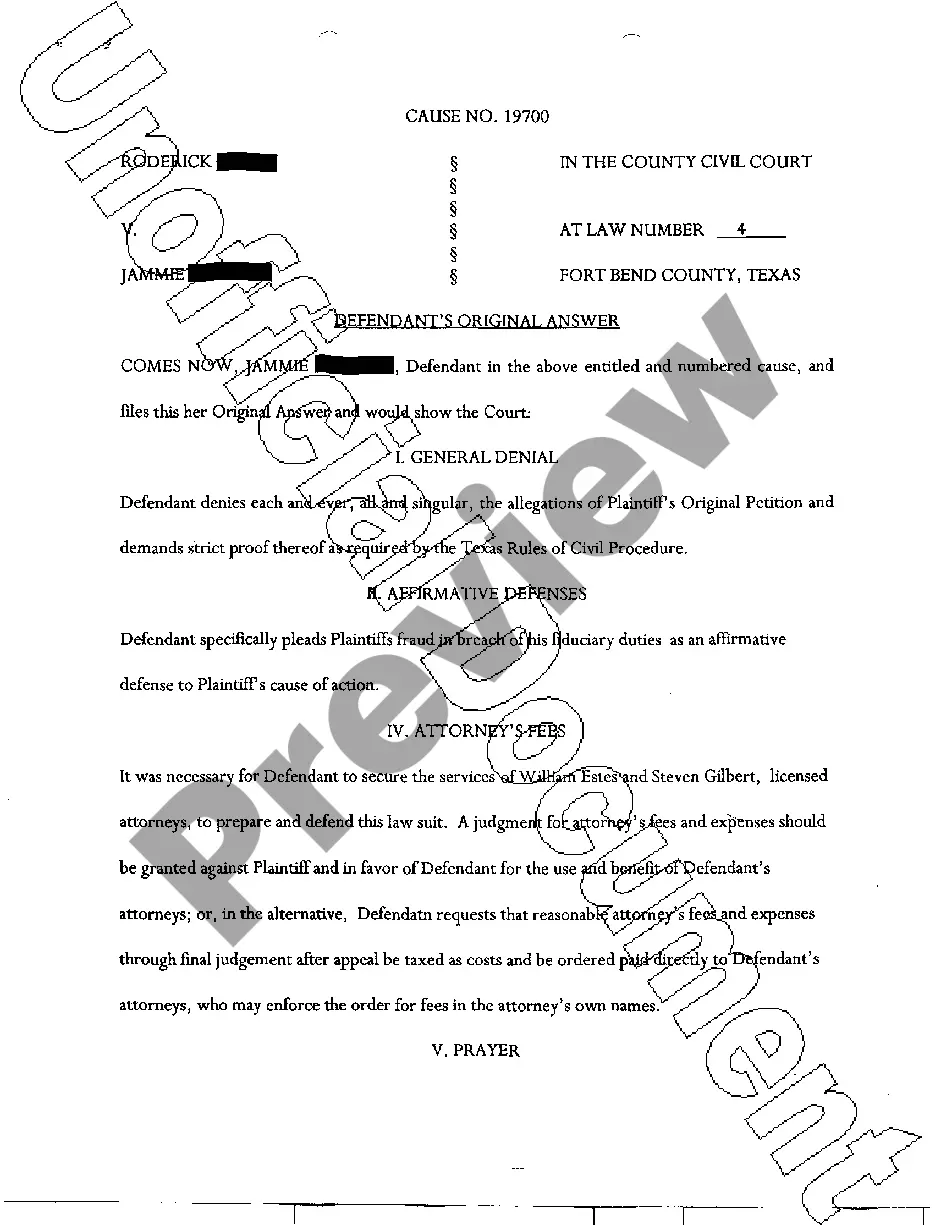

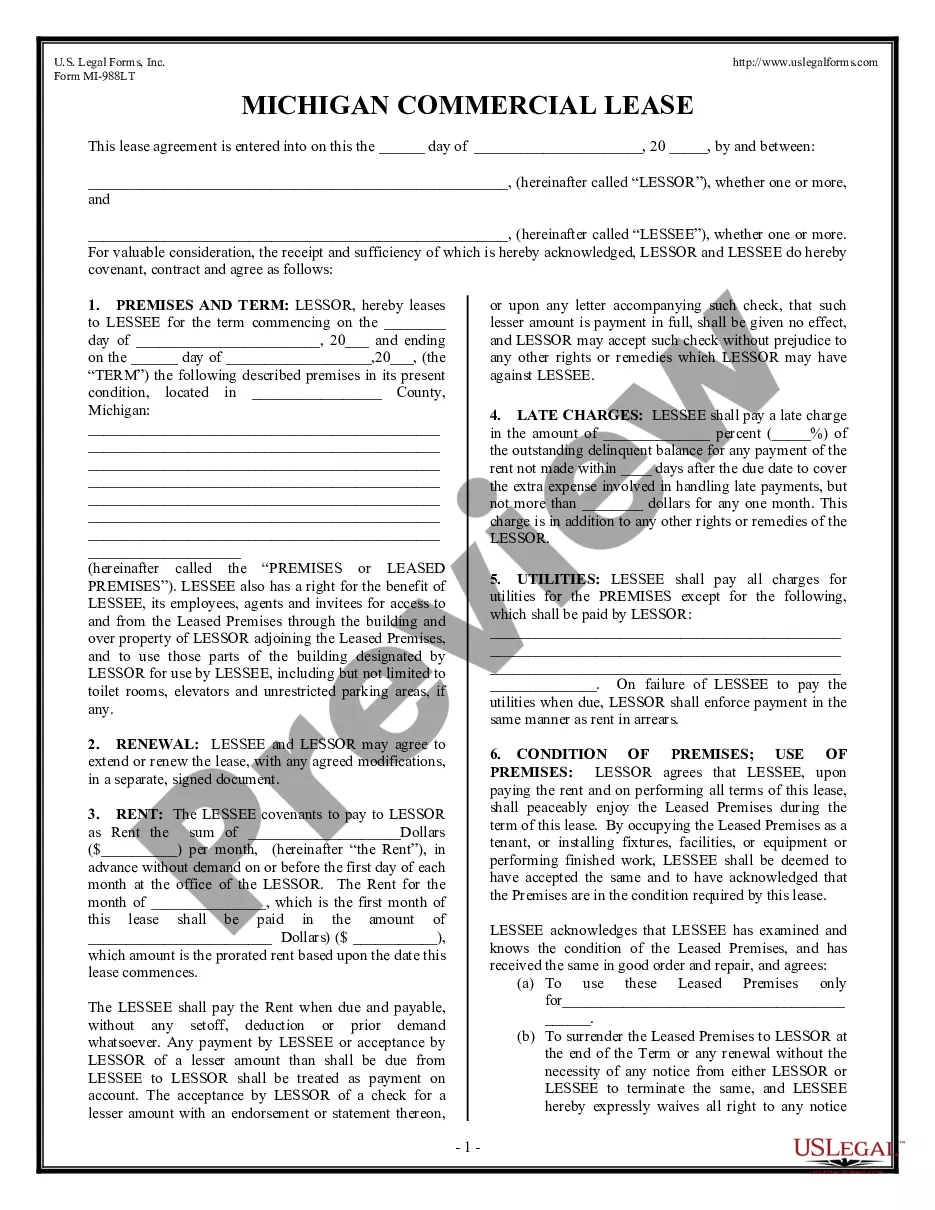

This form provides boilerplate contract clauses that merge prior and contemporary negotiations and agreements into the current contract agreement. Several different language options are included to suit individual needs and circumstances.

Ohio Negotiating and Drafting the Merger Provision

Description

How to fill out Negotiating And Drafting The Merger Provision?

Are you in a situation the place you require documents for both enterprise or specific reasons almost every day? There are tons of legitimate record themes available online, but discovering kinds you can rely is not easy. US Legal Forms gives 1000s of kind themes, much like the Ohio Negotiating and Drafting the Merger Provision, that are written to fulfill federal and state requirements.

Should you be already knowledgeable about US Legal Forms internet site and also have your account, simply log in. Following that, you may download the Ohio Negotiating and Drafting the Merger Provision design.

Should you not provide an bank account and want to start using US Legal Forms, abide by these steps:

- Obtain the kind you want and make sure it is to the right town/state.

- Make use of the Review key to review the shape.

- Read the information to actually have chosen the correct kind.

- In the event the kind is not what you`re looking for, use the Search area to obtain the kind that suits you and requirements.

- Once you get the right kind, simply click Purchase now.

- Select the rates program you need, fill in the specified information to create your bank account, and pay money for an order with your PayPal or bank card.

- Pick a hassle-free paper format and download your duplicate.

Get each of the record themes you possess purchased in the My Forms menus. You may get a more duplicate of Ohio Negotiating and Drafting the Merger Provision any time, if possible. Just click on the necessary kind to download or printing the record design.

Use US Legal Forms, probably the most comprehensive selection of legitimate forms, to save lots of time and avoid errors. The services gives professionally produced legitimate record themes that can be used for a variety of reasons. Generate your account on US Legal Forms and initiate producing your daily life easier.

Form popularity

FAQ

Your proposal must also include the financial background of both companies and a description of how the acquisition will be paid for. For example, if you plan on purchasing a target company, you might describe their assets, liabilities, and their net equity. You will then identify the proposed purchase price.

Having said all that, here's a typical outline of how a business plan for an acquisition should look: Executive Summary. ... Target Description. ... Market Overview. ... Sales and Marketing. ... Financial History and Projections. ... Transition Plan. ... Deal Structure. ... Appendices/Supporting Documents.

How to Write a Perfect Acquisition Proposal Develop a Convincing Narrative. ... Avoid Legalize and Waffle. ... Be Humble. ... Write in Broad and Complimentary Terms. ... Let Them Know Why a Deal Will Work. ... Suggest a Face-to-face Meeting.

How to Position Your Company for an Acquisition Conduct an internal audit. Ensure that your company is systemized. Clean up your balance sheet. Renew your most valuable contracts. Develop a 5-year strategic plan. Resolve outstanding legal and tax issues. Streamline your business. Ensure an outstanding team is in place.

The most common and famous example of merger & acquisition is Google and Android. Google is the master company in the IT industry and search engine, whereas Android was a start-up company struggling to exist in the mobile phone market.

Table of Contents Conduct Pre-Sale Due Diligence to Maintain Negotiating Posture. The Importance of Negotiating Position. Maintain Emotional Objectivity. Focus on Running Your Business. Keep Your Business on the Market. Avoid Deal Fatigue. The Importance of Honesty & Humility. The Importance of Communication Skills.

Parts of merger and acquisition contracts ?Parties and recitals. ?Price, currencies, and structure. ?Representations and warranties. ?Covenants. ?Conditions. ?Termination provisions. ?Indemnification. ?Tax.

12.2 Merger Clause. This Agreement and the other agreements, documents or instruments contemplated hereby shall constitute the entire agreement between the Parties, and shall supersede all prior agreements, understandings and negotiations between the Parties with respect to the subject matter hereof.