Ohio Basic Debt Instrument Workform

Description

How to fill out Basic Debt Instrument Workform?

If you require extensive, obtain, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Employ the site's straightforward and user-friendly search feature to locate the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. After locating the form you need, click the Purchase now button. Select the pricing plan you prefer and provide your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to find the Ohio Basic Debt Instrument Template with just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and click the Download button to access the Ohio Basic Debt Instrument Template.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure that you have chosen the form for the correct city/state.

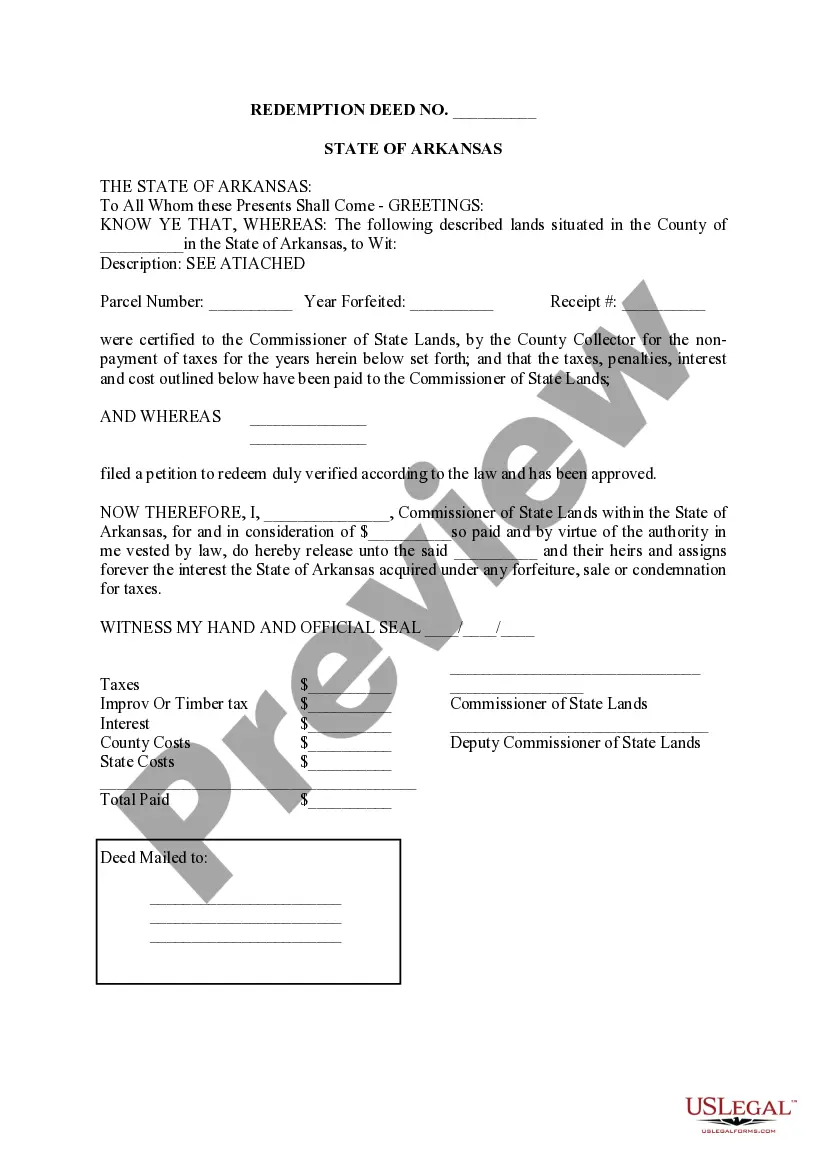

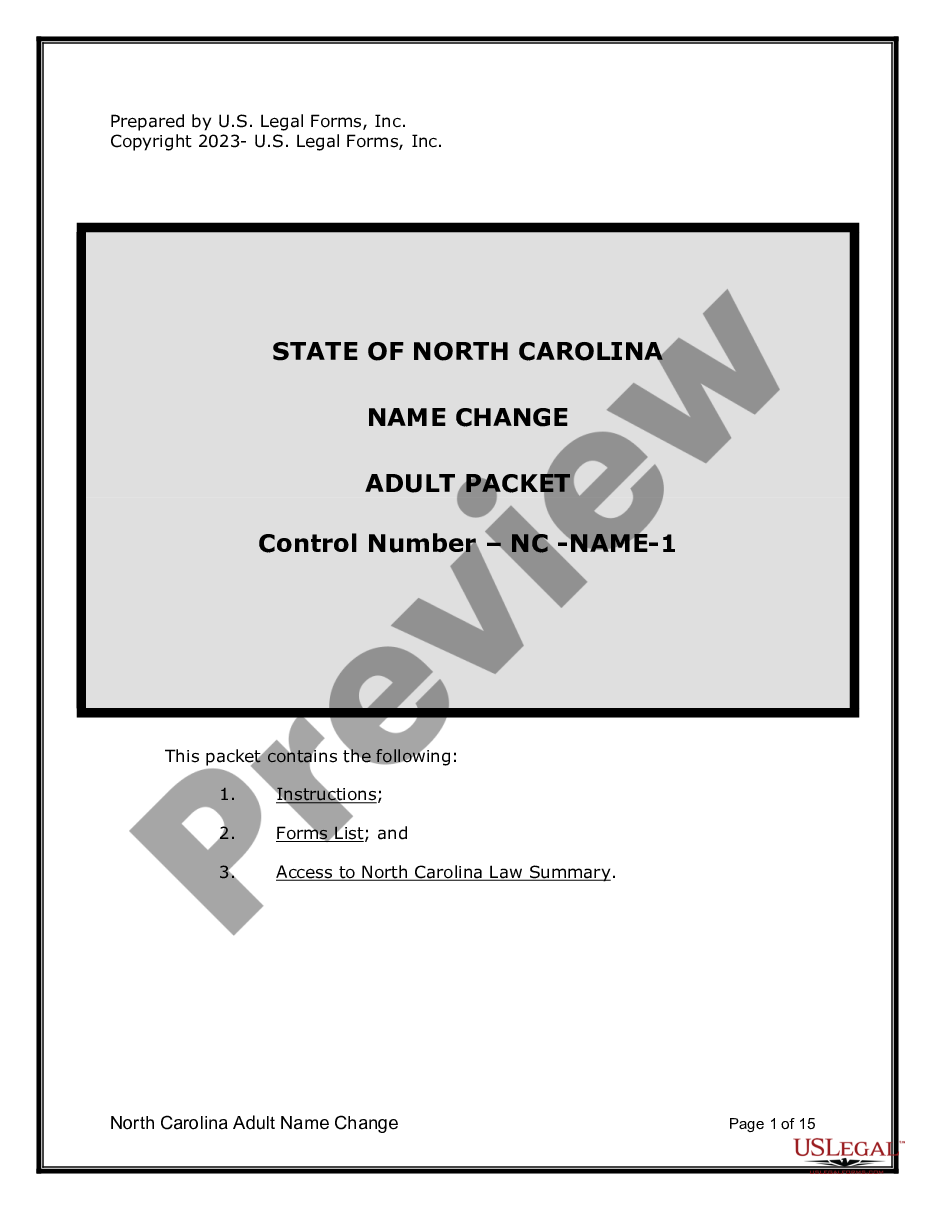

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations in the legal document format.

Form popularity

FAQ

Types of debt securitiesBonds, notes and medium-term notes. Bonds and notes can be issued on a standalone, once off basis or on a repeat programme basis.Commercial paper (CP)Interest-bearing securities.Zero coupon securities.High yield securities.Equity-linked securities.Warrants.Asset-backed securities.More items...

Debt instruments are tools an individual, government entity, or business entity can utilize for the purpose of obtaining capital. Debt instruments provide capital to an entity that promises to repay the capital over time. Credit cards, credit lines, loans, and bonds can all be types of debt instruments.

Debt instruments are assets that require a fixed payment to the holder, usually with interest. Examples of debt instruments include bonds (government or corporate) and mortgages. The equity market (often referred to as the stock market) is the market for trading equity instruments.

A debt instrument is an asset that individuals, companies, and governments use to raise capital or to generate investment income. Investors provide fixed-income asset issuers with a lump-sum in exchange for interest payments at regular intervals.

Credit cards, credit lines, loans, and bonds can all be types of debt instruments.

Debt instruments are assets that require a fixed payment to the holder, usually with interest. Examples of debt instruments include bonds (government or corporate) and mortgages. The equity market (often referred to as the stock market) is the market for trading equity instruments.

A debt instrument can be in paper or electronic form. Bonds, debentures, leases, certificates, bills of exchange and promissory notes are examples of debt instruments. These instruments also give market participants the option to transfer the ownership of debt obligation from one party to another.

Credit cards, credit lines, loans, and bonds can all be types of debt instruments. Typically, the term debt instrument primarily focuses on debt capital raised by institutional entities. Institutional entities can include governments and both private and public companies.

Held-to-maturity securities, trading securities, and available-for-sale securities are considered as three categories of debt securities.

There are different types of Debt Instruments available in India such as;Bonds.Certificates of Deposit.Commercial Papers.Debentures.Fixed Deposit (FD)G - Secs (Government Securities)National savings Certificate (NSC)