Ohio Sample Asset Purchase Agreement between third tier subsidiary of corporation (Seller) and second tier subsidiary of unrelated corporation (Buyer)

Description

How to fill out Sample Asset Purchase Agreement Between Third Tier Subsidiary Of Corporation (Seller) And Second Tier Subsidiary Of Unrelated Corporation (Buyer)?

Discovering the right lawful file design can be a struggle. Obviously, there are a lot of layouts available online, but how would you obtain the lawful form you need? Use the US Legal Forms web site. The support gives thousands of layouts, like the Ohio Sample Asset Purchase Agreement between third tier subsidiary of corporation (Seller) and second tier subsidiary of unrelated corporation (Buyer), that you can use for business and personal needs. Every one of the forms are checked out by specialists and satisfy federal and state needs.

When you are presently listed, log in to the account and click the Acquire option to obtain the Ohio Sample Asset Purchase Agreement between third tier subsidiary of corporation (Seller) and second tier subsidiary of unrelated corporation (Buyer). Make use of your account to appear through the lawful forms you possess acquired previously. Visit the My Forms tab of the account and acquire yet another version of your file you need.

When you are a brand new consumer of US Legal Forms, allow me to share simple directions that you can stick to:

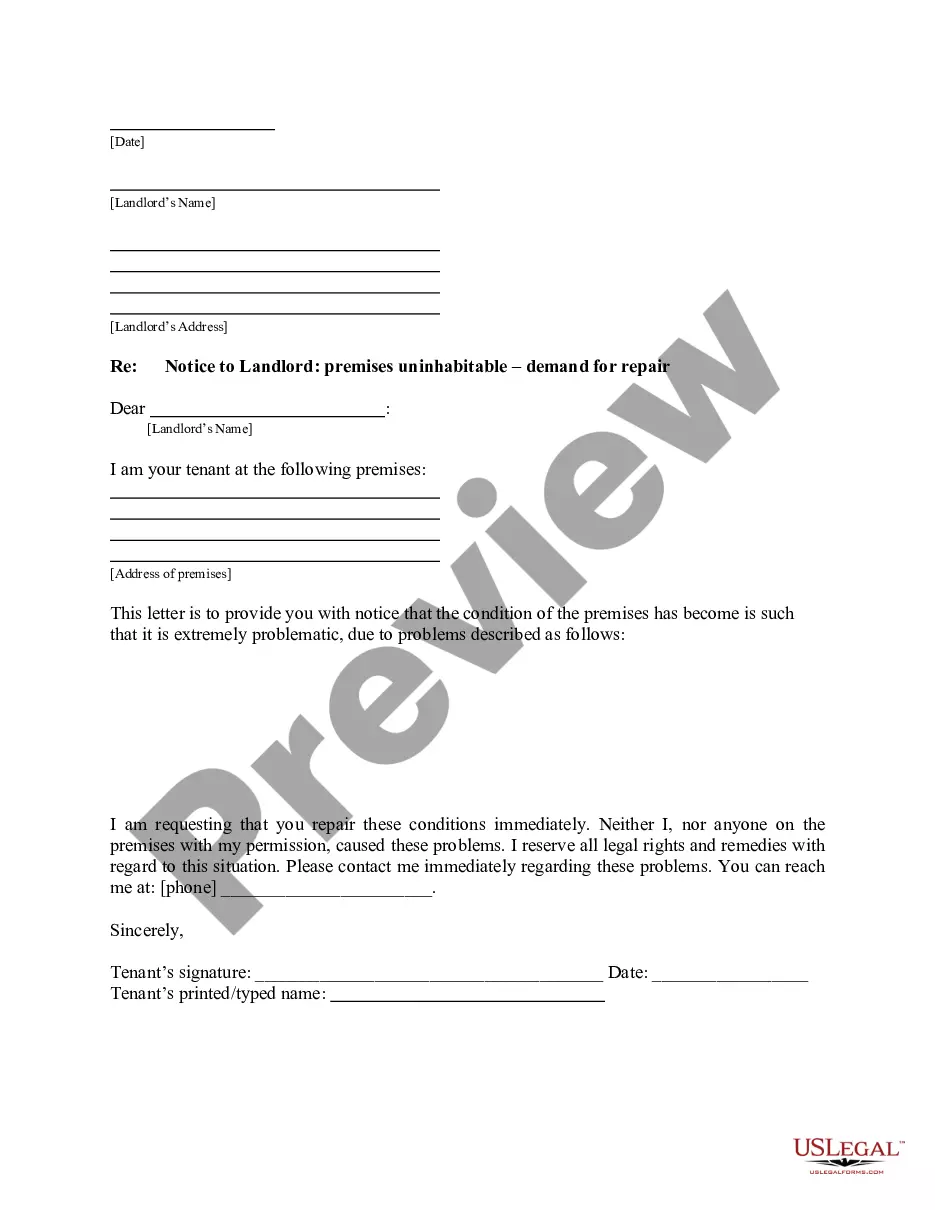

- Initial, make certain you have selected the correct form for your personal area/area. It is possible to check out the form while using Preview option and look at the form outline to guarantee it is the right one for you.

- If the form will not satisfy your expectations, use the Seach discipline to find the right form.

- When you are certain that the form is acceptable, go through the Purchase now option to obtain the form.

- Select the prices strategy you want and enter the needed details. Design your account and buy the transaction using your PayPal account or bank card.

- Opt for the file structure and down load the lawful file design to the gadget.

- Complete, change and printing and signal the received Ohio Sample Asset Purchase Agreement between third tier subsidiary of corporation (Seller) and second tier subsidiary of unrelated corporation (Buyer).

US Legal Forms will be the largest library of lawful forms that you will find a variety of file layouts. Use the company to down load skillfully-created files that stick to express needs.

Form popularity

FAQ

The asset purchase agreement is typically drafted by the buyer and seller of the assets. However, in some cases, it may be handled by an attorney.

In an asset purchase, the buyer agrees to purchase specific assets and liabilities. This means that they only take on the risks of those specific assets. This could include equipment, fixtures, furniture, licenses, trade secrets, trade names, accounts payable and receivable, and more.

At its most basic, a purchase agreement should include the following: Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

Definitions of the words and terms to be used in the legal instrument. Terms and conditions of the sale and purchase of the assets, including purchase price and terms of the purchase (full payment at close, down payment, subsequent payments, etc.) Terms and conditions of the closing of the agreement, if any.

An asset acquisition is the purchase of a company by buying its assets instead of its stock. In most jurisdictions, an asset acquisition typically also involves an assumption of certain liabilities.

In an asset purchase, the buyer agrees to purchase specific assets and liabilities. This means that they only take on the risks of those specific assets. This could include equipment, fixtures, furniture, licenses, trade secrets, trade names, accounts payable and receivable, and more.

A share purchase agreement is legally binding once it is signed by both parties. There is a period of negotiation before the agreement is signed, as each side needs to be certain that the terms distribute risk fairly. That is why due diligence is such an important part of the process, especially for the buyer.

There are two core methods to buy or sell a business: an asset purchase or a share purchase. An asset purchase requires the sale of individual assets. A share purchase requires the purchase of 100 percent of the shares of a company, effectively transferring all of the company's assets and liabilities to the purchaser.