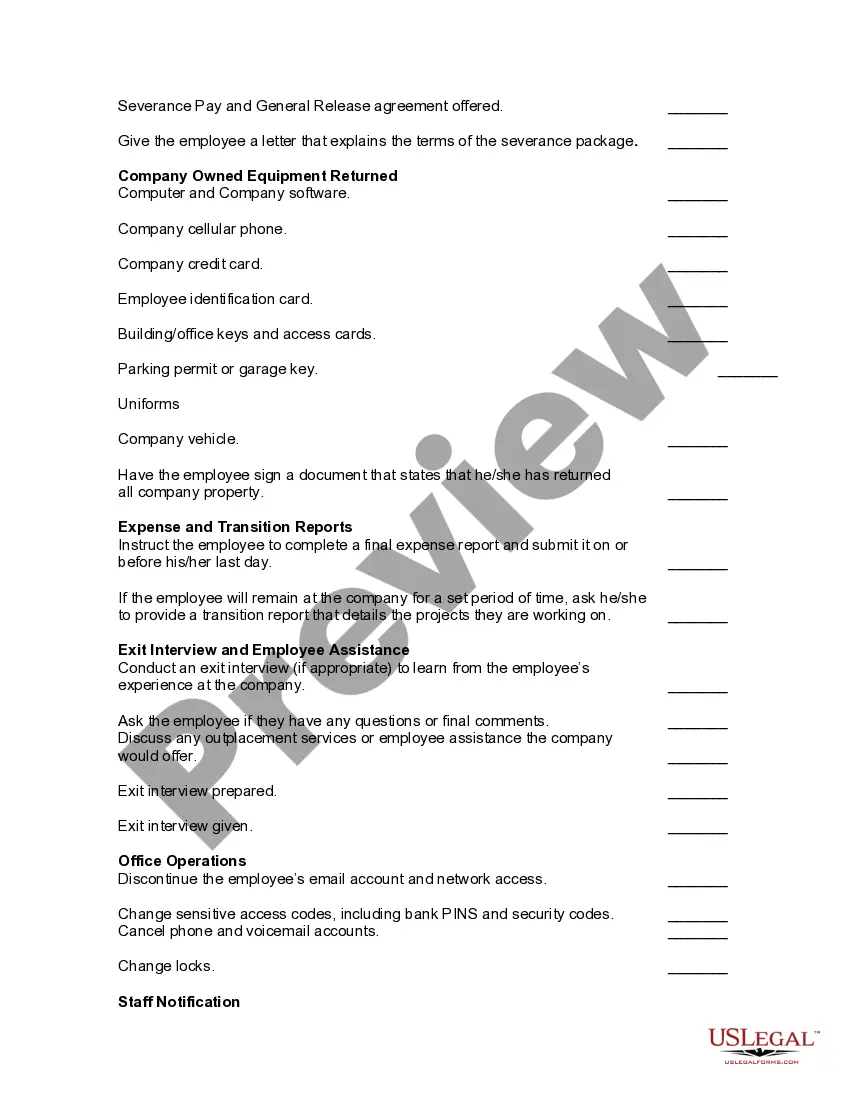

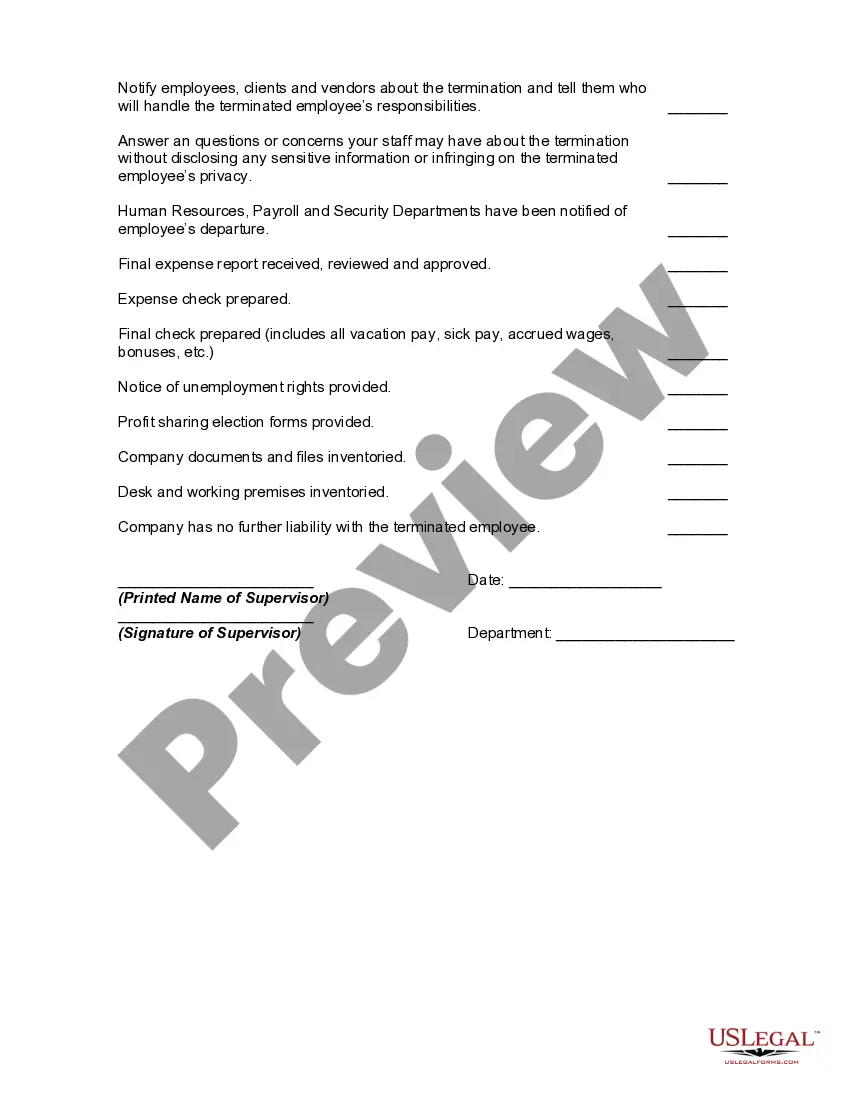

The following items should be checked off prior to an employee's final date of employment. Not all items will apply to all employees or to all circumstances.

Ohio Worksheet - Termination of Employment

Description

How to fill out Worksheet - Termination Of Employment?

Selecting the appropriate legal document template can be a challenge. Indeed, there are numerous designs accessible online, but how do you locate the legal form you require.

Use the US Legal Forms site. This service provides thousands of templates, including the Ohio Worksheet - Termination of Employment, which you can utilize for professional and personal needs. All forms are reviewed by experts and comply with state and federal requirements.

If you are already a member, Log In to your account and then click the Download button to obtain the Ohio Worksheet - Termination of Employment. Use your account to browse the legal forms you have previously acquired. Go to the My documents section of your account to download another copy of the document you desire.

US Legal Forms holds the largest library of legal documents where you can find a variety of file templates. Utilize the service to obtain professionally crafted documents that meet state requirements.

- Firstly, ensure you have chosen the correct form for your locality/state. You can preview the document using the Preview button and read the document description to confirm it is the appropriate one for you.

- If the document does not meet your requirements, utilize the Search field to find the right document.

- Once you are confident that the form is suitable, click on the Purchase now button to obtain the form.

- Select the pricing plan you prefer and enter the necessary information. Create your account and pay for your order using your PayPal account or credit card.

- Choose the file format and download the legal document template for your use.

- Complete, edit, and print and sign the acquired Ohio Worksheet - Termination of Employment.

Form popularity

FAQ

Ohio Revised Code 1701.95 focuses on the rights and responsibilities of corporations regarding employee termination. It sets stipulations for corporate governance and outlines necessary actions during employment separations. Familiarity with this clause helps organizations manage terminations lawfully and efficiently. For detailed insights, the Ohio Worksheet - Termination of Employment can serve as an essential resource.

Call the unemployment office at 1-877-644-6562 (1-877-OHIO-JOB).

Here's a step-by-step look at how to complete the form.Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

All 1099G's Issued by the Ohio Department of Taxation will be mailed by January 31st. 1099G's are available to view and print online through our Individual Online Services. You can elect to be removed from the next year's mailing by signing up for email notification.

To complete your application, you can file your claim online at FloridaJobs.org/RAApplication, You must file for state Reemployment Assistance benefits before filing for PUA. During the application process, you will be asked if you were impacted by COVID-19.

Form PUA-1099G is a federal form that the Internal Revenue Service requires to be provided to unemployment compensation recipients who were paid PUA benefits during the prior year. This statement shows the amount of PUA benefits paid and the amount of federal income tax withheld, if any.

File online at , 24 hours/day, 7 days/week....Once your application has been filed:You will receive further information by mail or e-mail.Your claim will be assigned to a Processing Center, based on the last four digits of the your Social Security number.More items...

PUA applications are no longer being accepted. The PUA program expired across the nation in early September 2021. In Ohio, PUA ended on September 4, 2021.

Individuals who receive a 1099-G form and did not file for unemployment benefits should visit unemployment.ohio.gov and click on the red Report Identity Theft button or call 1-833-658-0394, if they have not already done so.