Ohio Letter to Lender for Produce the Note Request

Description

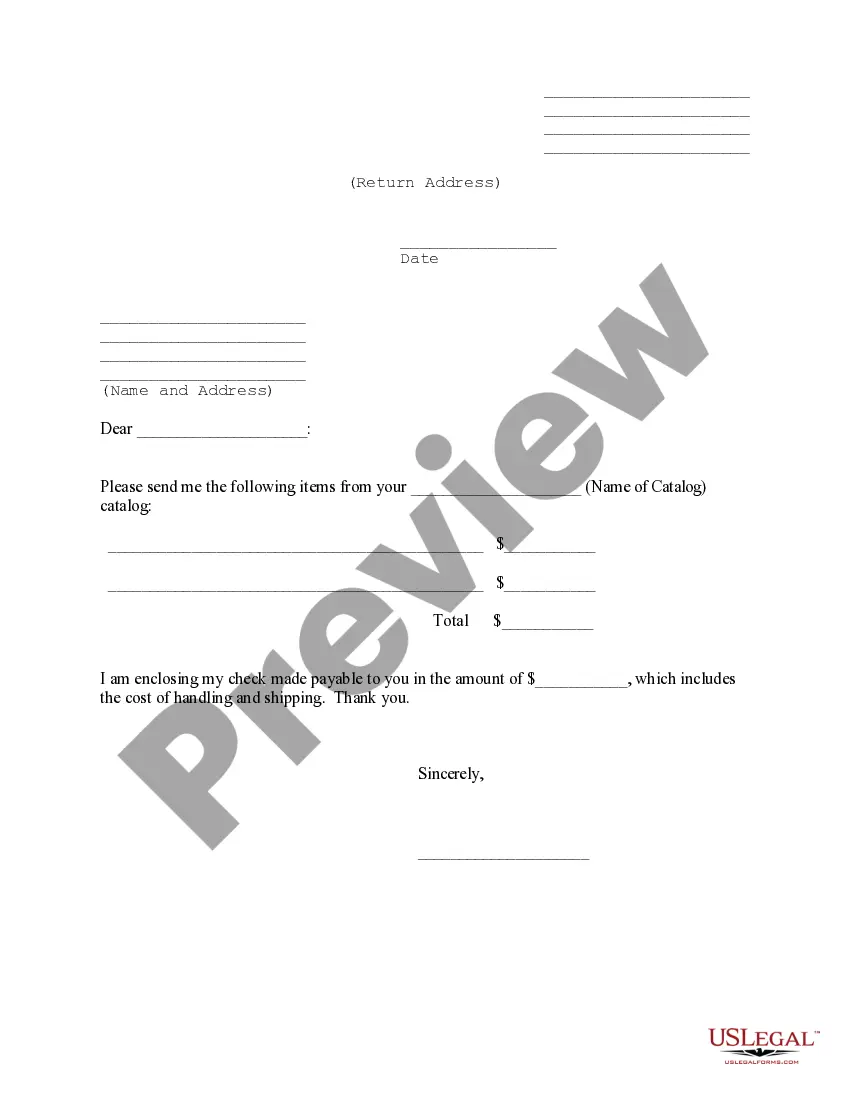

How to fill out Letter To Lender For Produce The Note Request?

US Legal Forms - one of the most prominent repositories of legal templates in the USA - offers a vast selection of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, categorized by type, state, or keywords. You will find the latest versions of forms such as the Ohio Letter to Lender for Produce the Note Request in just seconds.

If you already have an account, Log In and download the Ohio Letter to Lender for Produce the Note Request from the US Legal Forms library. The Download option will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Proceed with the purchase. Use a credit card or PayPal account to complete the transaction.

Select the format and download the form onto your device. Edit, fill out, and print, then sign the downloaded Ohio Letter to Lender for Produce the Note Request. Each template you add to your account has no expiration date and belongs to you indefinitely. So, if you need to download or print another copy, simply go to the My documents section and click on the form you wish.

- Ensure you have chosen the correct form for your area/state.

- Select the Review option to examine the form's details.

- Read the form description to confirm that you have selected the correct form.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select your preferred payment plan and provide your information to register for an account.

Form popularity

FAQ

A lender approval letter is a formal document confirming that the lender has reviewed and accepted your Ohio Letter to Lender for Produce the Note Request. This letter typically outlines the terms of approval and any conditions that must be met. Having this letter is beneficial as it serves as proof of the lender's commitment to your case, aiding in smoother transactions and negotiations. It empowers you by providing clarity on your financial status.

If the lender loses the promissory note, it can complicate their ability to enforce the mortgage agreement. This may lead to legal disputes or issues regarding your mortgage status. To address this, consider sending an Ohio Letter to Lender for Produce the Note Request to formally request clarification and documentation, safeguarding your rights as a borrower.

Filling out a promissory note involves including key details such as the principal amount, interest rate, payment due dates, and the signatures of all parties involved. You can find sample templates online to guide you through the process. Additionally, referencing the Ohio Letter to Lender for Produce the Note Request can ensure that you meet all necessary requirements for documentation.

Being on the mortgage but not the note means you are responsible for the property but may not have the same rights as the note holder. This situation can create confusion regarding your obligations and rights. It's advisable to send an Ohio Letter to Lender for Produce the Note Request to clarify your position and ensure all parties are aware of your involvement.

If your lender cannot produce the note, it may impact their ability to enforce the mortgage. This situation can complicate your payment obligations and legal standing. Sending an Ohio Letter to Lender for Produce the Note Request can help you formally request the necessary documentation, ensuring that your rights are protected.

When a lender cannot produce a note, then they are not able to prove when they took ownership or assignment of the note. A court may dismiss the case as a result.

When you take out a mortgage, or any other kind of loan, the law requires you to sign a document that signifies your agreement to repay the money. The promissory note represents a binding legal document, enforceable in a court of law.

The sheriff must inform the court within 60 days of the sale. The court then has 30 days to confirm the sale. This process could take anywhere from a couple of days to the full 90 days. The time between the sale and the court's confirmation is called the redemption period.

In Ohio, the foreclosure process can take anywhere from six to 18 months or longer. How long will a foreclosure action or bankruptcy stay on my credit report?

Even if a promissory note is lost, the legal obligation to repay the loan remains. The lender has a right to re-establish the note legally as long as it has not sold or transferred the note to another party.