Ohio Quickstart Loan and Security Agreement between Silicon Valley Bank and iPrint, Inc.

Description

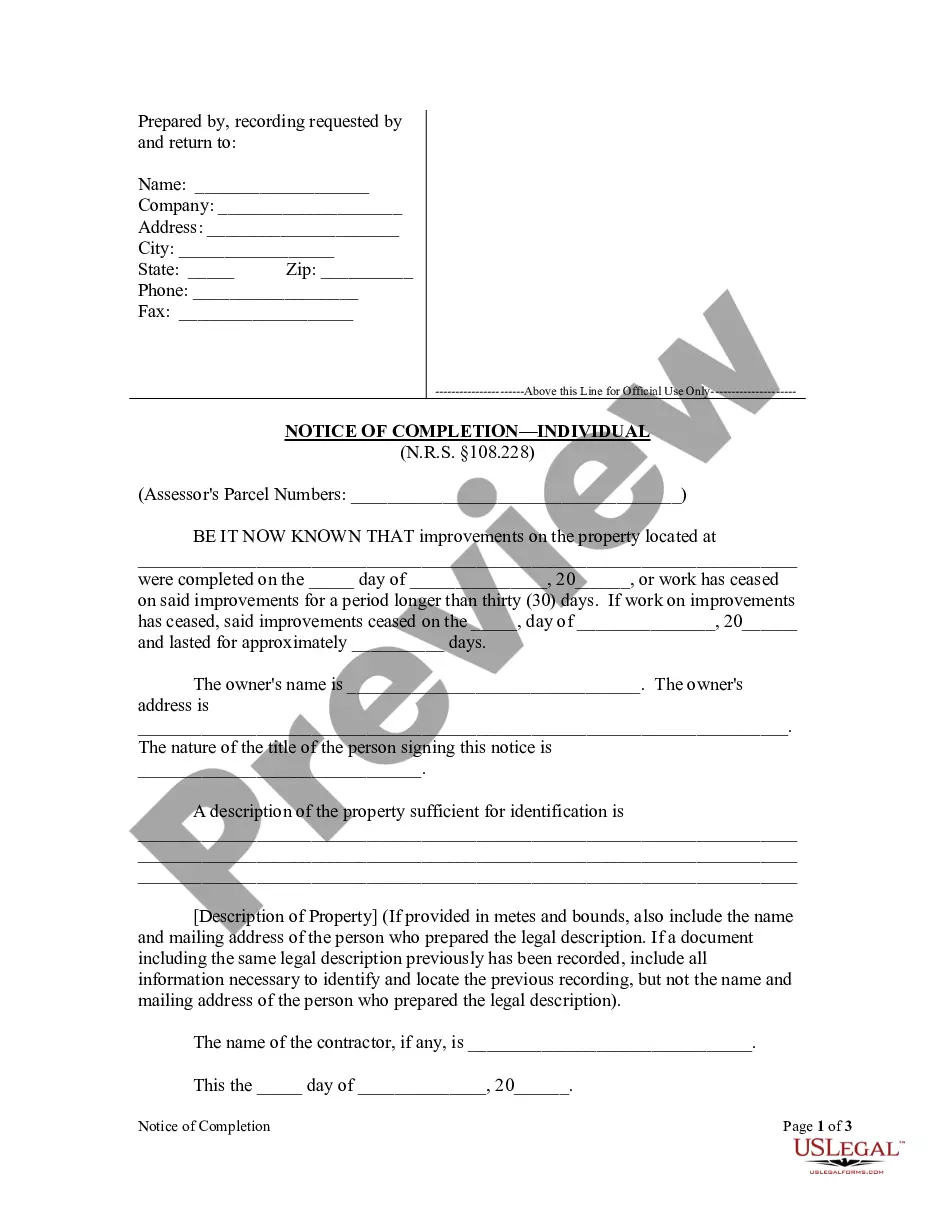

How to fill out Quickstart Loan And Security Agreement Between Silicon Valley Bank And IPrint, Inc.?

Choosing the right authorized document template can be a battle. Naturally, there are a variety of web templates available online, but how do you get the authorized form you want? Take advantage of the US Legal Forms web site. The support delivers thousands of web templates, such as the Ohio Quickstart Loan and Security Agreement between Silicon Valley Bank and iPrint, Inc., that you can use for enterprise and private requirements. All the kinds are checked by professionals and meet up with state and federal requirements.

Should you be previously signed up, log in for your profile and click the Obtain switch to obtain the Ohio Quickstart Loan and Security Agreement between Silicon Valley Bank and iPrint, Inc.. Make use of profile to look from the authorized kinds you may have purchased previously. Visit the My Forms tab of the profile and acquire another duplicate in the document you want.

Should you be a fresh end user of US Legal Forms, allow me to share easy instructions for you to follow:

- First, make certain you have selected the proper form for the city/state. You can check out the shape making use of the Preview switch and read the shape description to ensure it is the right one for you.

- In case the form does not meet up with your requirements, take advantage of the Seach industry to discover the right form.

- When you are positive that the shape would work, click on the Purchase now switch to obtain the form.

- Select the prices prepare you want and enter the needed info. Make your profile and buy an order making use of your PayPal profile or charge card.

- Select the document formatting and obtain the authorized document template for your device.

- Full, revise and print and indication the obtained Ohio Quickstart Loan and Security Agreement between Silicon Valley Bank and iPrint, Inc..

US Legal Forms may be the greatest collection of authorized kinds in which you can see various document web templates. Take advantage of the company to obtain professionally-made papers that follow state requirements.

Form popularity

FAQ

Based in Santa Clara, California, the bank was shut down after its investments greatly decreased in value and its depositors withdrew large amounts of money, among other factors. Later in March, First Citizens Bank bought up all deposits and loans of the failed bank.

Pandemonium broke loose in the banking world when Silicon Valley Bank collapsed earlier this month and sparked a chain reaction of similar failures, including Credit Suisse, First Republic Bank, Signature Bank, Silvergate Bank and others. Hundreds of banks remain at risk of the same fate.

SVB didn't have the cash on hand to liquidate these deposits because they were tied up in long-term investments. They started selling their bonds at a significant loss, which caused distress to customers and investors. Within 48 hours after disclosing the sale of assets, the bank collapsed.

The Federal Reserve took steps following the collapse of SVB to improve confidence in the banking system and prevent future banking failures, including its Bank Term Funding Program. First Citizens Bank struck a deal with the FDIC to buy SVB's deposits and loans, in addition to certain other assets.

Fees ? As a Defaulting Lender, SVB will typically not be entitled to receive commitment fees and letter of credit fees on its portion of revolving commitments.

If you had a loan As receiver, the FDIC will retain all the assets from Silicon Valley Bank for later disposition. Loan customers should continue to make their payments as usual.