Ohio Sample Letter for Short Sale Request to Lender

Description

How to fill out Sample Letter For Short Sale Request To Lender?

Are you situated in a location where you require paperwork for both business or personal reasons every day? There are numerous legal document templates accessible online, but finding ones you can trust isn't simple.

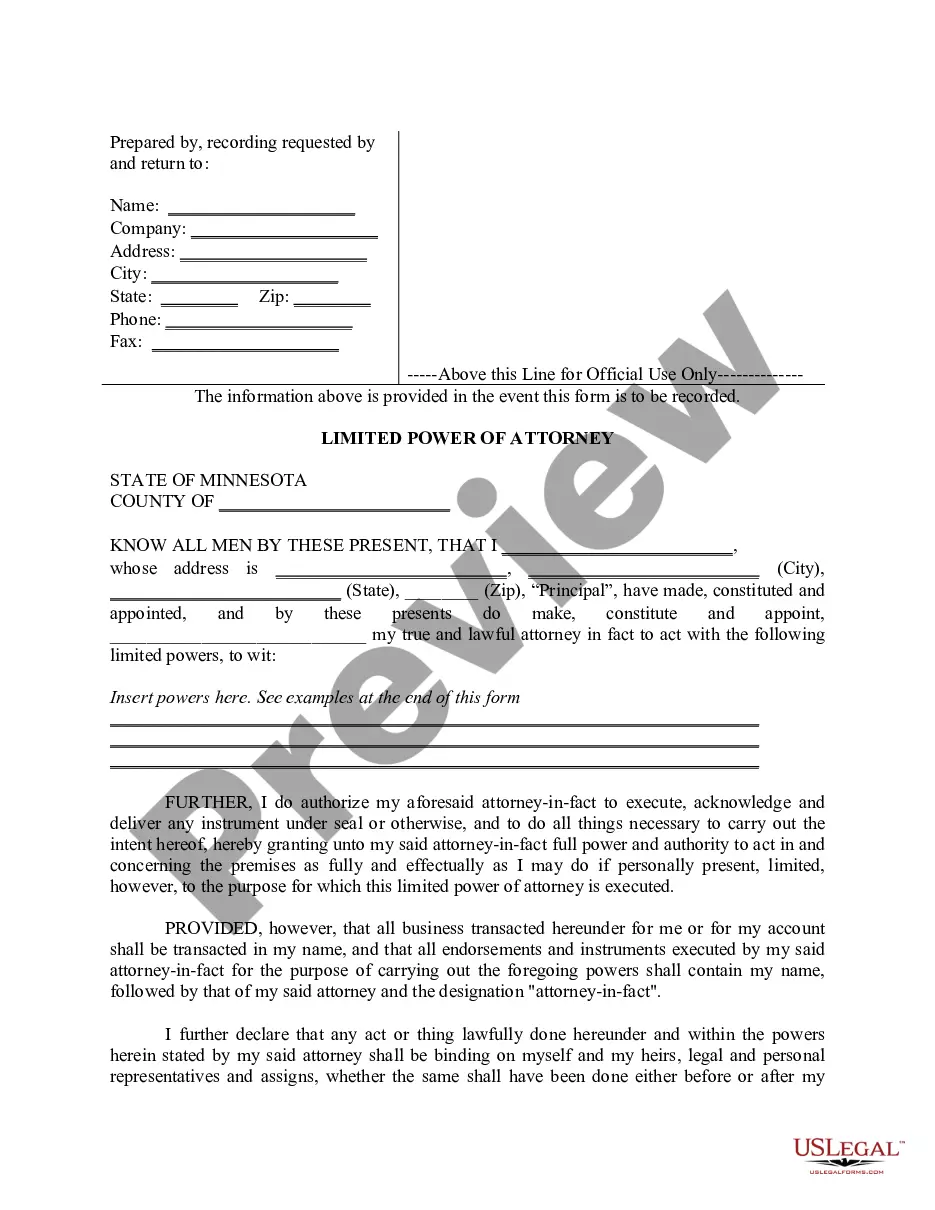

US Legal Forms offers a vast array of form templates, such as the Ohio Sample Letter for Short Sale Request to Lender, which is designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. Afterwards, you can download the Ohio Sample Letter for Short Sale Request to Lender template.

Access all the document templates you have purchased in the My documents section. You can retrieve another copy of the Ohio Sample Letter for Short Sale Request to Lender at any time if needed. Just select the required form to download or print the document template.

Use US Legal Forms, the most comprehensive selection of legal forms, to save time and minimize errors. The service provides appropriately crafted legal document templates that you can utilize for a variety of purposes. Create your account on US Legal Forms and start simplifying your life.

- Locate the form you need and ensure it’s for your specific state/region.

- Utilize the Preview button to review the document.

- Check the description to confirm you have chosen the correct form.

- If the form isn’t what you are looking for, use the Search field to find the form that meets your needs and requirements.

- Once you find the correct form, click Buy now.

- Select the pricing plan you prefer, fill in the necessary information to create your account, and complete the purchase using your PayPal or credit card.

- Choose a suitable file format and download your copy.

Form popularity

FAQ

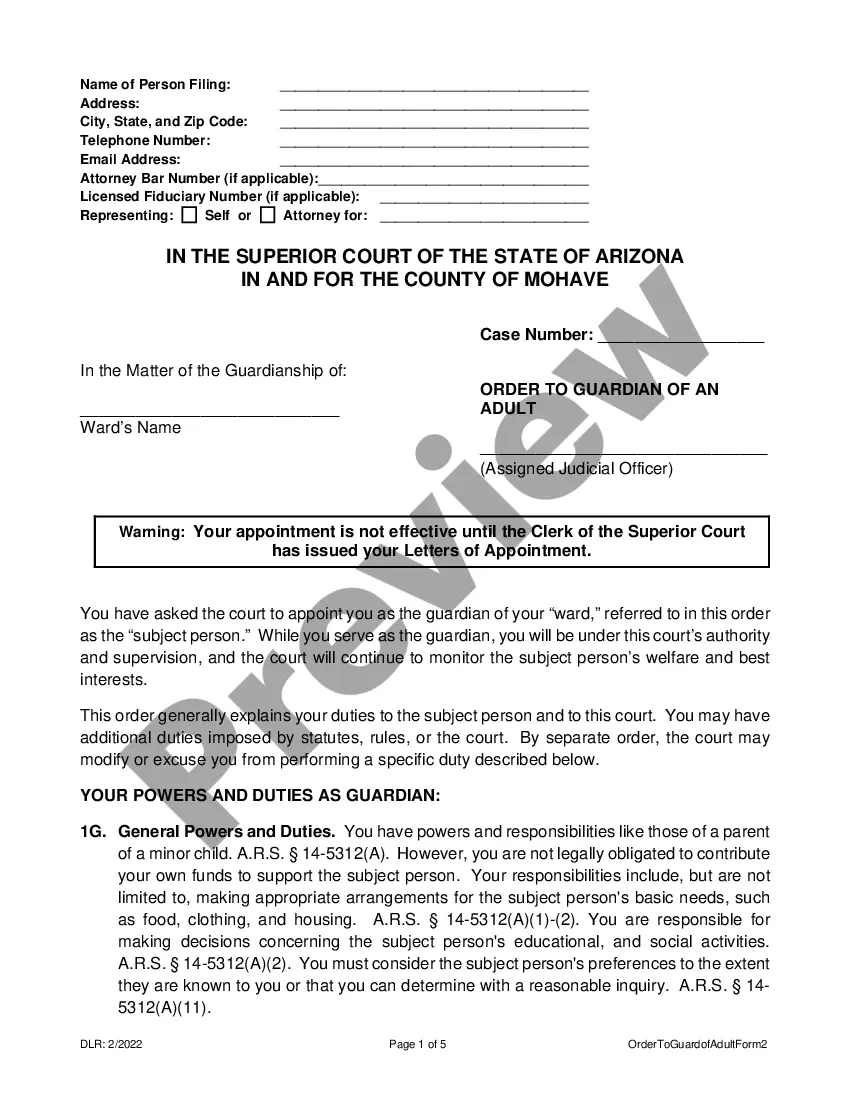

When considering a short sale, banks typically accept offers that are less than the outstanding mortgage amount. This reduction can vary significantly based on factors such as the home's condition and the local market. Using an Ohio Sample Letter for Short Sale Request to Lender can help you present a compelling case to the bank, potentially leading to a more favorable offer. Always remember, a properly crafted request can make a substantial difference in negotiations.

During the short sale process, the lender has the right to approve or deny the proposed sale. This decision is based on their evaluation of the offer and your financial situation. Additionally, the lender may require a full financial disclosure from you. Understanding these rights helps clarify what to expect, making the process smoother when you present an Ohio Sample Letter for Short Sale Request to Lender.

To initiate a short sale, first, communicate your financial difficulties to your lender. They will assess your situation and may request documentation of your financial status. Then, you can submit an Ohio Sample Letter for Short Sale Request to Lender, formally asking for approval. This letter outlines your circumstances and seeks permission to sell the property for less than the outstanding mortgage.

Short sale approval is the lender’s agreement to allow the sale of a property for less than the outstanding mortgage amount. This process helps homeowners avoid foreclosure and allows them to sell the home despite financial difficulties. Receiving short sale approval requires detailed communication and documentation, including an Ohio Sample Letter for Short Sale Request to Lender that outlines your financial hardship. Approval can provide relief, allowing the homeowner to transition to a healthier financial situation.

To gain short sale approval, you need to submit a comprehensive package to the lender, including documents that confirm your financial hardship. It often helps to include an Ohio Sample Letter for Short Sale Request to Lender, which outlines your situation clearly and concisely. Additionally, working with a real estate agent experienced in short sales can also facilitate the approval process, as they know the expectations and requirements of lenders. Communication throughout this process is crucial to maintain transparency.

Lenders may deny a short sale for several reasons, such as failing to demonstrate a true financial hardship. If the lender believes that the homeowner can still afford the mortgage, they may refuse the short sale request. Additionally, if the offer on the property is too low or if the paperwork is incomplete, the lender may reject the request as well. Utilizing an Ohio Sample Letter for Short Sale Request to Lender can help clearly outline your situation and increase your chances of approval.

Yes, short sales can negatively impact your credit score; however, the effect is typically less severe than a foreclosure. A short sale is recorded on your credit report but demonstrates that you took steps to resolve the situation responsibly. It is essential to understand how a short sale might affect your credit situation and recovery options. Using an Ohio Sample Letter for Short Sale Request to Lender can help clarify your intentions and potentially improve your standing with your lender.

You can ask for a short sale by directly approaching your lender with your request. Begin by preparing an Ohio Sample Letter for Short Sale Request to Lender that explains your current financial challenges. Include relevant documentation, such as income statements and a hardship letter. This clear and organized approach will help your lender understand your situation better.

The amount you can offer on a short sale depends on the current market value and the outstanding mortgage balance. Generally, offers are made below market value, taking into account the lender’s need to minimize losses. It's crucial to present a reasonable offer backed by comparable sales in your area. An Ohio Sample Letter for Short Sale Request to Lender can provide clarity and structure when submitting your offer.

To request a short sale, you need to start by gathering necessary financial documents and information about your property. Next, prepare an Ohio Sample Letter for Short Sale Request to Lender that outlines your financial situation and your request for a short sale. Submitting this letter along with supporting documents ensures that the lender has a complete picture of your circumstances. Clear communication can help facilitate the process.