Ohio Subscription Agreement

Description

How to fill out Subscription Agreement?

Choosing the right legal papers format could be a have a problem. Of course, there are a lot of templates available online, but how will you discover the legal kind you need? Make use of the US Legal Forms site. The services provides thousands of templates, including the Ohio Subscription Agreement, that can be used for organization and personal demands. All the types are inspected by specialists and meet up with federal and state requirements.

In case you are previously signed up, log in for your accounts and then click the Obtain key to find the Ohio Subscription Agreement. Use your accounts to look with the legal types you have acquired previously. Visit the My Forms tab of your respective accounts and get another copy from the papers you need.

In case you are a fresh end user of US Legal Forms, allow me to share basic recommendations that you should follow:

- First, make certain you have selected the proper kind to your city/area. You may check out the form making use of the Review key and read the form information to guarantee it will be the right one for you.

- In the event the kind fails to meet up with your needs, make use of the Seach field to obtain the proper kind.

- Once you are sure that the form is acceptable, go through the Purchase now key to find the kind.

- Select the rates prepare you need and enter the needed information and facts. Make your accounts and pay money for an order using your PayPal accounts or Visa or Mastercard.

- Choose the document structure and down load the legal papers format for your gadget.

- Comprehensive, edit and printing and indication the received Ohio Subscription Agreement.

US Legal Forms will be the most significant library of legal types for which you can discover different papers templates. Make use of the company to down load professionally-produced papers that follow status requirements.

Form popularity

FAQ

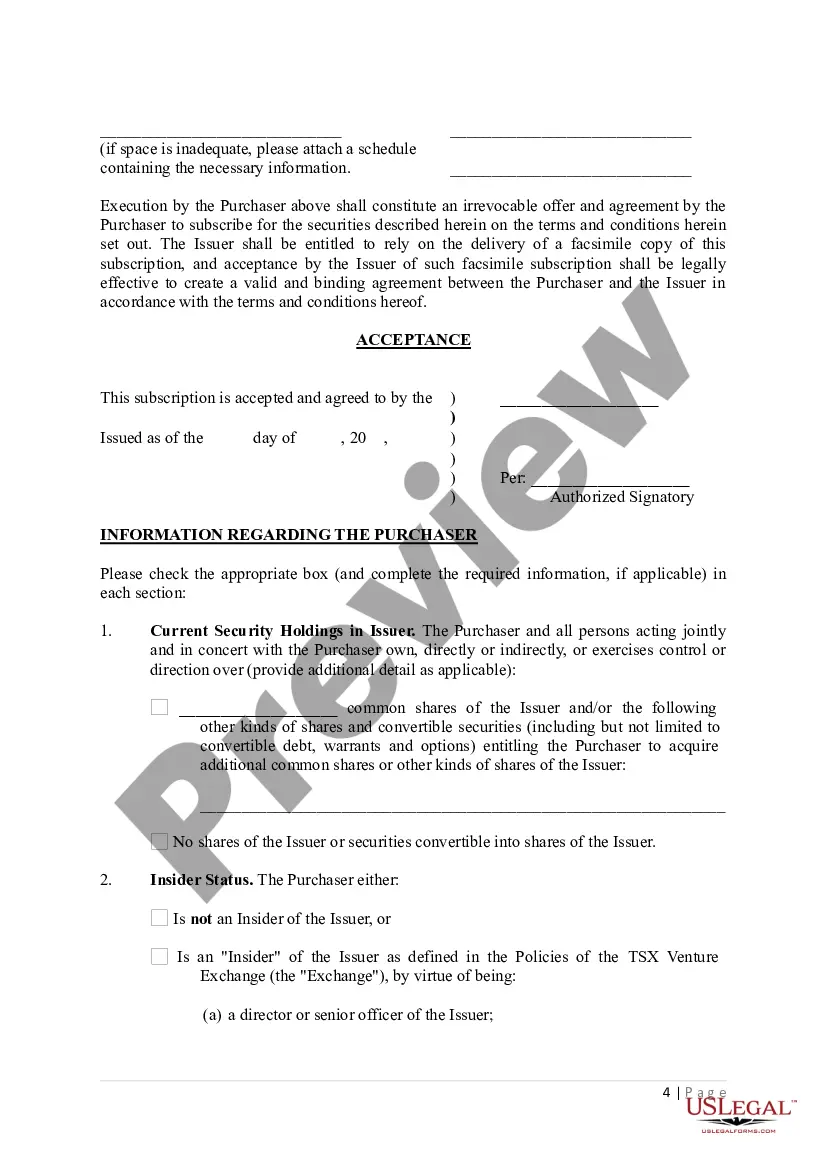

There are two key documents that set out the terms and the structure of an LLC, the Operating Agreement and the Subscription Agreement. Note that investors do not buy shares in an LLC ? they buy an interest, which determines their percentage ownership and is documented in the Subscription Agreement.

A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

There are two key documents that set out the terms and the structure of an LLC, the Operating Agreement and the Subscription Agreement. Note that investors do not buy shares in an LLC ? they buy an interest, which determines their percentage ownership and is documented in the Subscription Agreement.

Subscription agreements are legal contracts that allow an investor to buy shares, bonds, or units of a company as a subscriber and shareholder with limited partnerships (LP) or private placement rights. Share subscription agreements are a type of subscription agreement that involves purchasing shares specifically.

The Operating Agreement outlines how the governing body will operate. The Subscription Agreement is the legally binding agreement between the investor and the Issuer.

Summary. A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

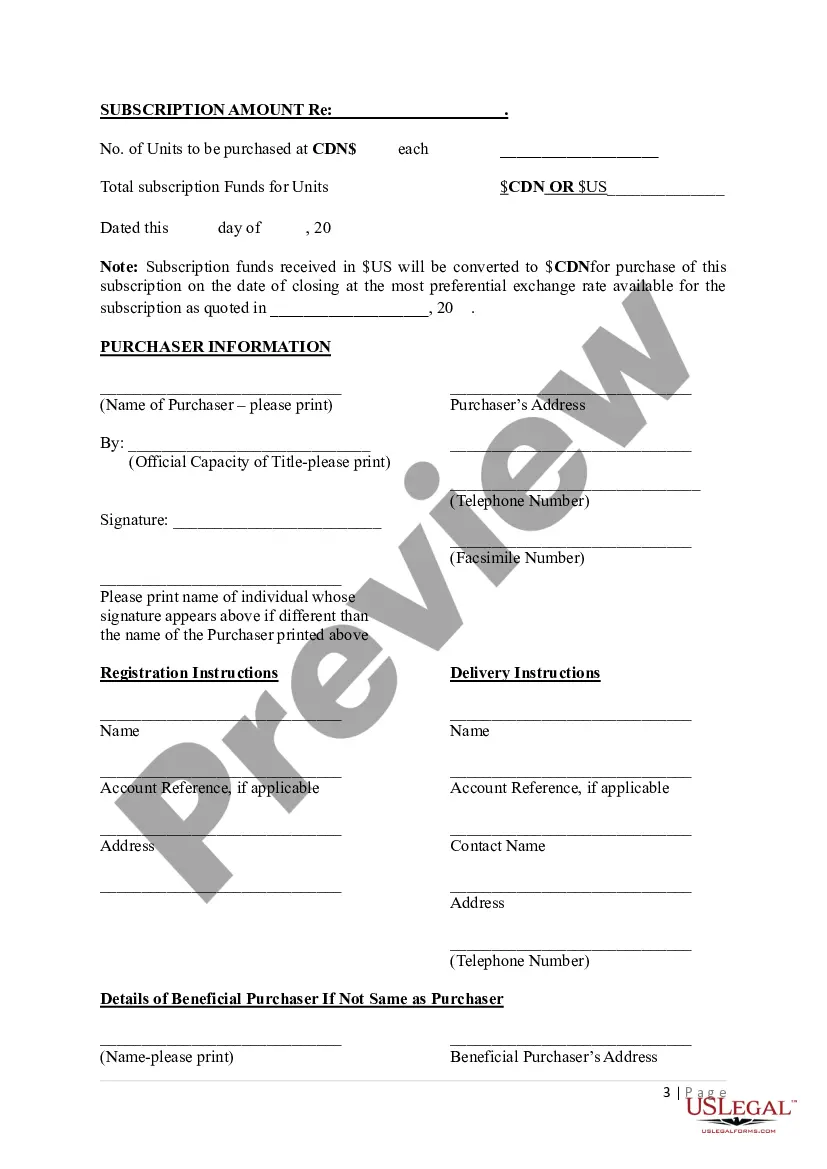

1.1 The Agreement provides for the sale of ________ [insert number and type of shares] to the Buyer by the Seller at a price of ______ [insert price per share], par value per share (the ?Shares?). 1.2 Purchase and Sale. The Seller agrees to sell and the Buyer agrees to buy the Shares. 1.3 Delivery of Shares.