Ohio Text of proposed amendment to certificate of incorporation

Description

How to fill out Text Of Proposed Amendment To Certificate Of Incorporation?

Are you currently within a situation the place you will need documents for possibly business or specific purposes almost every working day? There are a lot of legal document themes available on the net, but getting ones you can rely on isn`t simple. US Legal Forms delivers a large number of kind themes, much like the Ohio Text of proposed amendment to certificate of incorporation, that happen to be composed to fulfill state and federal requirements.

When you are previously informed about US Legal Forms internet site and also have a free account, simply log in. After that, you are able to obtain the Ohio Text of proposed amendment to certificate of incorporation template.

Should you not have an profile and would like to begin to use US Legal Forms, adopt these measures:

- Get the kind you will need and ensure it is for that correct area/region.

- Take advantage of the Preview option to review the shape.

- See the outline to actually have chosen the correct kind.

- In case the kind isn`t what you`re searching for, make use of the Research discipline to discover the kind that meets your requirements and requirements.

- If you obtain the correct kind, simply click Buy now.

- Choose the prices strategy you desire, fill in the required information and facts to produce your money, and purchase an order utilizing your PayPal or credit card.

- Choose a handy document file format and obtain your duplicate.

Get all the document themes you have bought in the My Forms food list. You can get a extra duplicate of Ohio Text of proposed amendment to certificate of incorporation whenever, if needed. Just click the needed kind to obtain or print the document template.

Use US Legal Forms, one of the most considerable collection of legal forms, to save lots of efforts and steer clear of blunders. The assistance delivers appropriately produced legal document themes which can be used for a selection of purposes. Generate a free account on US Legal Forms and initiate generating your lifestyle a little easier.

Form popularity

FAQ

(1) A corporation's board of directors may restate its articles of incorporation at any time with or without a vote of the members. (2) The restatement may include one or more amendments to the articles of incorporation.

All corporations must incorporate with the Ohio Secretary of State to lawfully conduct business in Ohio. A corporation must file Articles of Incorporation (Articles) with the Ohio Secretary of State before it transacts business in Ohio.

Texas has one form for all domestic for-profit businesses. Fill out and file in duplicate Form 424, Certificate of Amendment. You can file it in person, by mail or online at Texas SOSDirect for $1 log in fee. You also can fax your amendment with form 807 with your credit card information.

The Articles of Incorporation are like the constitution of the corporation that provides a broad framework for its establishment, whereas the bylaws can be likened to the individual laws that must be consistent with the Articles of Incorporation.

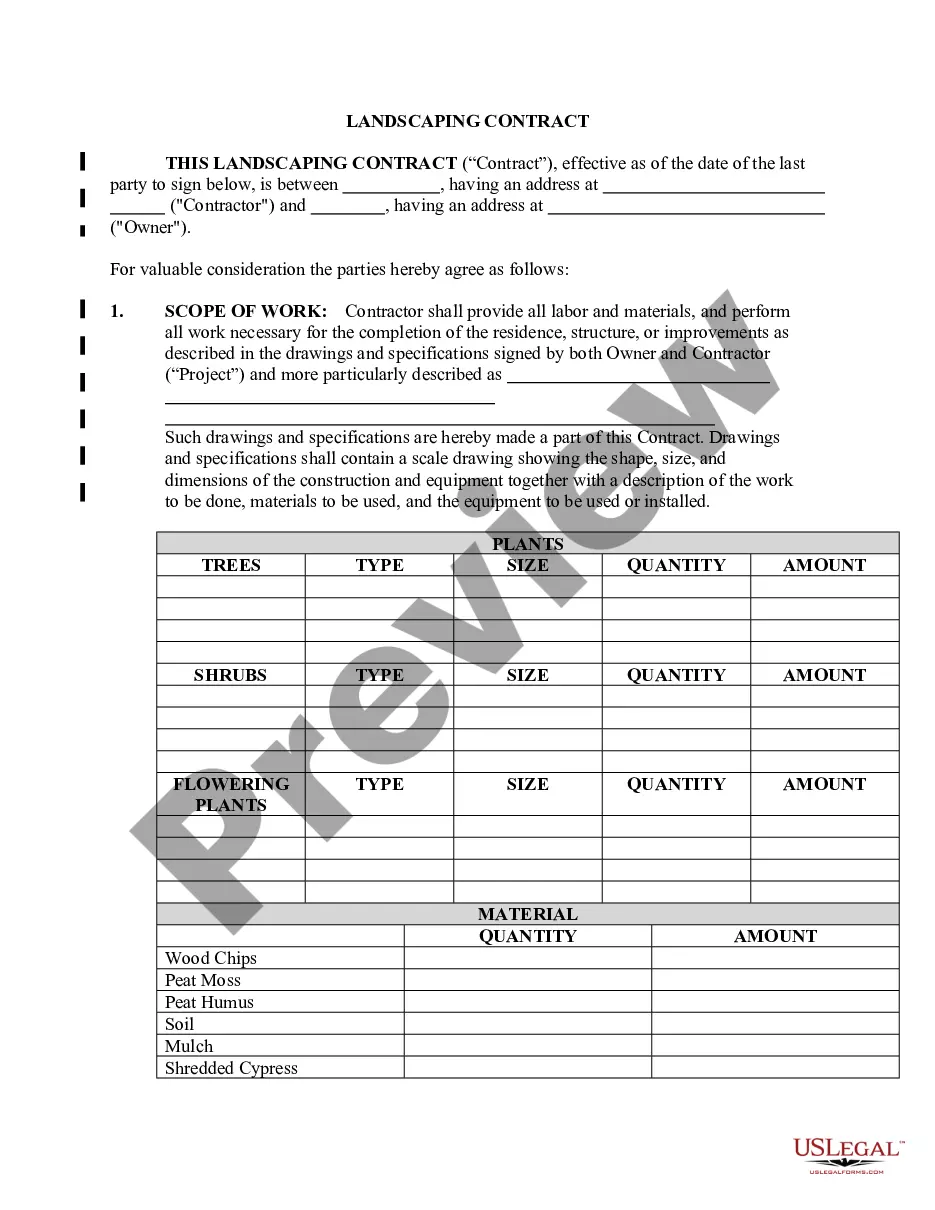

An amendment to your corporation's Articles of Incorporation is filed when you need to update, add to, or otherwise change the original content of your articles. Amendments are important corporate filings as they are required to modify essential corporate information, such as changes to stock information.

To amend (change, add or delete) provisions contained in the Articles of Incorporation, it is necessary to prepare and file with the California Secretary of State a Certificate of Amendment of Articles of Incorporation in compliance with California Corporations Code sections 900-910.

Steps to Amend Your Ohio Articles of Incorporation Determine whether you need to change your Ohio AOI. Complete the Ohio Certificate of Amendment. Attach supporting documents to your Ohio amendment. Submit separate filings for Ohio statutory agent changes.

In order to change your LLC name, you must file a Certificate of Amendment with the Ohio Secretary of State. This officially updates your legal entity (your Limited Liability Company) on the state records. Note: The Ohio Secretary of State is responsible for LLC formation and administration, including name changes.