Ohio Employee Evaluation Form for Sole Trader

Description

How to fill out Employee Evaluation Form For Sole Trader?

Are you in a circumstance where you will require documents for various business or personal reasons almost daily.

There are numerous legal document templates accessible online, but discovering those you can trust isn't easy.

US Legal Forms offers thousands of form templates, such as the Ohio Employee Evaluation Form for Sole Trader, which are created to meet federal and state regulations.

If you identify the correct form, click on Acquire now.

Select the pricing plan you prefer, fill out the necessary information to create your account, and complete your purchase using your PayPal or Visa or Mastercard.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Ohio Employee Evaluation Form for Sole Trader template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you require and ensure it is for the correct area/county.

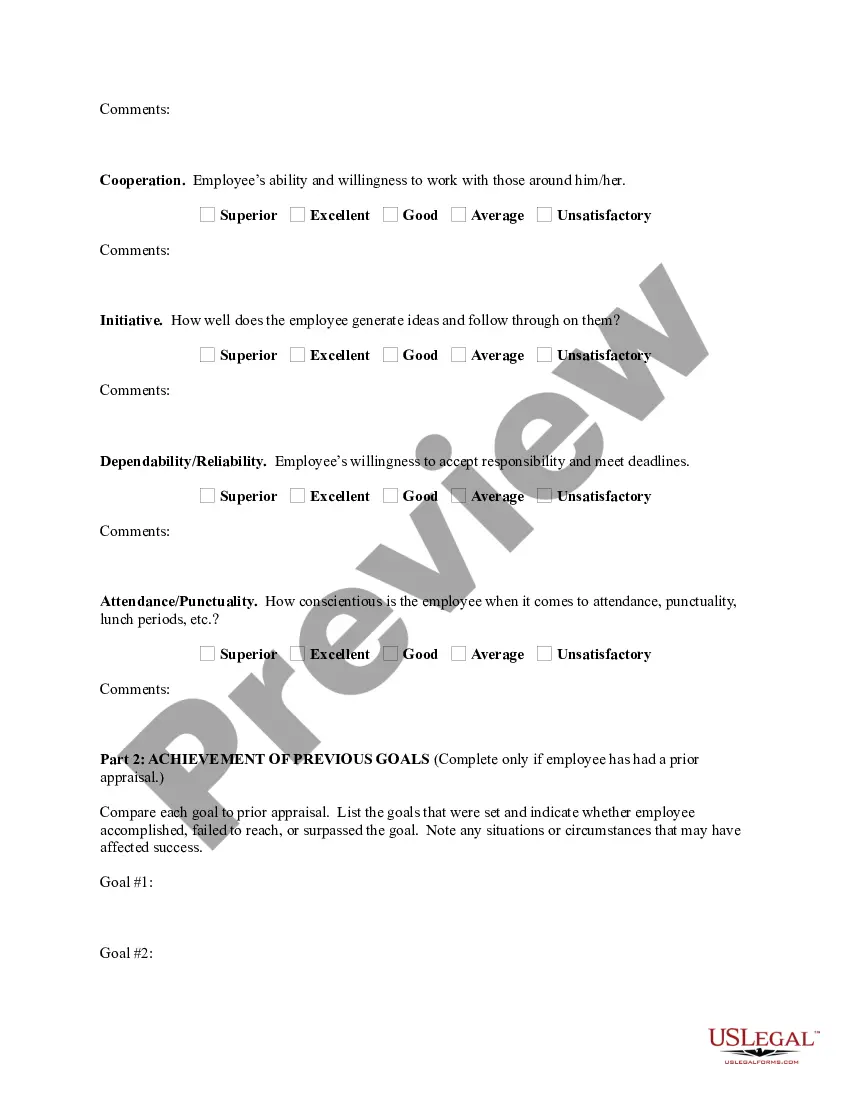

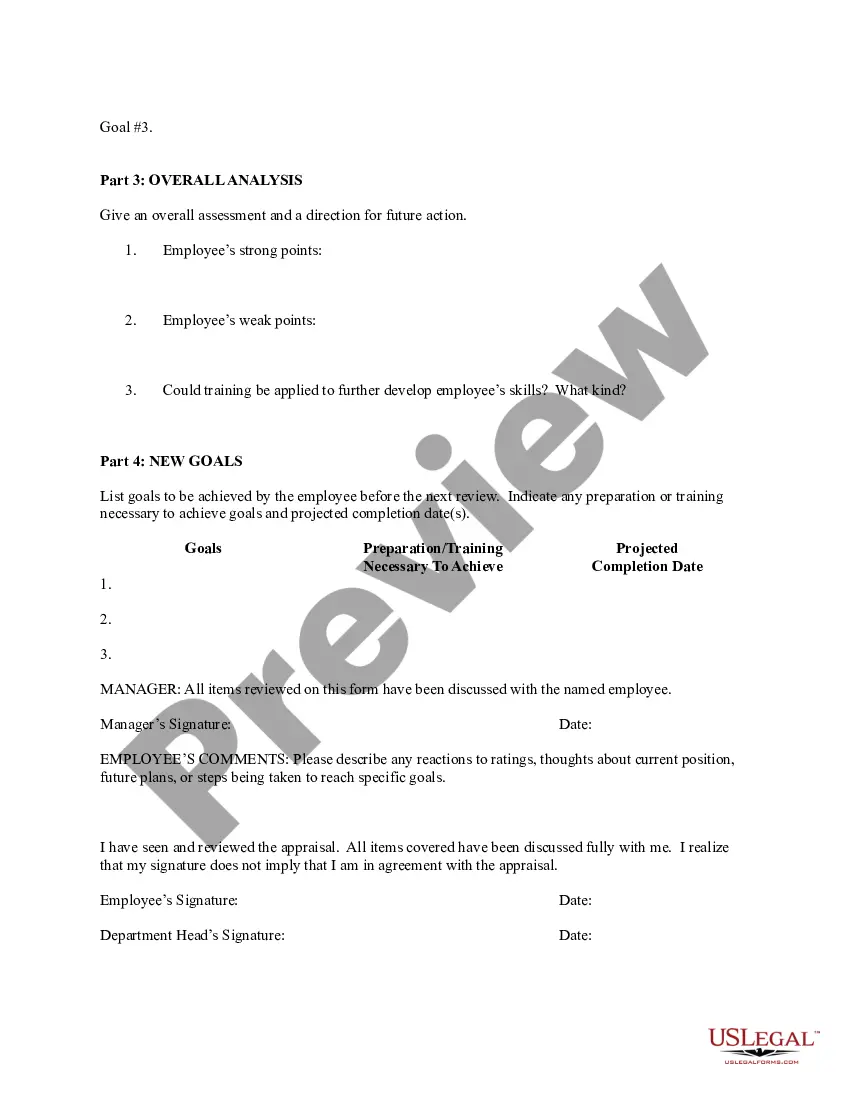

- Utilize the Review button to examine the form.

- Check the description to confirm you have chosen the right form.

- If the form isn’t what you are looking for, use the Search field to find a form that meets your needs.

Form popularity

FAQ

Each new employee will need to fill out the I-9 Employment Eligibility Verification Form from U.S. Citizenship and Immigration Services. The I-9 Form is used to confirm citizenship and eligibility to work in the U.S.

In Ohio, because independent contractors are not considered employees, they are not eligible for workers' compensation benefits. However, if you manage an independent contractor, and regularly control their performance, this freelancer or subcontractor is now considered your employee and requires your coverage.

Steps to Hiring your First Employee in OhioStep 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.Step 7 Labor Law Posters and Required Notices.More items...?

Whatever the LLC considers itself for tax purposes determines whether the LLC owner must have workers' compensation coverage. If the LLC considers itself a sole proprietorship or partnership, coverage is optional for the owner. If the LLC considers itself a corporation, the owner must cover himself or herself.

An individual incorporated as a corporation, sole owner, zero employees does NOT have to establish or maintain an Ohio workersfffd compensation policy unless the employer is required by another authority to show proof of workersfffd compensation coverage (in which case having elective coverage would be sufficient) or if, at

Do you need workers' compensation in Ohio if you are self-employed? A sole proprietor or member of a partnership must carry workers' compensation insurance for any employees of the business, but it is optional for owners to have insurance for themselves.

Establishes both identity and employment authorization. Employers must report the employee's name, address, Social Security number, date of birth, date of hire and the state in which the employee works. Federal and state laws require all employers to report all employees who live or work in Ohio.

All employers must establish employment eligibility and the identity of new employees by completing Form I-9. 2. Employers need to keep completed I-9's for three years or one year after an employee leaves.

The average rates for workers compensation in Ohio are $0.64 per $100 in payroll.

Make sure you and new hires complete employment forms required by law.W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.