t what you`re searching for, use the Lookup discipline to find the type that fits your needs and specifications.

- Once you obtain the correct type, click on Buy now.

- Choose the rates program you want, fill in the desired details to create your money, and pay money for the transaction utilizing your PayPal or charge card.

- Choose a hassle-free file formatting and download your copy.

Get all the record themes you might have bought in the My Forms food selection. You may get a further copy of Ohio Policies and Procedures Designed to Detect and Prevent Insider Trading whenever, if required. Just click the essential type to download or print out the record web template.

Use US Legal Forms, one of the most comprehensive assortment of lawful varieties, to save lots of some time and prevent mistakes. The services delivers appropriately manufactured lawful record themes that you can use for a variety of reasons. Generate your account on US Legal Forms and begin producing your lifestyle a little easier.

Form popularity

FAQ

Burden of Proof in Insider Trading Cases Prosecutors must prove that the defendant actually received information, that the information was both ?material? and ?nonpublic,? and that the information directly influenced the defendant's trade.

SEC Tracking Market surveillance activities: This is one of the most important ways of identifying insider trading. The SEC uses sophisticated tools to detect illegal insider trading, especially around the time of important events such as earnings reports and key corporate developments. 5.

Insider trading is when non-published information from a company is used to make a trading decision by someone with an invested interest in that company. It is illegal to engage in insider trading, but it is legal to trade your company shares as long as you follow the guidelines set by the SEC.

Insider trading is an extraordinarily difficult crime to prove. The underlying act of buying or selling securities is, of course, perfectly legal activity. It is only what is in the mind of the trader that can make this legal activity a prohibited act of insider trading. Direct evidence of insider trading is rare.

The government tries to prevent and detect insider trading by monitoring the trading activity in the market. The SEC monitors trading activity, especially around important events such as earnings announcements, acquisitions, and other events material to a company's value that may move their stock prices significantly.

Courts impose liability for insider trading with Rule 10b-5 under the classical theory of insider trading and, since U.S. v. O'Hagan, 521 U.S. 642 (1997), under the misappropriation theory of insider trading.

Federal and state securities laws prohibit the purchase or sale of a company's securities by anyone who is aware of material information about that company that is not generally known or available to the public.

The government tries to prevent and detect insider trading by monitoring the trading activity in the market. The SEC monitors trading activity, especially around important events such as earnings announcements, acquisitions, and other events material to a company's value that may move their stock prices significantly.