Ohio Real Property - Schedule A - Form 6A - Post 2005

Description

How to fill out Real Property - Schedule A - Form 6A - Post 2005?

Are you currently inside a place in which you need files for either enterprise or person reasons almost every time? There are tons of legal document web templates available on the Internet, but discovering types you can rely is not effortless. US Legal Forms provides a huge number of form web templates, like the Ohio Real Property - Schedule A - Form 6A - Post 2005, that are composed to fulfill state and federal needs.

In case you are already informed about US Legal Forms web site and have your account, basically log in. Following that, you may acquire the Ohio Real Property - Schedule A - Form 6A - Post 2005 template.

If you do not have an profile and wish to start using US Legal Forms, follow these steps:

- Find the form you require and ensure it is for your appropriate city/area.

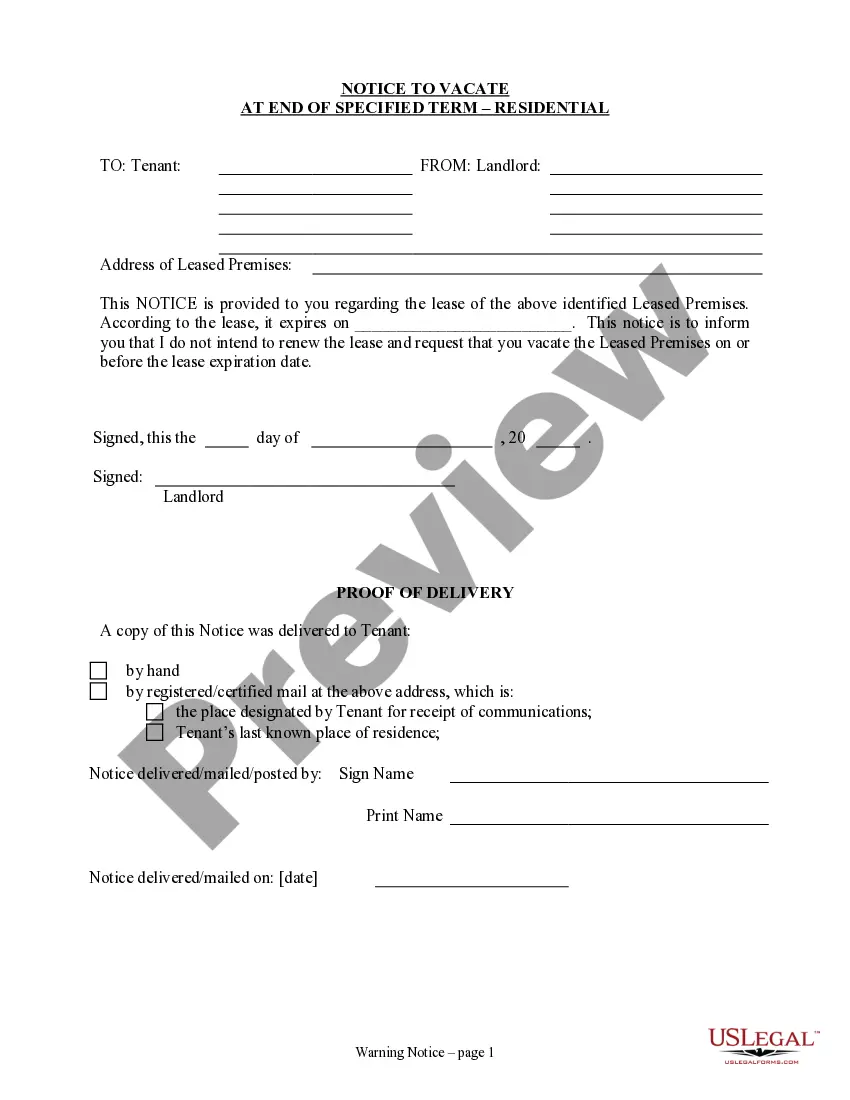

- Utilize the Review key to check the form.

- Browse the information to ensure that you have chosen the proper form.

- In case the form is not what you are searching for, make use of the Look for area to get the form that meets your needs and needs.

- Whenever you discover the appropriate form, click on Acquire now.

- Select the prices prepare you need, fill in the required information to generate your money, and buy the order using your PayPal or bank card.

- Choose a convenient data file format and acquire your duplicate.

Locate each of the document web templates you have bought in the My Forms menus. You may get a more duplicate of Ohio Real Property - Schedule A - Form 6A - Post 2005 any time, if required. Just go through the necessary form to acquire or print out the document template.

Use US Legal Forms, the most considerable variety of legal forms, to save lots of efforts and steer clear of faults. The service provides expertly produced legal document web templates which you can use for a selection of reasons. Make your account on US Legal Forms and initiate producing your lifestyle easier.

Form popularity

FAQ

Ohio has two types of Homestead Exemption: (1) senior and disabled persons homestead exemption and (2) disabled veterans enhanced homestead exemption. Senior and Disabled Persons Homestead Exemption protects the first $25,000 of your home's value from taxation.

Ac cording to state law and department rules, auditors conduct a full reappraisal of real property every six years and update values in the third year following each sexennial reappraisal.

Reducing Your Taxes Homestead Exemption Provides Property Tax Relief for Senior Citizens and the Disabled: ... NEW Homestead Exemption for 100% DISABLED VETERANS and their surviving spouse: ... Owner Occupancy Credit (formerly known as the 2 ½ % Tax Reduction) for Owner-Occupied Home:

This Plan will protect Ohio seniors from increases in property taxes by implementing a property tax freeze for individuals that meet the following eligibility requirements: Individual must be seventy years of age or older. Income must not exceed seventy thousand dollars.

General Information. The Homestead Exemption is a property tax reduction available by application to seniors (age 65 or older) and the disabled (permanent/total).

Household income includes the income of the applicant and the applicants' spouse. Social Security income is exempt and is not considered income when related to the Homestead Exemption.

If it can be proven that the owner knew about a problem and failed to disclose it on the required form, you might be able to hold them responsible for paying for the repair. If the seller and/or their realtor intentionally defrauded you, you can seek damages amounting to double the cost of repairs.

This form is required by Ohio Revised Code Section 5302.30. PROFESSIONAL INSPECTION(S). Owner's Statement: The statements contained in this form are made by the owner and are not the statements of the owner's agent or subagent.