Ohio Stock Option and Award Plan

Description

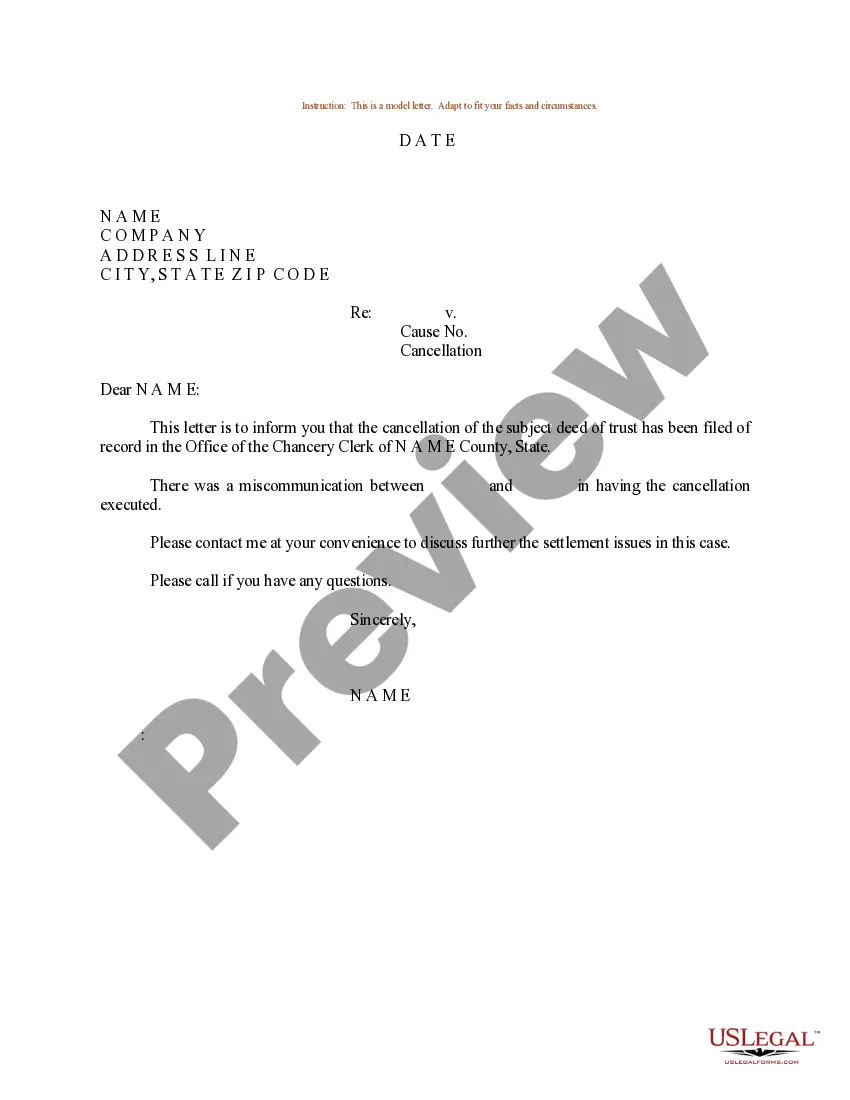

How to fill out Stock Option And Award Plan?

Finding the appropriate lawful document template can be a challenge. Naturally, there are countless templates accessible online, but how can you find the legitimate form you need? Utilize the US Legal Forms website. The service offers a vast array of templates, including the Ohio Stock Option and Award Plan, which can be utilized for both business and personal needs. All documents are reviewed by professionals and comply with state and federal guidelines.

If you are currently registered, Log In to your account and click the Download button to acquire the Ohio Stock Option and Award Plan. Use your account to browse through the legal forms you have previously purchased. Go to the My documents tab in your account to obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions you can follow.

Select the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired Ohio Stock Option and Award Plan. US Legal Forms is the largest catalog of legal forms where you can find various document templates. Utilize the service to download professionally crafted documents that adhere to state regulations.

- First, ensure you have chosen the correct form for your city/state.

- You can review the form using the Review button and check the form description to confirm it is suitable for you.

- If the form does not meet your needs, use the Search area to find the appropriate form.

- Once you are confident the form is acceptable, select the Buy Now button to obtain the form.

- Choose the pricing plan you want and enter the necessary information.

- Create your account and complete your purchase using your PayPal account or Visa or Mastercard.

Form popularity

FAQ

Capital gains are taxable at both the federal and state levels.

Generally, any profit you make on the sale of a stock is taxable at either 0%, 15% or 20% if you held the shares for more than a year or at your ordinary tax rate if you held the shares for less than a year. Also, any dividends you receive from a stock are usually taxable.

The rate is at least 3.5% percent. Ohio Administrative Code 5703-7-10 provides that withholding agents must withhold at least 3.5% on supplemental compensation such as bonuses, commissions, and other nonrecurring types of payments other than salaries and wages.

For 2021, the flat withholding rate for bonuses is 22% except when those bonuses are above $1 million. If your employee's bonus exceeds $1 million, congratulations to both of you on your success! These large bonuses are taxed at a flat rate of 37%.

If the employee sells the shares within one year 15% tax is levied against the capital gains. If the employee sells the shares after one year they are considered long term assets and are not taxable.

AK, FL, NV, NH, SD, TN, TX, WA, and WY have no state capital gains tax. AL, AR, DE, HI, IN, IA, KY, MD, MO, MT, NJ, NM, NY, ND, OR, OH, PA, SC, and WI either allow taxpayer to deduct their federal taxes from state taxable income, have local income taxes, or have special tax treatment of capital gains income.

Because stock option income is compensation, a taxpayer who receives stock option income while a resident of a reciprocity state is not subject to Ohio tax on the income, even if it was earned for services performed in Ohio.

The combined state and federal capital gains tax rate in Ohio would rise from the current 28.6 percent to 48.2 percent under President Biden's American Families Plan, according to a new study from the Tax Foundation.

Statutory Stock OptionsYou have taxable income or deductible loss when you sell the stock you bought by exercising the option. You generally treat this amount as a capital gain or loss. However, if you don't meet special holding period requirements, you'll have to treat income from the sale as ordinary income.

Supplemental withholding rate The supplemental rate of Ohio state income tax withholding on bonuses, commissions, and nonrecurring types of payments, or compensation is established by regulation at 3.5% and is not affected by the income tax changes under H.B. 110. (Ohio Administrative Code 5703-7-10, rev.