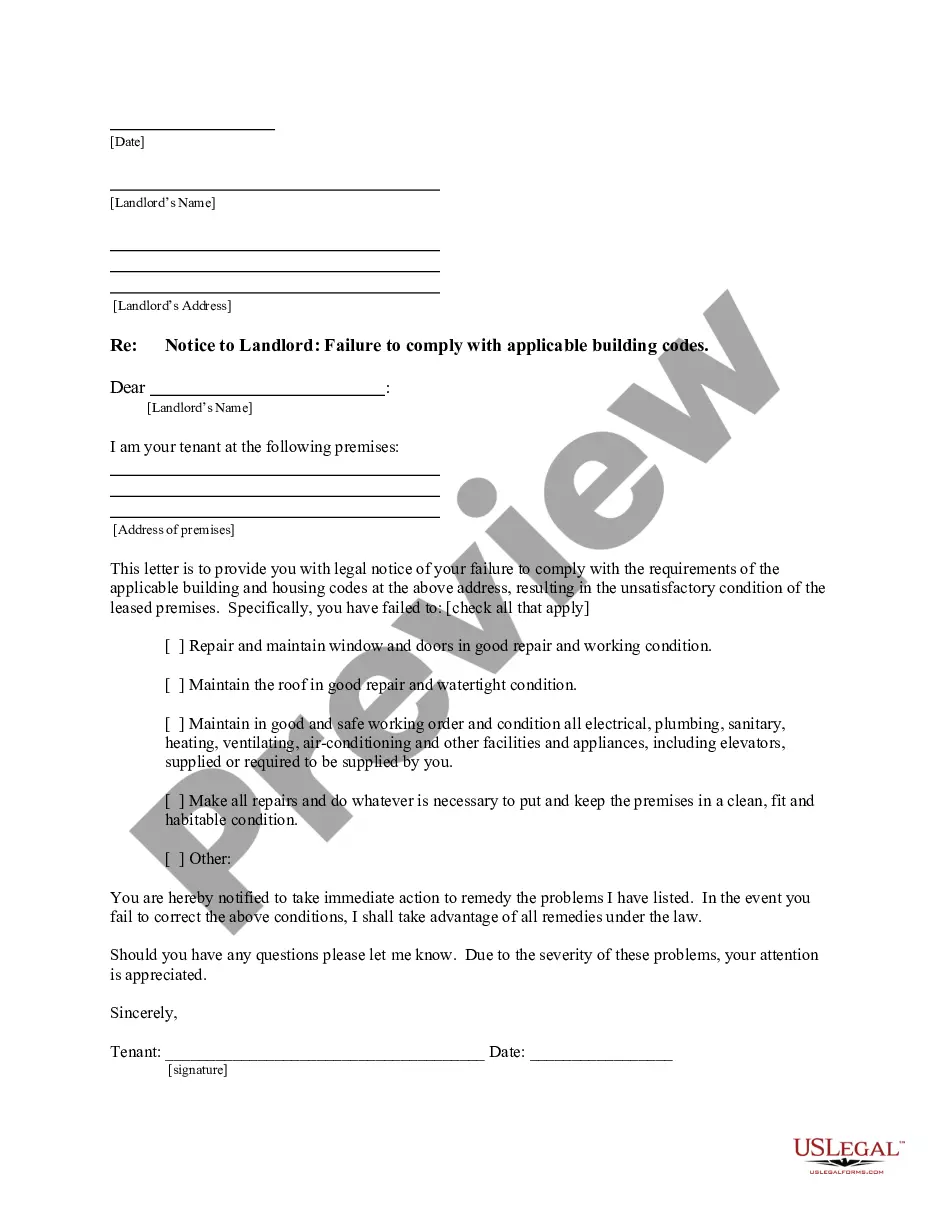

This is a letter from a withdrawing partner to the clients he has represented at his former firm. The letter is also mailed with an enclosure that gives the clients the options of transferring their files with the withdrawing attorney, remaining with the same firm, or choosing another firm to represent them. This letter includes an example of the enclosure with the file transfer options.

Ohio Letter from Individual Partner to Clients

Description

How to fill out Letter From Individual Partner To Clients?

Finding the right legitimate file format can be a struggle. Obviously, there are tons of templates accessible on the Internet, but how can you find the legitimate type you require? Utilize the US Legal Forms site. The services delivers a huge number of templates, for example the Ohio Letter from Individual Partner to Clients, which you can use for company and personal requires. All the forms are inspected by specialists and meet up with state and federal needs.

When you are already registered, log in to the profile and click on the Obtain button to get the Ohio Letter from Individual Partner to Clients. Use your profile to look with the legitimate forms you have purchased previously. Visit the My Forms tab of your profile and obtain yet another version from the file you require.

When you are a brand new end user of US Legal Forms, here are simple instructions that you should stick to:

- Initially, make certain you have chosen the proper type to your area/county. You can look through the shape utilizing the Preview button and read the shape description to guarantee this is basically the right one for you.

- In case the type will not meet up with your expectations, take advantage of the Seach industry to obtain the appropriate type.

- When you are sure that the shape would work, select the Buy now button to get the type.

- Choose the rates plan you would like and enter in the essential info. Make your profile and buy an order making use of your PayPal profile or charge card.

- Choose the data file structure and obtain the legitimate file format to the product.

- Total, modify and produce and indication the attained Ohio Letter from Individual Partner to Clients.

US Legal Forms is definitely the biggest library of legitimate forms that you will find a variety of file templates. Utilize the service to obtain professionally-manufactured papers that stick to express needs.

Form popularity

FAQ

To make amendments to your limited liability company in Ohio, you must provide the completed Domestic Limited Liability Company Certificate of Amendment or Restatement form (543a) to the Secretary of State by mail or in person.

How to Add a Member to Your Ohio LLC Make sure you comply with Ohio's Revised LLC Act. ing to Ohio Rev Code § 1706.27, an Ohio LLC may add a new member in any of the following ways: ... Update your Ohio LLC Operating Agreement. ... Check your Ohio LLC Articles of Organization. ... Contact the IRS.

Follow these steps for a smooth process when you add an owner to an LLC. Understand the consequences. ... Review your operating agreement. ... Decide on the specifics. ... Prepare and vote on an amendment to add an owner to LLC. ... Amend the articles of organization (if necessary) ... File any required tax forms.

Adding Members to My LLC: Step by Step Review Your Operating Agreement. Determine Terms and Profit Shares. Take It to a Vote. Amend Your Articles of Organization. Update and File Tax Forms.

5 Steps to Setting Up a DBA for Your LLC Decide on a Business Name for Your DBA. ... Register the DBA Name You Want to Use. ... Secure Any Business Licenses or Registration Needed. ... Publish Notice of Your New DBA. ... Consider Trademarking Your DBA Name.

Hear this out loud Pause(1) "Trade name" means a name used in business or trade to designate the business of the user and to which the user asserts a right to exclusive use. (2) "Fictitious name" means a name used in business or trade that is fictitious and that the user has not registered or is not entitled to register as a trade name.