Ohio Proposal to approve restricted stock plan

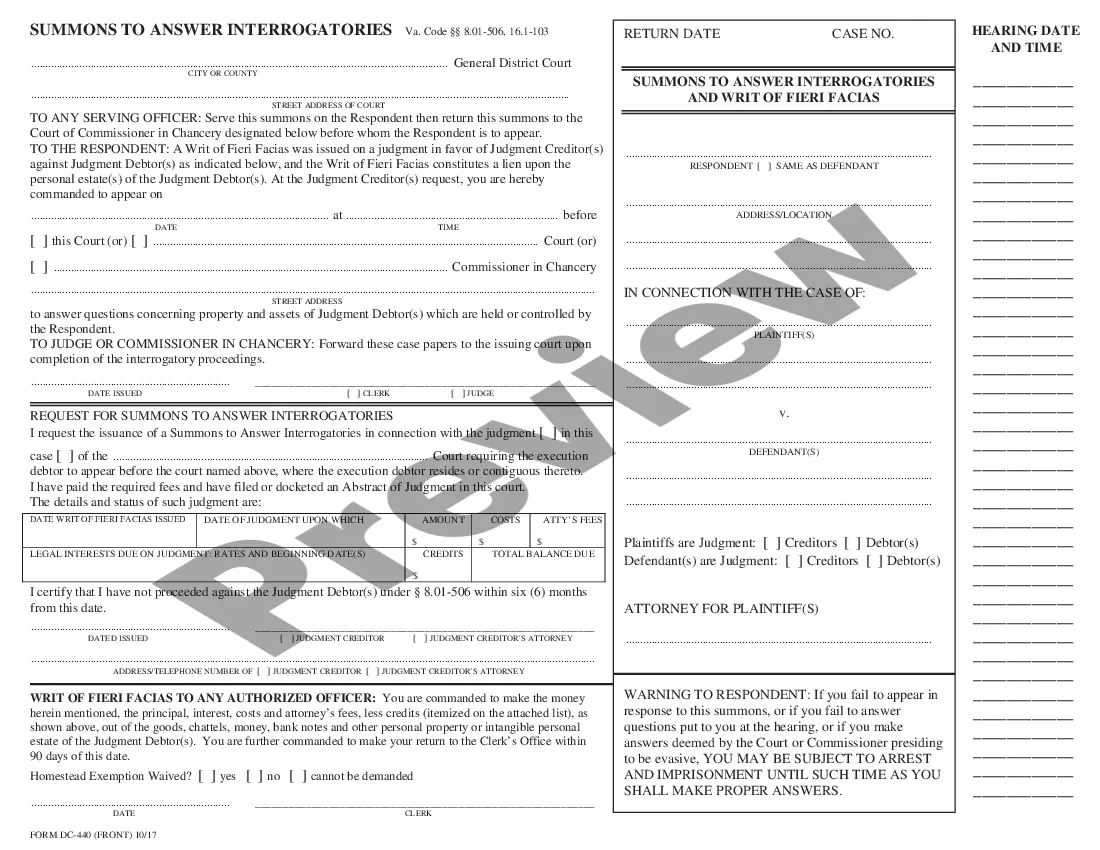

Description

How to fill out Proposal To Approve Restricted Stock Plan?

If you have to total, down load, or printing lawful file web templates, use US Legal Forms, the greatest collection of lawful varieties, which can be found online. Make use of the site`s simple and easy convenient search to find the papers you require. A variety of web templates for business and specific purposes are sorted by classes and claims, or key phrases. Use US Legal Forms to find the Ohio Proposal to approve restricted stock plan within a few clicks.

If you are already a US Legal Forms customer, log in to the bank account and then click the Obtain button to find the Ohio Proposal to approve restricted stock plan. Also you can entry varieties you previously downloaded in the My Forms tab of your bank account.

If you use US Legal Forms the first time, follow the instructions under:

- Step 1. Ensure you have chosen the form for the right city/region.

- Step 2. Take advantage of the Review method to look through the form`s content material. Never overlook to see the information.

- Step 3. If you are unhappy with all the type, take advantage of the Lookup industry at the top of the display to discover other types in the lawful type design.

- Step 4. After you have located the form you require, click the Get now button. Select the costs program you favor and put your references to sign up to have an bank account.

- Step 5. Process the purchase. You can utilize your Мisa or Ьastercard or PayPal bank account to finish the purchase.

- Step 6. Pick the file format in the lawful type and down load it in your gadget.

- Step 7. Comprehensive, edit and printing or indication the Ohio Proposal to approve restricted stock plan.

Each lawful file design you purchase is your own permanently. You possess acces to every type you downloaded within your acccount. Click the My Forms section and pick a type to printing or down load yet again.

Be competitive and down load, and printing the Ohio Proposal to approve restricted stock plan with US Legal Forms. There are millions of expert and state-particular varieties you may use to your business or specific needs.

Form popularity

FAQ

RSUs are a type of equity compensation that grants employees a specific number of company shares subject to a vesting schedule and potentially other stipulations. The vesting schedule dictates when ownership rights are activated, typically upon completing a certain number of service years.

You may not sell, assign, pledge, encumber, or otherwise transfer any interest in the Restricted Shares until the dates set forth in the Vesting Schedule set forth below, at which point the Restricted Shares will be referred to as ?Vested.? A Restricted Share shall not be subject to execution, attachment or similar ...

RSUs are taxed as income to you when they vest. If you sell your shares immediately, there is no capital gain tax, and you only pay ordinary income taxes. If instead, the shares are held beyond the vesting date, any gain (or loss) is taxed as a capital gain (or loss).

Here are some examples of what you can say during your negotiation for RSUs. ?I'm really excited to start working here at [Name of Company] and I want to feel even more invested in it right out of the gate. Would [Name of Company] be willing to give me RSUs as part of my offer??

?I'm so excited about this promotion and look forward to continuing to help [company] grow. I know it's fairly common for employees to receive grants of RSUs at certain points during their career here. Would it be possible for me to receive a grant of RSUs as part of this promotion??