Ohio Notice of Assignment of Security Interest

Description

How to fill out Notice Of Assignment Of Security Interest?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal form templates that you can download or print.

Through the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the latest versions of forms such as the Ohio Notice of Assignment of Security Interest in just moments.

If you already have an account, sign in and download the Ohio Notice of Assignment of Security Interest from your US Legal Forms library. The Download button will appear on every template you view. You can access all forms you've previously downloaded in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Edit. Fill, modify, print, and sign the downloaded Ohio Notice of Assignment of Security Interest. Every template added to your account has no expiration date and is yours permanently. So, if you want to download or print an additional copy, simply go to the My documents section and click on the form you desire. Access the Ohio Notice of Assignment of Security Interest with US Legal Forms, the most comprehensive collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs.

- If this is your first time using US Legal Forms, here are simple guidelines to get started.

- Confirm you have selected the correct form for your area/county. Click the Preview button to review the contents of the form.

- Check the form's summary to ensure you have chosen the correct one.

- If the form does not meet your requirements, utilize the Search feature at the top of the screen to find one that does.

- If you are pleased with the form, verify your selection by clicking the Purchase now button.

- Then, choose your preferred payment plan and enter your information to register for an account.

Form popularity

FAQ

To obtain a security interest, a creditor must properly document the agreement with the debtor. This involves creating a security agreement that describes the collateral and the obligation it secures. When filing the Ohio Notice of Assignment of Security Interest, ensure to follow all legal procedures to enforce your rights. Utilizing platforms like uslegalforms can help streamline this process.

The creation of a security interest is the process by which a lender or creditor establishes a legal claim on collateral pledged by a borrower. This involves a clear agreement between both parties, typically evidenced through a security agreement. An Ohio Notice of Assignment of Security Interest formalizes this relationship and protects the interests of the secured party. Ultimately, this creates a level of trust and security in business transactions.

Security interest is an enforceable legal claim or lien on collateral that has been pledged, usually to obtain a loan. The borrower provides the lender with a security interest in certain assets, which gives the lender the right to repossess all or part of the property if the borrower stops making loan payments.

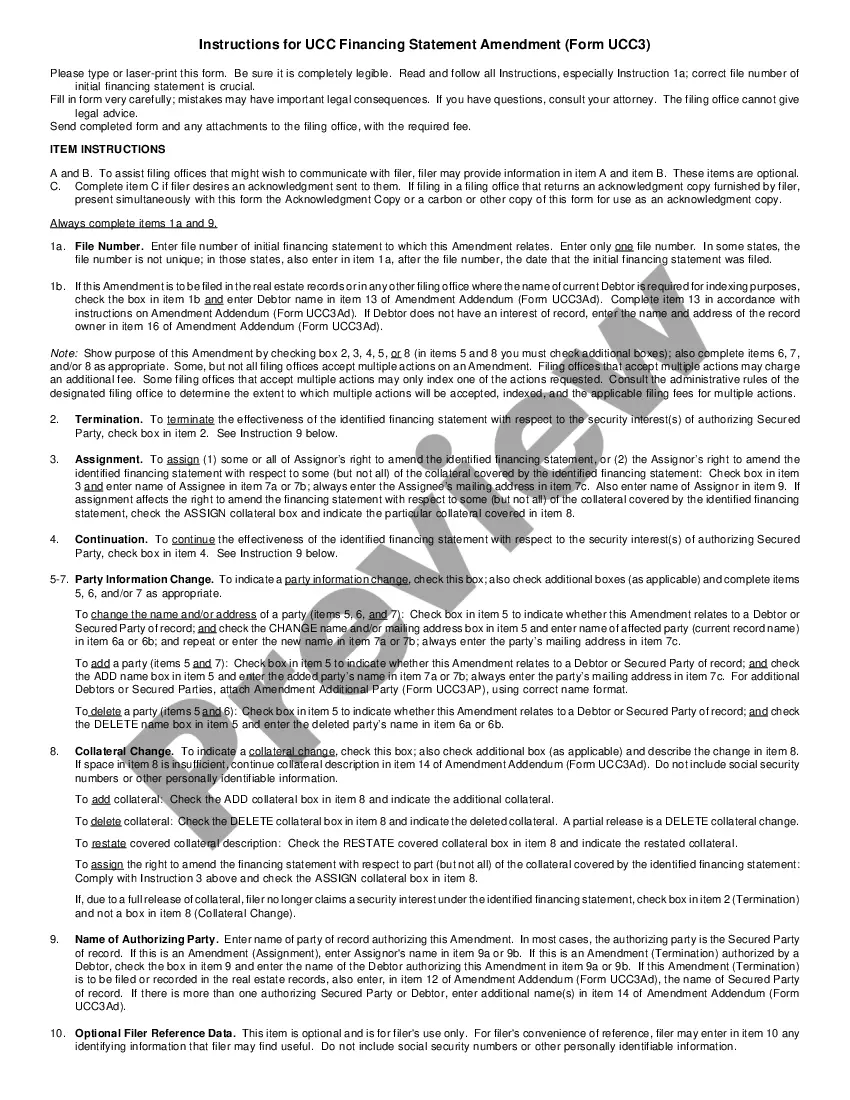

File a UCC-3 termination statement if you are releasing the entire security interest. File a UCC-3 amendment statement to either amend the collateral description or release certain collateral if only part of the security interest in collateral is being released.

Upon payment in full of the Scheduled Interest Payments, the security interest evidenced by this Agreement in any Collateral remaining in the Escrow Account shall automatically terminate and be of no further force and effect.

However, generally speaking, the primary ways for a secured party to perfect a security interest are:by filing a financing statement with the appropriate public office.by possessing the collateral.by "controlling" the collateral; or.it's done automatically upon attachment of the security interest.

If at any time any Grantor shall take a security interest in any property of an Account Debtor or any other person to secure payment and performance of an Account, such Grantor shall promptly assign such security interest to the Collateral Agent.

In order for a security interest to be enforceable against the debtor and third parties, UCC Article 9 sets forth three requirements: Value must be provided in exchange for the collateral; the debtor must have rights in the collateral or the ability to convey rights in the collateral to a secured party; and either the

Ask the lender to terminate the lien upon payoff. When you pay off a loan, a good rule of thumb is to immediately submit a request with the lender to file a UCC-3 form with your secretary of state. The UCC-3 will terminate the lien on your company's asset (or assets) and remove the UCC-1 filing.

Definition of security interest : the rights that a creditor has in the personal property of a debtor that secures an obligation : lien.