Ohio Employee Separation Report

Description

How to fill out Employee Separation Report?

If you wish to total, download, or create legal document templates, utilize US Legal Forms, the largest assortment of legal forms that are accessible online.

Make use of the site’s straightforward and user-friendly search to locate the documents you require.

Various templates for corporate and individual purposes are organized by categories and states, or keywords.

- Utilize US Legal Forms to find the Ohio Employee Separation Report with just a few clicks.

- If you are currently a US Legal Forms user, sign in to your account and click the Download button to acquire the Ohio Employee Separation Report.

- You can also access forms you previously purchased in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow these steps.

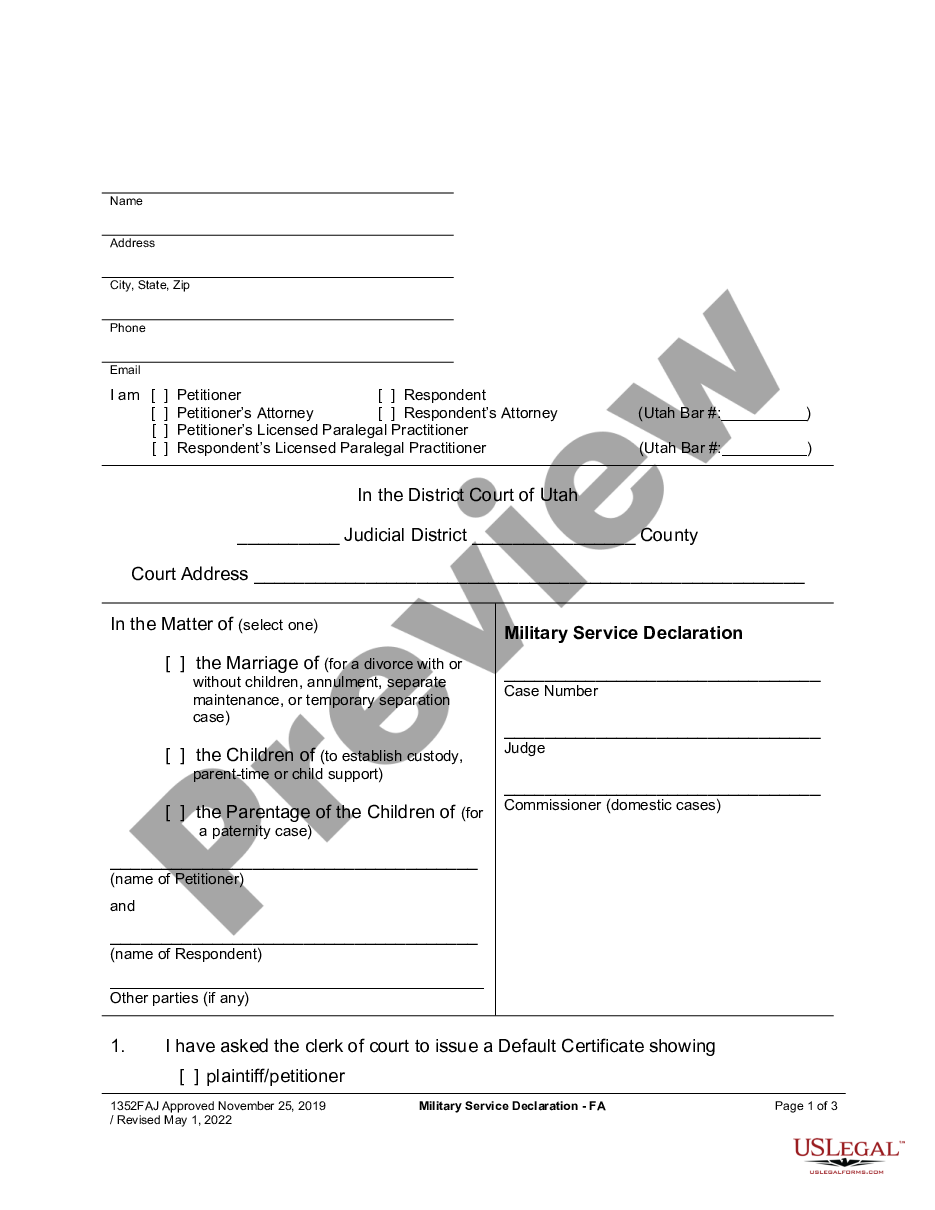

- Step 1. Make sure you have chosen the form for the correct region/state.

- Step 2. Use the Preview option to inspect the form’s contents. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other templates in the legal form template.

Form popularity

FAQ

To file the Ohio 501 form, gather the necessary employee information and complete the form according to Ohio Department of Job and Family Services guidelines. You can submit the completed form electronically or via mail. Ensure that you also document your resignation through the Ohio Employee Separation Report for a complete record.

The Ohio 501 form does not require regular filing; it is used specifically at the time of an employee's separation. It’s essential to complete this form accurately to ensure proper documentation of employment statuses. If you're unsure how to manage this filing, the Ohio Employee Separation Report can guide you through the necessary steps.

If a claim for unemployment compensation (UC) benefits is filed and the claimant lists your business as a recent employer, you will receive a Request to Employer for Separation Information - with a response deadline of 10 business days. ODJFS offers various methods of completing this request for information.

You will be ineligible for benefits for the number of weeks of severance you received. Apply for unemployment compensation even if you are receiving severance and.

If a claim for unemployment compensation (UC) benefits is filed and the claimant lists your business as a recent employer, you will receive a Request to Employer for Separation Information - with a response deadline of 10 business days. ODJFS offers various methods of completing this request for information.

Once it receives your appeal, the ODJFS has 21 days to decide whether to issue a redetermination of your claim or refer your appeal to the Unemployment Compensation Review Commission (UCRC). If the ODJFS issues a redetermination, you will receive it by mail.

Ohio Employers who Fail to Respond to Requests for Separation Information may now Pay for It. Ohio recently warned employers that they could be charged for unemployment compensation benefits received by employees who obtained them fraudulently.

On the contrary, if an employer ignores these claims, they may find their unemployment taxes eating into their bottom line. If the employer does not respond or responds too late, the worker could automatically get UI benefits, in most states.

If you quit your job, you won't be eligible for unemployment benefits unless you had just cause to leave your job. In general, just cause means that you had a compelling, job-related reason for leaving the position and a reasonably careful person would have done the same in your circumstances.

Known as the Ohio Job Insurance (OJI) database. most recent employer(s). f097 The employer(s) has 10 days to respond. provide thorough information for the separation to be properly adjudicated.