Ohio Employment Status Form

Description

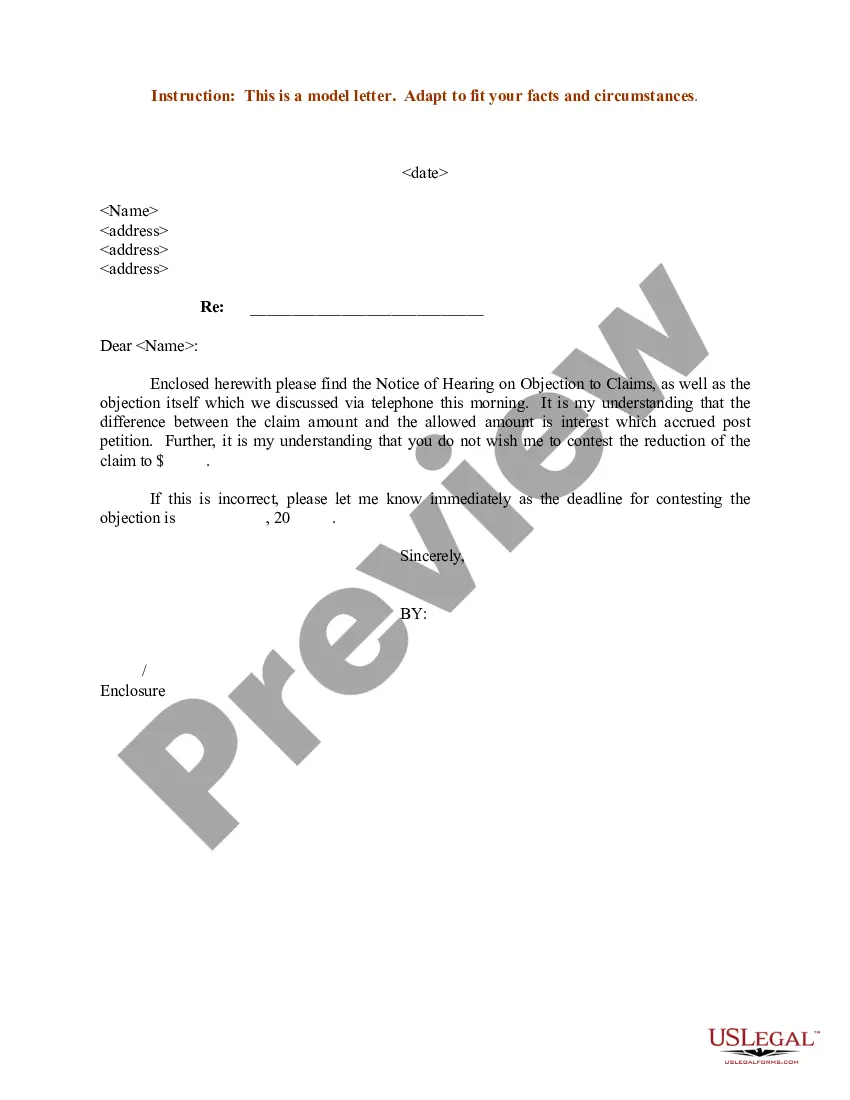

How to fill out Employment Status Form?

If you need to compile, acquire, or create official document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's straightforward and user-friendly search feature to locate the documents you need.

Various templates for business and personal purposes are categorized by types and states, or keywords. Utilize US Legal Forms to find the Ohio Employment Status Form in just a few clicks.

Every legal document template you obtain is yours indefinitely. You have access to every form you saved within your account. Click the My documents section to select a form to print or download again.

Compete and obtain, then print the Ohio Employment Status Form with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Ohio Employment Status Form.

- You can also access forms you have previously saved in the My documents section of your account.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Review feature to examine the form's details. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other forms in the legal format.

- Step 4. Once you have located the form you need, click the Buy now button. Choose the payment plan you prefer and enter your details to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Retrieve the format of the legal form and save it to your device.

- Step 7. Complete, revise, and print or sign the Ohio Employment Status Form.

Form popularity

FAQ

The following states opted to create their own state W-4 forms: Delaware, Idaho, Nebraska, Oregon, South Carolina, and Wisconsin whereas Colorado, New Mexico, North Dakota, and Utah will adopt the new inputs that the 2020 Federal W-4 put forth.

Here's a step-by-step look at how to complete the form.Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

You can check the status online by logging into your account at unemployment.ohio.gov. It normally takes 3 to 4 weeks to process your application from the date you apply, but it may take longer if you were employed out of state, if you served in the military, or if you worked for the federal government.

2021 Ohio IT 1040 Individual Income Tax Return - Includes Ohio IT 1040, Schedule of Adjustments, IT BUS, Schedule of Credits, Schedule of Dependents, IT WH, and IT 40P.

Ohio IT 4 is an Ohio Employee Withholding Exemption Certificate. The employer is required to have each employee that works in Ohio to complete this form.

Every employer maintaining an office or transacting business within the state of Ohio and making payment of any compensation to an employee, whether a resident or nonresident, must withhold Ohio income tax. Withholding is not required if the compensation is paid for or to: 1.

Submit form IT 4 to your employer on or before the start date of employment so your employer will withhold and remit Ohio income tax from your compensation.

All 1099G's Issued by the Ohio Department of Taxation will be mailed by January 31st. 1099G's are available to view and print online through our Individual Online Services.

The W-4 is a form that you complete and give to your employer (not the IRS) for federal tax and the equivalent form for state tax withholding. The W-4 communicates to your employer(s) how much federal and/or state tax you - and your spouse if s/he works - wish to have withheld from each paycheck in a pay period.