Ohio Assignment of Overriding Royalty Interest with Multiple Leases that are Non Producing with Reservation of the Right to Pool

Description

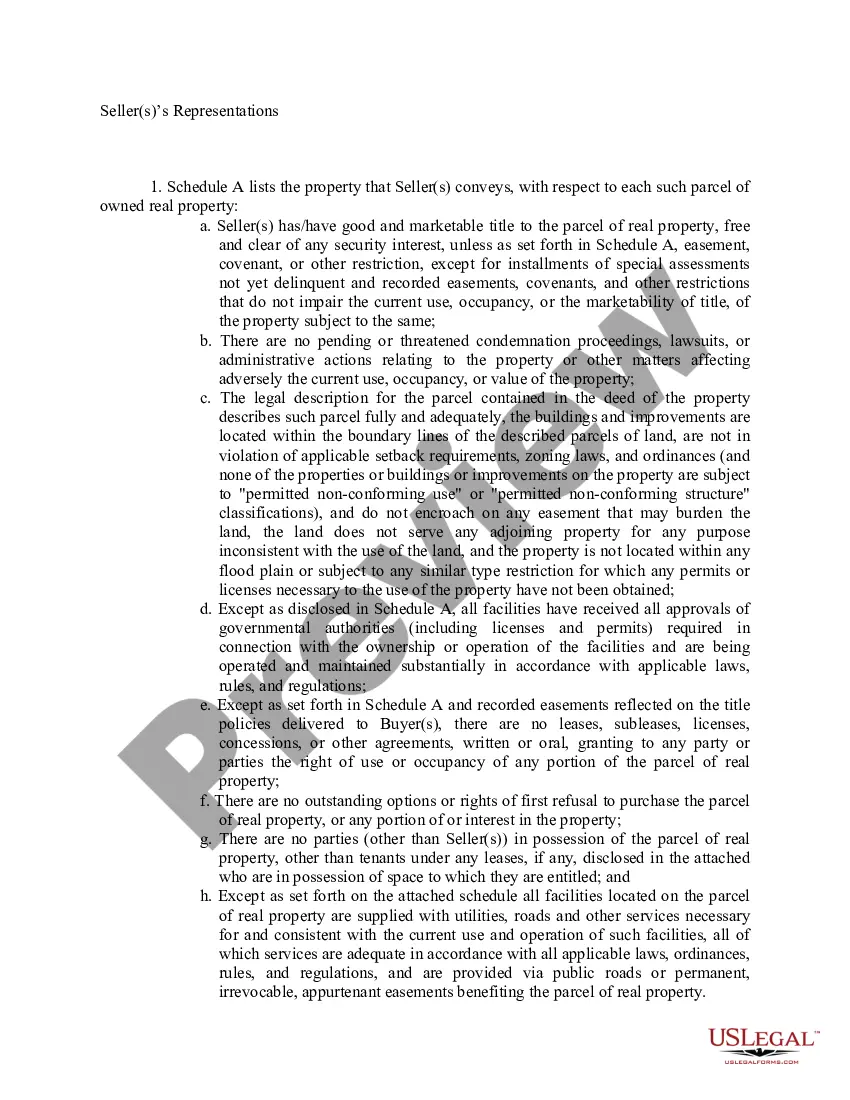

How to fill out Assignment Of Overriding Royalty Interest With Multiple Leases That Are Non Producing With Reservation Of The Right To Pool?

Choosing the best legitimate file design can be quite a have difficulties. Of course, there are plenty of themes available on the Internet, but how do you find the legitimate form you require? Take advantage of the US Legal Forms website. The services delivers thousands of themes, for example the Ohio Assignment of Overriding Royalty Interest with Multiple Leases that are Non Producing with Reservation of the Right to Pool, that can be used for enterprise and personal needs. Each of the varieties are checked out by experts and meet up with state and federal needs.

In case you are already signed up, log in in your account and click the Down load key to have the Ohio Assignment of Overriding Royalty Interest with Multiple Leases that are Non Producing with Reservation of the Right to Pool. Make use of account to appear with the legitimate varieties you have bought formerly. Check out the My Forms tab of your account and have another backup of the file you require.

In case you are a new end user of US Legal Forms, listed here are simple instructions that you should follow:

- Initial, make certain you have chosen the right form for your town/region. It is possible to check out the shape making use of the Preview key and browse the shape outline to ensure this is basically the right one for you.

- When the form will not meet up with your requirements, take advantage of the Seach field to find the right form.

- When you are positive that the shape is suitable, go through the Get now key to have the form.

- Opt for the prices prepare you desire and enter in the essential details. Build your account and pay money for an order using your PayPal account or bank card.

- Pick the submit structure and obtain the legitimate file design in your device.

- Total, modify and print and indication the obtained Ohio Assignment of Overriding Royalty Interest with Multiple Leases that are Non Producing with Reservation of the Right to Pool.

US Legal Forms may be the largest collection of legitimate varieties in which you can find numerous file themes. Take advantage of the service to obtain appropriately-manufactured papers that follow express needs.

Form popularity

FAQ

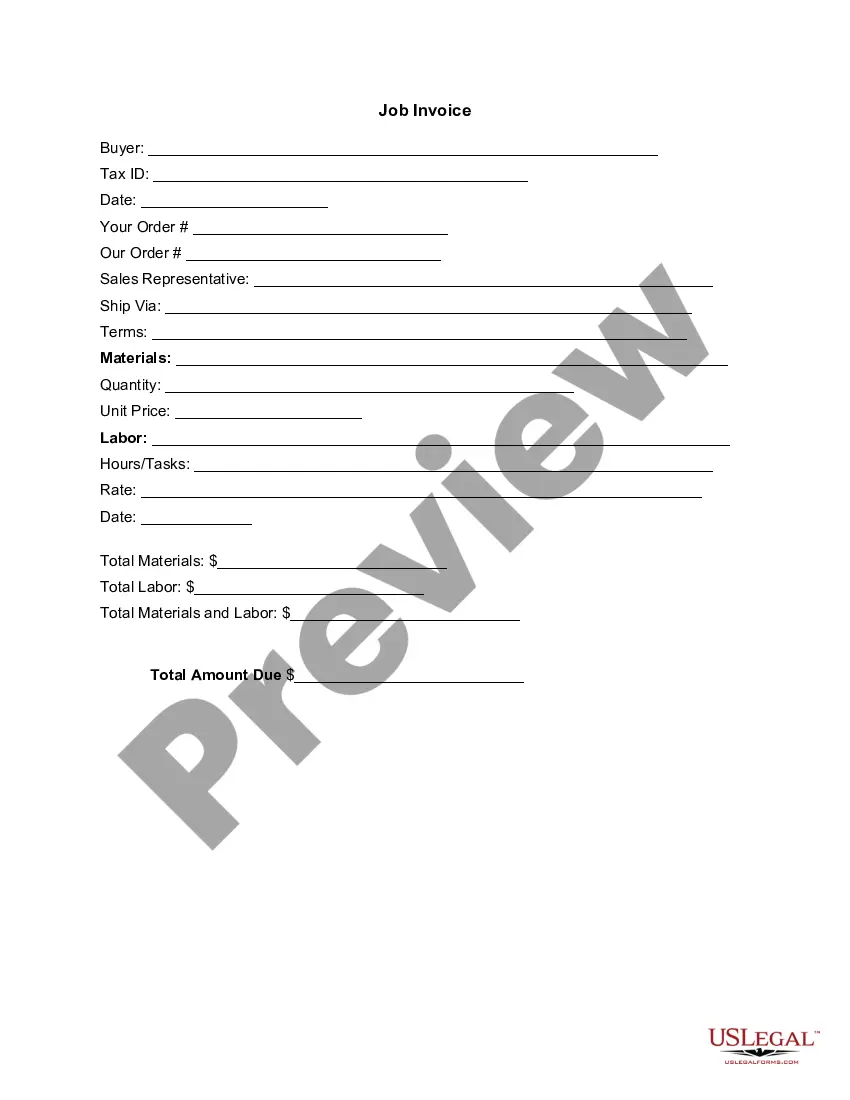

A gross overriding royalty entitles the owner to a share of the market price of the mined product as at the time they are available to be taken less any costs incurred by the operator to bring the product to the point of sale.

Once the lease ends, the lessee can obtain a new lease from the mineral owner without any overriding royalty obligation. To prevent this scenario, the ?anti-washout provision? was created. This provision is designed to ensure that the overriding royalty interest remains intact if the lease is extended.

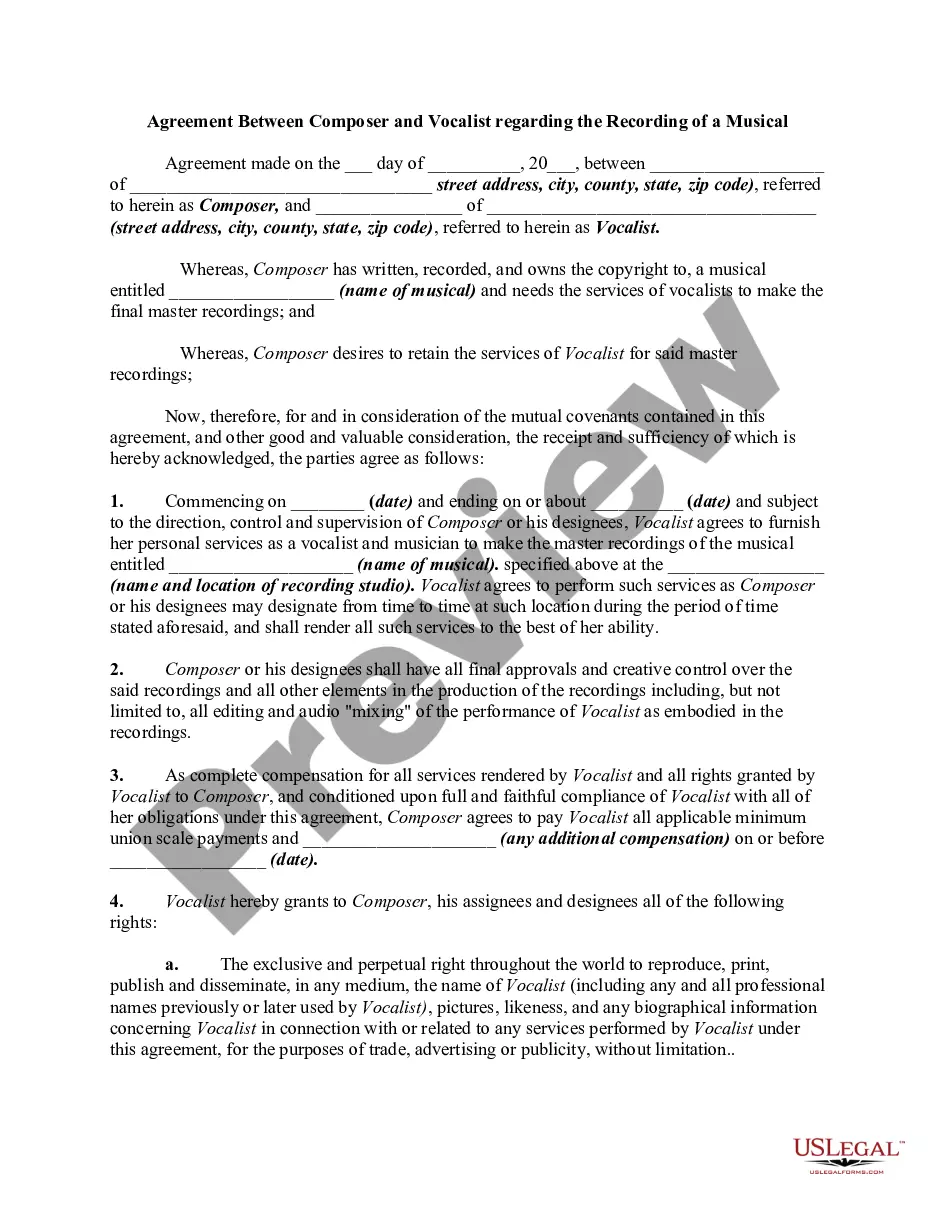

An overriding royalty agreement is a contract that gives an entity the right to receive revenue from certain productions or sales. The specific type of occurence that royalties are required to be paid on is included in the overriding royalty agreement.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain ?royalty interest? it is expensefree, bearing no operational costs of production.

The owner of a royalty interest receives a portion of the income generated from oil and gas production. Unlike an ORRI, a royalty-interest owner does not have the right to execute leases or collect bonus payments. The RI owner does not bear any operating costs or expenses related to the well.

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.